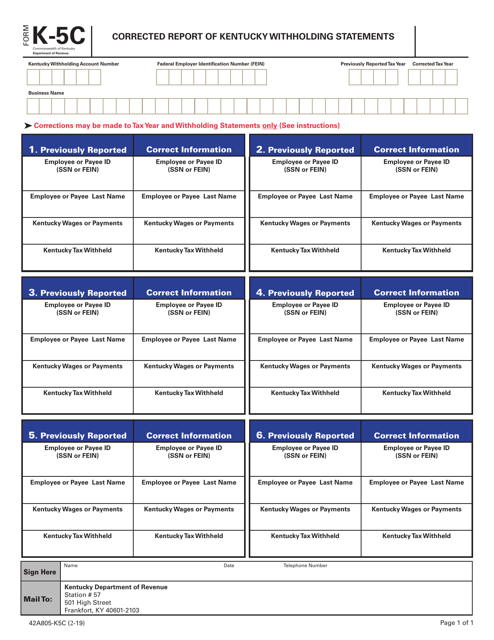

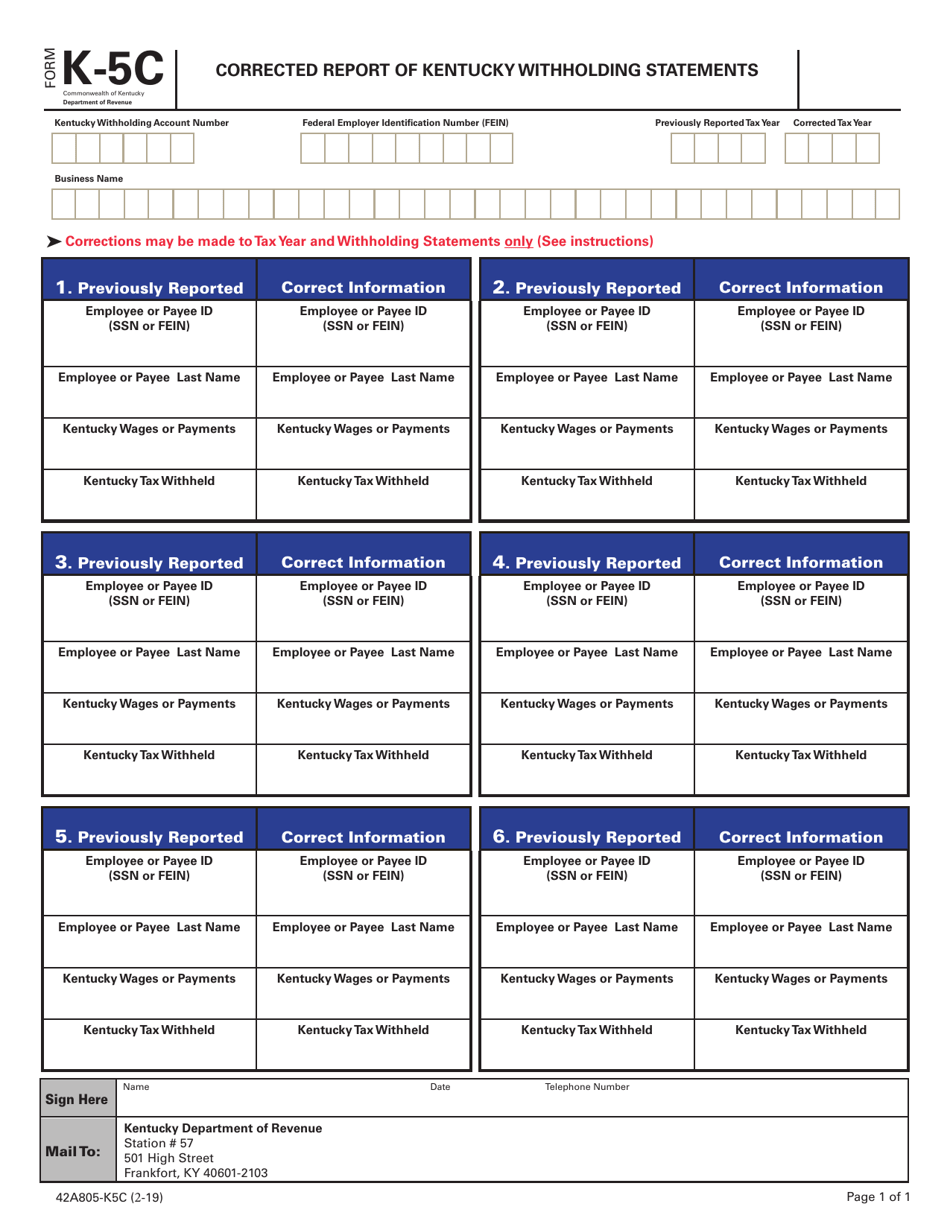

Form K-5C Corrected Report of Kentucky Withholding Statements - Kentucky

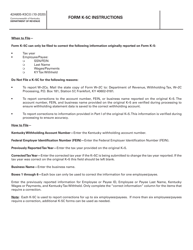

What Is Form K-5C?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form K-5C?

A: Form K-5C is the Corrected Report of Kentucky Withholding Statements.

Q: What is the purpose of Form K-5C?

A: The purpose of Form K-5C is to correct any errors or omissions on previously filed Kentucky withholding statements.

Q: Who needs to file Form K-5C?

A: Anyone who needs to correct an error or omission on a previously filed Kentucky withholding statement needs to file Form K-5C.

Q: When is Form K-5C due?

A: Form K-5C is due on or before the last day of the month following the end of the calendar quarter in which the error or omission was discovered.

Q: Are there any penalties for filing Form K-5C late?

A: Yes, there may be penalties for filing Form K-5C late. It is important to file the form on time to avoid any penalties.

Q: Do I need to include any attachments with Form K-5C?

A: You may need to include certain attachments with Form K-5C, such as corrected W-2 forms or other supporting documentation. Refer to the instructions for Form K-5C for more information.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-5C by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.