Instructions for Form K-5C, 42A805-K5C Corrected Report of Kentucky Withholding Statements - Kentucky

This document contains official instructions for Form K-5C , and Form 42A805-K5C . Both forms are released and collected by the Kentucky Department of Revenue. An up-to-date fillable Form K-5C is available for download through this link.

FAQ

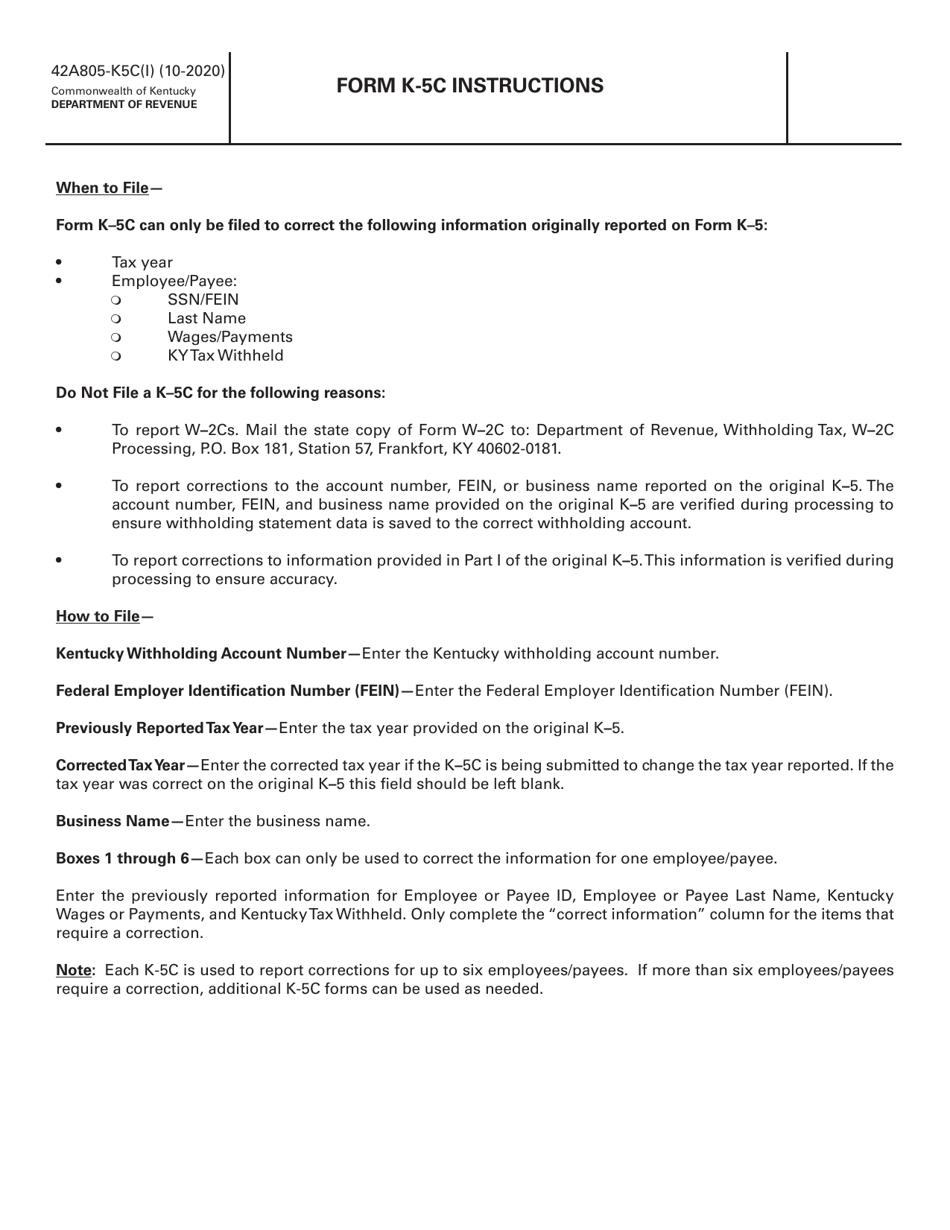

Q: What is Form K-5C?

A: Form K-5C is a corrected report of Kentucky withholding statements for Kentucky.

Q: Who needs to file Form K-5C?

A: Anyone who needs to correct their Kentucky withholding statements.

Q: What is the purpose of Form K-5C?

A: The purpose of Form K-5C is to correct any errors or discrepancies in Kentucky withholding statements.

Q: When is Form K-5C due?

A: Form K-5C is due on or before the last day of February following the calendar year in which the errors or discrepancies occurred.

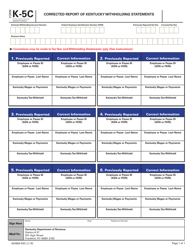

Q: What information do I need to complete Form K-5C?

A: You will need the corrected information for the Kentucky withholding statements, including the recipient's name, social security number, and the corrected amount of Kentucky withholding.

Q: Are there any penalties for not filing Form K-5C?

A: Yes, there may be penalties for not filing Form K-5C or for filing it late. It is important to file the form correctly and on time to avoid penalties.

Q: Can I paper file Form K-5C?

A: Yes, you can paper file Form K-5C by mailing it to the Kentucky Department of Revenue.

Q: Is there a fee for filing Form K-5C?

A: No, there is no fee for filing Form K-5C.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Kentucky Department of Revenue.