This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-12

for the current year.

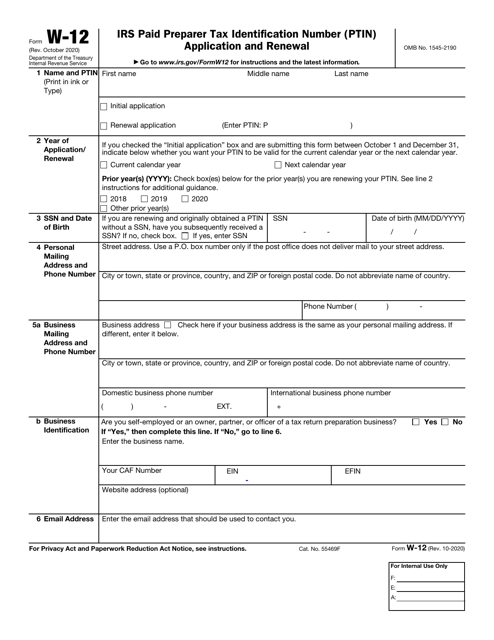

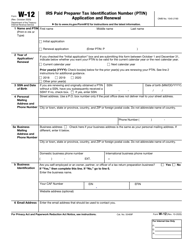

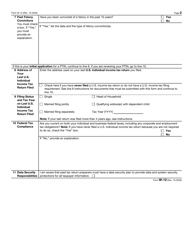

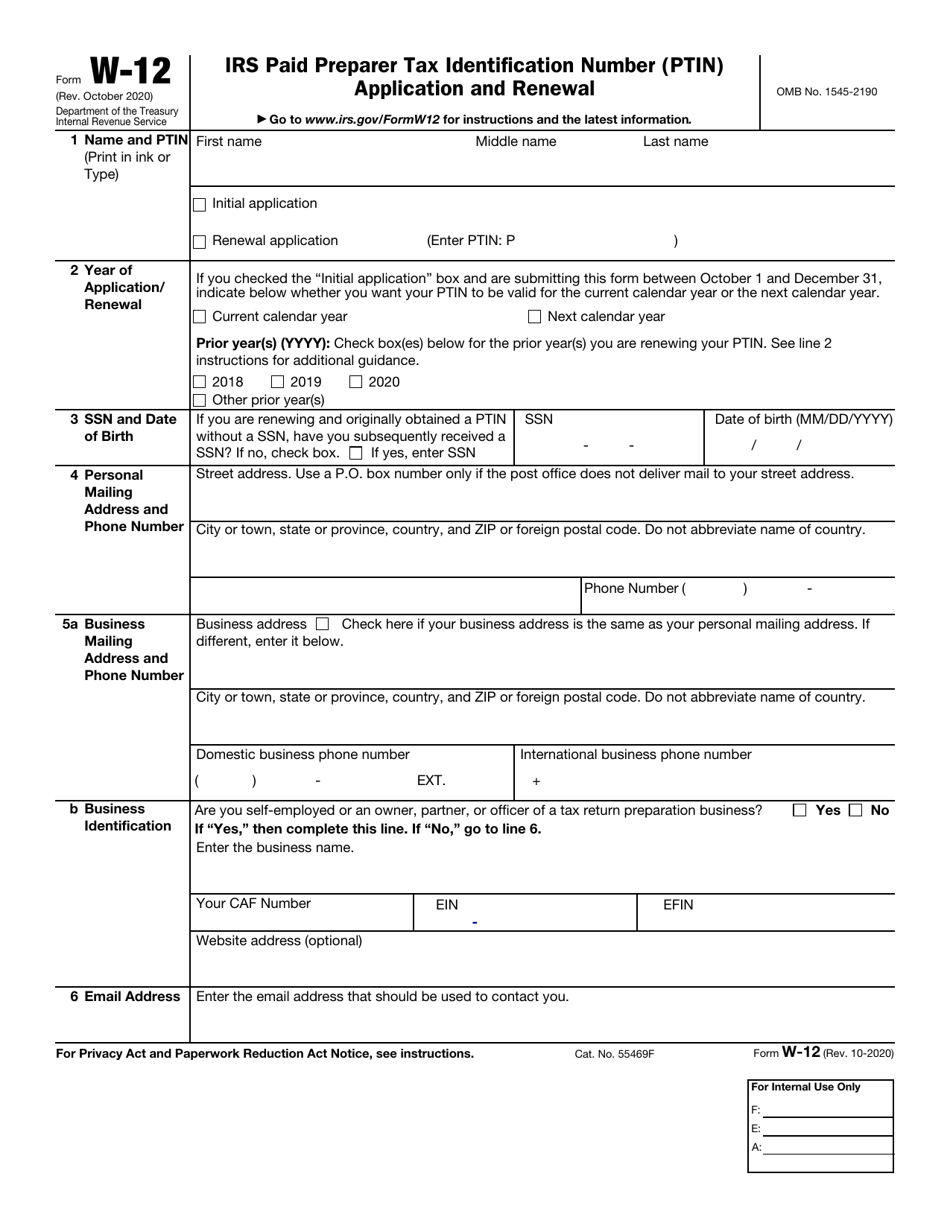

IRS Form W-12 IRS Paid Preparer Tax Identification Number (Ptin) Application and Renewal

What Is IRS Form W-12?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form W-12?

A: IRS Form W-12 is the form used to apply for or renew a Preparer Tax Identification Number (PTIN) with the Internal Revenue Service (IRS).

Q: What is a Preparer Tax Identification Number (PTIN)?

A: A Preparer Tax Identification Number (PTIN) is a unique identification number assigned by the IRS to tax return preparers.

Q: Why do I need a PTIN?

A: You need a PTIN if you are a professional tax return preparer and want to be able to legally prepare and sign tax returns for clients.

Q: Who needs to file IRS Form W-12?

A: Anyone who is a tax return preparer and does not already have a PTIN, or needs to renew their existing PTIN, needs to file IRS Form W-12.

Q: Is there a fee to apply for or renew a PTIN?

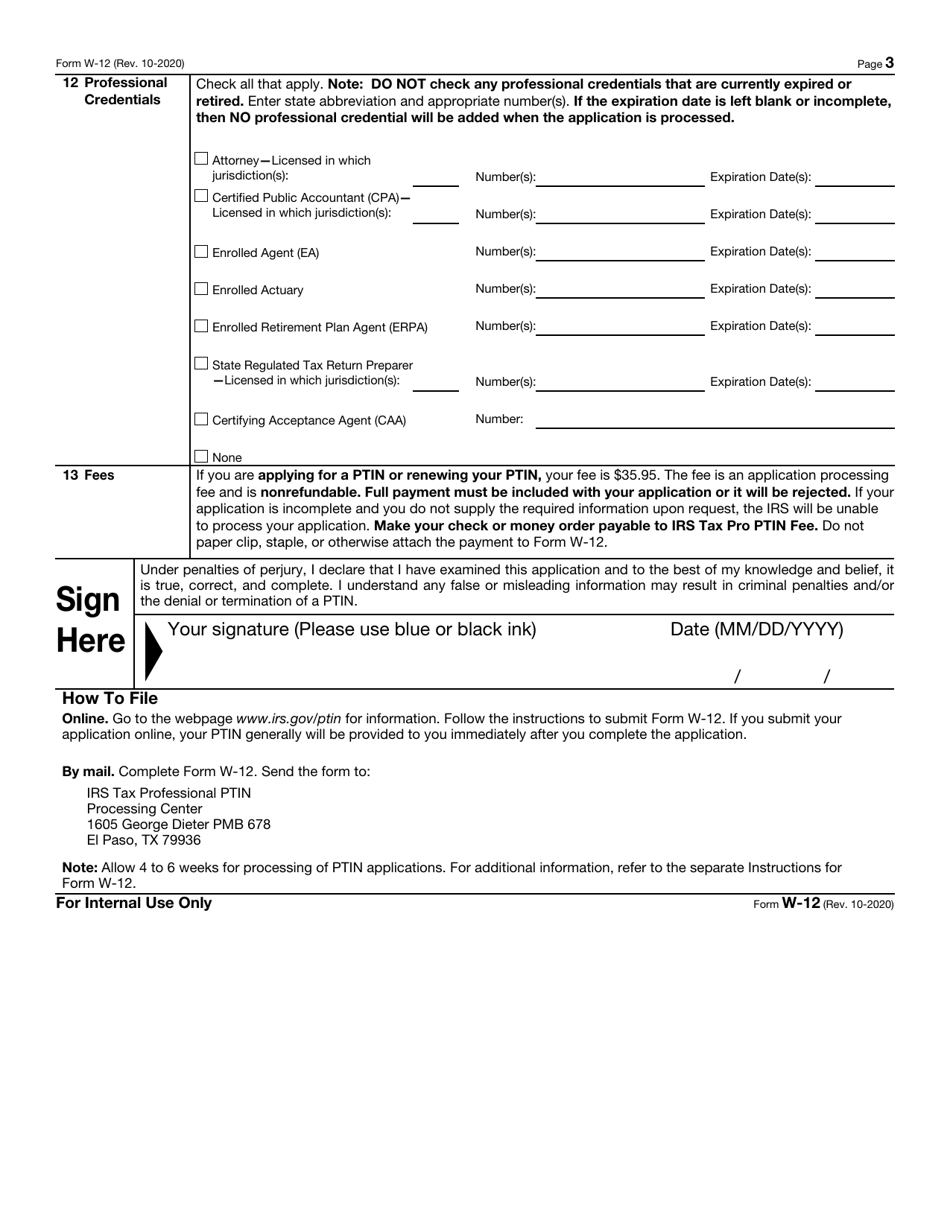

A: Yes, there is a fee associated with applying for or renewing a PTIN, which is determined by the IRS.

Q: How often do I need to renew my PTIN?

A: PTINs need to be renewed annually, and the renewal period typically begins in October each year.

Q: Can I use the same PTIN for multiple tax years?

A: Yes, you can use the same PTIN for multiple tax years as long as it remains valid and you continue to meet the requirements to have a PTIN.

Q: What happens if I don't have a valid PTIN?

A: If you are a professional tax return preparer and do not have a valid PTIN, you may be prohibited from legally preparing and signing tax returns for clients.

Form Details:

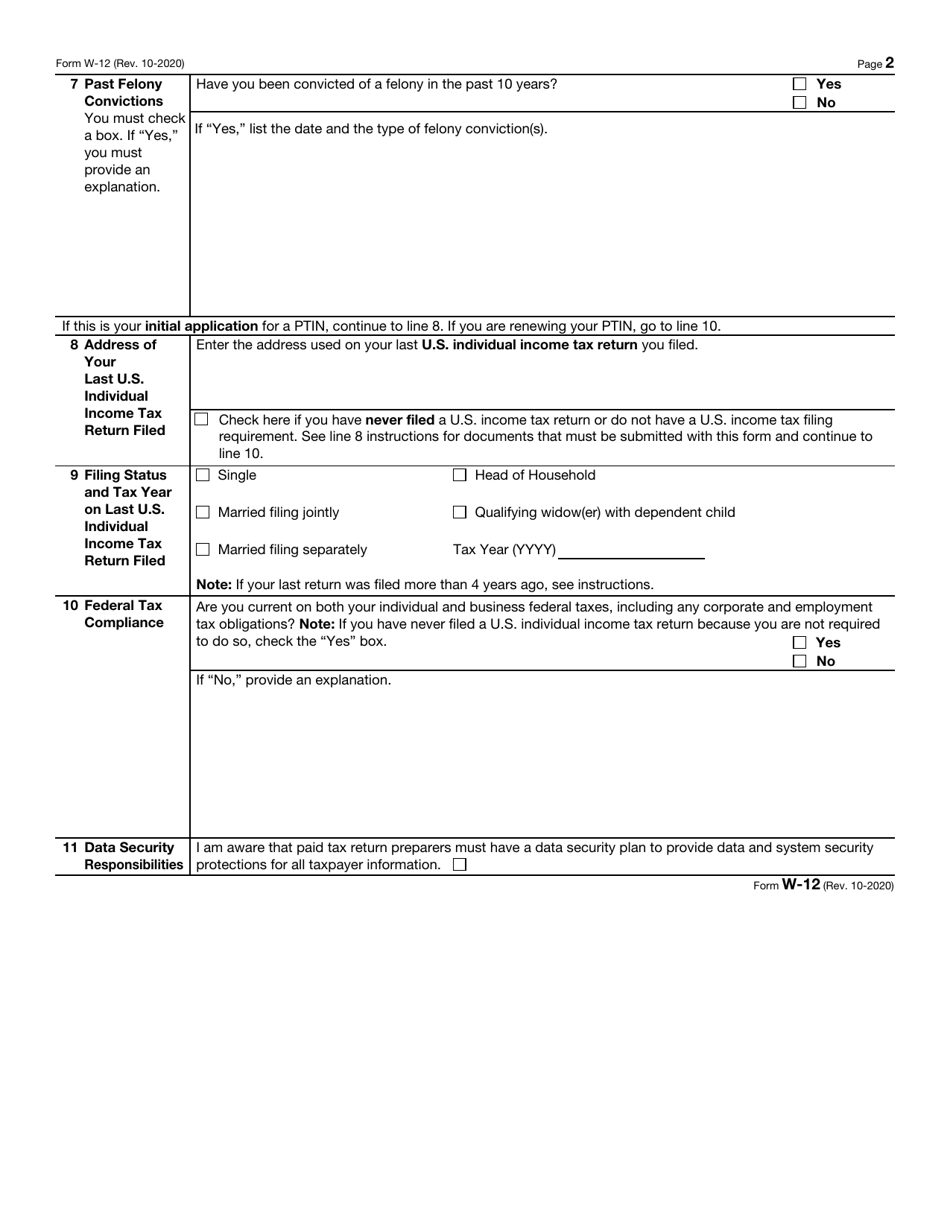

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-12 through the link below or browse more documents in our library of IRS Forms.