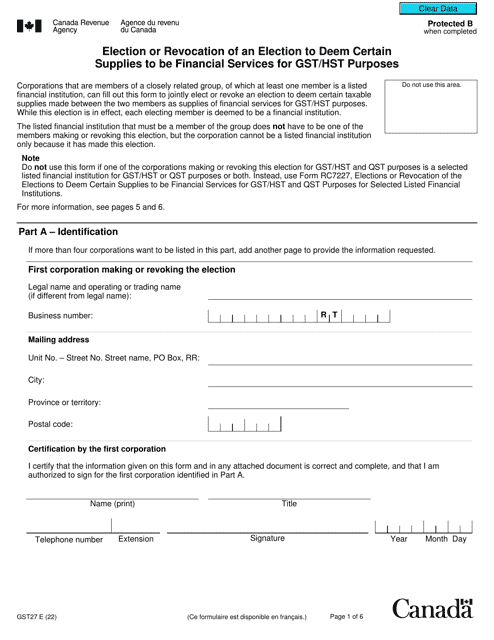

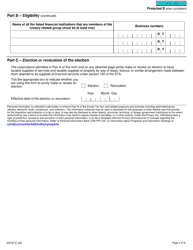

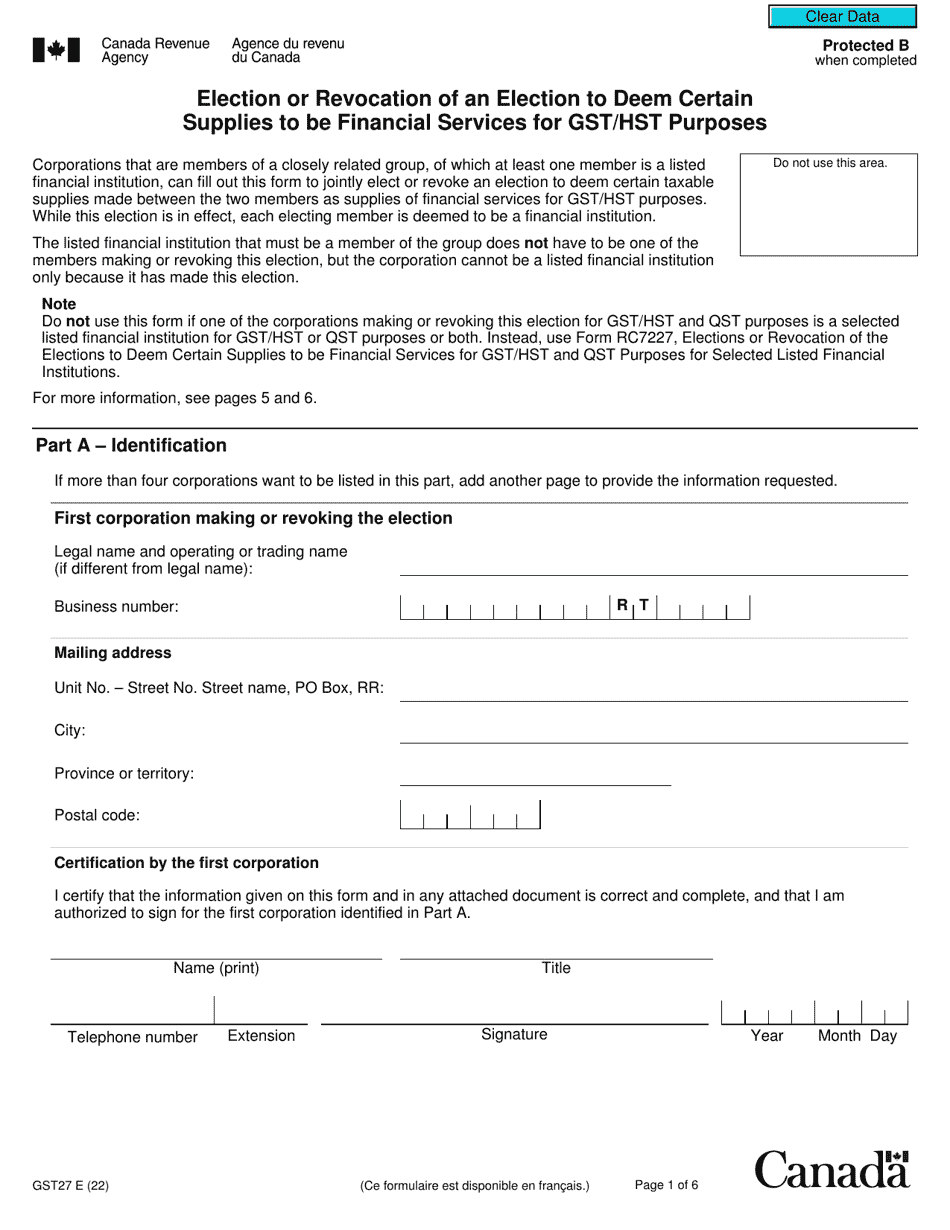

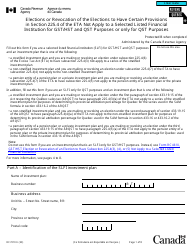

Form GST27 Election or Revocation of an Election to Deem Certain Supplies to Be Financial Services for Gst / Hst Purposes - Canada

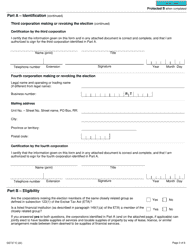

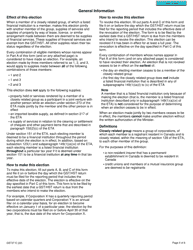

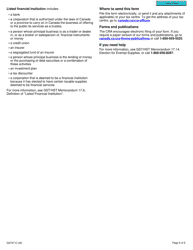

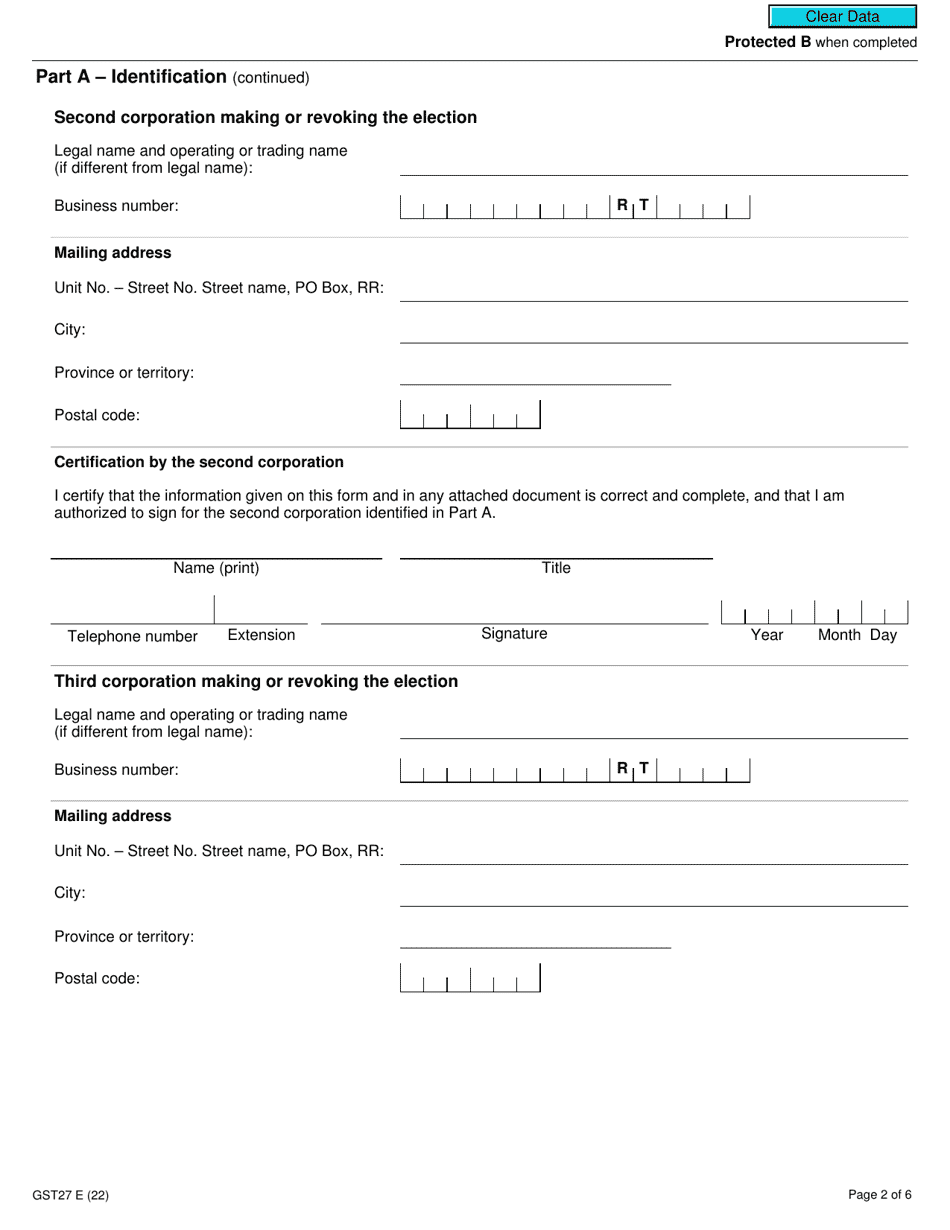

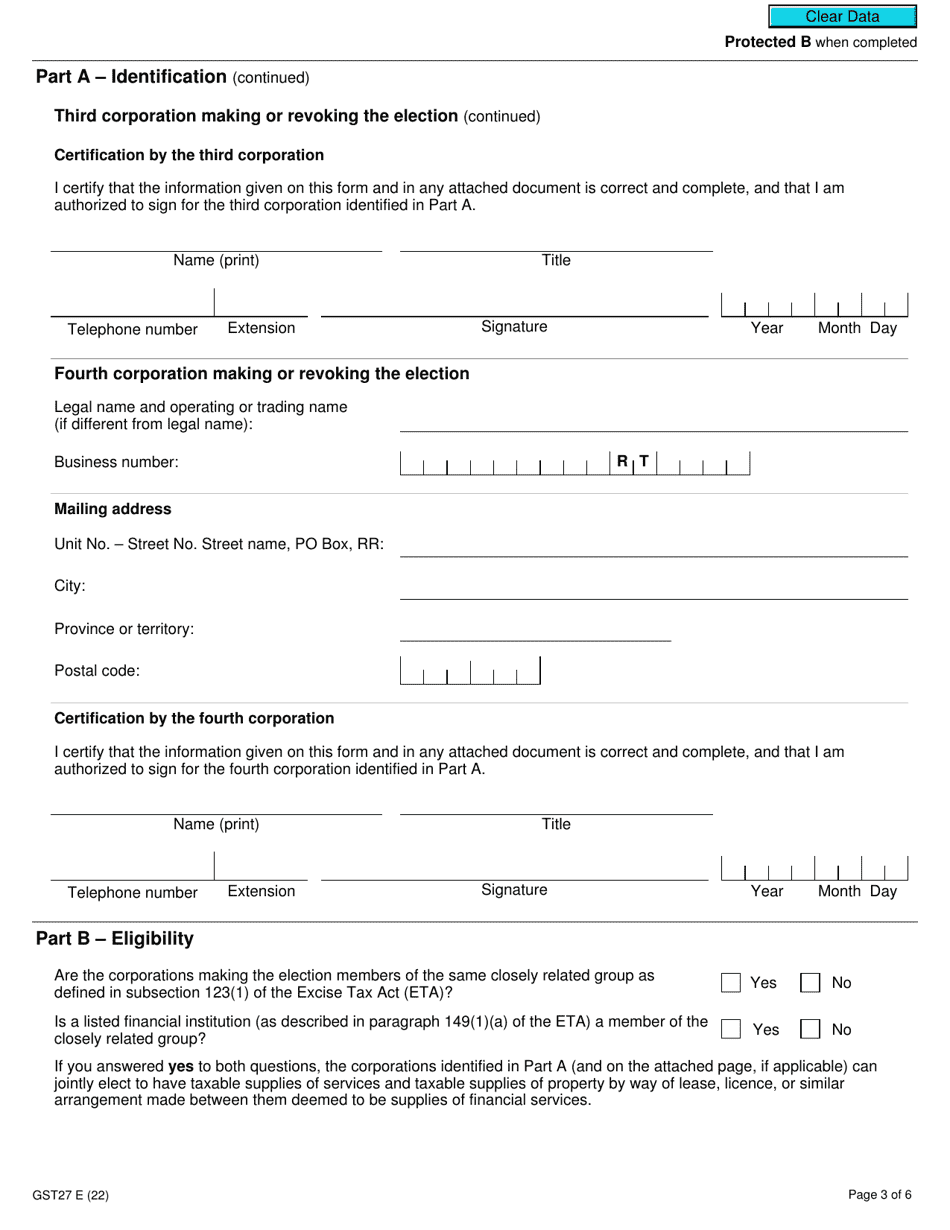

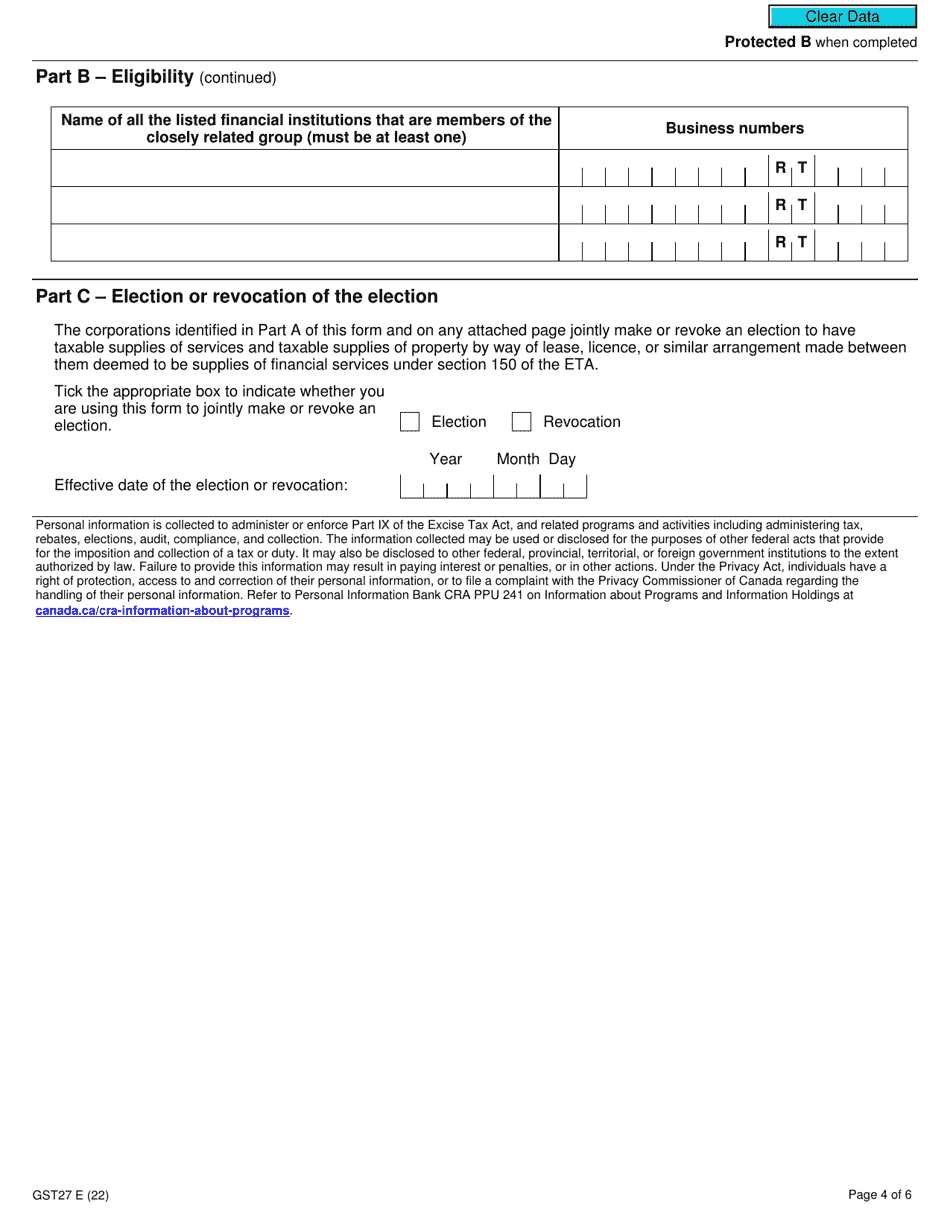

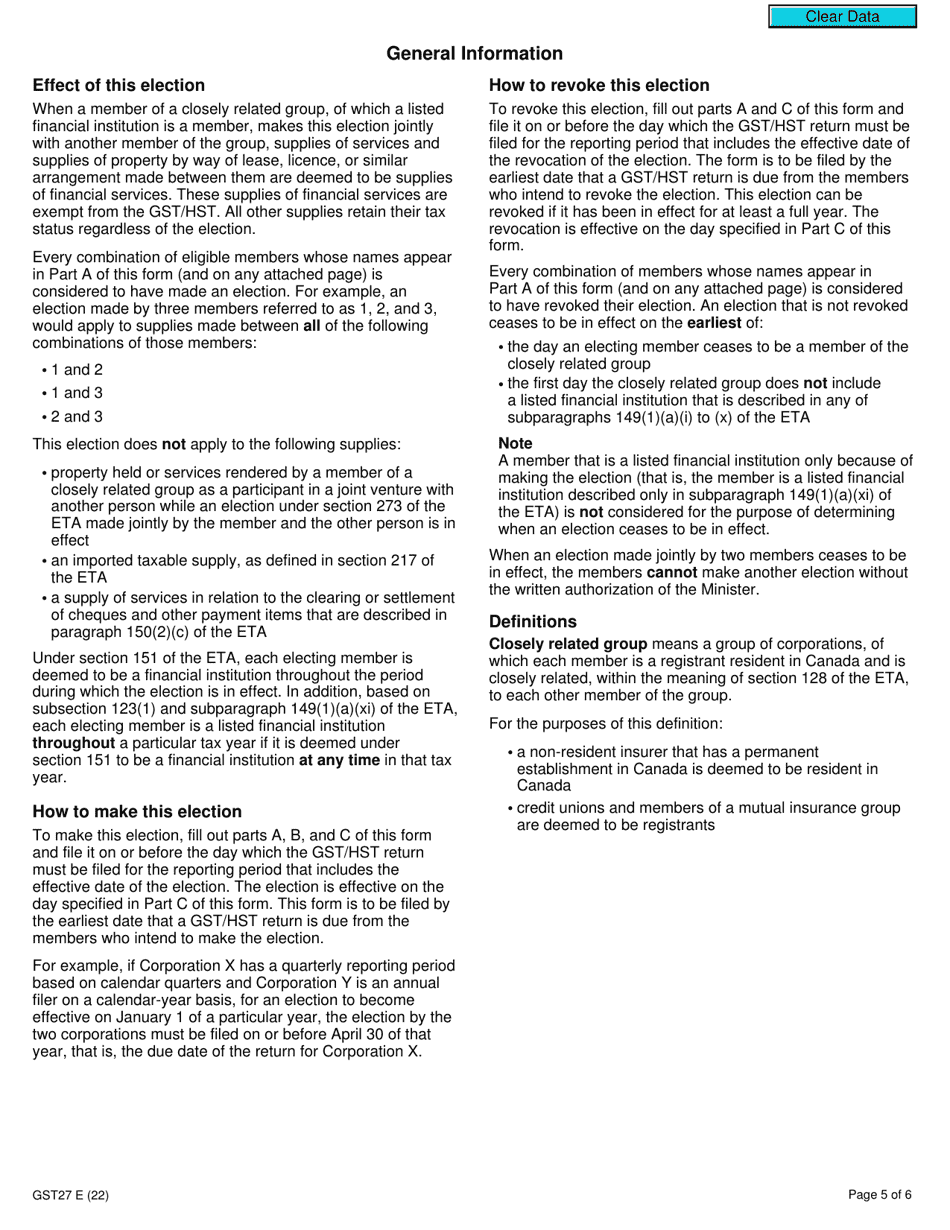

Form GST27 is used in Canada for the election or revocation of an election to deem certain supplies to be financial services for GST/HST (Goods and Services Tax/Harmonized Sales Tax) purposes. This form allows businesses to elect to treat certain supplies as financial services for tax purposes, which can have specific tax implications.

The form GST27 is filed by businesses in Canada to make an election or revoke an election to treat specific supplies as financial services for GST/HST purposes.

Form GST27 Election or Revocation of an Election to Deem Certain Supplies to Be Financial Services for Gst/Hst Purposes - Canada - Frequently Asked Questions (FAQ)

Q: What is form GST27?

A: Form GST27 is a form used in Canada to make an election or revoke an election to deem certain supplies as financial services for GST/HST purposes.

Q: What is the purpose of form GST27?

A: The purpose of form GST27 is to allow individuals or businesses in Canada to elect or revoke an election to treat certain supplies as financial services for GST/HST purposes.

Q: Who can use form GST27?

A: Any individual or business in Canada that wants to make an election or revoke an election to treat certain supplies as financial services for GST/HST purposes can use form GST27.

Q: What are financial services for GST/HST purposes?

A: Financial services for GST/HST purposes include services such as loans, deposits, insurance, and investment management.

Q: How do I fill out form GST27?

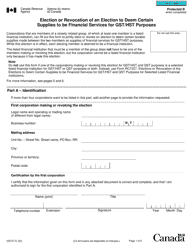

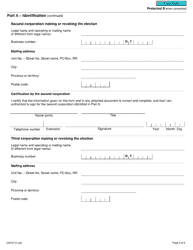

A: To fill out form GST27, you need to provide your identification information, the effective date of the election or revocation, and details about the supplies being deemed as financial services.

Q: Are there any fees associated with form GST27?

A: There are no fees associated with filing form GST27.

Q: Can I cancel or amend the election made on form GST27?

A: Yes, you can cancel or amend the election made on form GST27 by submitting a new form GST27 with the updated information.

Q: What happens after filing form GST27?

A: After filing form GST27, the CRA will review the election or revocation and notify you of any changes or adjustments to your GST/HST obligations.