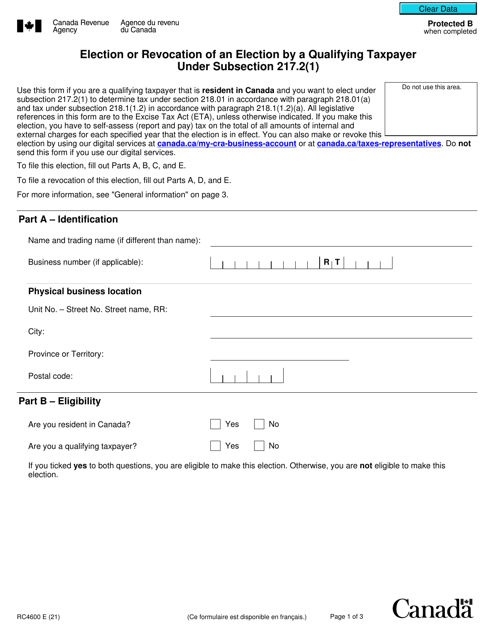

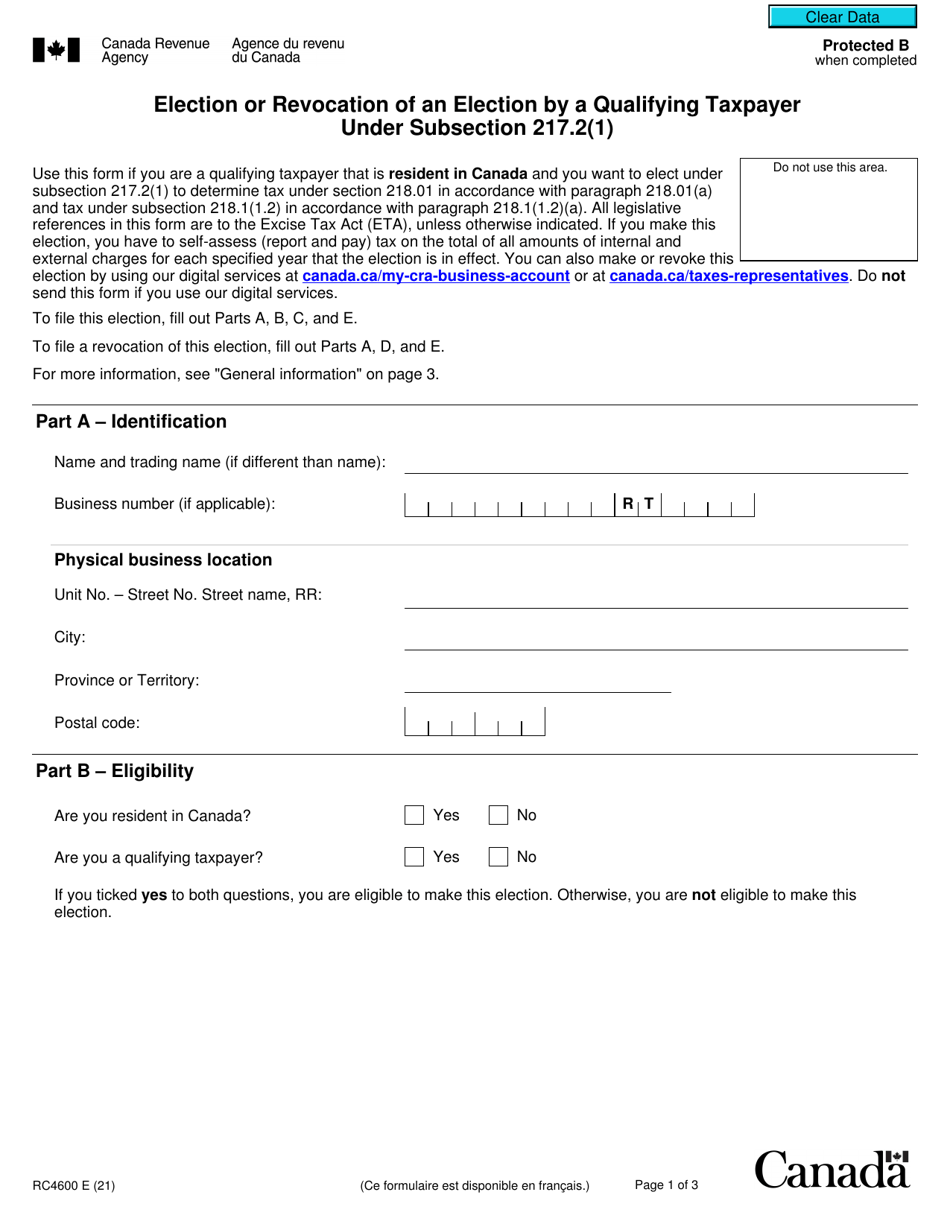

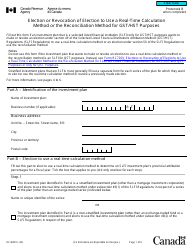

Form RC4600 Election or Revocation of an Election by a Qualifying Taxpayer Under Subsection 217.2(1) - Canada

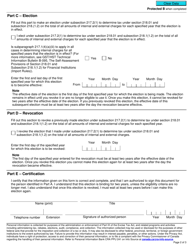

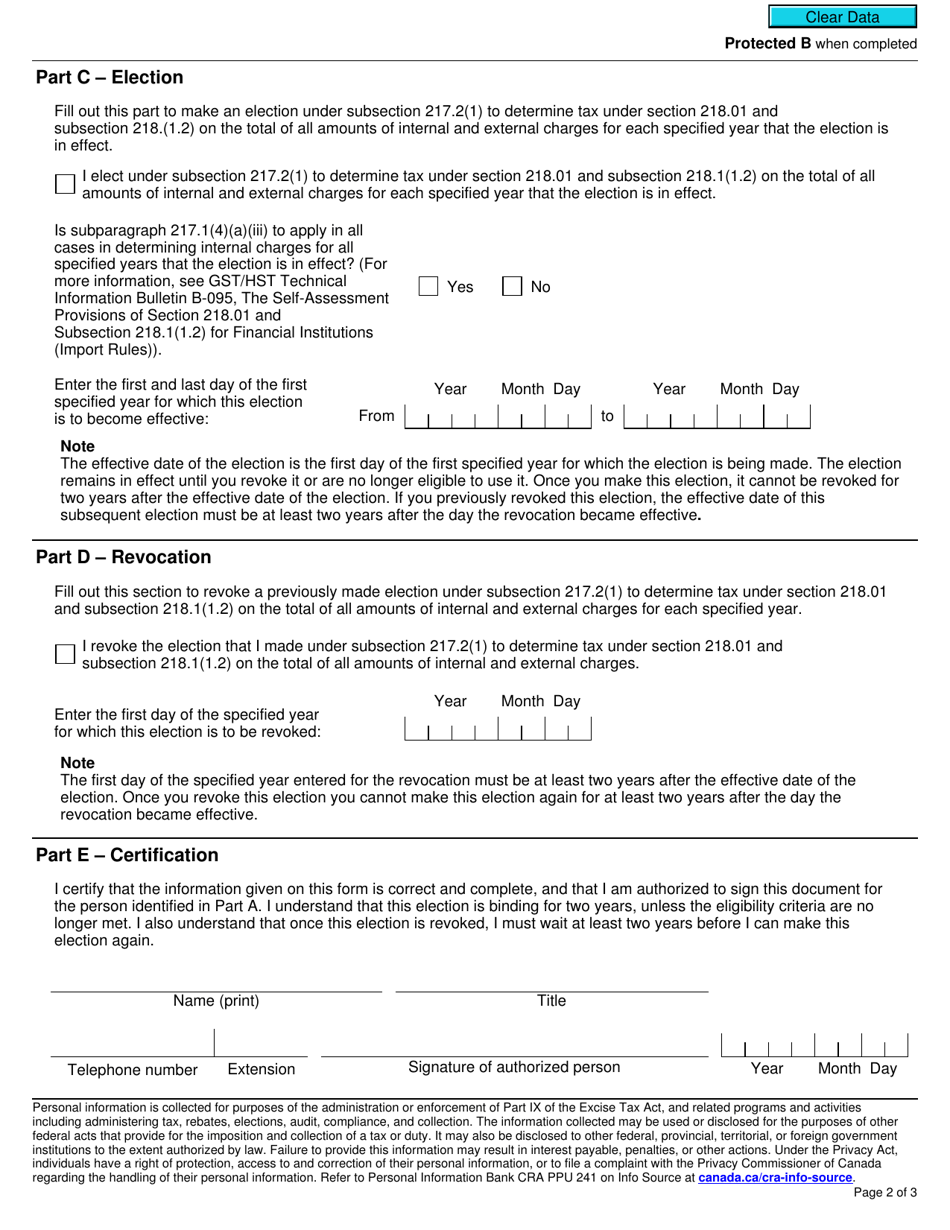

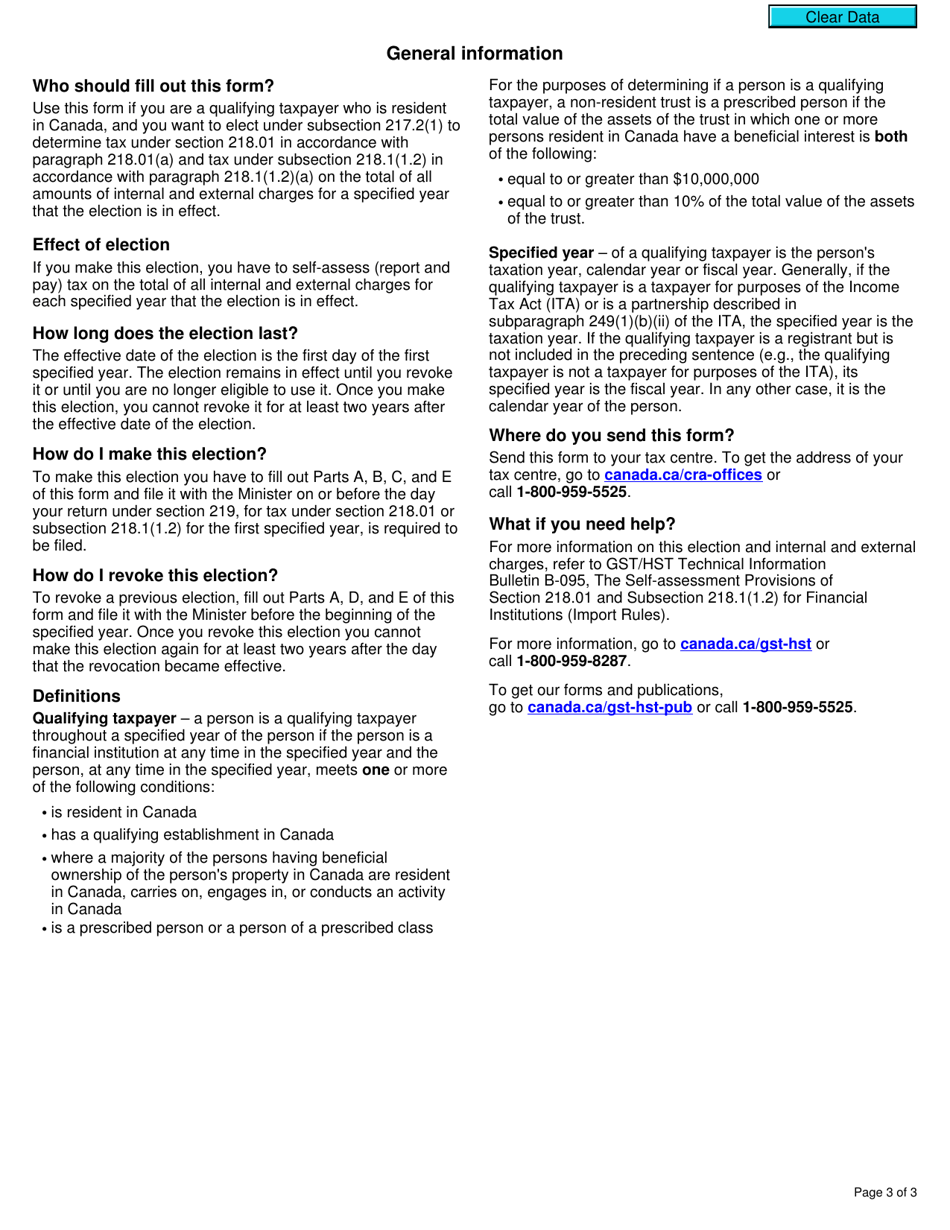

Form RC4600 is used in Canada by qualifying taxpayers to make an election or revoke a previously made election under subsection 217.2(1) of the Canadian Income Tax Act. This election is related to non-resident property income and allows taxpayers to choose to include this income in their Canadian tax return at the Canadian tax rate instead of the non-resident withholding tax rate.

The form RC4600 is filed by a qualifying taxpayer in Canada who wishes to make or revoke an election under subsection 217.2(1) of the Canadian Income Tax Act.

Form RC4600 Election or Revocation of an Election by a Qualifying Taxpayer Under Subsection 217.2(1) - Canada - Frequently Asked Questions (FAQ)

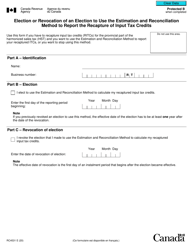

Q: What is Form RC4600?

A: Form RC4600 is a tax form used in Canada for the election or revocation of an election by a qualifying taxpayer under subsection 217.2(1).

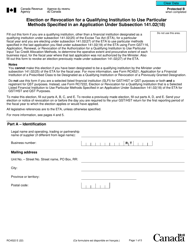

Q: Who can use Form RC4600?

A: Qualifying taxpayers in Canada can use Form RC4600 to make an election or revoke an election under subsection 217.2(1).

Q: What does subsection 217.2(1) refer to?

A: Subsection 217.2(1) refers to the section of the Canadian Income Tax Act that pertains to the taxation of non-resident individuals.

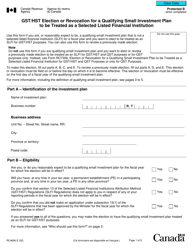

Q: What is the purpose of making an election under subsection 217.2(1)?

A: Making an election under subsection 217.2(1) allows non-resident individuals to be taxed only on income earned in Canada, instead of worldwide income.

Q: How do I complete Form RC4600?

A: You should carefully follow the instructions provided on the form to complete and submit Form RC4600 accurately.

Q: Is there a deadline for filing Form RC4600?

A: The deadline for filing Form RC4600 may vary, so it is important to check the CRA guidelines or consult a tax professional for specific deadlines.

Q: What should I do if I need help with Form RC4600?

A: If you need help with Form RC4600, you can contact the Canada Revenue Agency (CRA) or seek assistance from a tax professional.