This version of the form is not currently in use and is provided for reference only. Download this version of

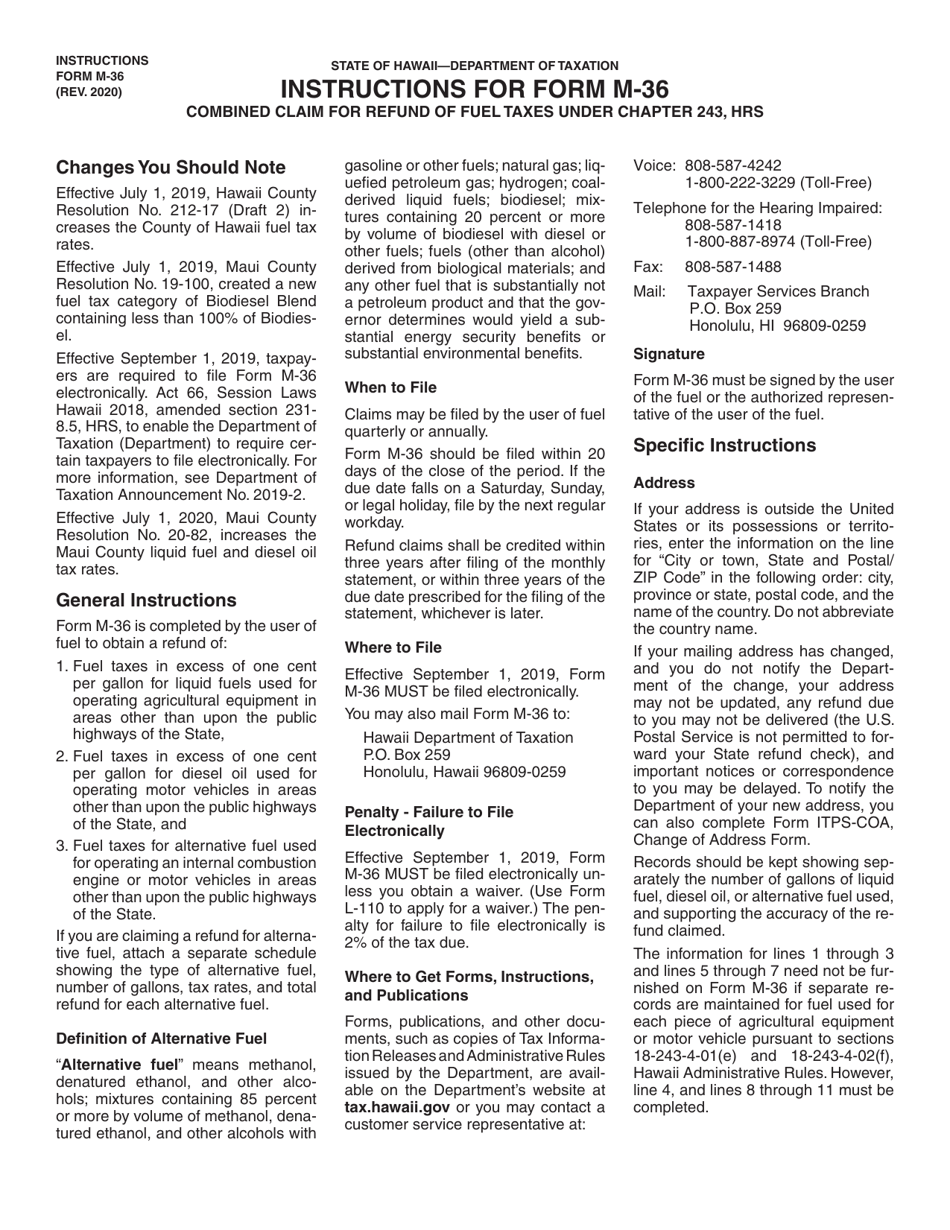

Instructions for Form M-36

for the current year.

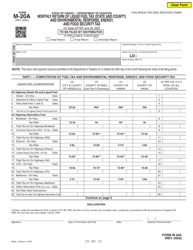

Instructions for Form M-36 Quarterly Combined Claim for Refund of Fuel Taxes Under Chapter 243, Hrs - Hawaii

This document contains official instructions for Form M-36 , Quarterly Combined Claim for Refund of Fuel Taxes Under Chapter 243, Hrs - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form M-36 is available for download through this link.

FAQ

Q: What is Form M-36?

A: Form M-36 is a Quarterly Combined Claim for Refund of Fuel Taxes Under Chapter 243, Hrs in Hawaii.

Q: Who should use Form M-36?

A: Form M-36 should be used by individuals or businesses who want to claim a refund of fuel taxes under Chapter 243, Hrs in Hawaii.

Q: What is the purpose of Form M-36?

A: The purpose of Form M-36 is to file a claim for refund of fuel taxes paid in Hawaii.

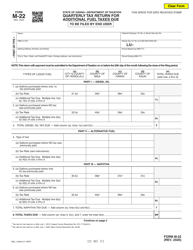

Q: How often should Form M-36 be filed?

A: Form M-36 should be filed quarterly.

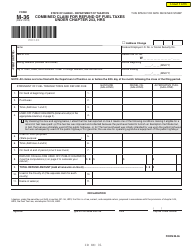

Q: What information is required on Form M-36?

A: Form M-36 requires information such as the claimant's name, address, fuel type, amount of fuel purchased, and amount of tax paid.

Q: Is there a deadline for filing Form M-36?

A: Yes, Form M-36 must be filed by the last day of the month following the end of each quarter.

Q: How long does it take to process a refund claim filed using Form M-36?

A: The processing time for a refund claim filed using Form M-36 varies, but it generally takes several weeks to several months.

Q: Are there any additional documentation or attachments required with Form M-36?

A: Yes, you may need to attach supporting documents such as fuel purchase receipts and statements.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.