This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST44

for the current year.

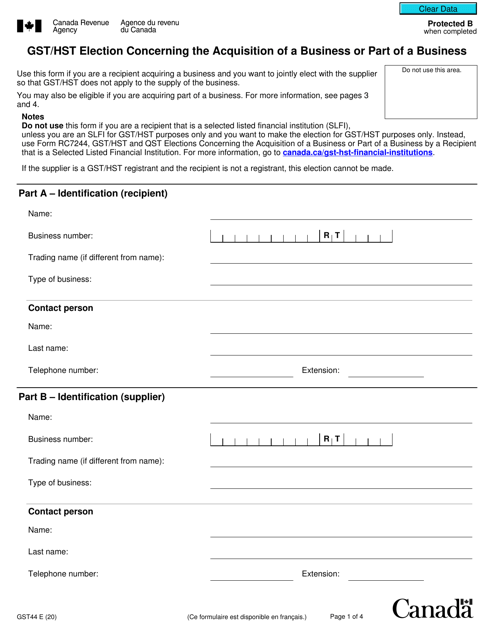

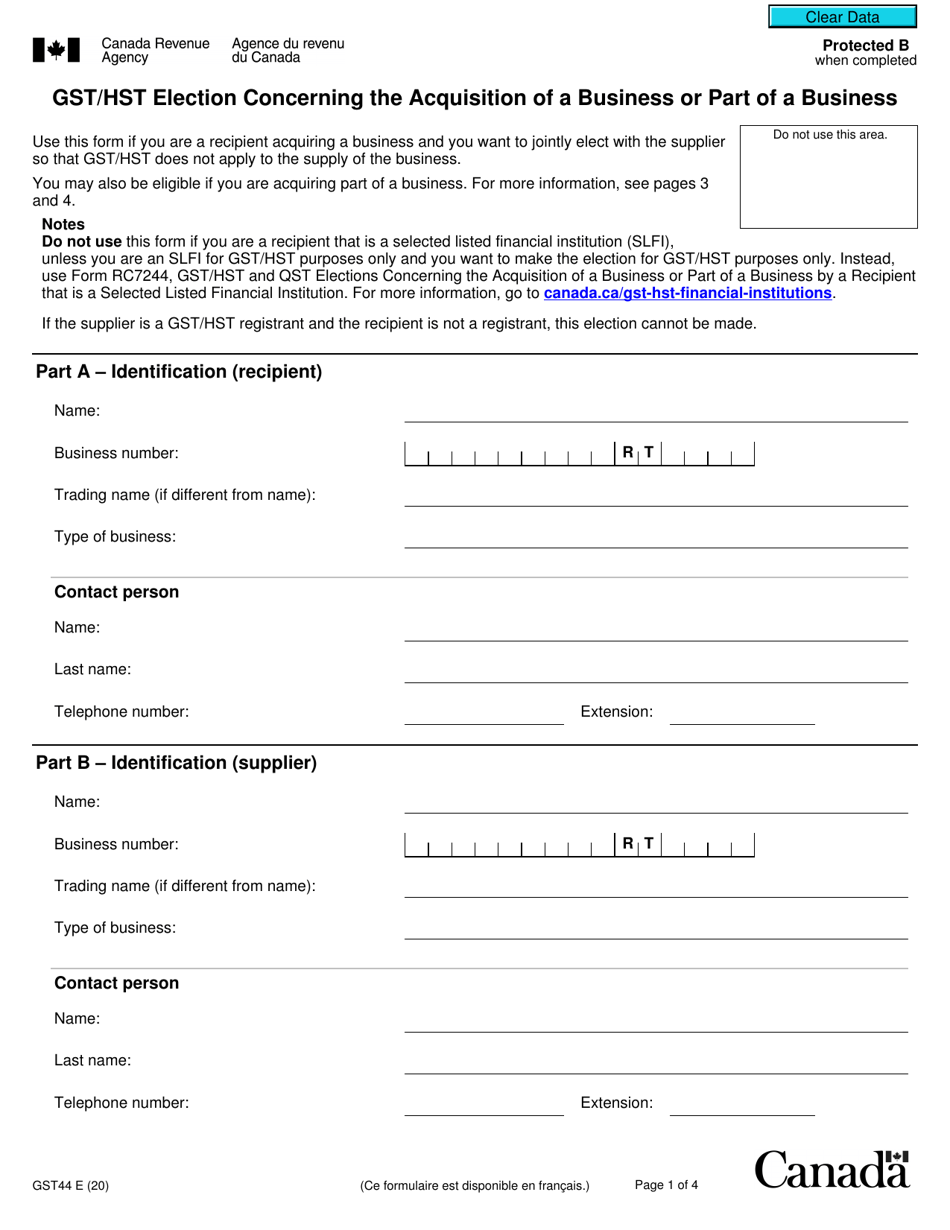

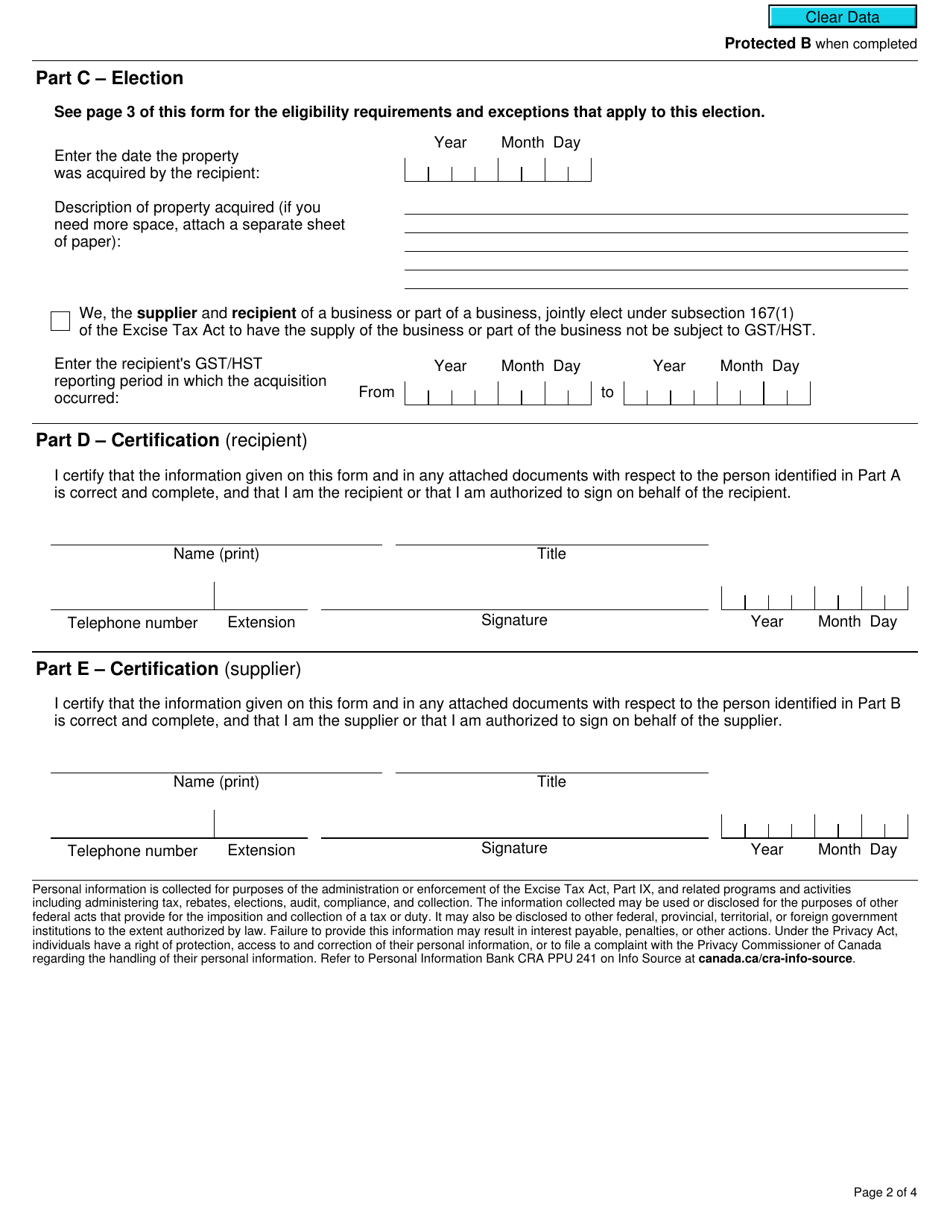

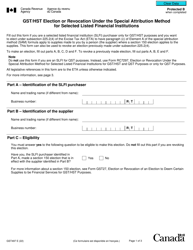

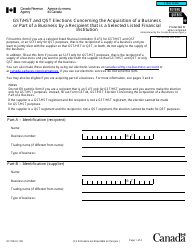

Form GST44 Gst / Hst Election Concerning the Acquisition of a Business or Part of a Business - Canada

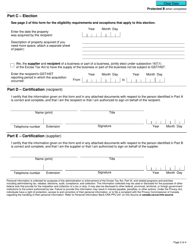

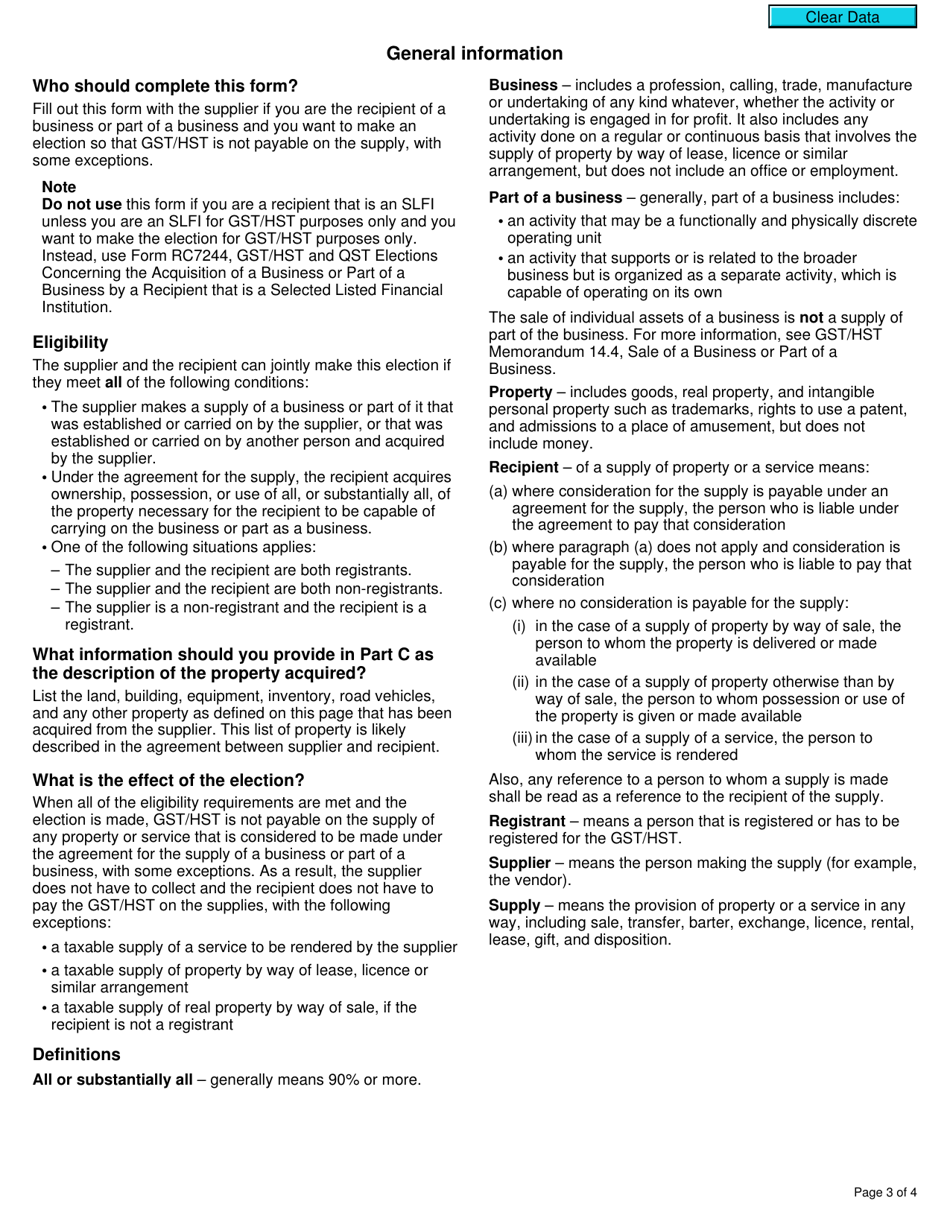

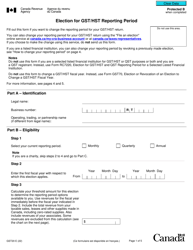

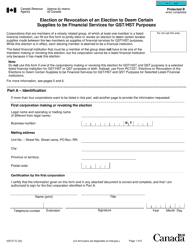

The Form GST44 GST/HST Election concerning the acquisition of a business or part of a business in Canada is used to elect how goods and services tax (GST) or harmonized sales tax (HST) will be applied to the acquisition. It allows the purchaser and vendor to choose whether to have the GST/HST apply to the transaction.

The Form GST44 GST/HST election regarding the acquisition of a business or part of a business in Canada is filed by the purchaser of the business or part of the business.

FAQ

Q: What is Form GST44?

A: Form GST44 is a form used in Canada to make a GST/HST election concerning the acquisition of a business or part of a business.

Q: What is a GST/HST election?

A: A GST/HST election is a choice made by a taxpayer regarding the application of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) to a specific transaction or business.

Q: What does the Form GST44 cover?

A: The Form GST44 covers the election concerning the acquisition of a business or part of a business.

Q: Why would someone need to make a GST/HST election concerning the acquisition of a business?

A: A taxpayer may need to make a GST/HST election concerning the acquisition of a business in order to determine how the GST or HST will apply to the transaction.

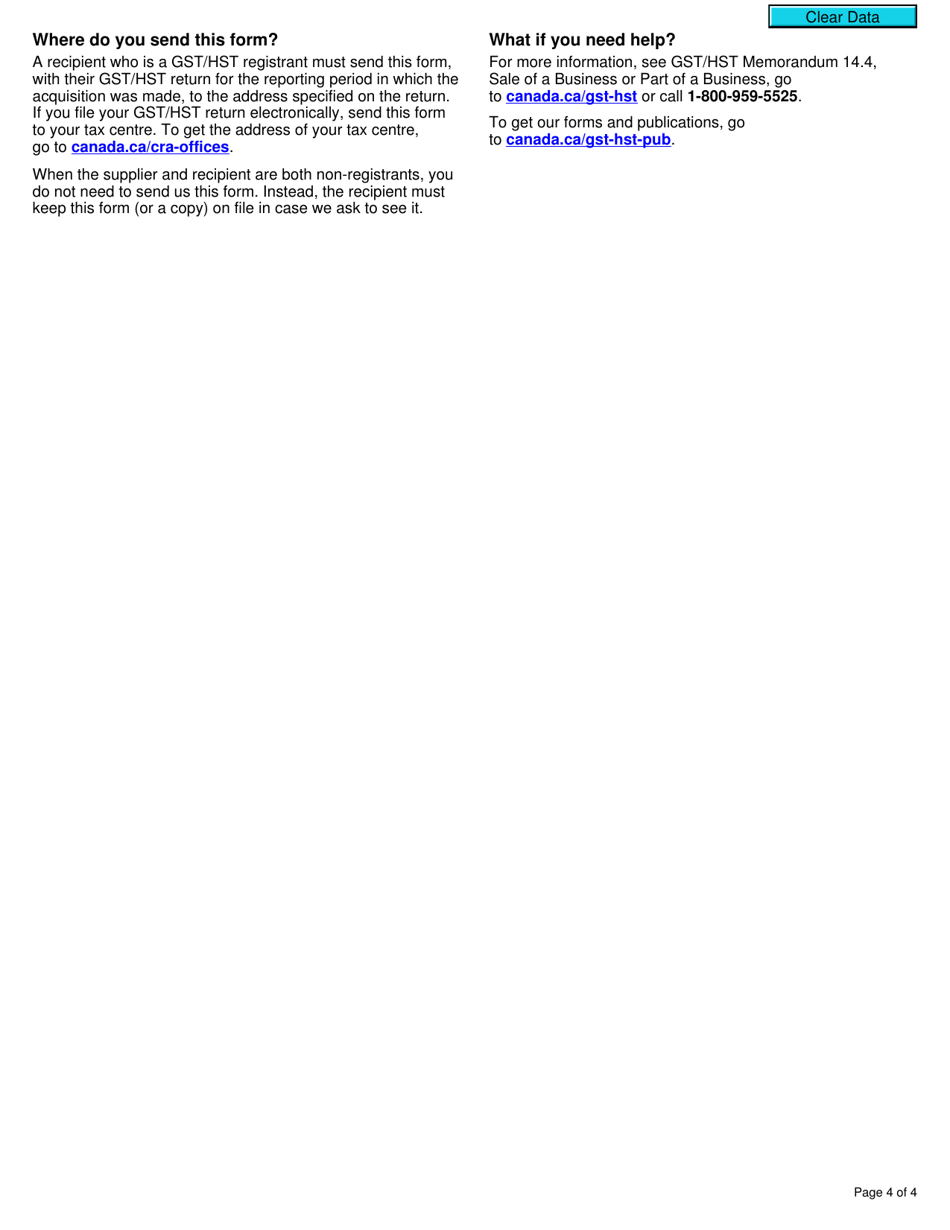

Q: Are there any deadlines for filing Form GST44?

A: Yes, there are deadlines for filing Form GST44. The specific deadlines depend on the circumstances of the acquisition of the business.

Q: Is Form GST44 applicable in the United States?

A: No, Form GST44 is specific to Canada and is not applicable in the United States.

Q: What information is required to fill out Form GST44?

A: To fill out Form GST44, you will need information about the parties involved in the acquisition, details of the business being acquired, and the desired GST/HST election.

Q: Is it necessary to consult a tax professional when filling out Form GST44?

A: While it is not mandatory, consulting a tax professional may be helpful to ensure accurate completion of Form GST44 and to understand the implications of the GST/HST election.