This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST114

for the current year.

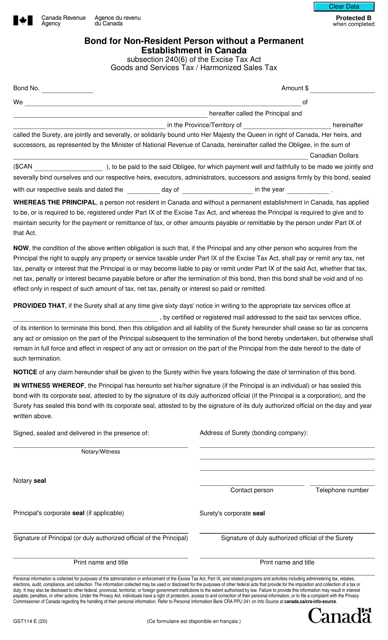

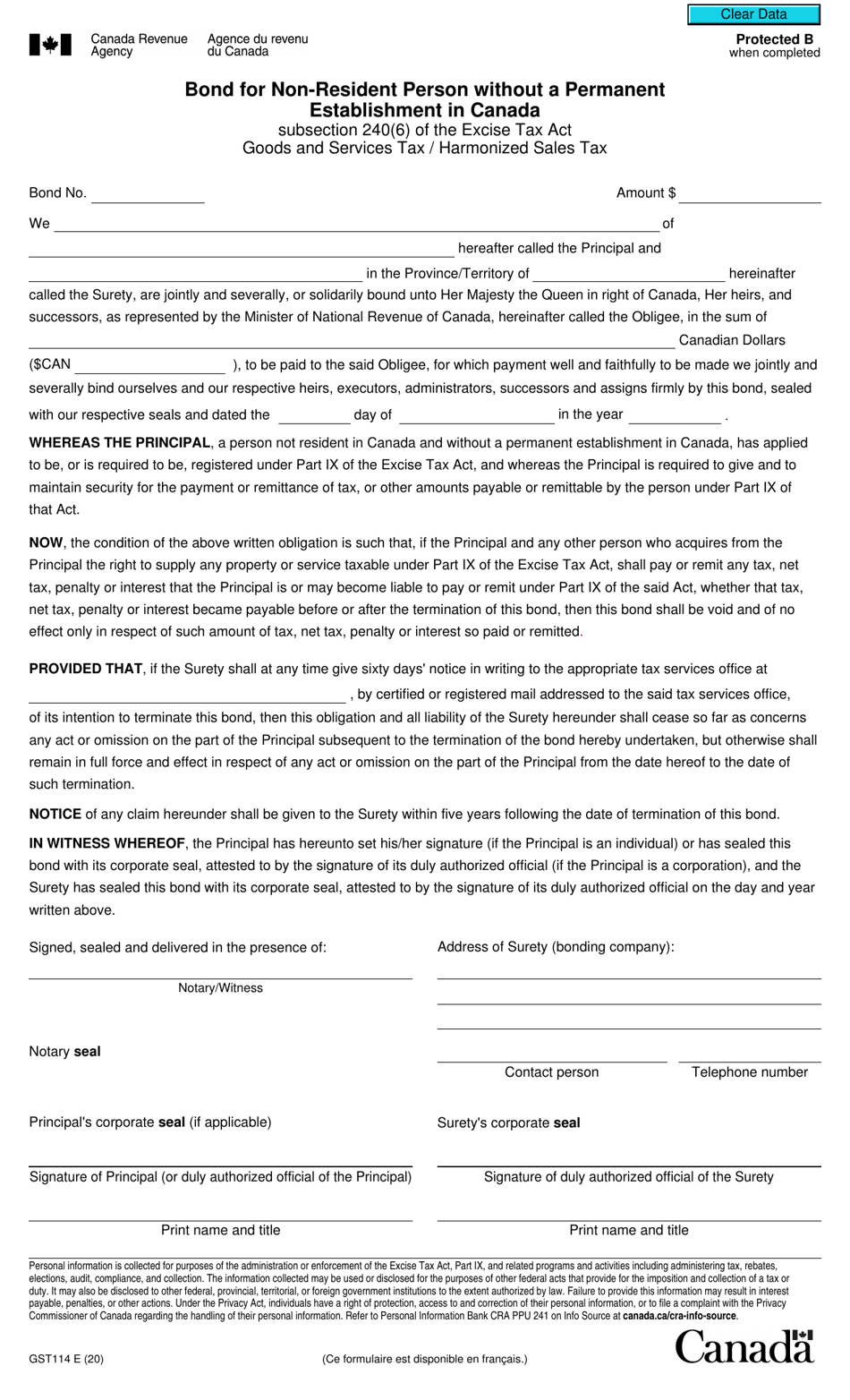

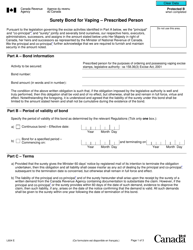

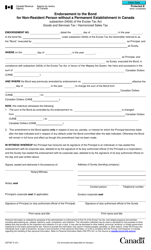

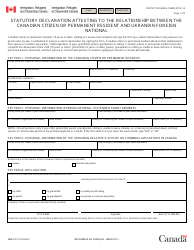

Form GST114 Bond for Non-resident Person Without a Permanent Establishment in Canada - Canada

Form GST114, Bond for Non-resident Person Without a Permanent Establishment in Canada, is used by non-resident persons who do not have a permanent establishment in Canada to provide a bond to the Canada Revenue Agency (CRA) as a security for the potential GST/HST liabilities they may have. This form helps ensure the collection of taxes owed by non-resident individuals or businesses that conduct business in Canada.

The non-resident person without a permanent establishment in Canada files the Form GST114 Bond.

FAQ

Q: What is GST114 Bond?

A: GST114 Bond is a form required by the Canada Revenue Agency (CRA) for non-resident persons without a permanent establishment in Canada.

Q: Who needs to complete form GST114?

A: Non-resident persons without a permanent establishment in Canada need to complete form GST114.

Q: What is the purpose of form GST114?

A: The purpose of form GST114 is to provide a bond that ensures the non-resident person complies with the requirements of the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) in Canada.

Q: How do I complete form GST114?

A: Form GST114 requires various information such as the non-resident person's name, contact information, and the amount of the bond.

Q: Are there any fees associated with form GST114?

A: Yes, there may be fees associated with form GST114. The amount of the bond and any applicable fees will be determined by the CRA.

Q: Is the bond refundable?

A: The bond may be refundable after the non-resident person has met all their obligations under the GST and HST requirements in Canada.

Q: What happens if I don't provide a bond?

A: Failure to provide a bond when required may result in penalties and interest charges.

Q: Can I submit form GST114 electronically?

A: Yes, form GST114 can be submitted electronically through the CRA's My Business Account or Represent a Client service.

Q: Are there any exemptions from providing a bond?

A: Yes, there are certain exemptions from providing a bond. It is best to consult with the CRA or a tax professional to determine if you are eligible for an exemption.