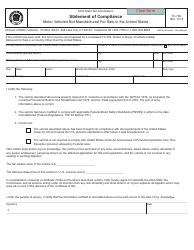

This version of the form is not currently in use and is provided for reference only. Download this version of

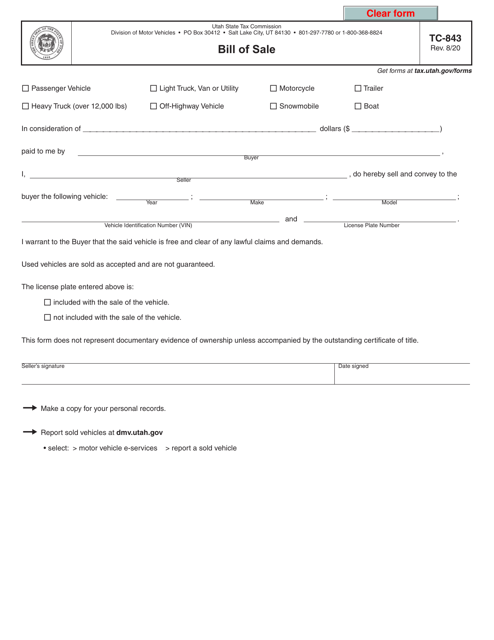

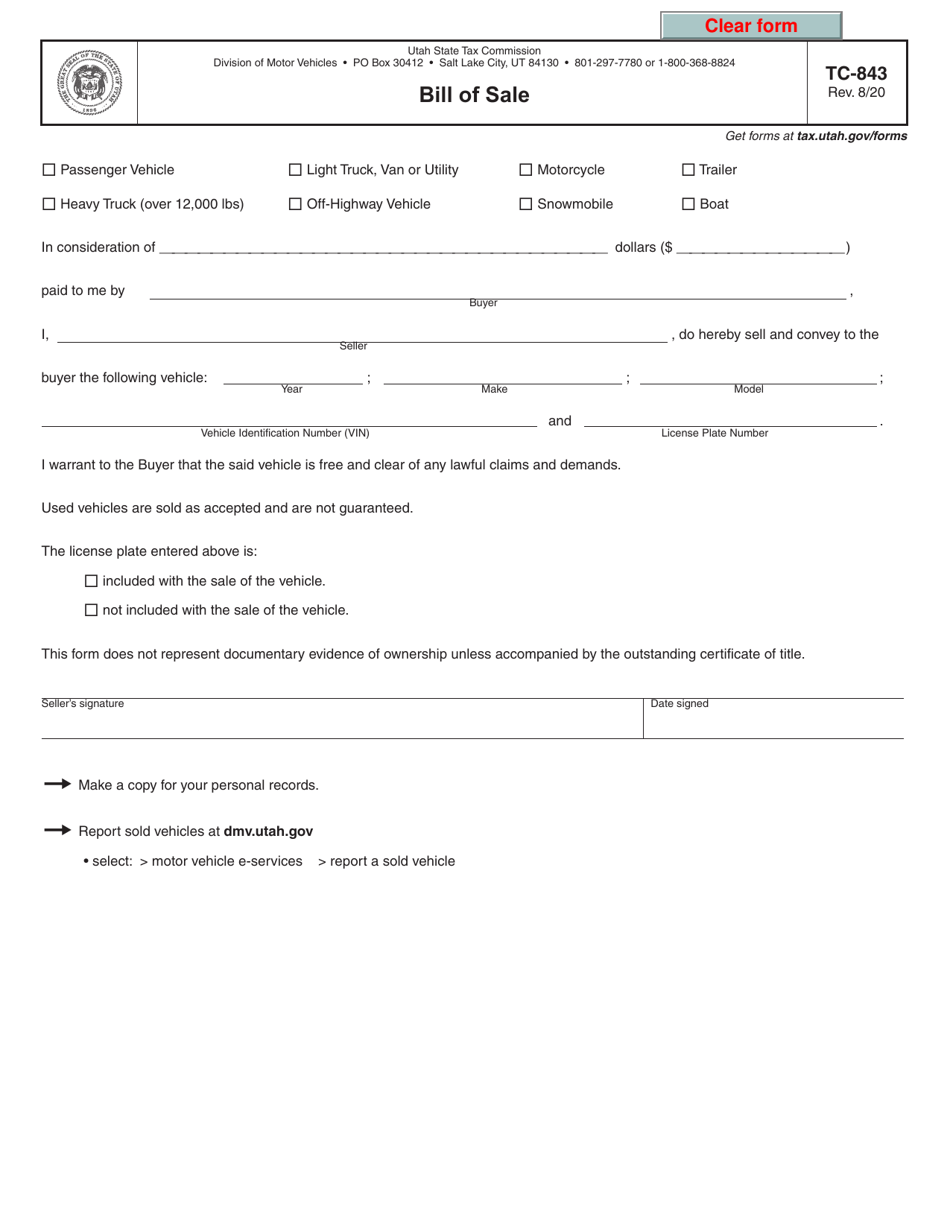

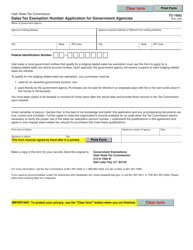

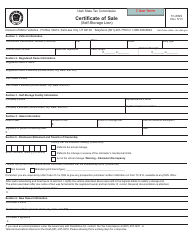

Form TC-843

for the current year.

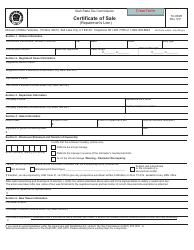

Form TC-843 Bill of Sale - Utah

What Is Form TC-843?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

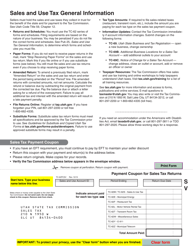

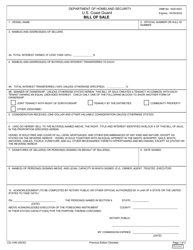

Q: What is Form TC-843?

A: Form TC-843 is a Bill of Sale document used in the state of Utah.

Q: What is the purpose of Form TC-843?

A: Form TC-843 is used to document the sale and transfer of ownership of a vehicle in Utah.

Q: Who needs to use Form TC-843?

A: Both the buyer and the seller of a vehicle in Utah need to use Form TC-843.

Q: What information is required on Form TC-843?

A: Form TC-843 requires information about the buyer, seller, vehicle details, and the sale price.

Q: Are there any fees associated with Form TC-843?

A: Yes, there is a fee for filing Form TC-843 with the Utah State Tax Commission.

Q: Do I need to notarize Form TC-843?

A: No, Form TC-843 does not require notarization.

Q: How long do I have to submit Form TC-843 after a vehicle sale?

A: Form TC-843 must be submitted within 30 days of the date of sale.

Q: What should I do with the completed Form TC-843?

A: The buyer needs to keep a copy of Form TC-843, and the seller needs to submit it to the Utah State Tax Commission.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-843 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.