This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2152 Schedule 1

for the current year.

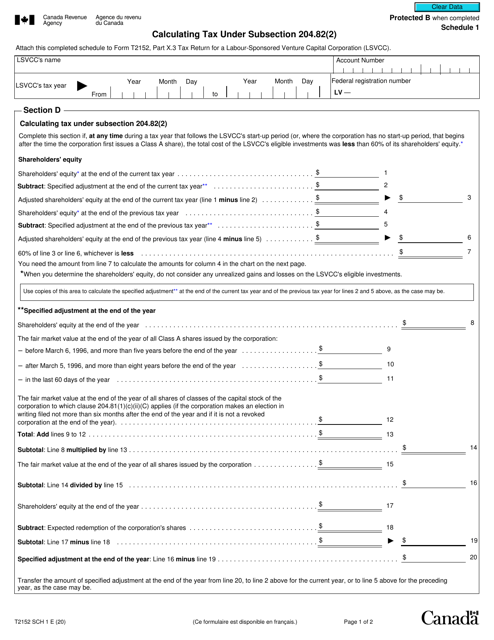

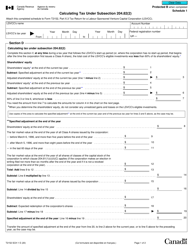

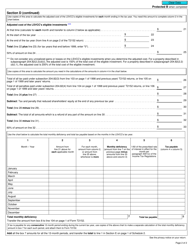

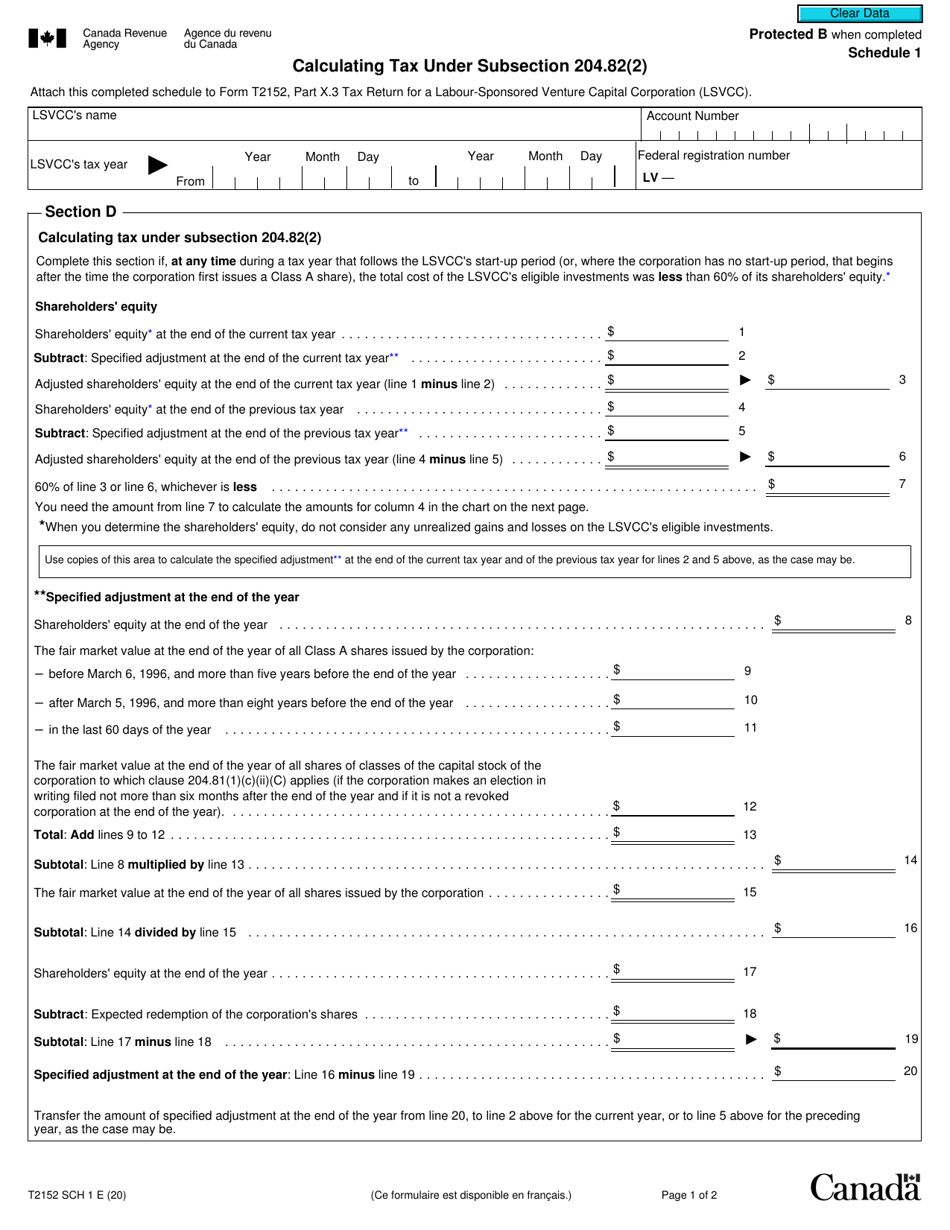

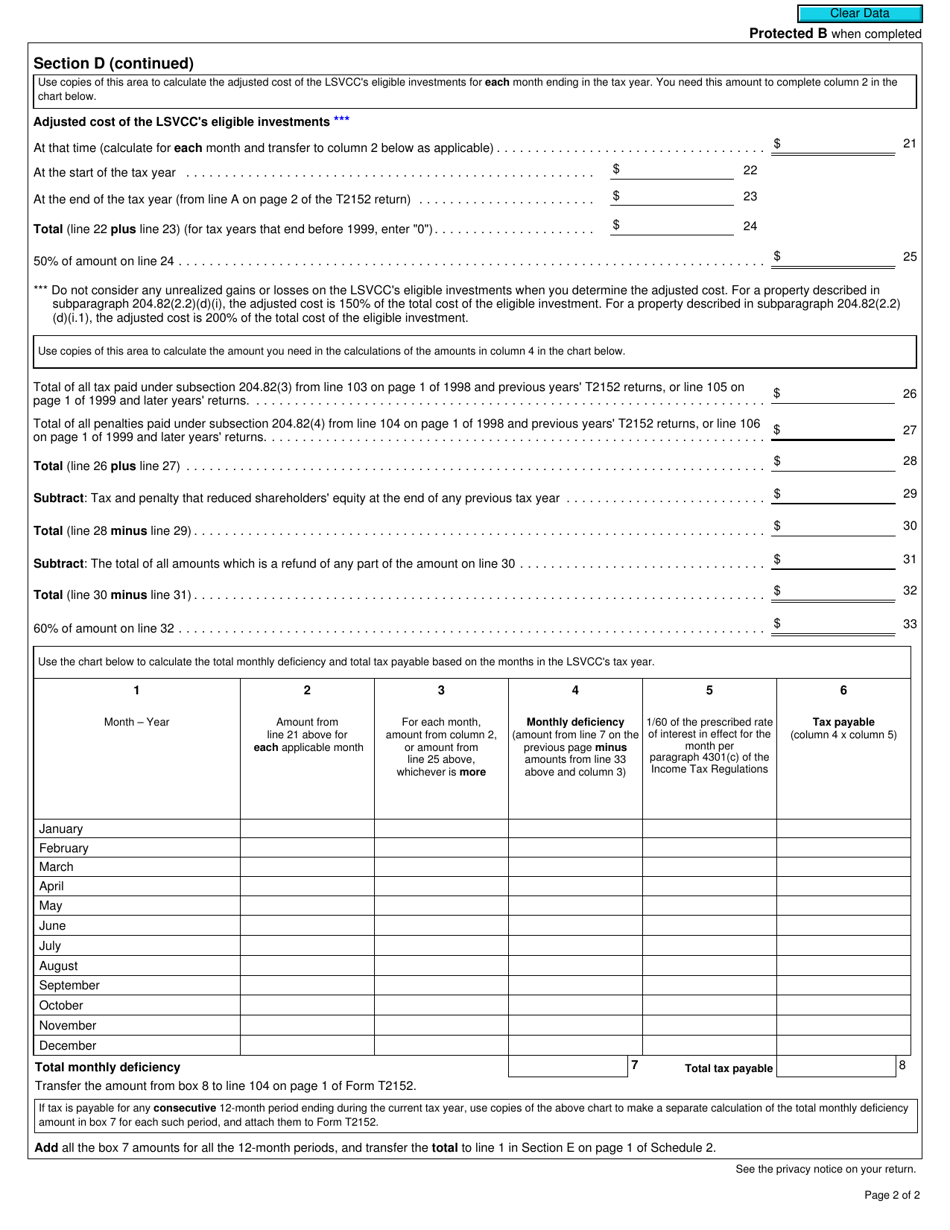

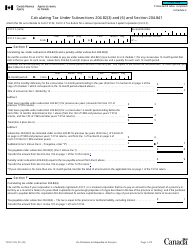

Form T2152 Schedule 1 Calculating Tax Under Subsection 204.82(2) - Canada

Form T2152 Schedule 1 "Calculating Tax Under Subsection 204.82(2)" in Canada is used for determining the taxes payable by corporations that are subject to the special tax rules related to designated provisions. It is specifically used to calculate tax owed under subsection 204.82(2) of the Canadian Income Tax Act.

FAQ

Q: What is Form T2152 Schedule 1?

A: Form T2152 Schedule 1 is a tax form used in Canada to calculate tax under subsection 204.82(2).

Q: What does subsection 204.82(2) refer to?

A: Subsection 204.82(2) is a specific section of the Canadian tax code.

Q: Who should use Form T2152 Schedule 1?

A: Individuals or businesses in Canada who need to calculate tax under subsection 204.82(2) should use this form.

Q: What information is required on Form T2152 Schedule 1?

A: The form requires specific information related to the calculation of tax under subsection 204.82(2).

Q: Is Form T2152 Schedule 1 mandatory?

A: If you are required to calculate tax under subsection 204.82(2), then filling out this form is mandatory.

Q: Are there any instructions available for filling out Form T2152 Schedule 1?

A: Yes, the CRA provides instructions on how to fill out this form correctly.

Q: Can I file Form T2152 Schedule 1 electronically?

A: As of now, Form T2152 Schedule 1 can only be filed in paper form and cannot be submitted electronically.

Q: What should I do after completing Form T2152 Schedule 1?

A: After completing the form, follow the instructions provided to submit it to the CRA.