This version of the form is not currently in use and is provided for reference only. Download this version of

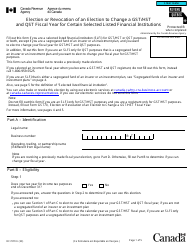

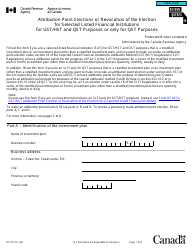

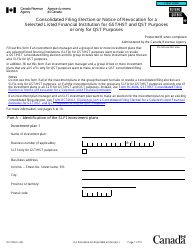

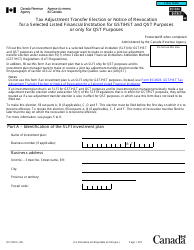

Form RC7222

for the current year.

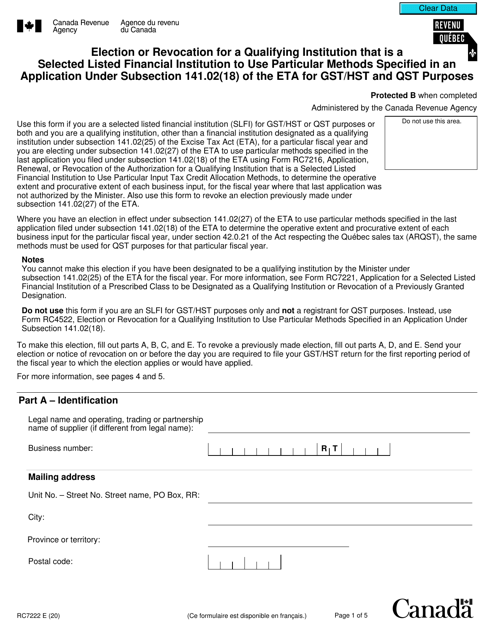

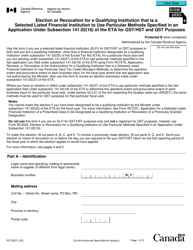

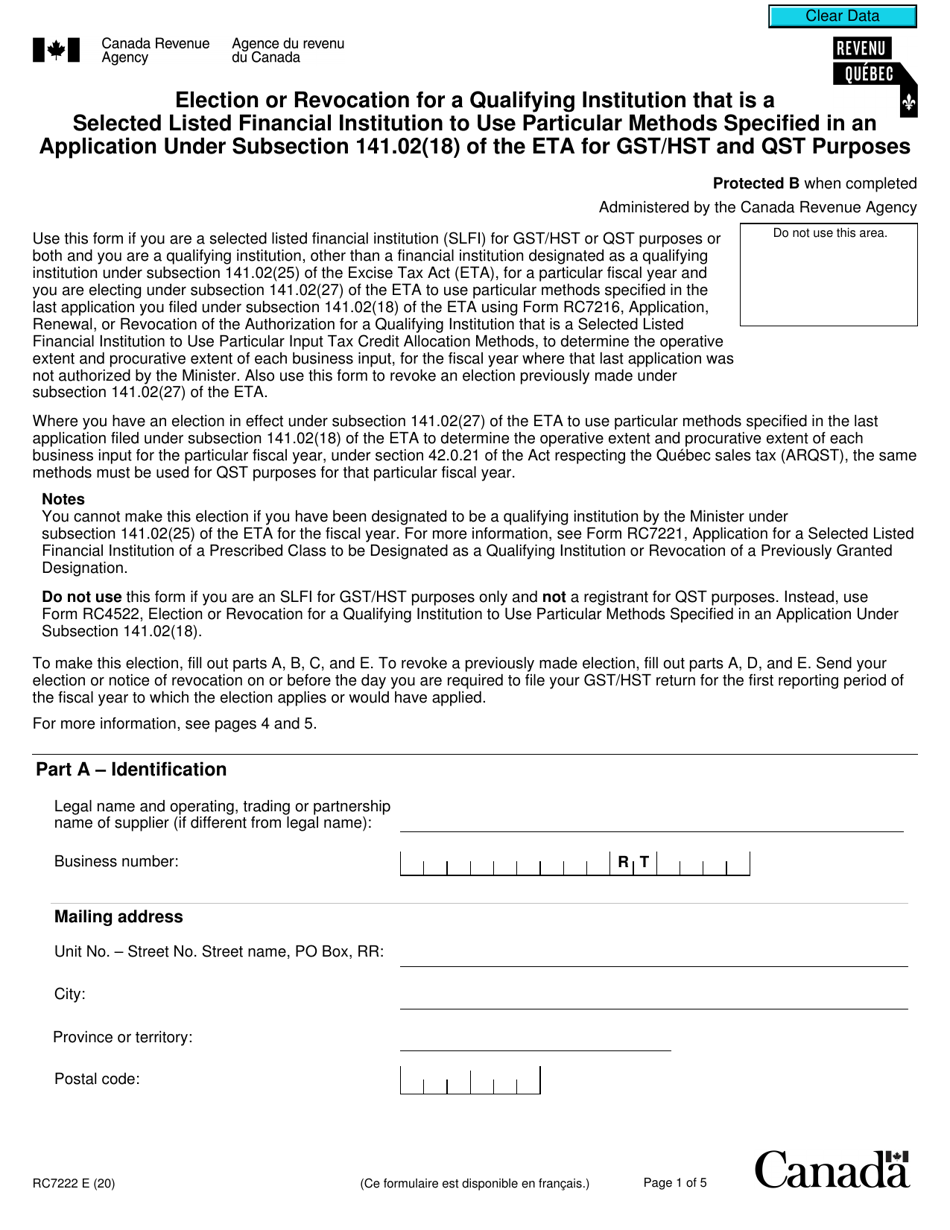

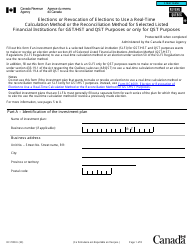

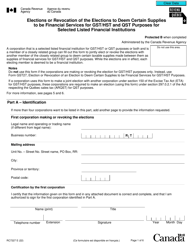

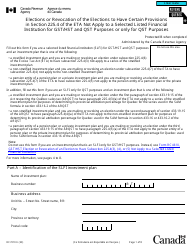

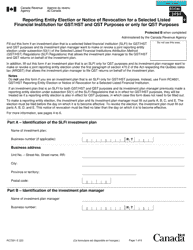

Form RC7222 Election or Revocation for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) of the ETA for Gst / Hst and Qst Purposes - Canada

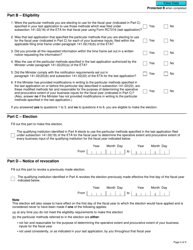

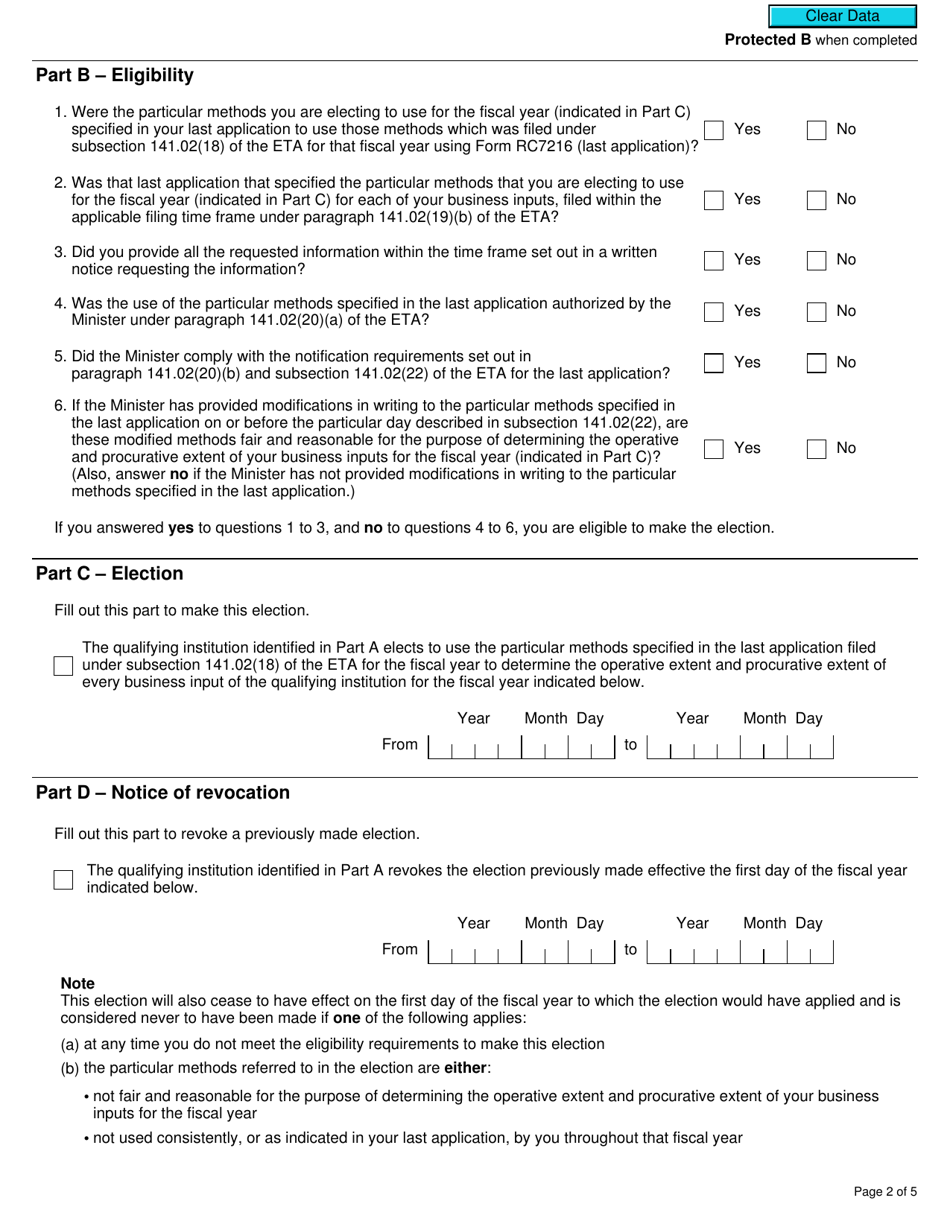

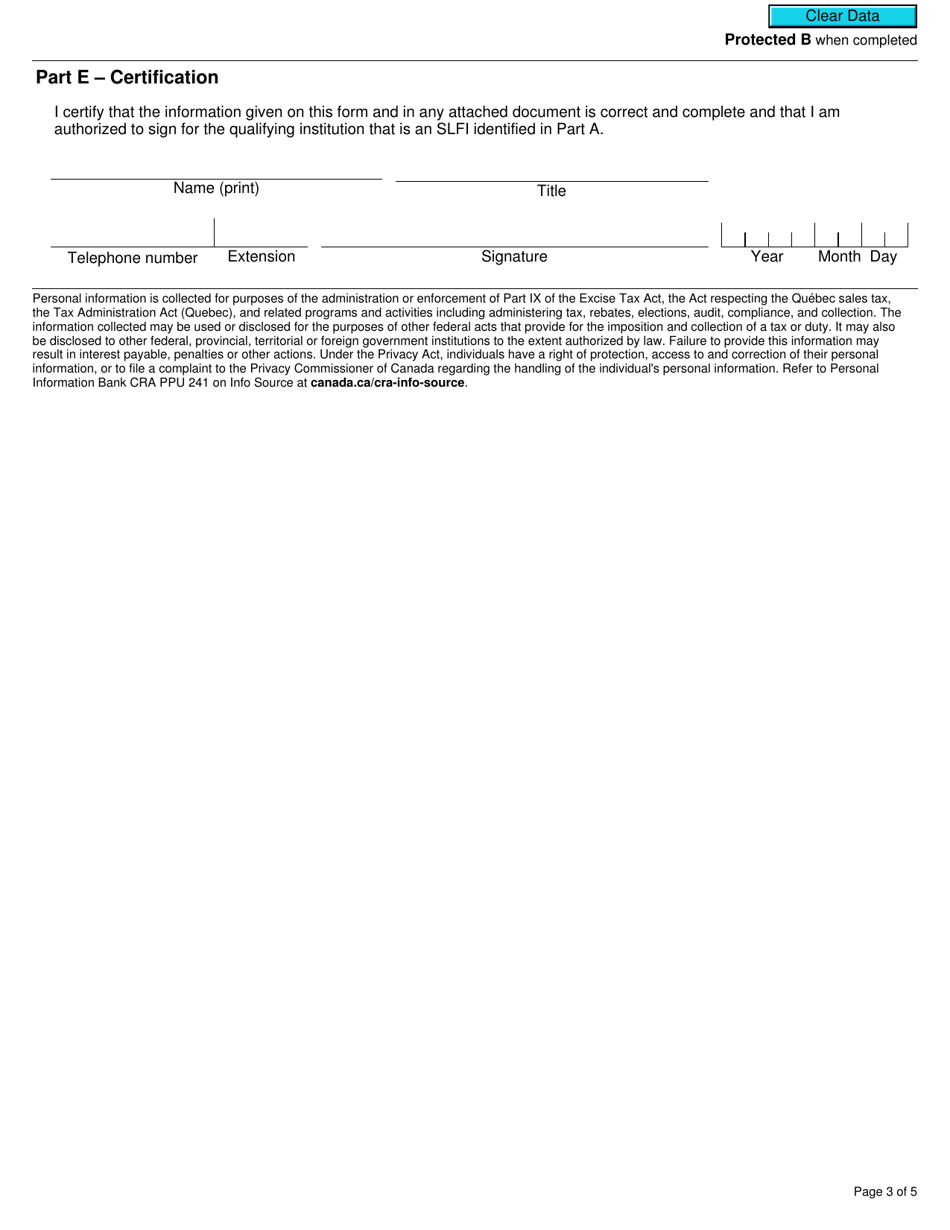

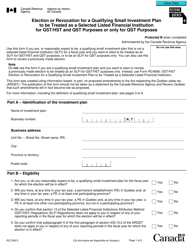

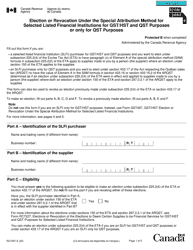

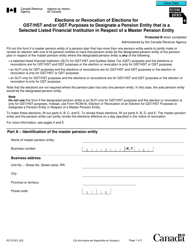

Form RC7222 is used by qualifying institutions in Canada that are selected listed financial institutions to elect or revoke their choice to use particular methods specified in an application under subsection 141.02(18) of the Excise Tax Act for GST/HST and QST purposes. This form is used for the purpose of determining the method of calculating the net tax adjustment (NTA) and the net tax deduction (NTD) for financial institutions. It allows selected listed financial institutions to choose the method that best aligns with their business needs.

The form RC7222 "Election or Revocation for a Qualifying Institution that is a Selected Listed Financial Institution to Use Particular Methods Specified in an Application under Subsection 141.02(18) of the ETA for GST/HST and QST Purposes" is filed by selected listed financial institutions in Canada who want to elect or revoke the use of particular methods specified in an application under subsection 141.02(18) of the Excise Tax Act (ETA) for GST/HST and QST purposes.

FAQ

Q: What is Form RC7222?

A: Form RC7222 is a document used in Canada for requesting or revoking the election of specific methods for a qualifying institution that is a selected listed financial institution to use for GST/HST and QST purposes.

Q: What is the purpose of Form RC7222?

A: The purpose of Form RC7222 is to allow qualifying institutions that are selected listed financial institutions in Canada to elect or revoke the use of particular methods specified in an application under subsection 141.02(18) of the ETA (Excise Tax Act) for GST/HST and QST (Quebec Sales Tax) purposes.

Q: Who needs to use Form RC7222?

A: Form RC7222 is to be used by qualifying institutions that are selected listed financial institutions in Canada. These institutions can use this form to elect or revoke the use of specific methods for GST/HST and QST purposes.

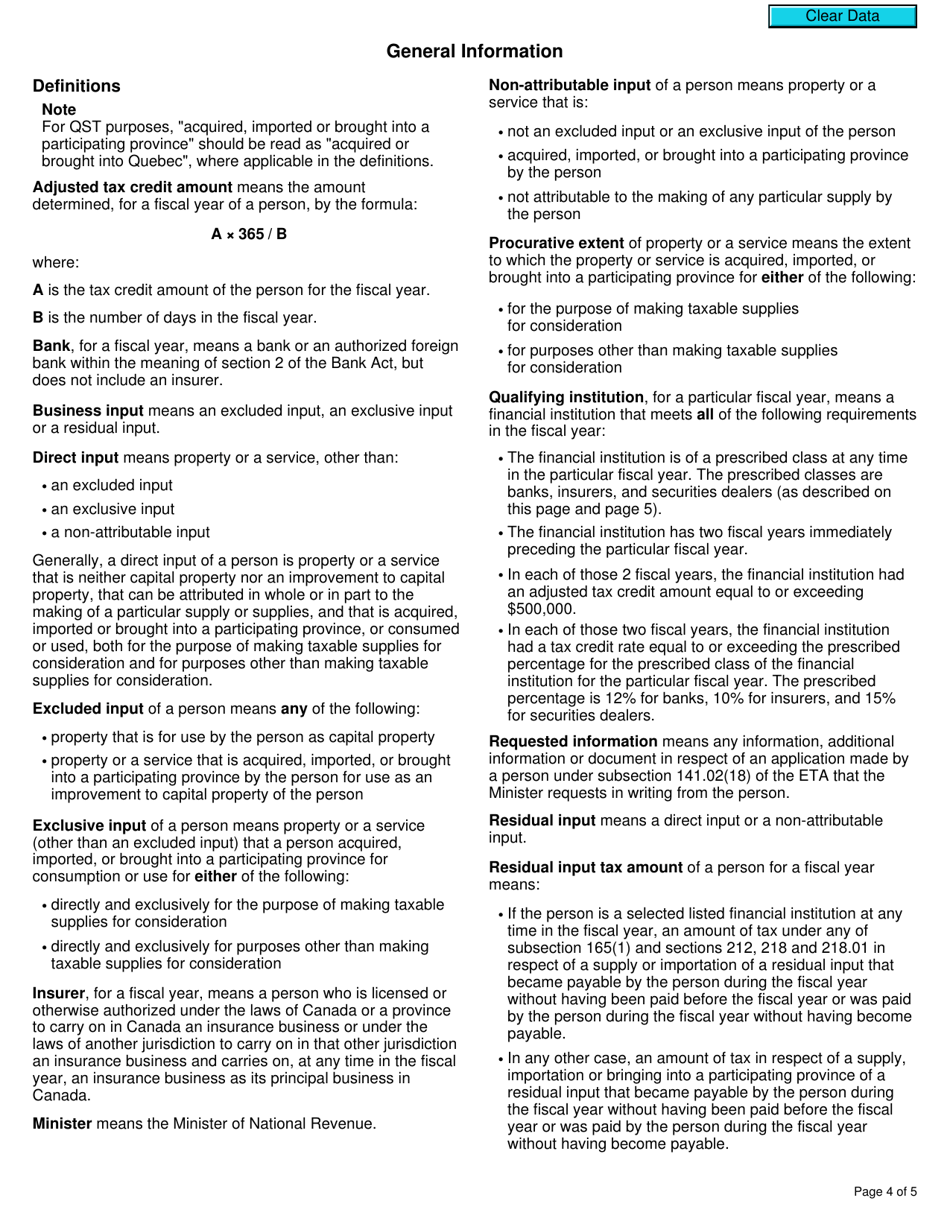

Q: What are qualifying institutions in Canada?

A: Qualifying institutions in Canada refer to financial institutions that are eligible to be considered selected listed financial institutions for GST/HST and QST purposes. These institutions need to meet certain criteria defined in the Excise Tax Act.

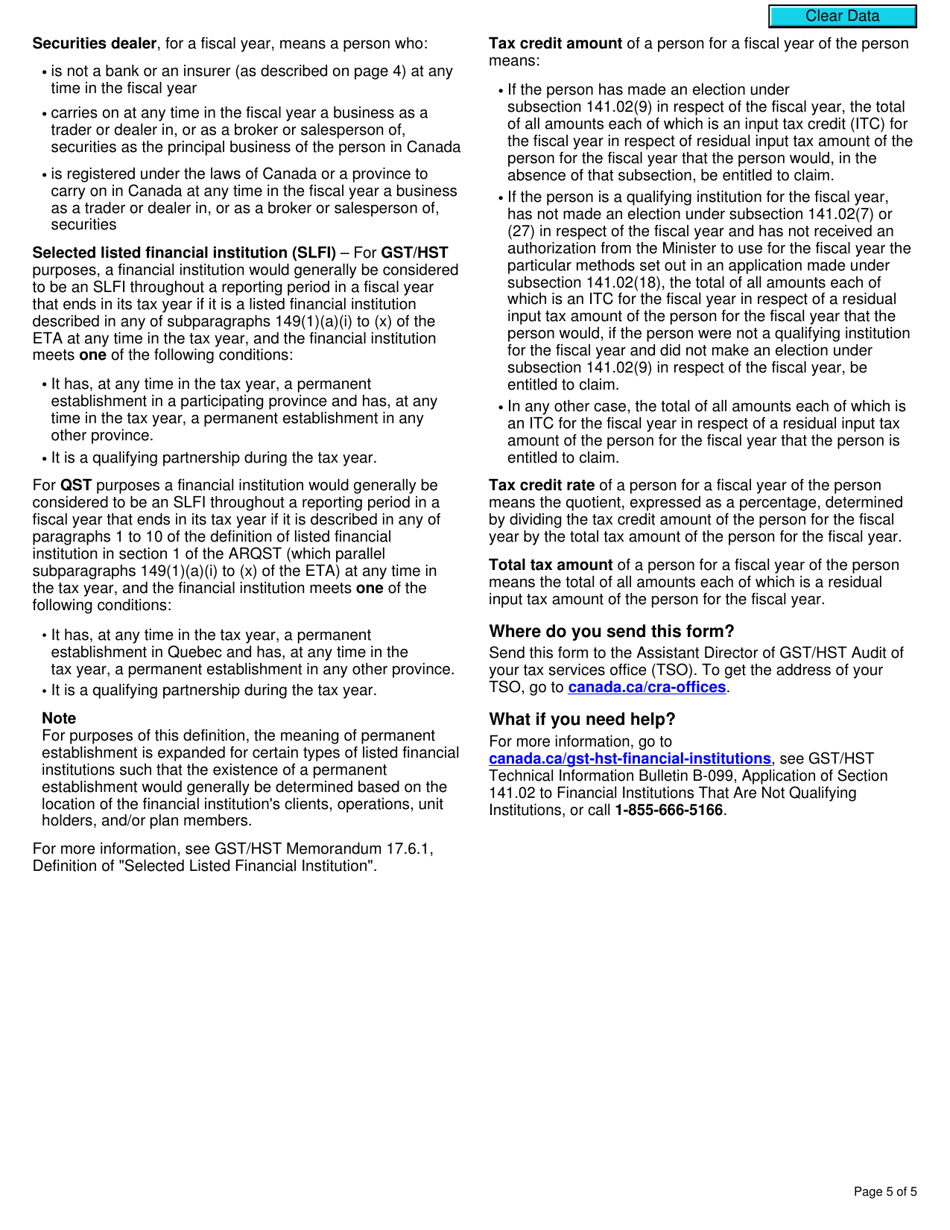

Q: What are selected listed financial institutions?

A: Selected listed financial institutions are financial institutions in Canada that meet specific requirements set out in the Excise Tax Act for GST/HST and QST purposes. These institutions may be eligible to use particular methods specified in an application under subsection 141.02(18) of the ETA.

Q: What are GST/HST and QST?

A: GST/HST (Goods and Services Tax/Harmonized Sales Tax) and QST (Quebec Sales Tax) are consumption taxes used in Canada. GST/HST is applicable in most provinces and territories, while QST is specific to the province of Quebec.

Q: What methods can be elected or revoked using Form RC7222?

A: Form RC7222 allows qualifying institutions to elect or revoke the use of particular methods specified in an application under subsection 141.02(18) of the Excise Tax Act for GST/HST and QST purposes. The specific methods eligible for election or revocation will be determined based on the institution's particular circumstances.

Q: How does one complete Form RC7222?

A: To complete Form RC7222, you need to provide the required information as per the instructions provided with the form. This may include details about your institution, the methods you wish to elect or revoke, and any supporting documentation or explanations as requested.

Q: Are there any deadlines for submitting Form RC7222?

A: The deadlines for submitting Form RC7222 may vary depending on the specific circumstances and requirements. It is advisable to consult the instructions provided with the form or contact the Canada Revenue Agency (CRA) for information regarding the applicable deadlines for your institution.