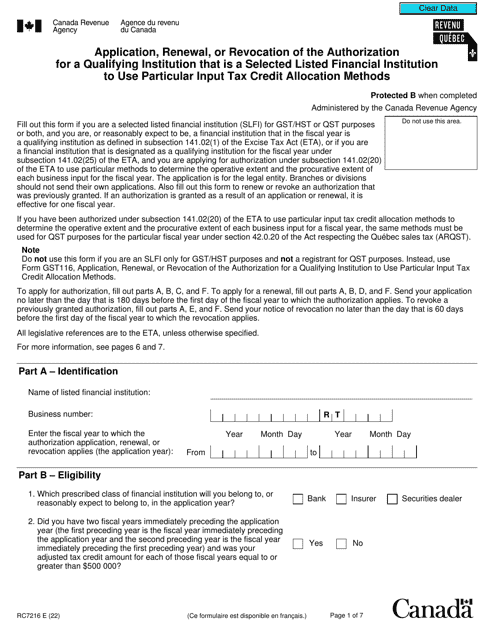

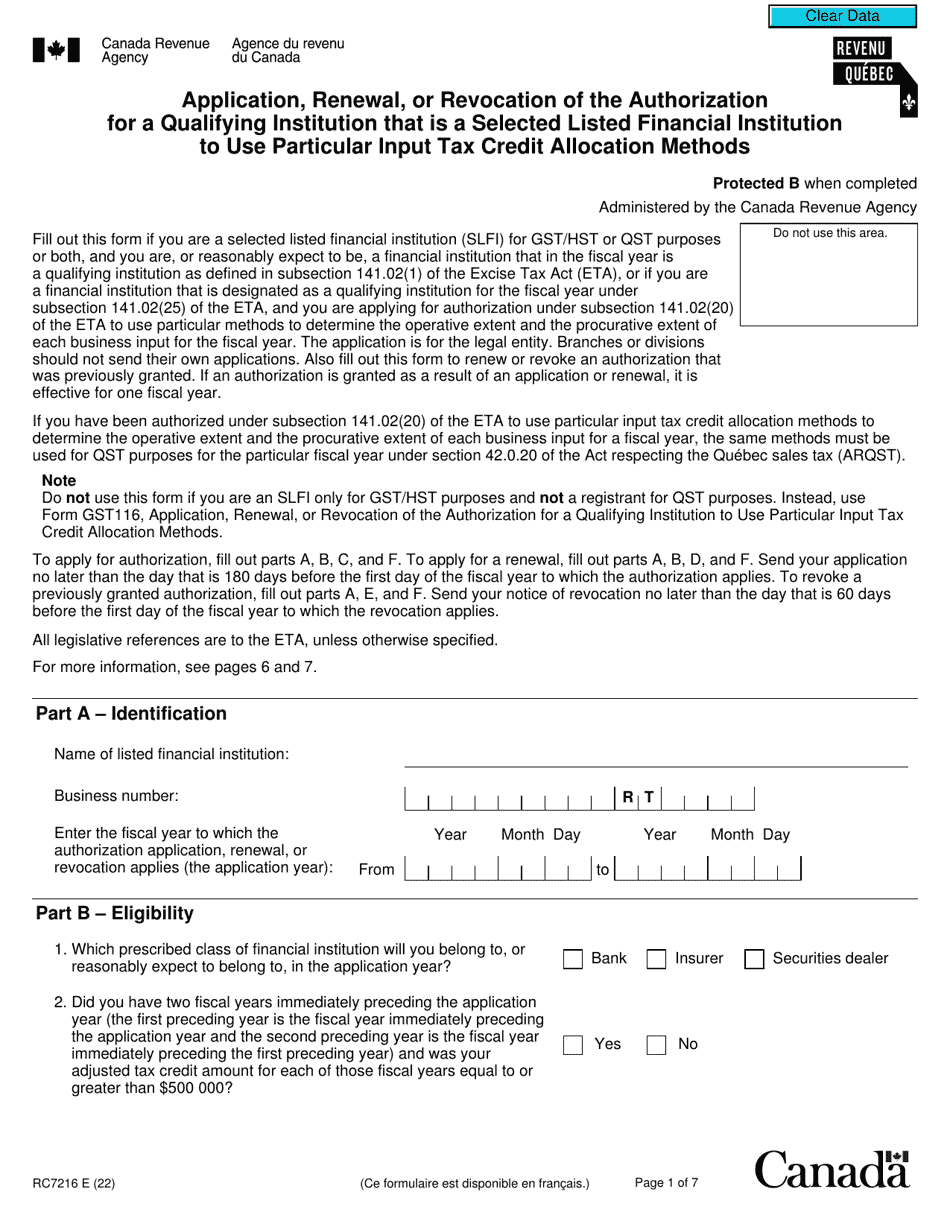

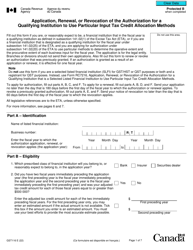

Form RC7216 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Input Tax Credit Allocation Methods - Canada

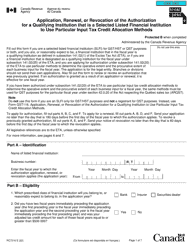

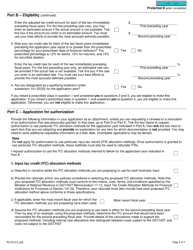

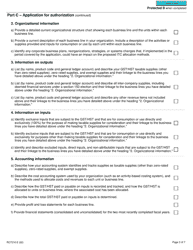

Form RC7216 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Input Tax Credit Allocation Methods in Canada is used for applying, renewing, or revoking the authorization for a qualifying institution that is a selected listed financial institution to use specific methods for allocating input tax credits.

The form RC7216 is filed by a qualifying institution that is a selected listed financial institution in Canada.

Form RC7216 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Input Tax Credit Allocation Methods - Canada - Frequently Asked Questions (FAQ)

Q: What is form RC7216?

A: Form RC7216 is used for the application, renewal, or revocation of the authorization for a qualifying institution that is a selected listed financial institution to use particular input tax credit allocation methods in Canada.

Q: Who uses form RC7216?

A: Qualifying institutions that are selected listed financial institutions use form RC7216.

Q: What is the purpose of form RC7216?

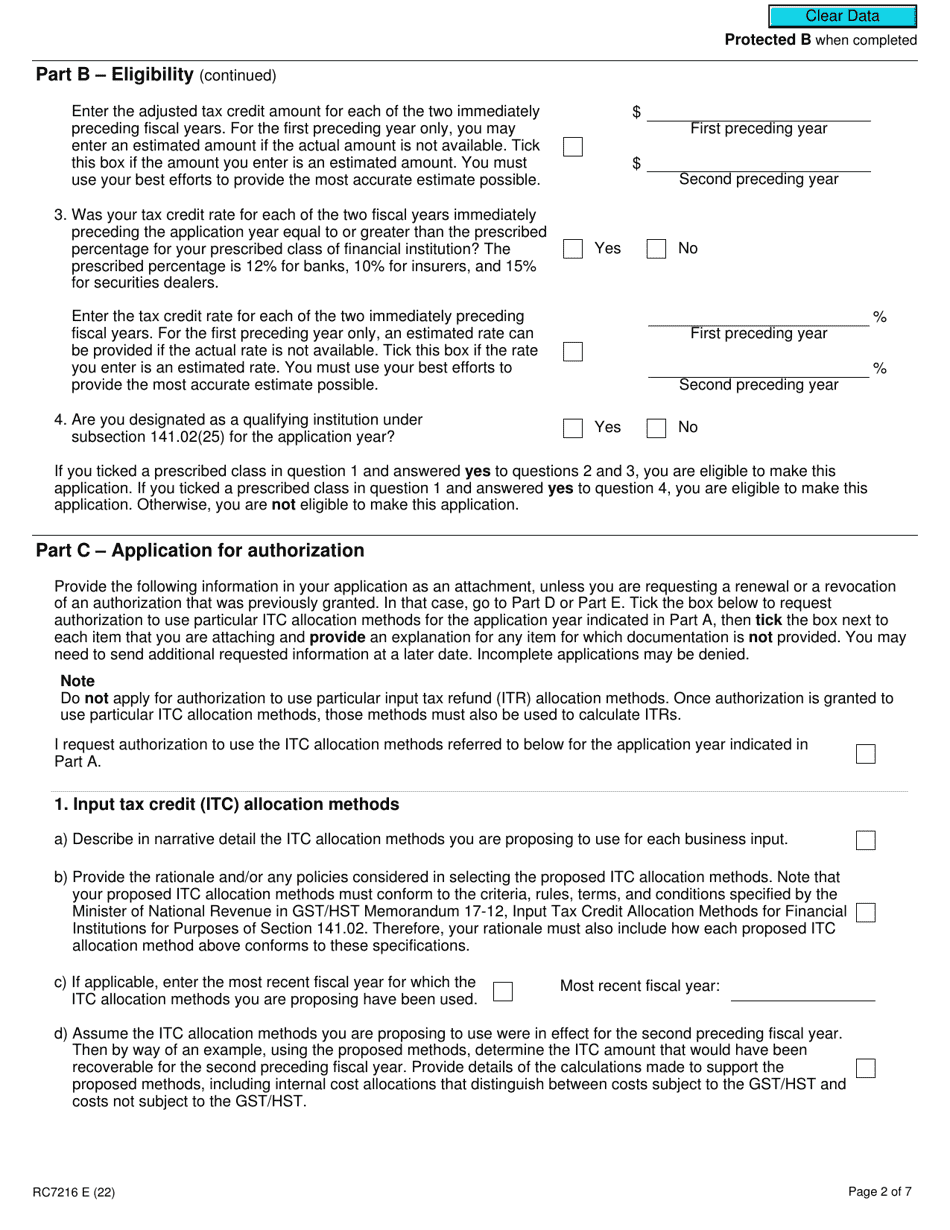

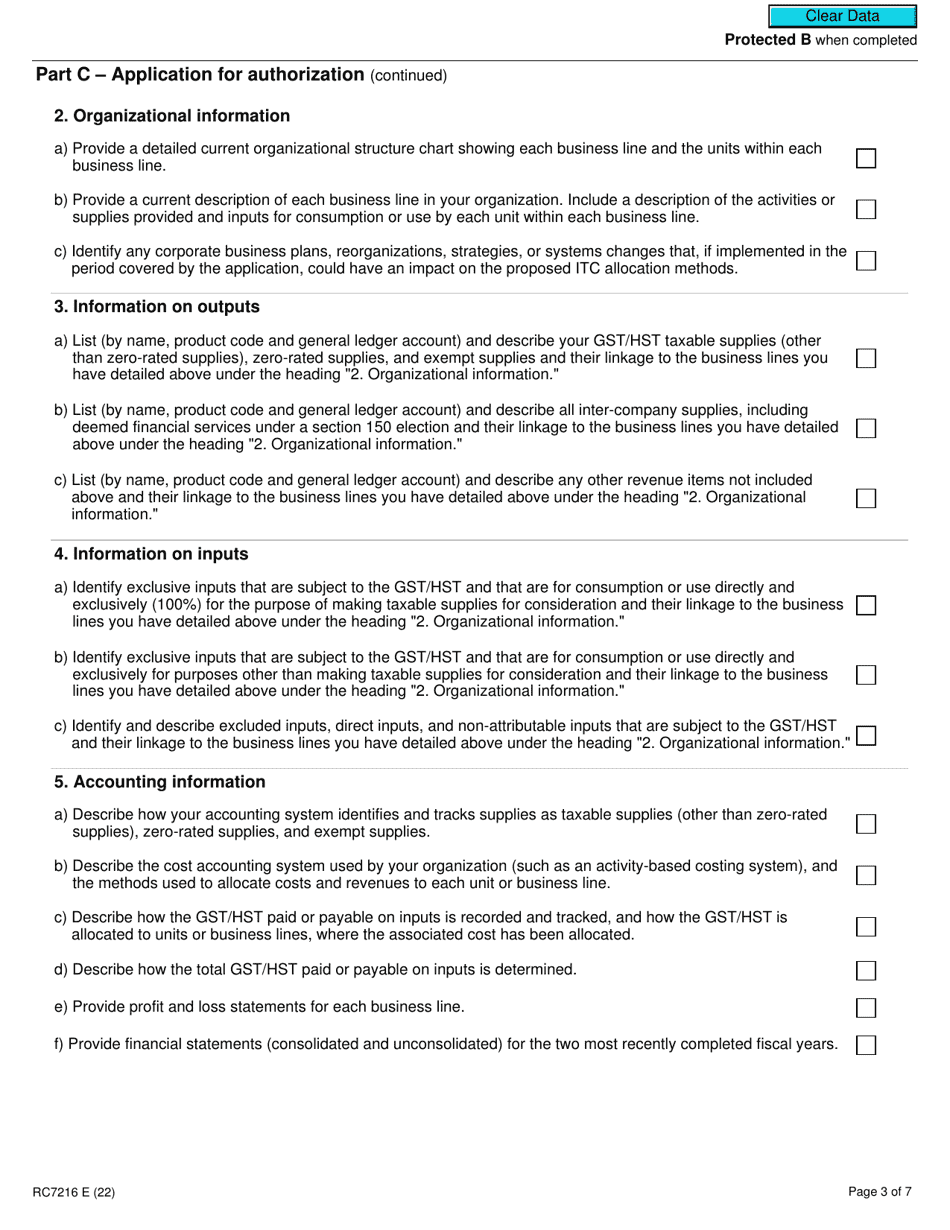

A: The purpose of form RC7216 is to apply, renew, or revoke the authorization for a qualifying institution to use specific input tax credit allocation methods.

Q: What are input tax credit allocation methods?

A: Input tax credit allocation methods refer to the ways in which a qualifying institution allocates and claims input tax credits for goods and services tax/harmonized sales tax (GST/HST).

Q: Do I need to renew the authorization on form RC7216?

A: Yes, the authorization on form RC7216 needs to be renewed periodically to continue using the selected input tax credit allocation methods.

Q: Can I revoke the authorization on form RC7216?

A: Yes, you can revoke the authorization on form RC7216 if you no longer wish to use the selected input tax credit allocation methods.