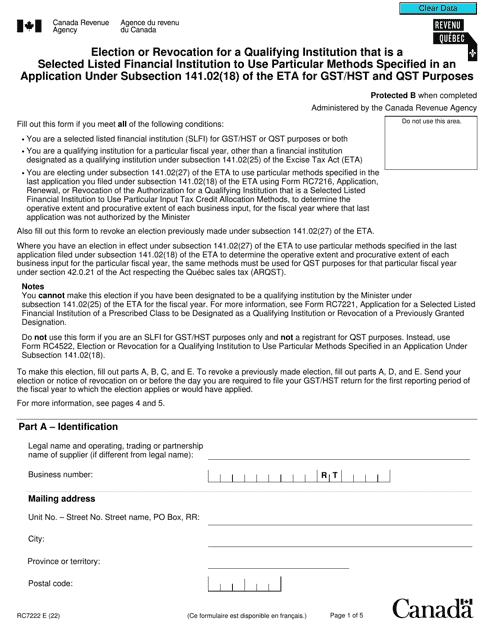

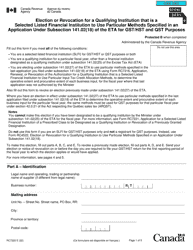

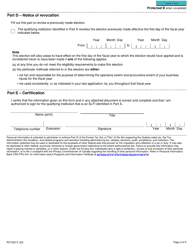

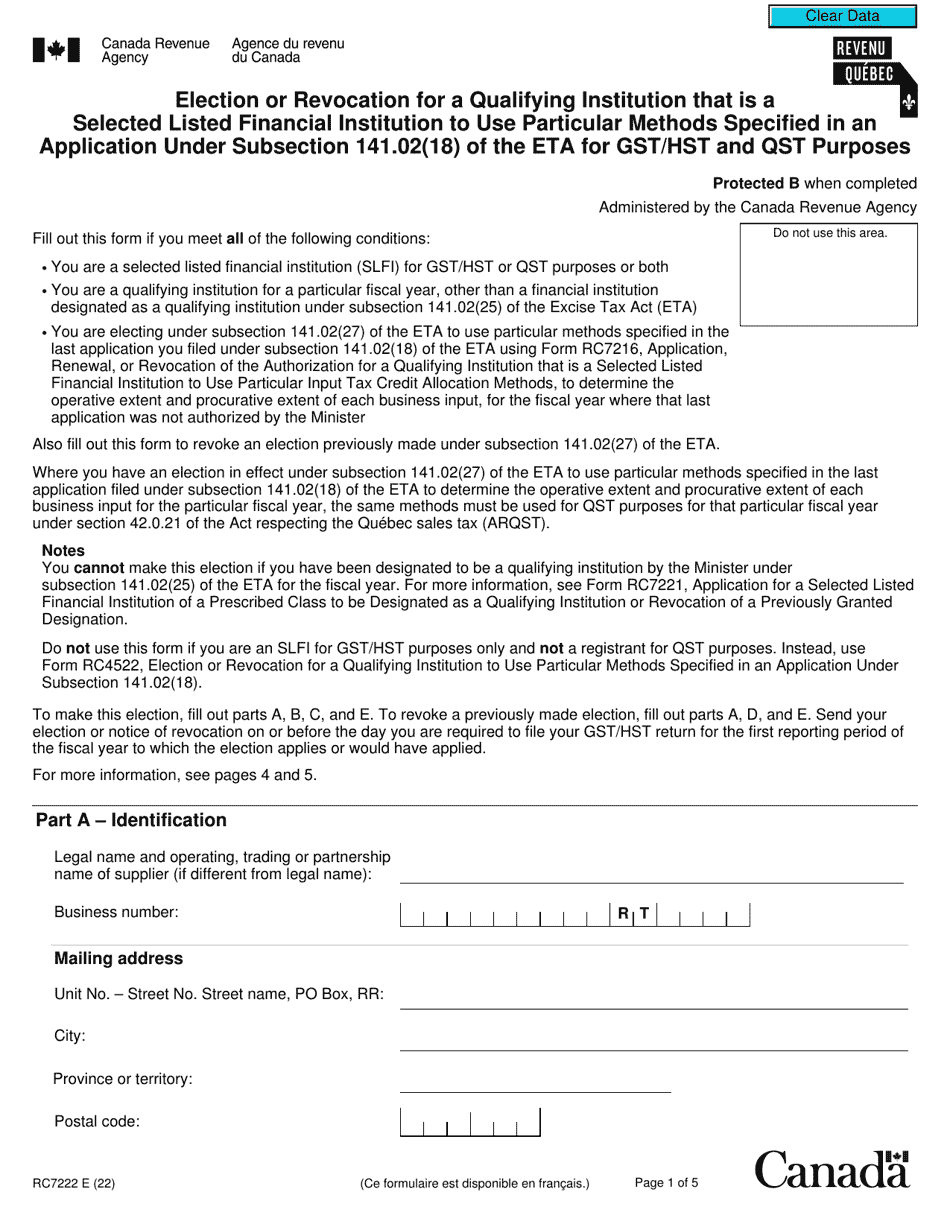

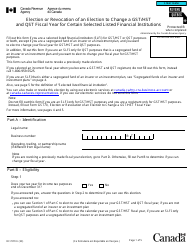

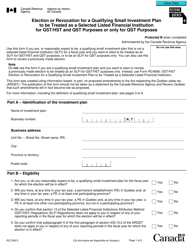

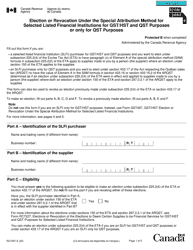

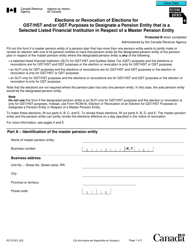

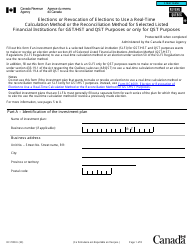

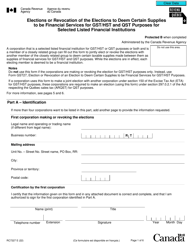

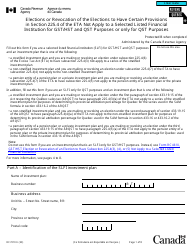

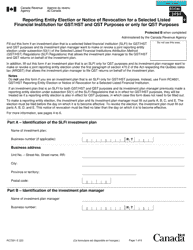

Form RC7222 Election or Revocation for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) of the ETA for Gst / Hst and Qst Purposes - Canada

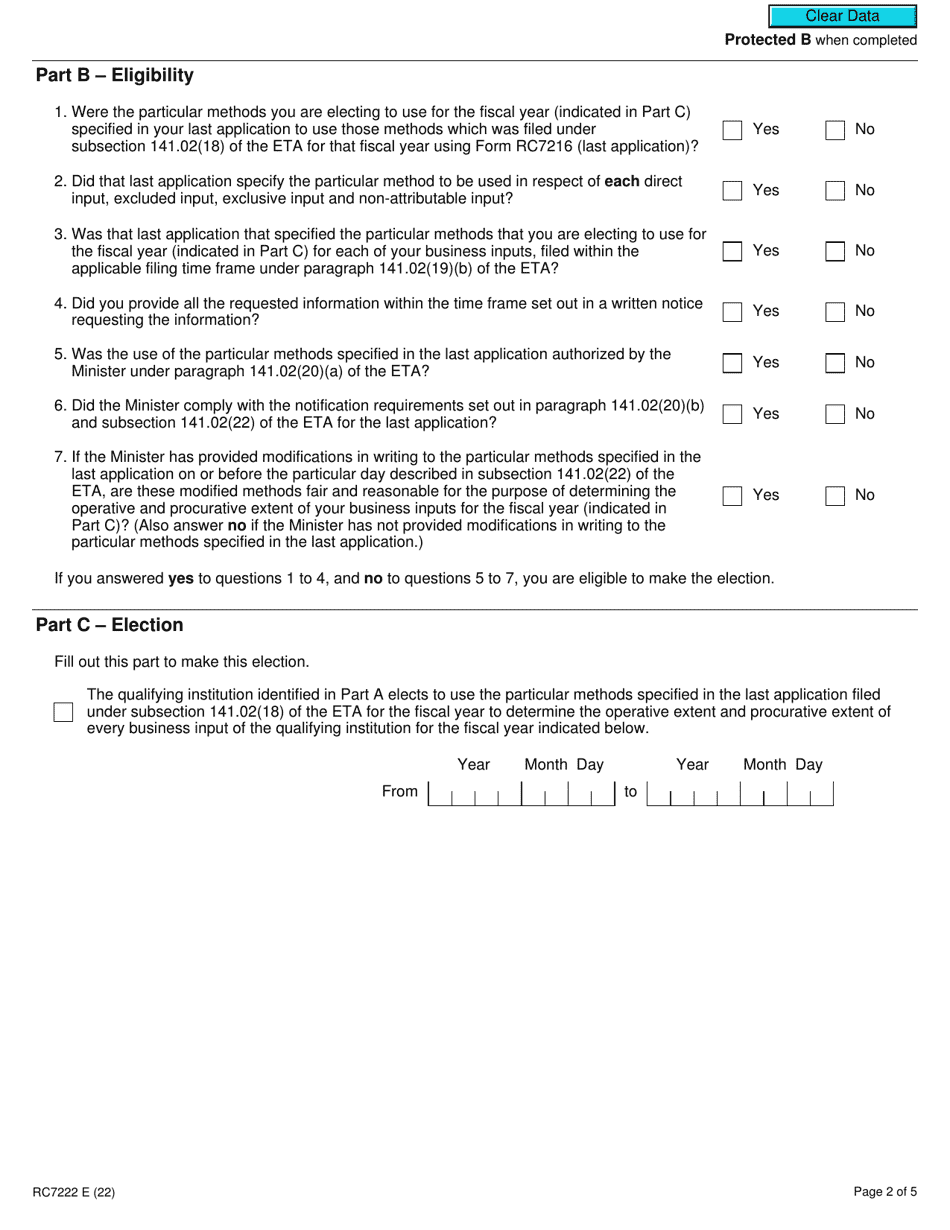

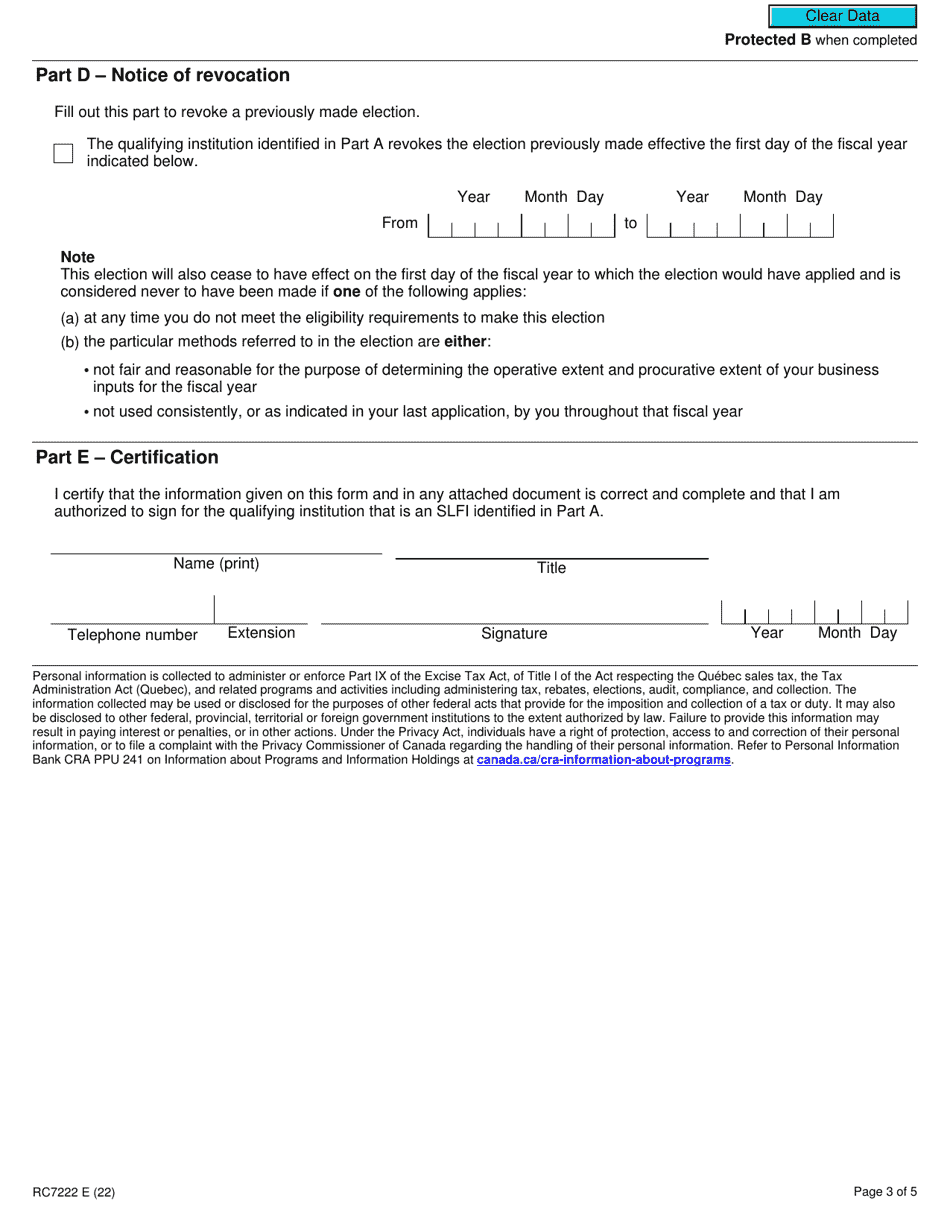

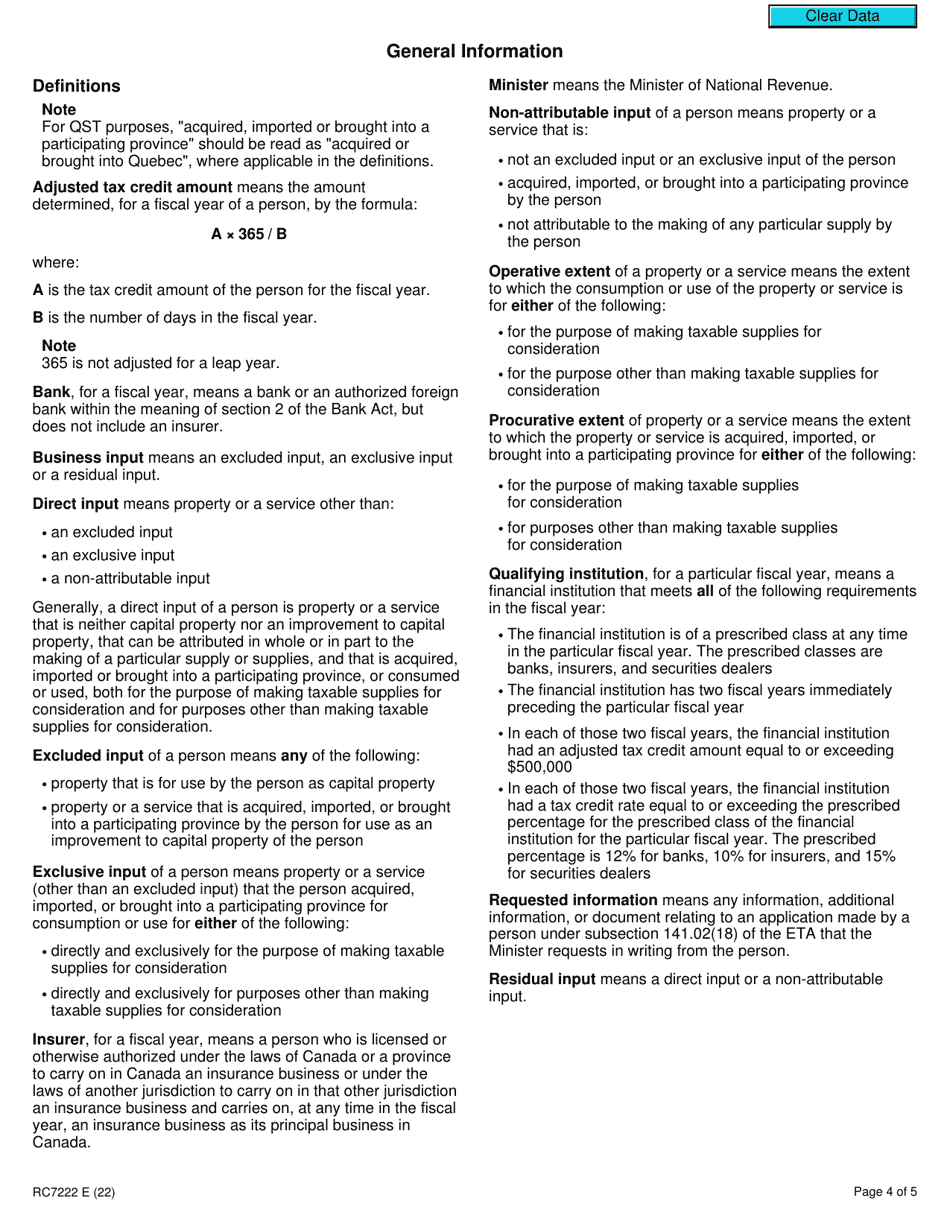

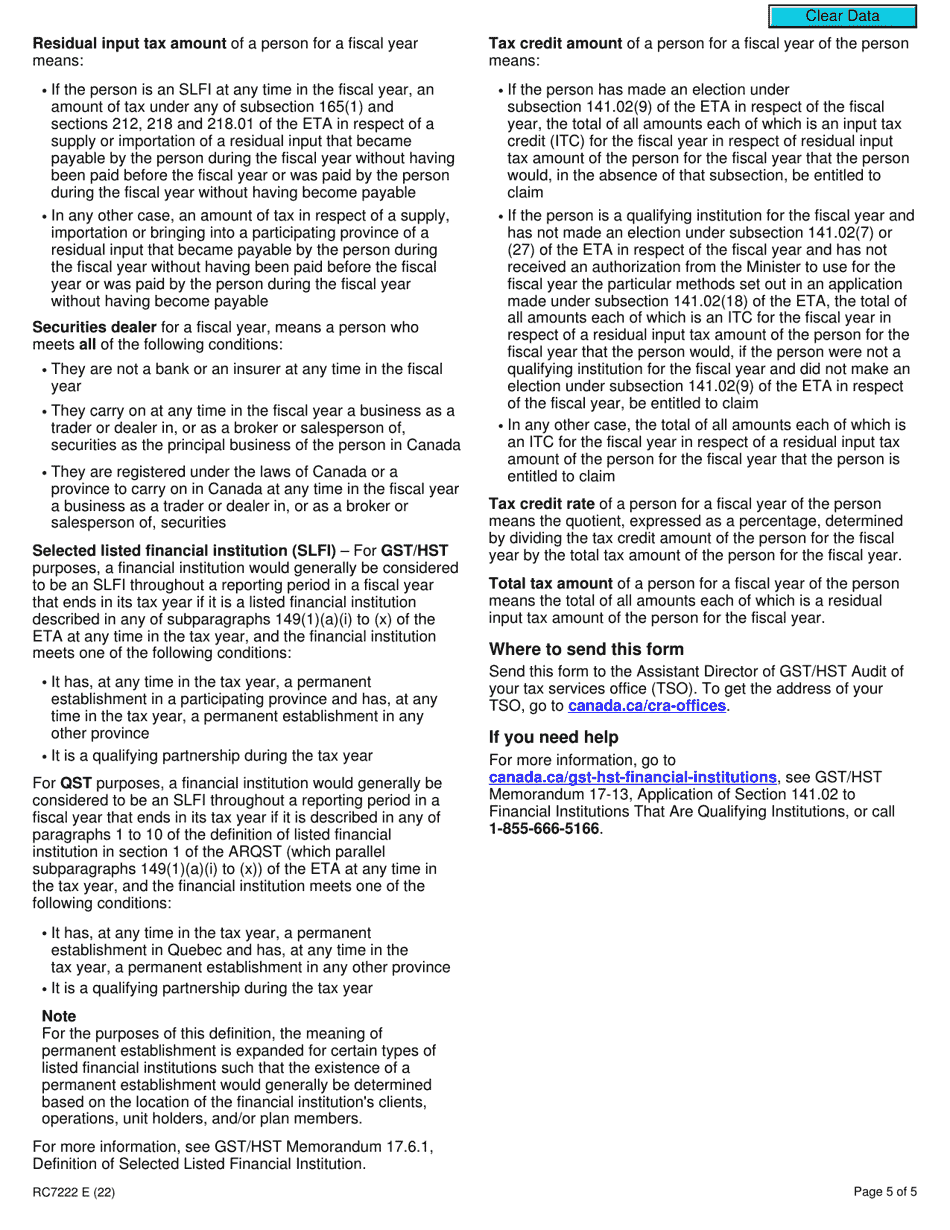

Form RC7222 Election or Revocation for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) of the ETA for Gst/Hst and Qst Purposes is used in Canada for a qualifying institution that is a selected listed financial institution to elect or revoke the use of particular methods specified in an application. This allows the institution to determine how GST/HST and QST (Goods and Services Tax/Harmonized Sales Tax and Quebec Sales Tax) should be calculated and reported for tax purposes.

The form RC7222 is filed by a qualifying institution that is a selected listed financial institution in Canada to elect or revoke the use of particular methods specified in an application under subsection 141.02(18) of the ETA for GST/HST and QST purposes.

Form RC7222 Election or Revocation for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) of the ETA for Gst/Hst and Qst Purposes - Canada - Frequently Asked Questions (FAQ)

Q: What is form RC7222?

A: Form RC7222 is the Election or Revocation for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) of the ETA for Gst/Hst and Qst Purposes.

Q: Who is eligible to use form RC7222?

A: Qualifying institutions that are selected listed financial institutions are eligible to use form RC7222.

Q: What is the purpose of form RC7222?

A: The purpose of form RC7222 is to allow qualifying institutions to elect or revoke the use of particular methods specified in an application under subsection 141.02(18) of the ETA for Gst/Hst and Qst purposes.

Q: What is ETA?

A: ETA refers to the Excise Tax Act, which is a Canadian tax law that imposes the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST).

Q: What is GST?

A: GST refers to the Goods and Services Tax, which is a tax on most goods and services sold or provided in Canada.

Q: What is HST?

A: HST refers to the Harmonized Sales Tax, which is a combined federal and provincial tax on most goods and services in certain provinces in Canada.

Q: What is QST?

A: QST refers to the Quebec Sales Tax, which is a tax on most goods and services sold or provided in Quebec.

Q: What is a qualifying institution?

A: A qualifying institution is an institution that meets certain criteria specified in the Excise Tax Act.

Q: What is a selected listed financial institution?

A: A selected listed financial institution is a financial institution that is designated by the Minister of National Revenue in Canada.

Q: How can I use form RC7222?

A: You can use form RC7222 to elect or revoke the use of particular methods specified in an application under subsection 141.02(18) of the ETA for Gst/Hst and Qst purposes by completing and submitting the form to the Canada Revenue Agency.