This version of the form is not currently in use and is provided for reference only. Download this version of

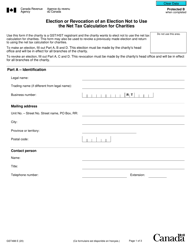

Form RC4600

for the current year.

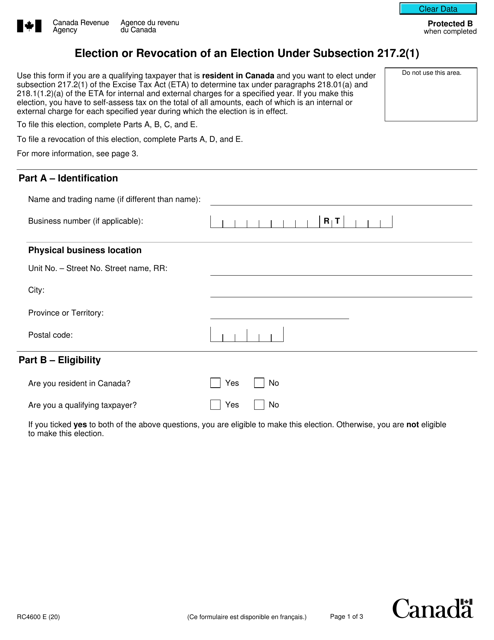

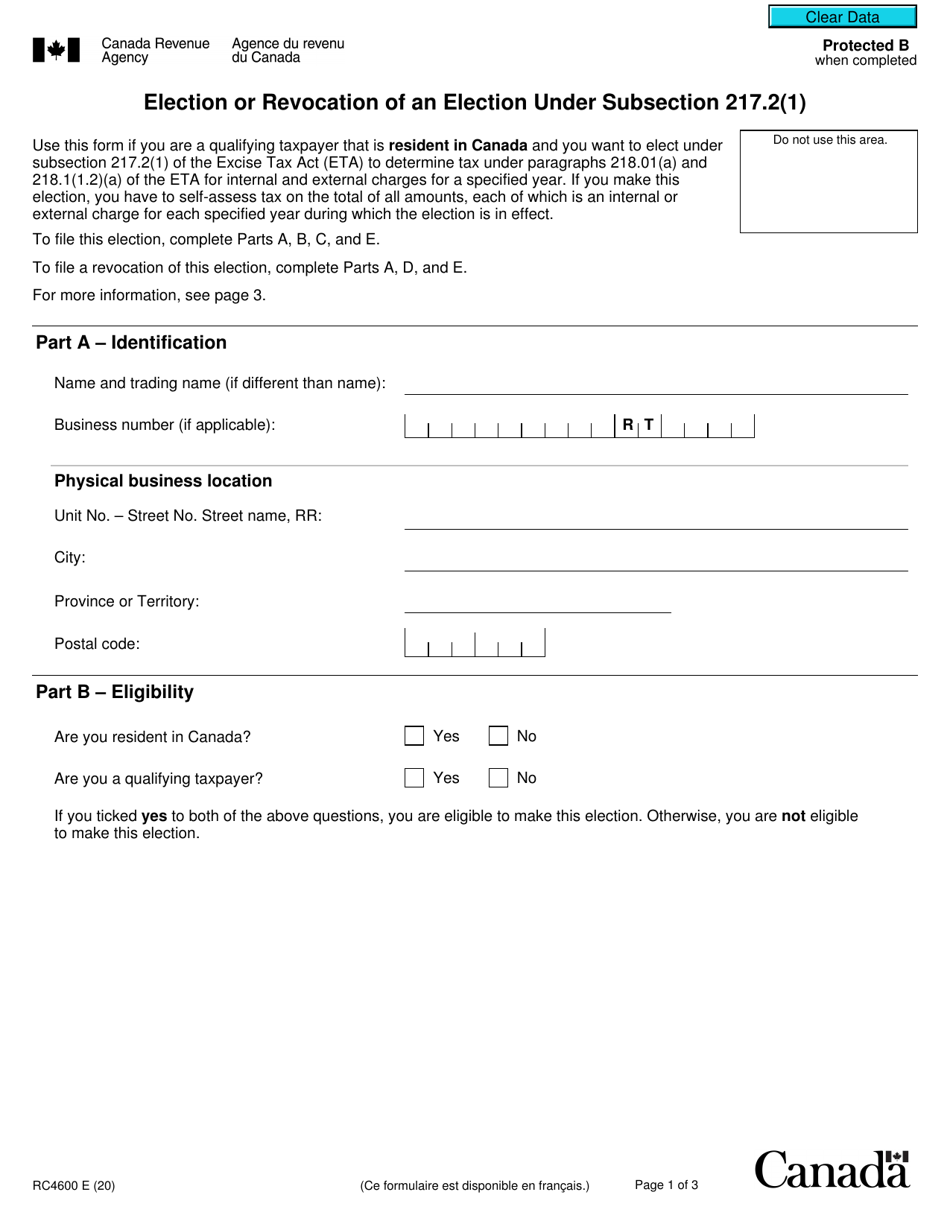

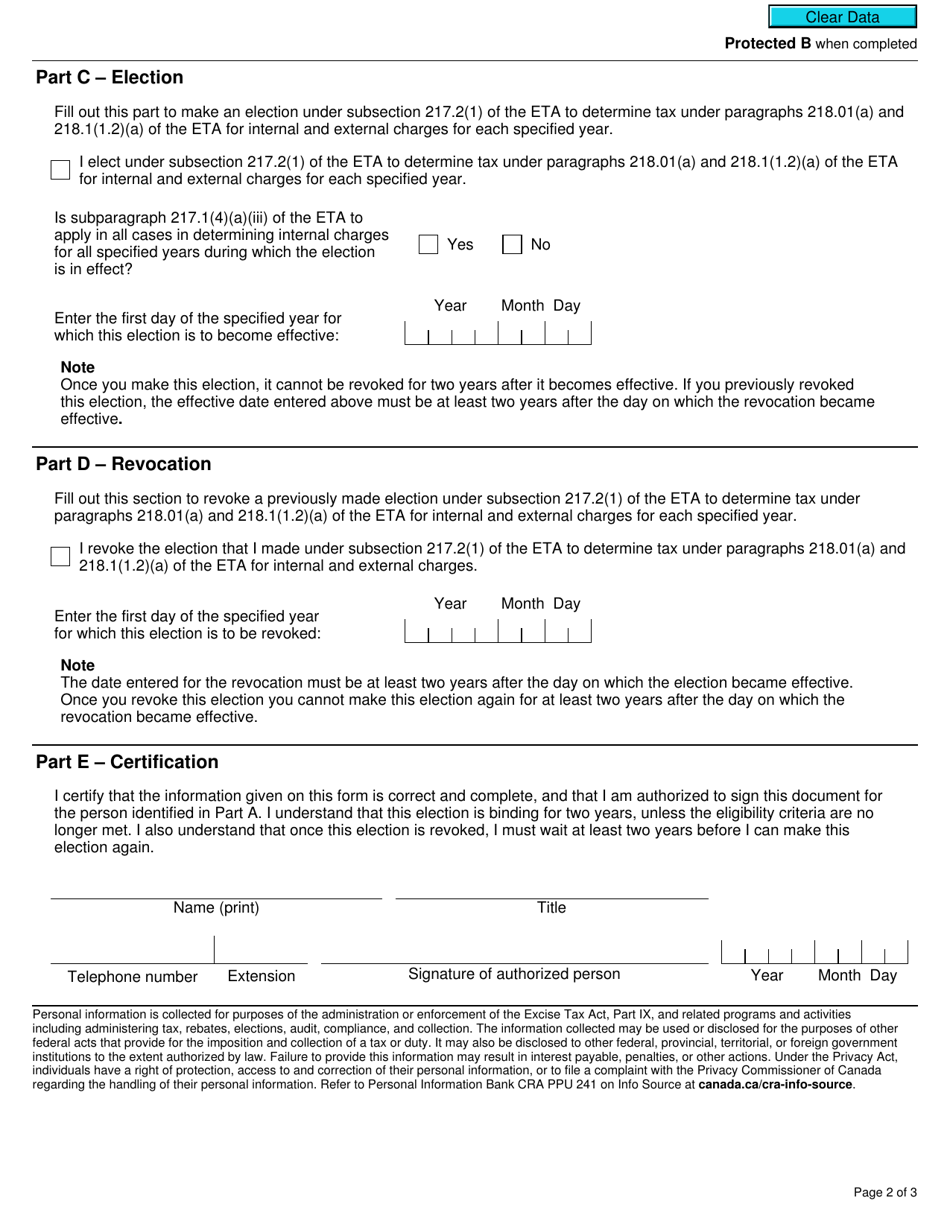

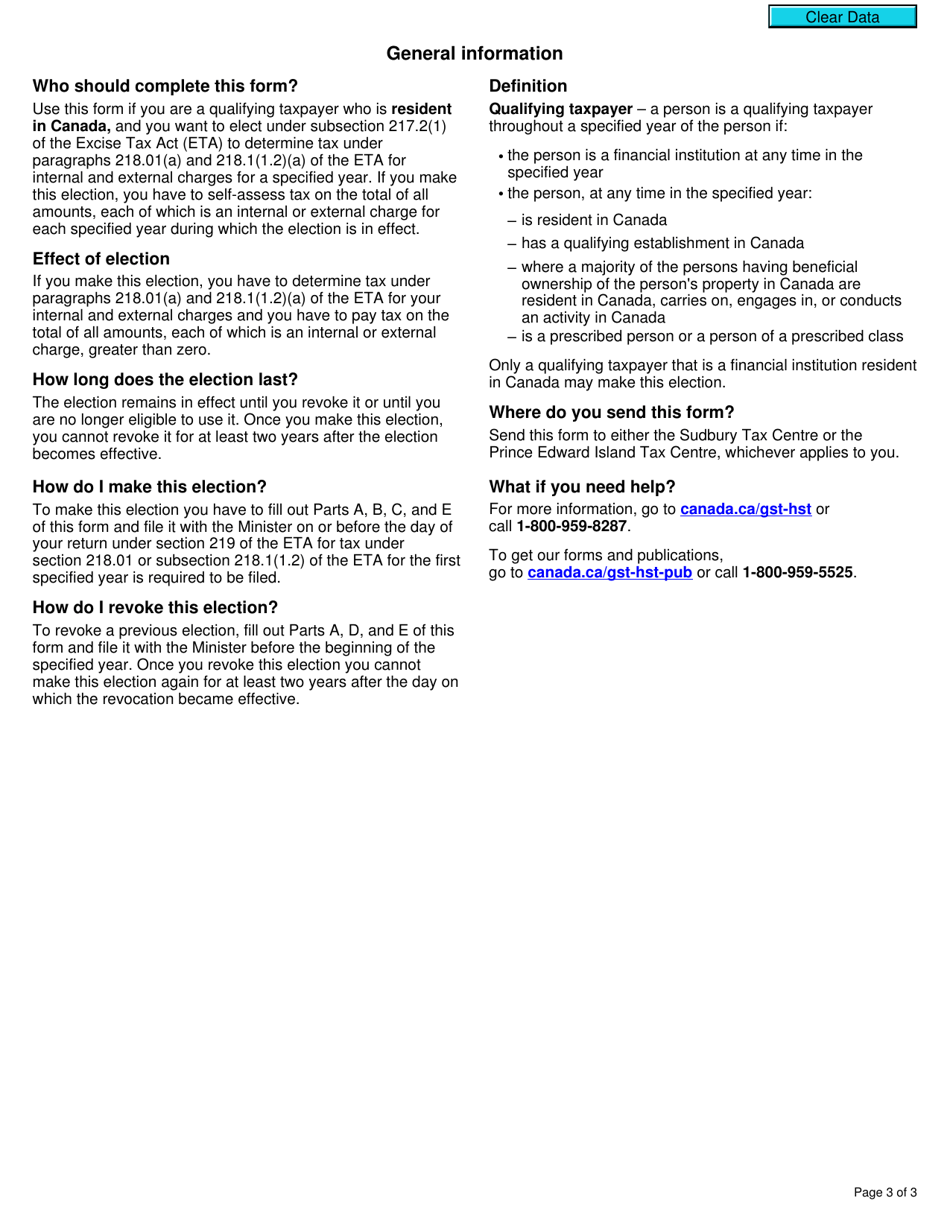

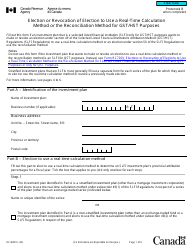

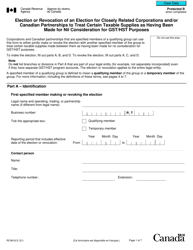

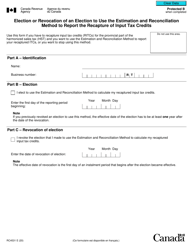

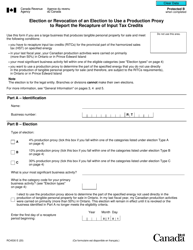

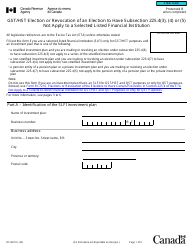

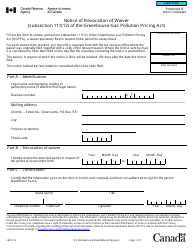

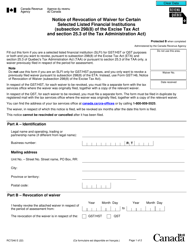

Form RC4600 Election or Revocation of an Election Under Subsection 217.2(1) - Canada

Form RC4600 is used for electing or revoking the election to split income for Canadian residents under subsection 217.2(1) of the Income Tax Act. This form allows individuals to allocate a portion of their income to their spouse or common-law partner for tax purposes.

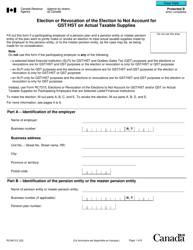

The Form RC4600 Election or Revocation of an Election Under Subsection 217.2(1) in Canada is filed by non-residents for tax purposes.

FAQ

Q: What is Form RC4600?

A: Form RC4600 is a form used in Canada to make an election or revoke an election under subsection 217.2(1) of the Income Tax Act.

Q: What does subsection 217.2(1) of the Income Tax Act refer to?

A: Subsection 217.2(1) of the Income Tax Act is related to the taxation of non-residents who receive certain types of income from Canada.

Q: When would someone use Form RC4600?

A: Someone would use Form RC4600 when they want to make an election or revoke an election regarding the taxation of certain types of income from Canada.

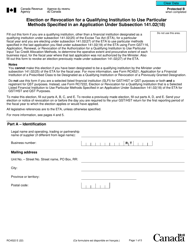

Q: Who is eligible to use Form RC4600?

A: Anyone who is a non-resident of Canada and receives income from Canada that falls under the provisions of subsection 217.2(1) may be eligible to use Form RC4600.

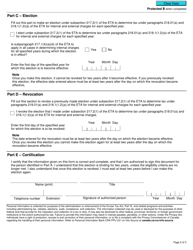

Q: Are there any deadlines for filing Form RC4600?

A: Yes, there are specific deadlines for filing Form RC4600, which can vary depending on the circumstances. It is important to check the instructions accompanying the form or consult with the CRA for the applicable deadlines.

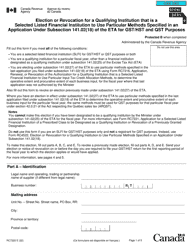

Q: Is professional help required to complete Form RC4600?

A: While it is possible to complete Form RC4600 on your own, seeking professional help from a tax advisor or accountant may be beneficial to ensure proper compliance with the tax regulations and maximize your tax benefits.

Q: What are the consequences of not filing Form RC4600 when required?

A: Failing to file Form RC4600 when required may result in penalties and interest charges imposed by the CRA. It is important to comply with the tax regulations to avoid these consequences.