This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7216

for the current year.

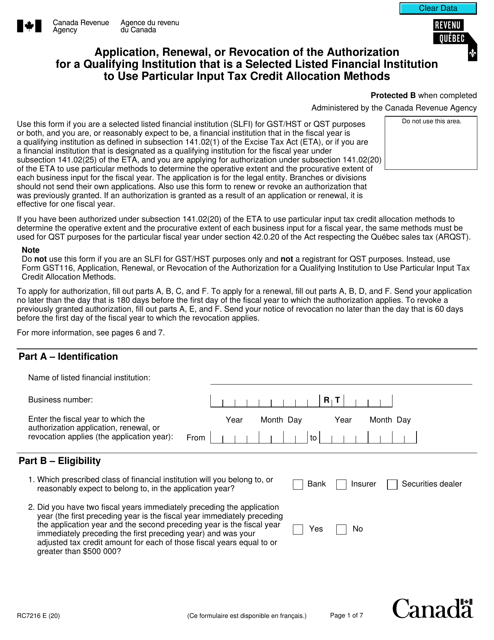

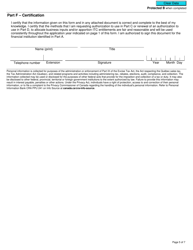

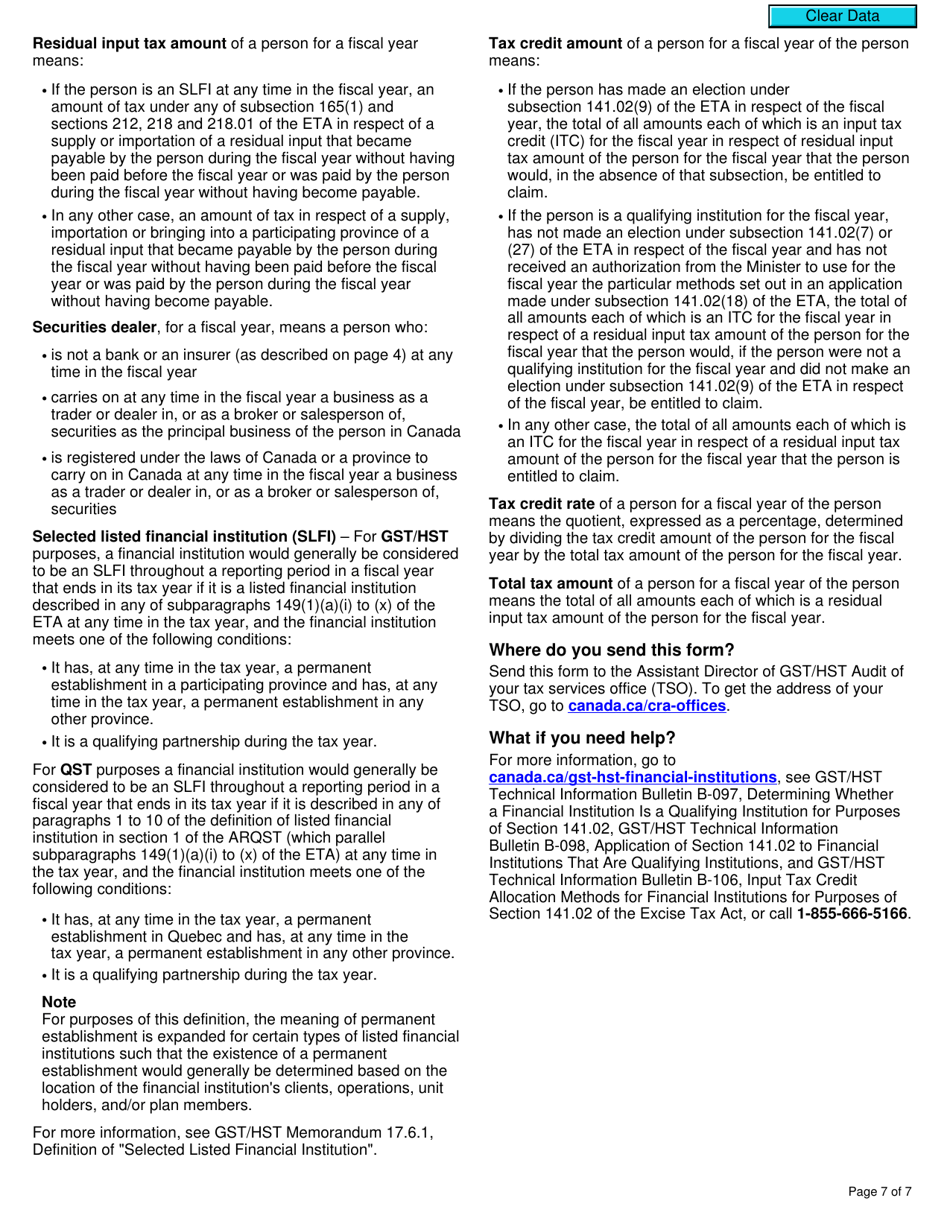

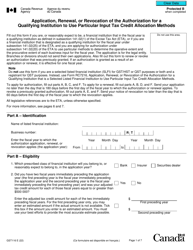

Form RC7216 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Input Tax Credit Allocation Methods - Canada

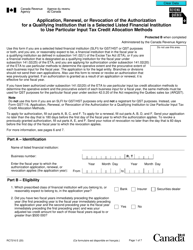

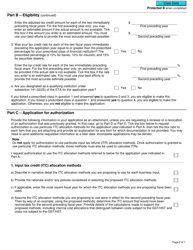

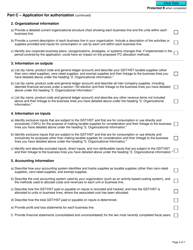

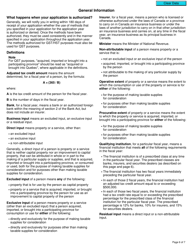

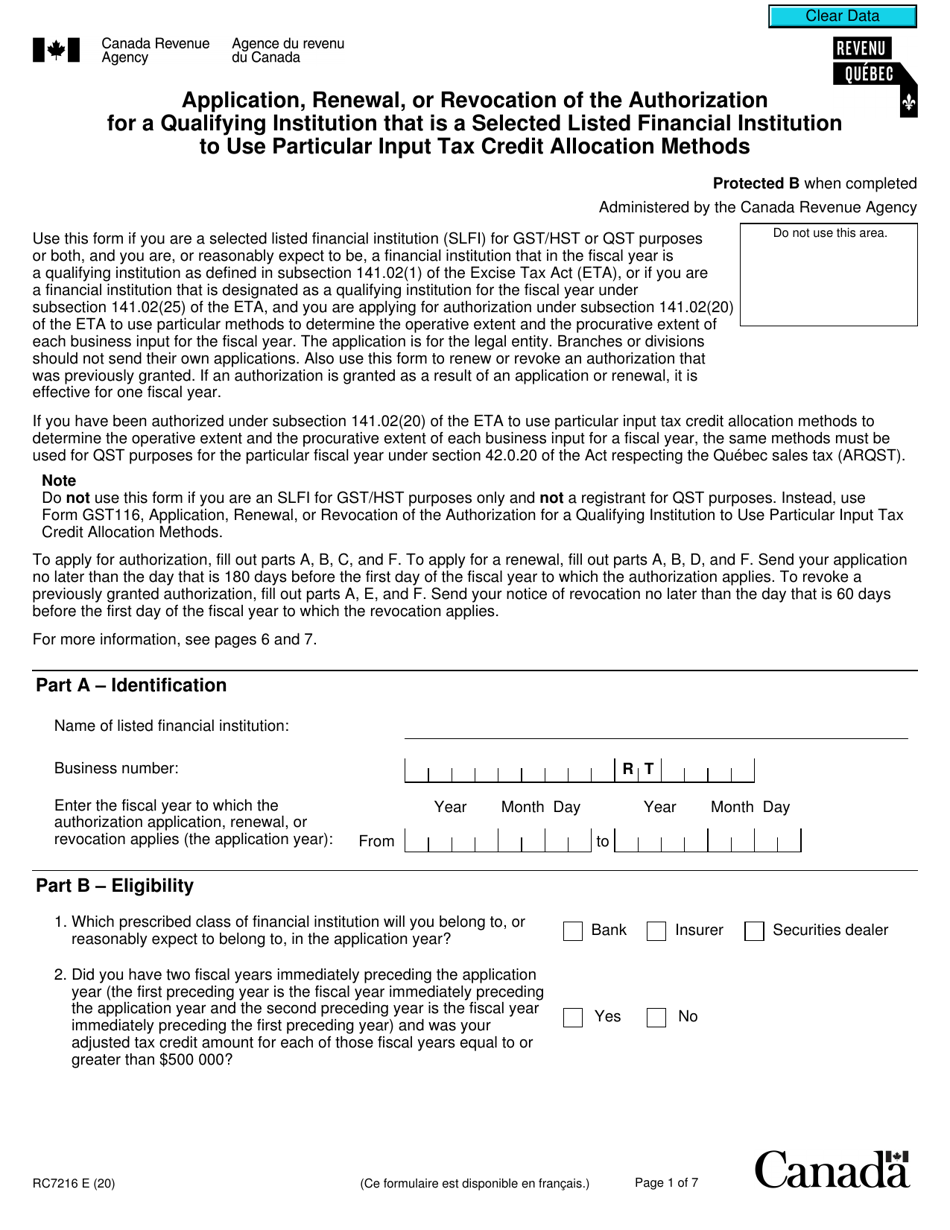

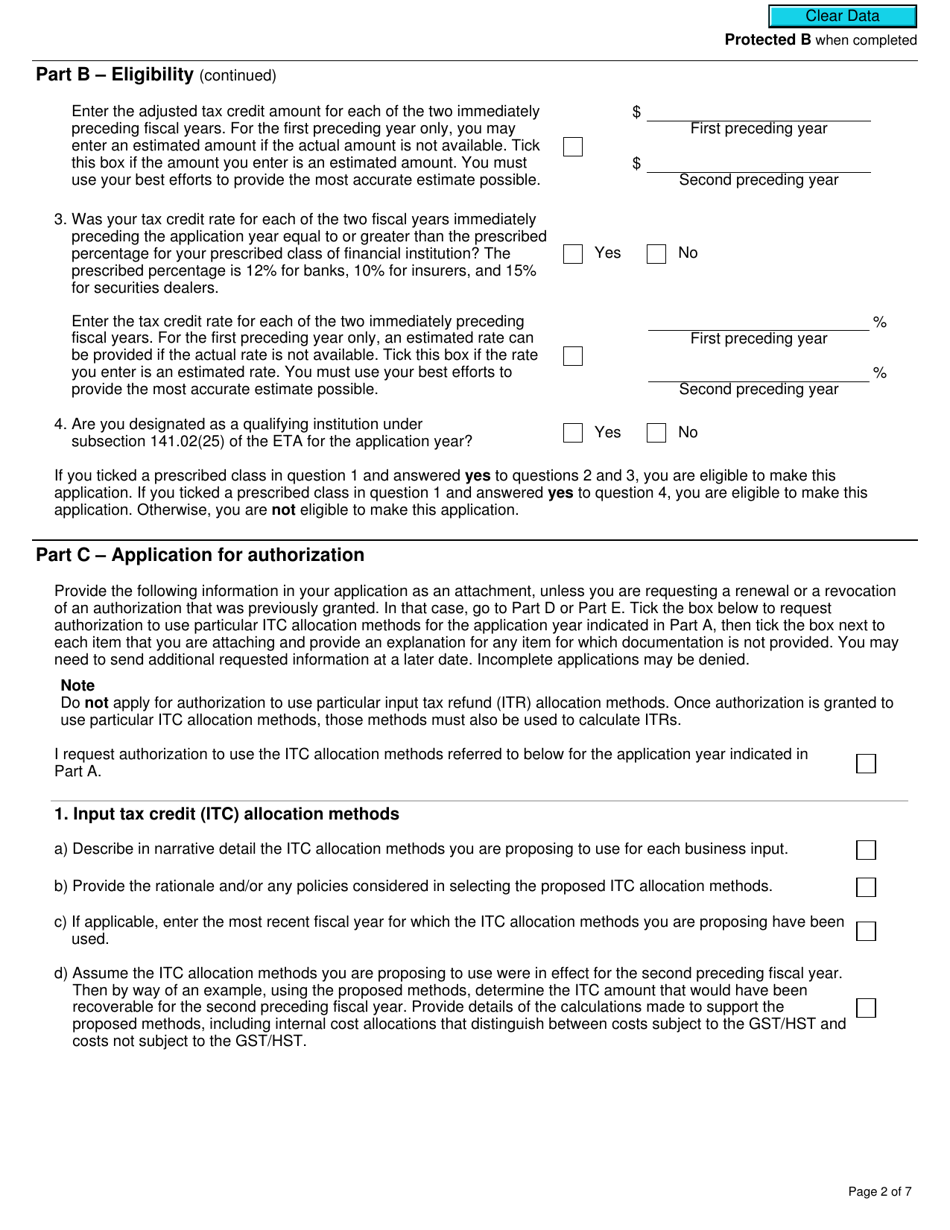

The Form RC7216 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Input Tax Credit Allocation Methods is used in Canada for applying, renewing, or revoking the authorization for a qualifying financial institution to use specific input tax credit allocation methods.

The Form RC7216 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Input Tax Credit Allocation Methods in Canada is filed by the qualifying institution itself.

FAQ

Q: What is RC7216?

A: RC7216 is an application form used in Canada to apply for, renew, or revoke the authorization for a qualifying institution that is a selected listed financial institution to use particular input tax credit allocation methods.

Q: Who can use Form RC7216?

A: Form RC7216 is used by qualifying institutions that are selected listed financial institutions in Canada.

Q: What is the purpose of Form RC7216?

A: The purpose of Form RC7216 is to apply for, renew, or revoke the authorization for a qualifying institution to use particular input tax credit allocation methods.

Q: What are input tax credit allocation methods?

A: Input tax credit allocation methods refer to the methods used to allocate input tax credits for qualifying institutions.

Q: When should Form RC7216 be filed?

A: Form RC7216 should be filed when applying for, renewing, or revoking the authorization for a qualifying institution to use particular input tax credit allocation methods.

Q: Are there any fees associated with filing Form RC7216?

A: There are no fees associated with filing Form RC7216.

Q: Is there a deadline to submit Form RC7216?

A: There is no specific deadline to submit Form RC7216, but it should be filed in a timely manner when applying for, renewing, or revoking the authorization.

Q: Can I make changes to Form RC7216 after submitting it?

A: If you need to make changes to Form RC7216 after submitting it, you should contact the Canada Revenue Agency (CRA) for further guidance.