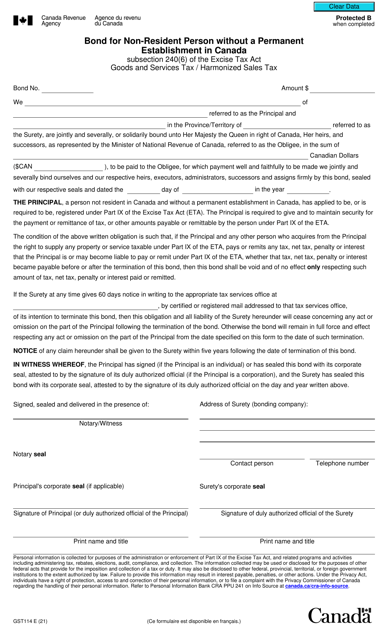

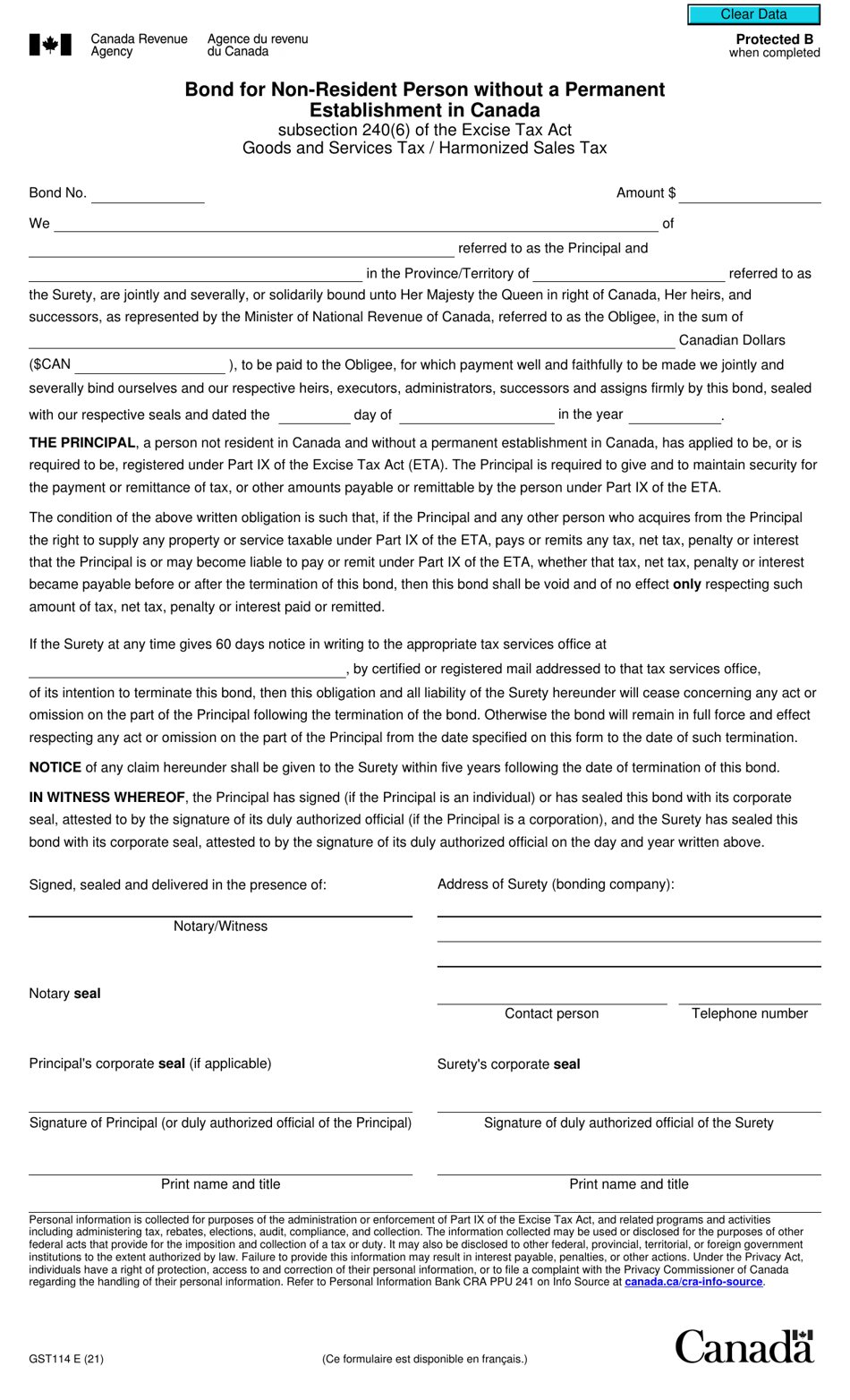

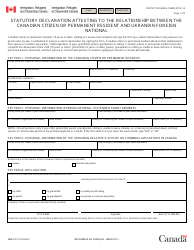

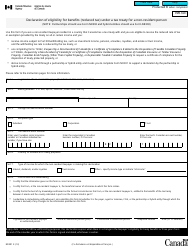

Form GST114 Bond for Non-resident Person Without a Permanent Establishment in Canada - Canada

Form GST114, Bond for Non-resident Person Without a Permanent Establishment in Canada, is used for non-resident persons who are not required to be registered for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) in Canada but make taxable supplies in the country. This form is used to provide a security bond when those non-residents apply for a GST/HST registration certificate to ensure compliance with Canadian tax laws.

The non-resident person without a permanent establishment in Canada is responsible for filing the Form GST114 Bond.

Form GST114 Bond for Non-resident Person Without a Permanent Establishment in Canada - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST114?

A: Form GST114 is the Bond for Non-resident Person Without a Permanent Establishment in Canada.

Q: Who needs to fill out Form GST114?

A: Non-resident persons without a permanent establishment in Canada need to fill out Form GST114.

Q: What is the purpose of Form GST114?

A: The purpose of Form GST114 is to provide a bond to cover the taxes owed on imported goods if the non-resident person does not have a permanent establishment in Canada.