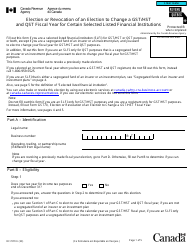

This version of the form is not currently in use and is provided for reference only. Download this version of

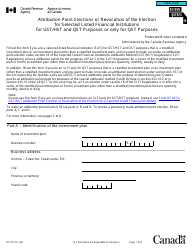

Form GST27

for the current year.

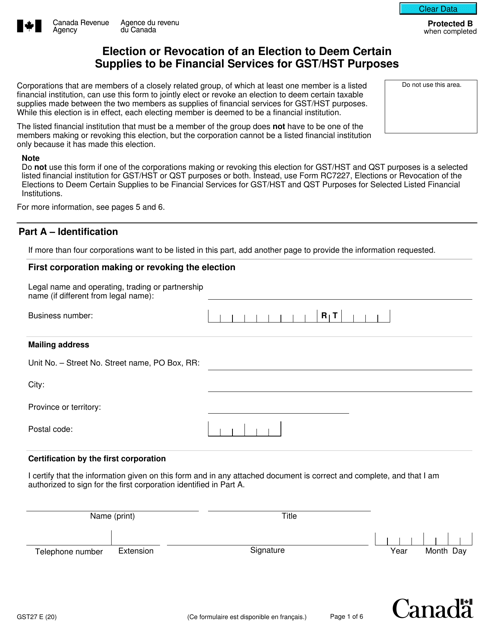

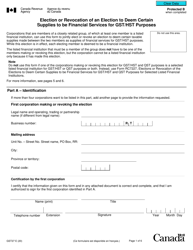

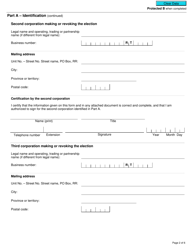

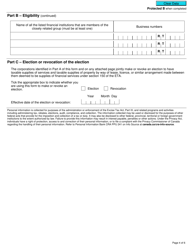

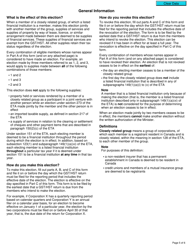

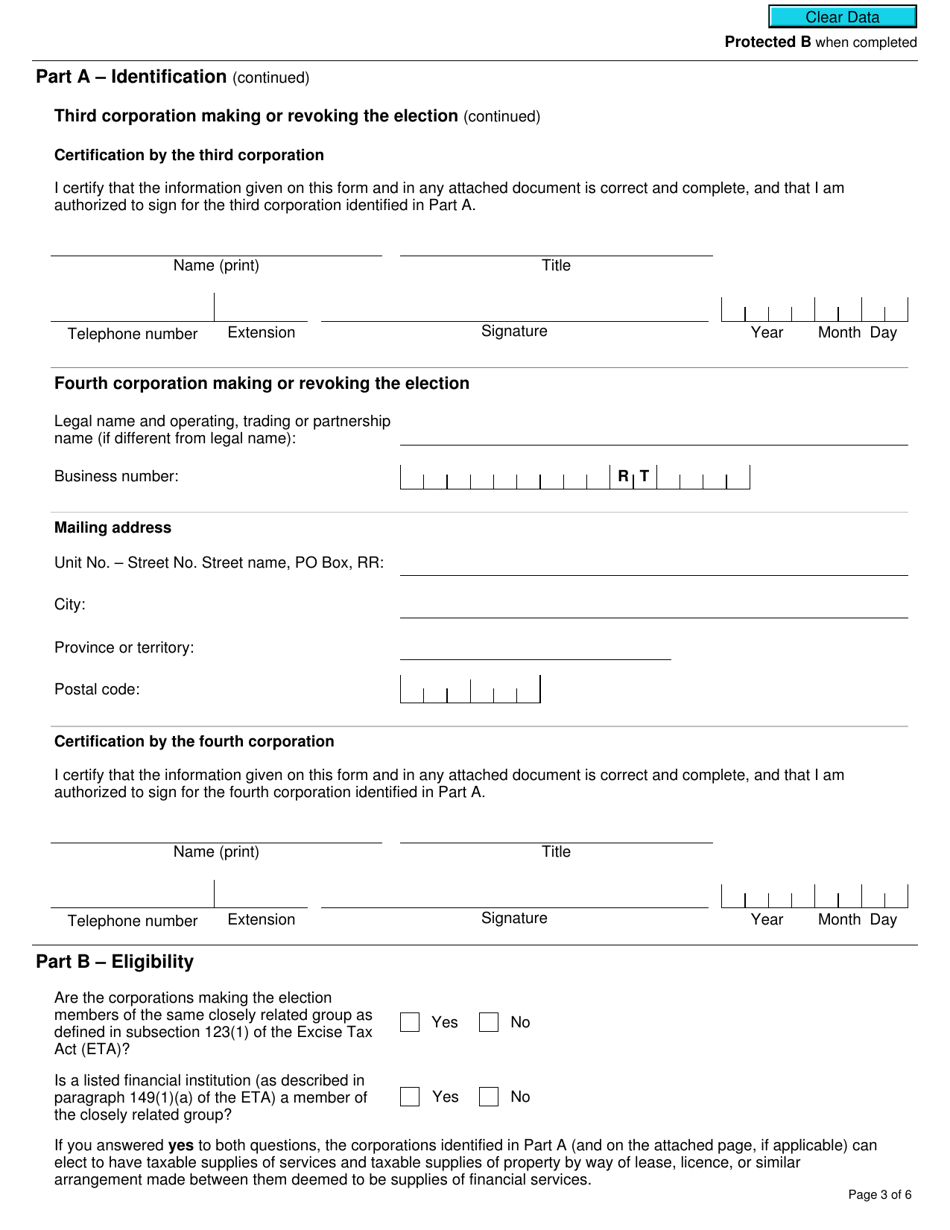

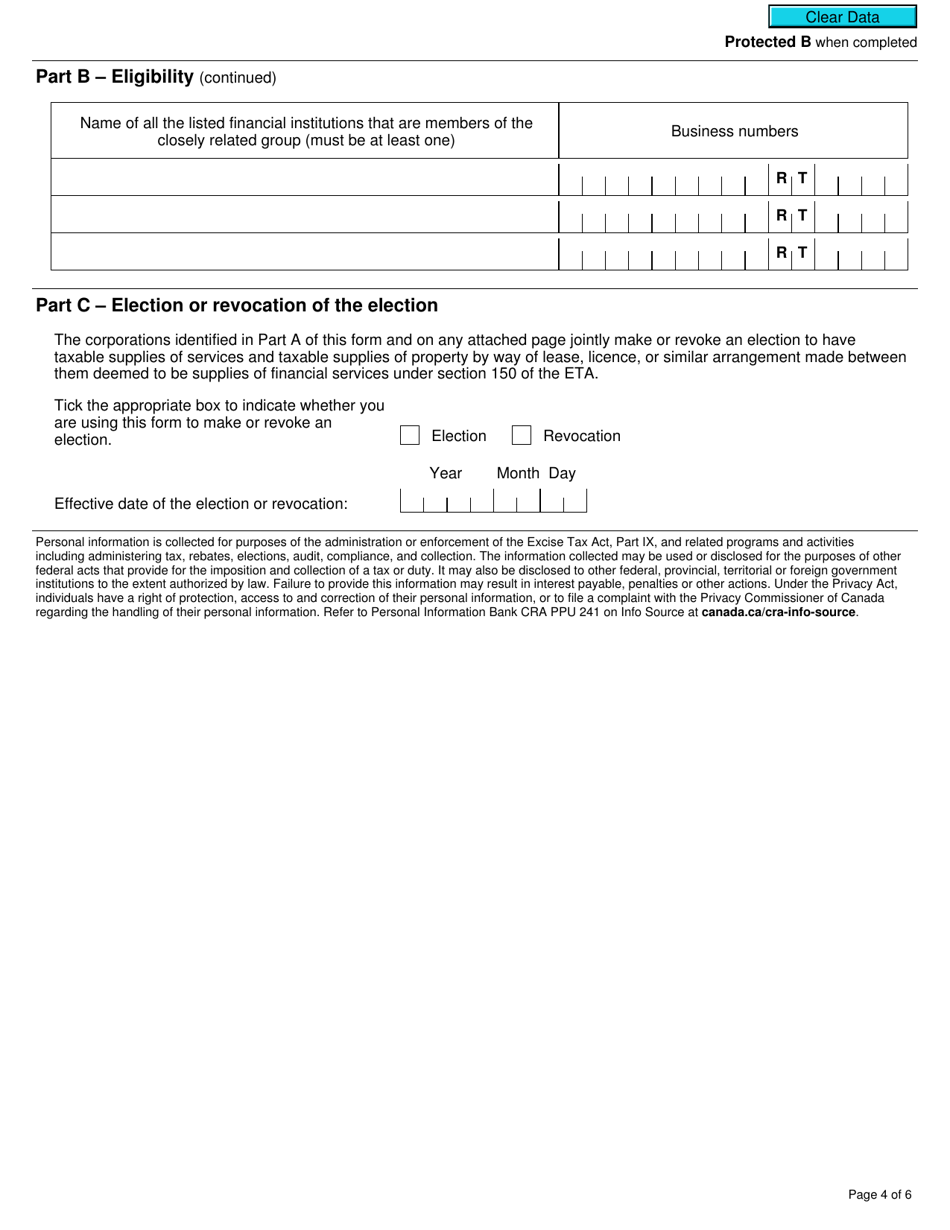

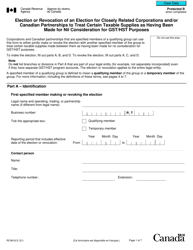

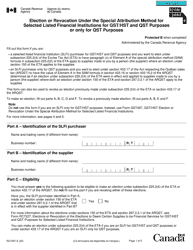

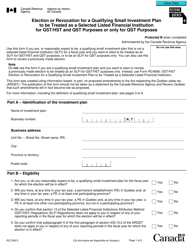

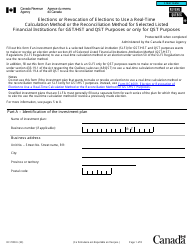

Form GST27 Election or Revocation of an Election to Deem Certain Supplies to Be Financial Services for Gst / Hst Purposes - Canada

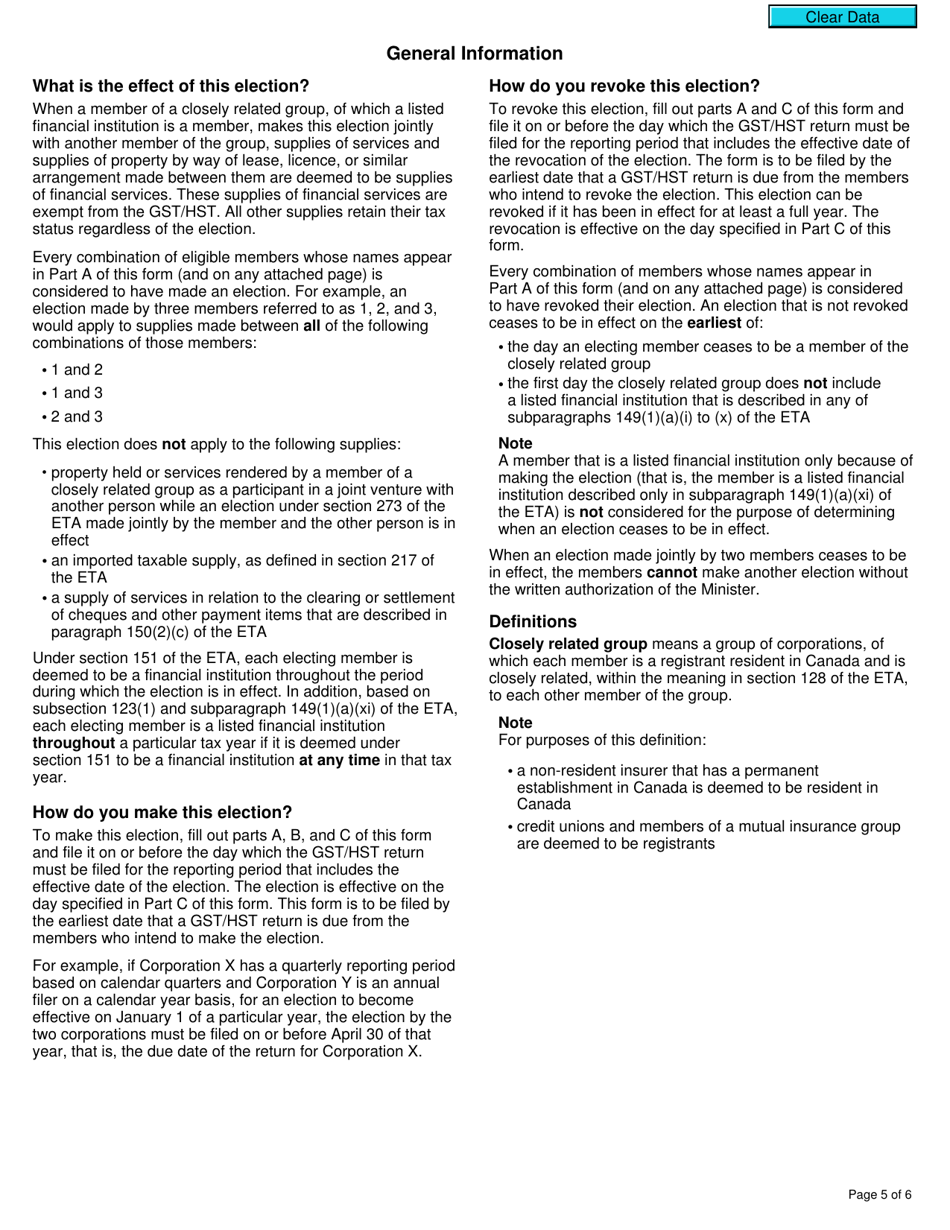

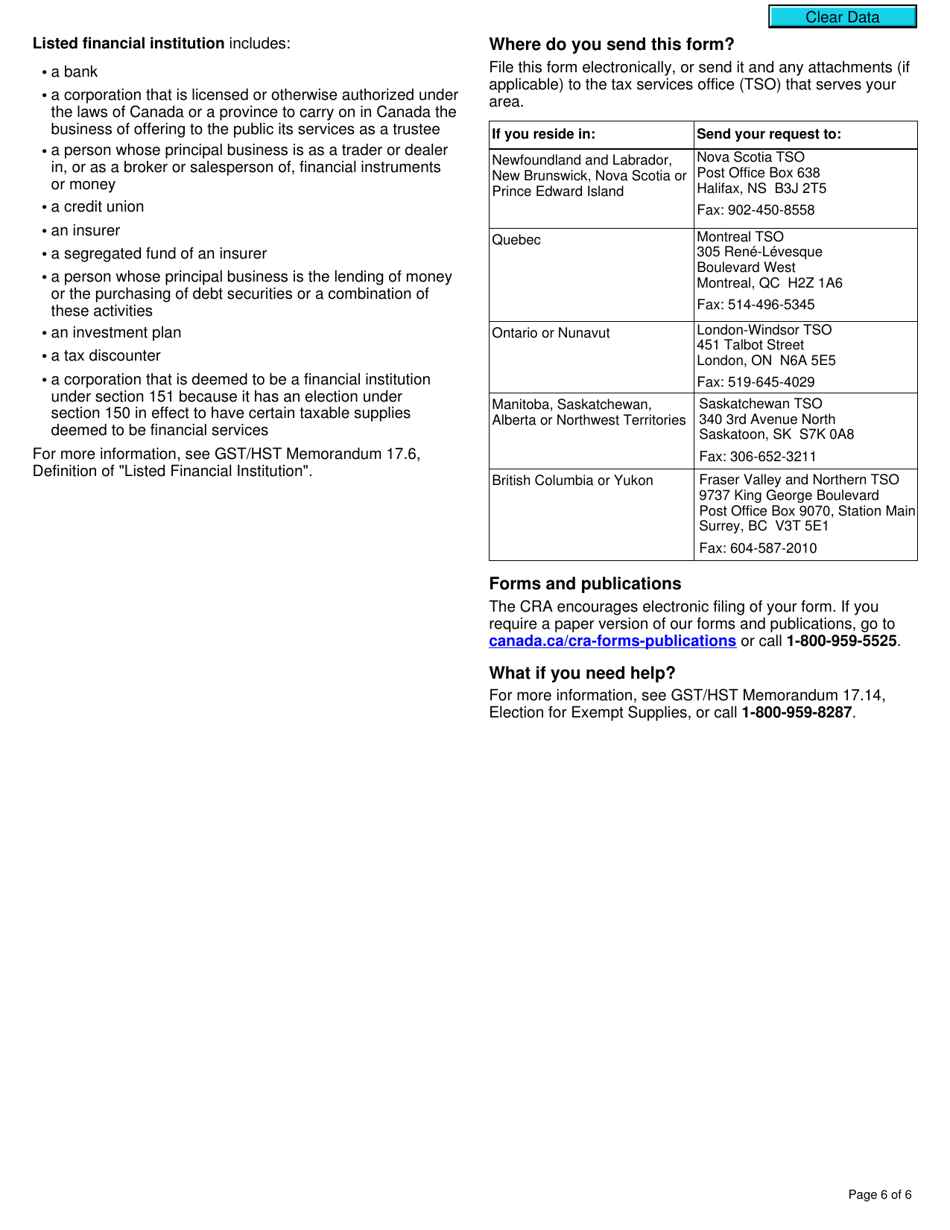

Form GST27 is used in Canada for electing or revoking an election to deem certain supplies to be "financial services" for GST/HST (Goods and Services Tax/Harmonized Sales Tax) purposes. This form is used by businesses to declare and manage their tax obligations related to financial services.

The form GST27 "Election or Revocation of an Election to Deem Certain Supplies to Be Financial Services for Gst/Hst Purposes" is filed by the person making the election or revoking the election, in Canada.

FAQ

Q: What is form GST27?

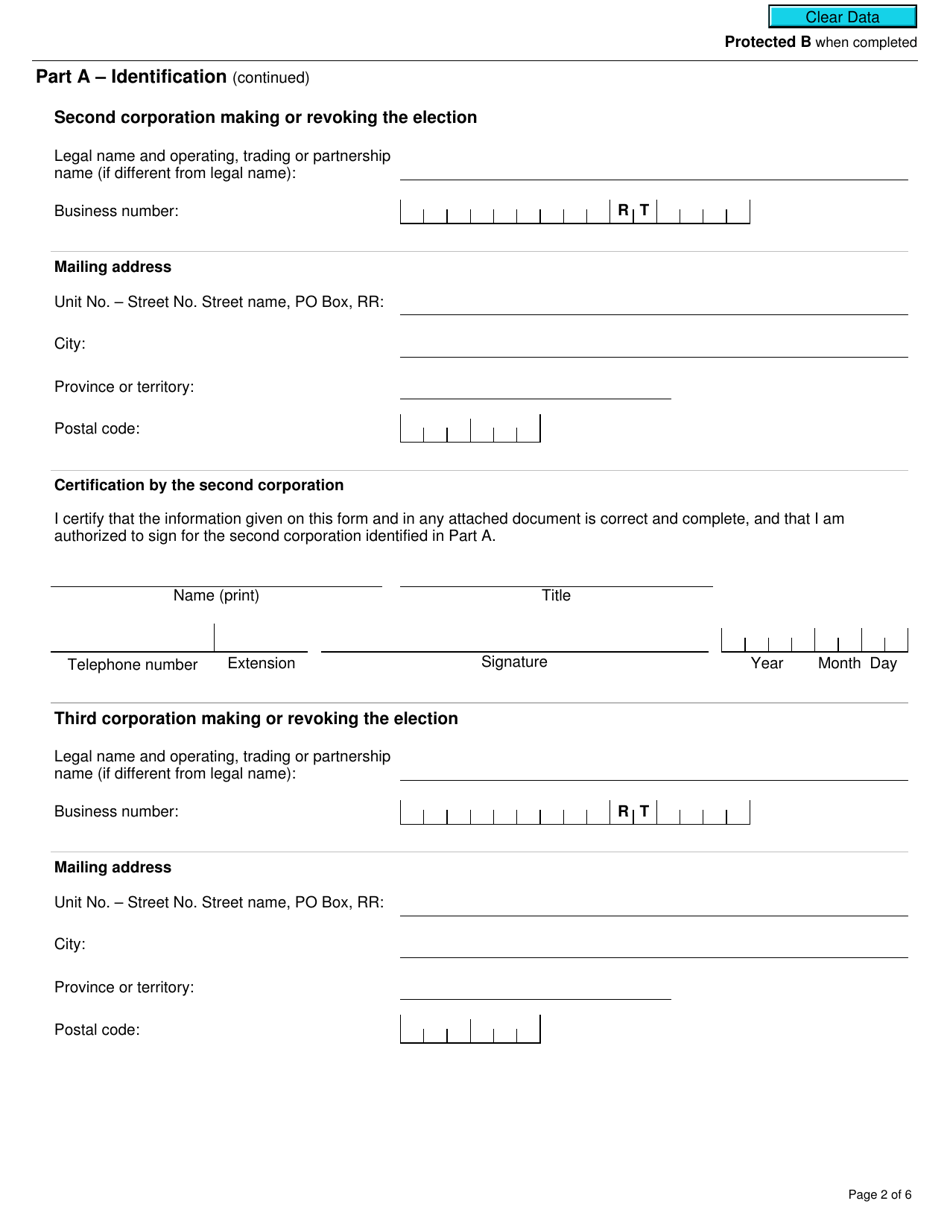

A: Form GST27 is a form used in Canada for the election or revocation of an election to deem certain supplies to be financial services for GST/HST purposes.

Q: What is the purpose of form GST27?

A: The purpose of form GST27 is to declare an election or revocation of an election to treat certain supplies as financial services for GST/HST purposes.

Q: Who can use form GST27?

A: Any person or business in Canada who wants to elect or revoke an election to treat certain supplies as financial services for GST/HST purposes can use form GST27.

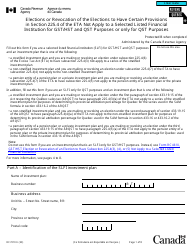

Q: What are financial services for GST/HST purposes?

A: Financial services for GST/HST purposes generally include services such as loans, investment management, insurance, and other similar activities.

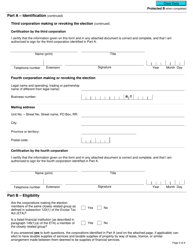

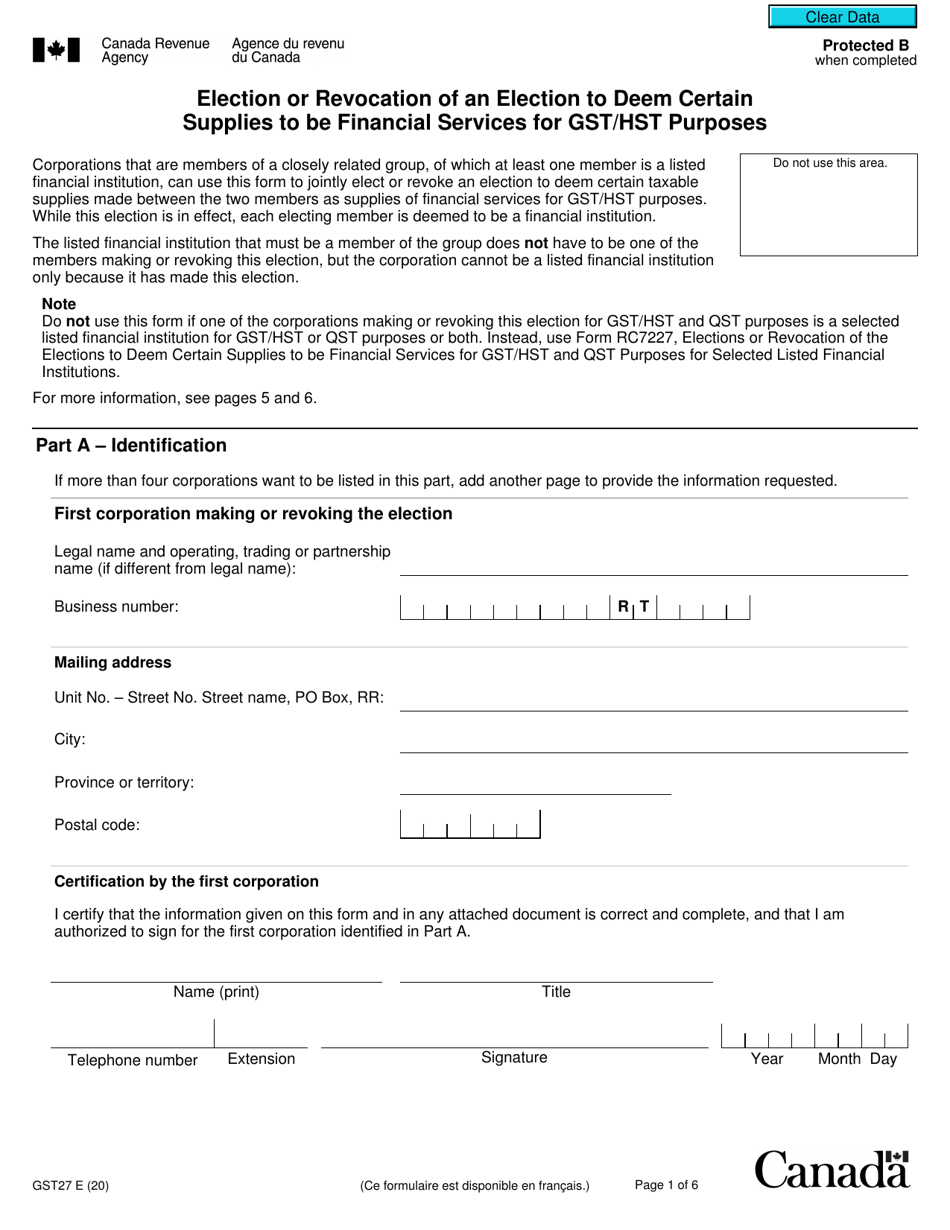

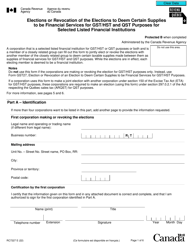

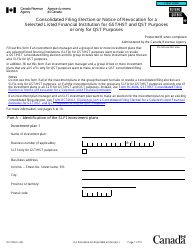

Q: What is the process for completing form GST27?

A: The process for completing form GST27 involves providing information about the election or revocation of an election, including the effective date and the relevant supplies.

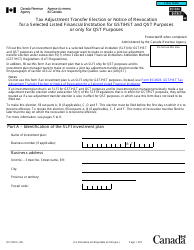

Q: Are there any deadlines for submitting form GST27?

A: Yes, there are specific deadlines for submitting form GST27, which may vary depending on the circumstances. It is important to consult the CRA or review the instructions on the form for the applicable deadlines.

Q: Is there a fee for filing form GST27?

A: There is no fee for filing form GST27.

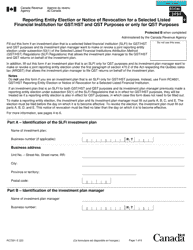

Q: What happens after submitting form GST27?

A: After submitting form GST27, the CRA will review the election or revocation of election and notify the person or business of the outcome.

Q: Can the election or revocation of an election be changed?

A: Yes, the election or revocation of an election can be changed, but it must be done by filing a new form GST27 to revoke the existing election or make a new election.

Q: Is professional assistance required to complete form GST27?

A: Professional assistance is not required to complete form GST27, but it is recommended to seek advice from a tax professional or consult the CRA's guidance if needed.