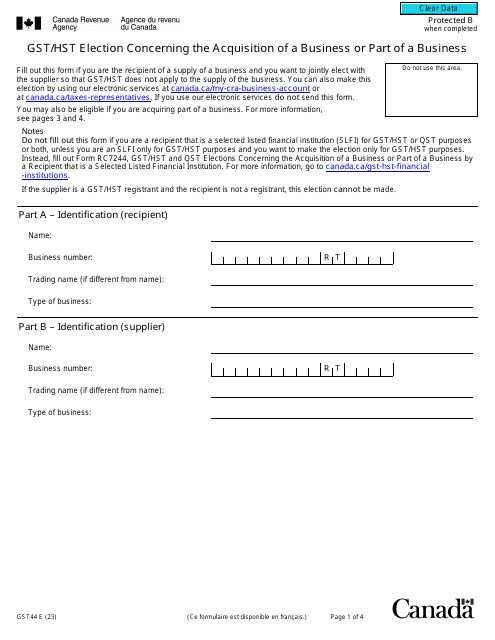

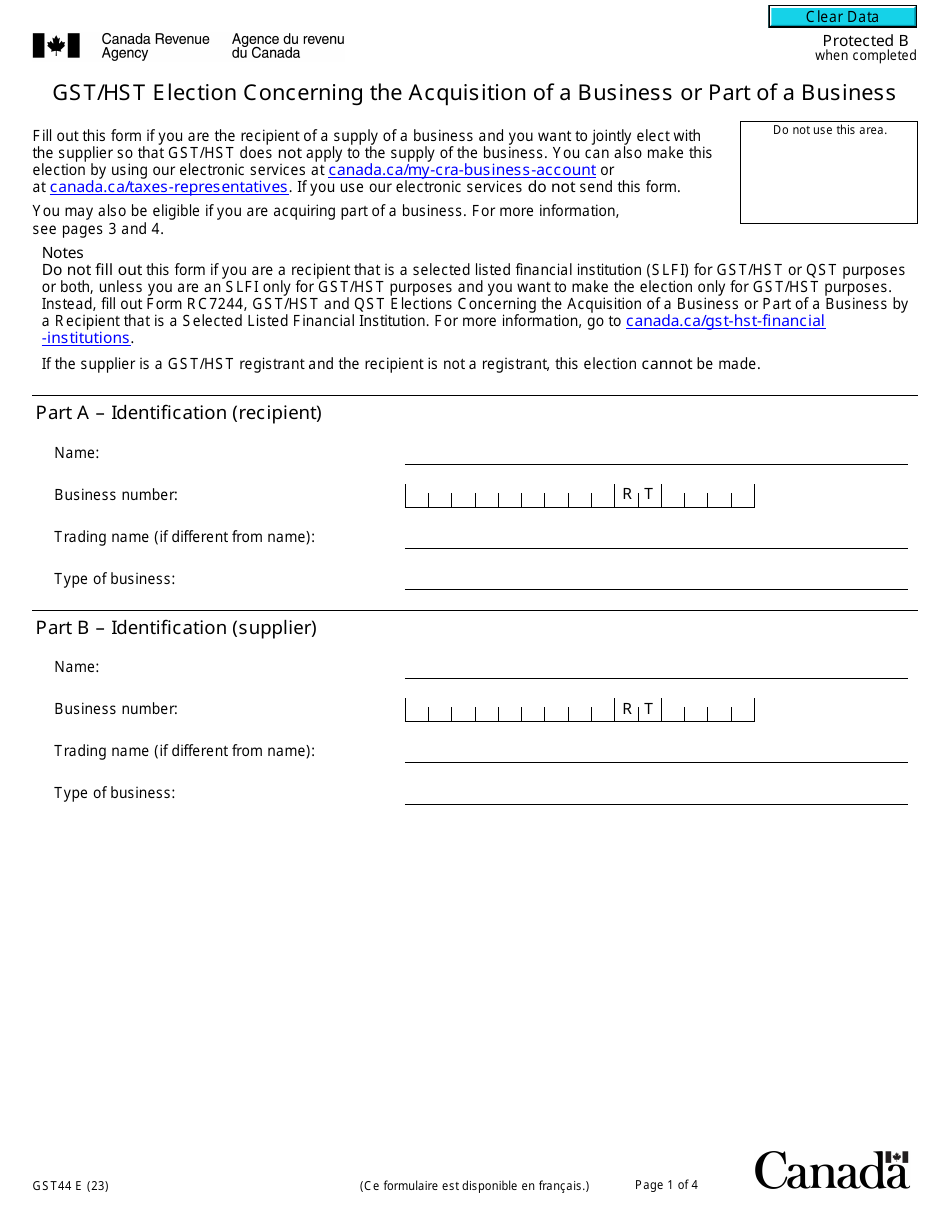

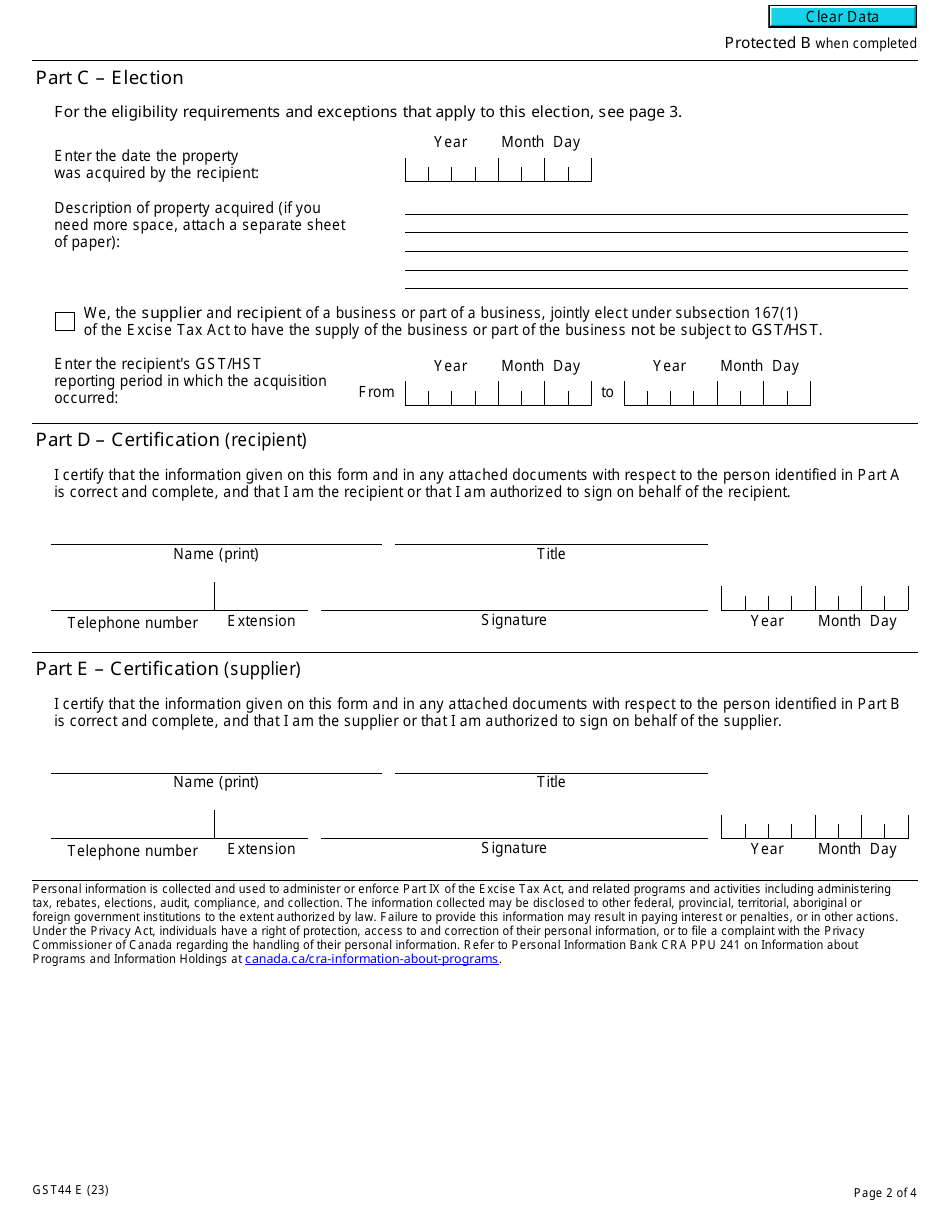

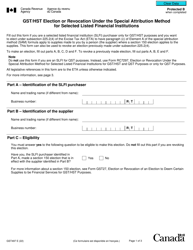

Form GST44 Gst / Hst Election Concerning the Acquisition of a Business or Part of a Business - Canada

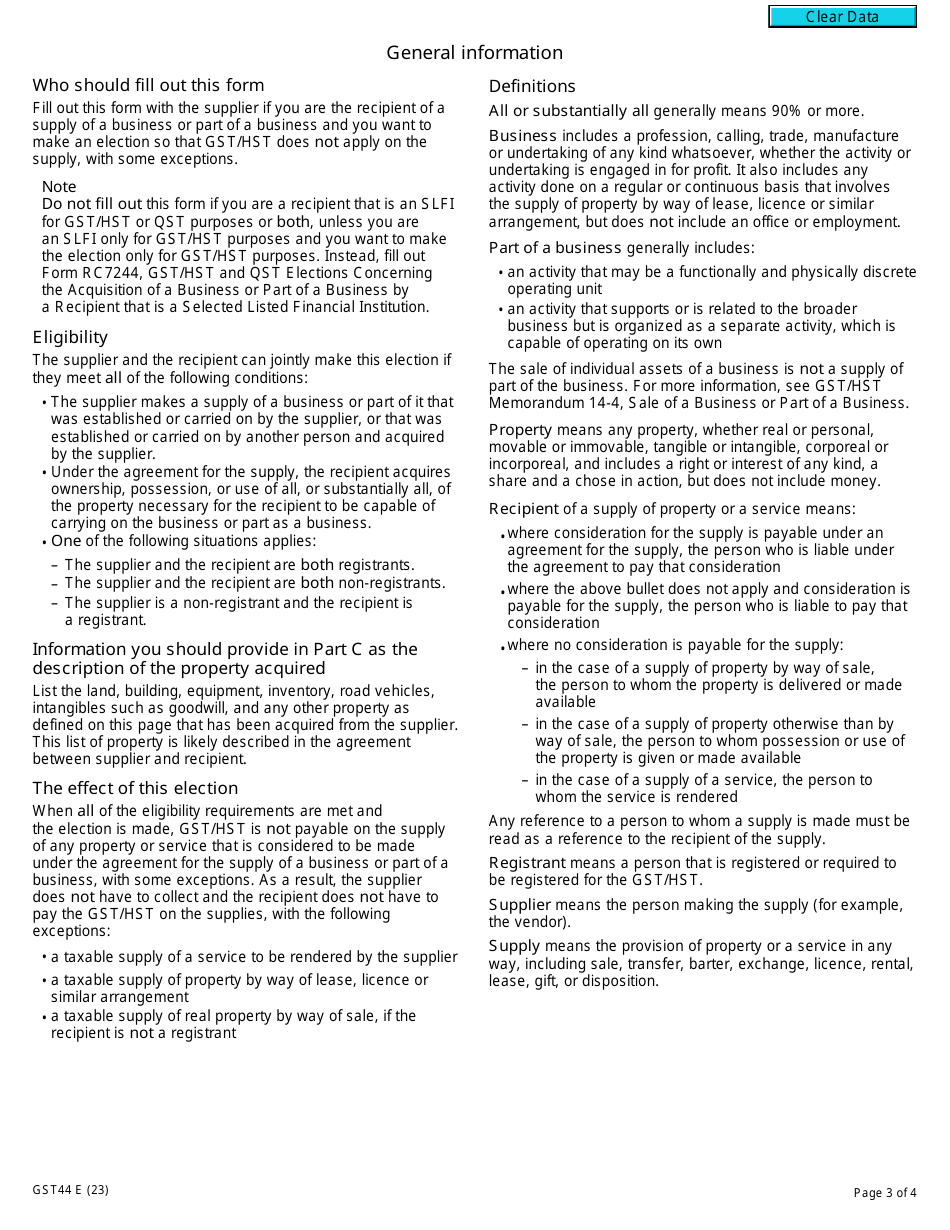

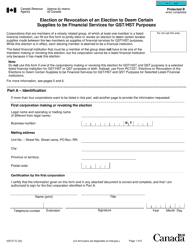

Form GST44 is used in Canada for making a GST/HST election concerning the acquisition of a business or part of a business. This election allows the purchaser of a business to be jointly and severally liable for certain outstanding GST/HST debts of the seller.

In Canada, the person acquiring a business or part of a business files the Form GST44 GST/HST Election.

Form GST44 Gst/Hst Election Concerning the Acquisition of a Business or Part of a Business - Canada - Frequently Asked Questions (FAQ)

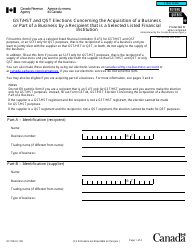

Q: What is a GST44 form?

A: The GST44 form is used in Canada for making a GST/HST election concerning the acquisition of a business or part of a business.

Q: What is a GST/HST election?

A: A GST/HST election allows a person or entity to choose whether or not to pay GST or HST on the acquisition of a business or part of a business.

Q: What does the GST44 form determine?

A: The GST44 form determines whether the purchaser will be responsible for paying GST/HST on the acquisition of a business or part of a business.

Q: Who needs to fill out the GST44 form?

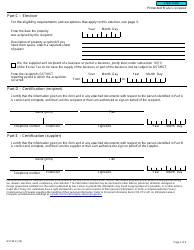

A: Both the vendor (seller) and the purchaser (buyer) of a business or part of a business need to fill out the GST44 form.

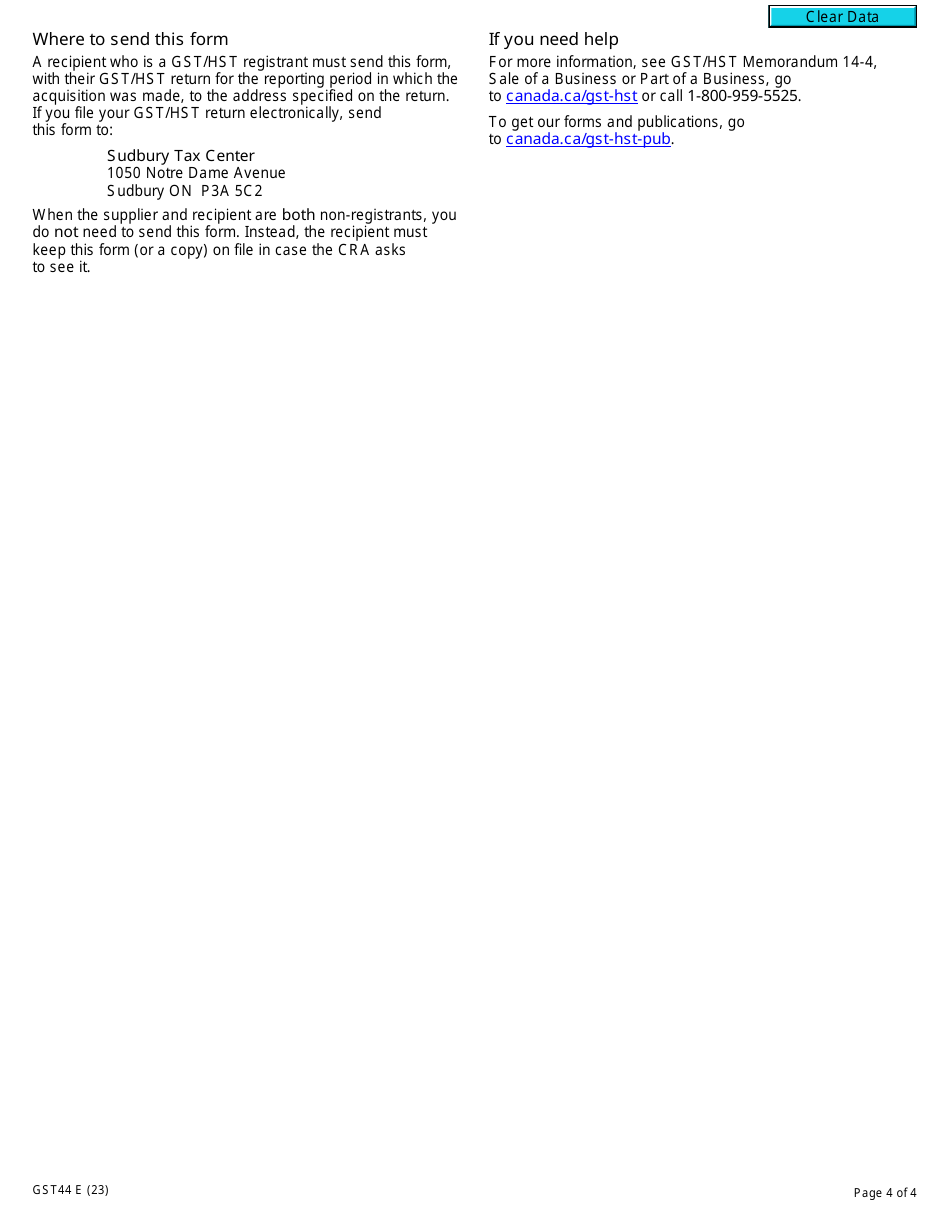

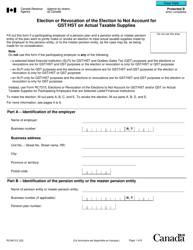

Q: When should the GST44 form be filed?

A: The GST44 form should be filed as soon as possible after the acquisition of a business or part of a business.

Q: Can the GST/HST election be revoked?

A: No, once the GST/HST election has been made, it cannot be revoked.

Q: What are the consequences of not filing a GST44 form?

A: Failure to file a GST44 form may result in the purchaser being responsible for paying GST/HST on the acquisition of the business or part of a business.

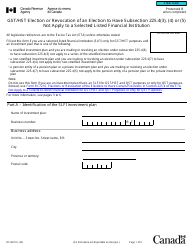

Q: Is there a fee for filing the GST44 form?

A: No, there is no fee for filing the GST44 form.