This version of the form is not currently in use and is provided for reference only. Download this version of

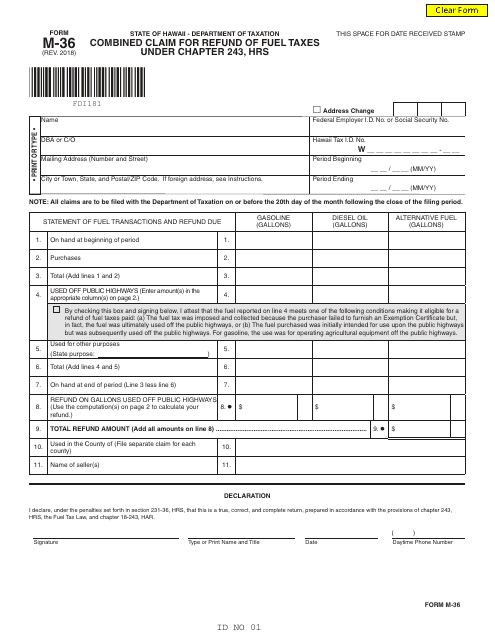

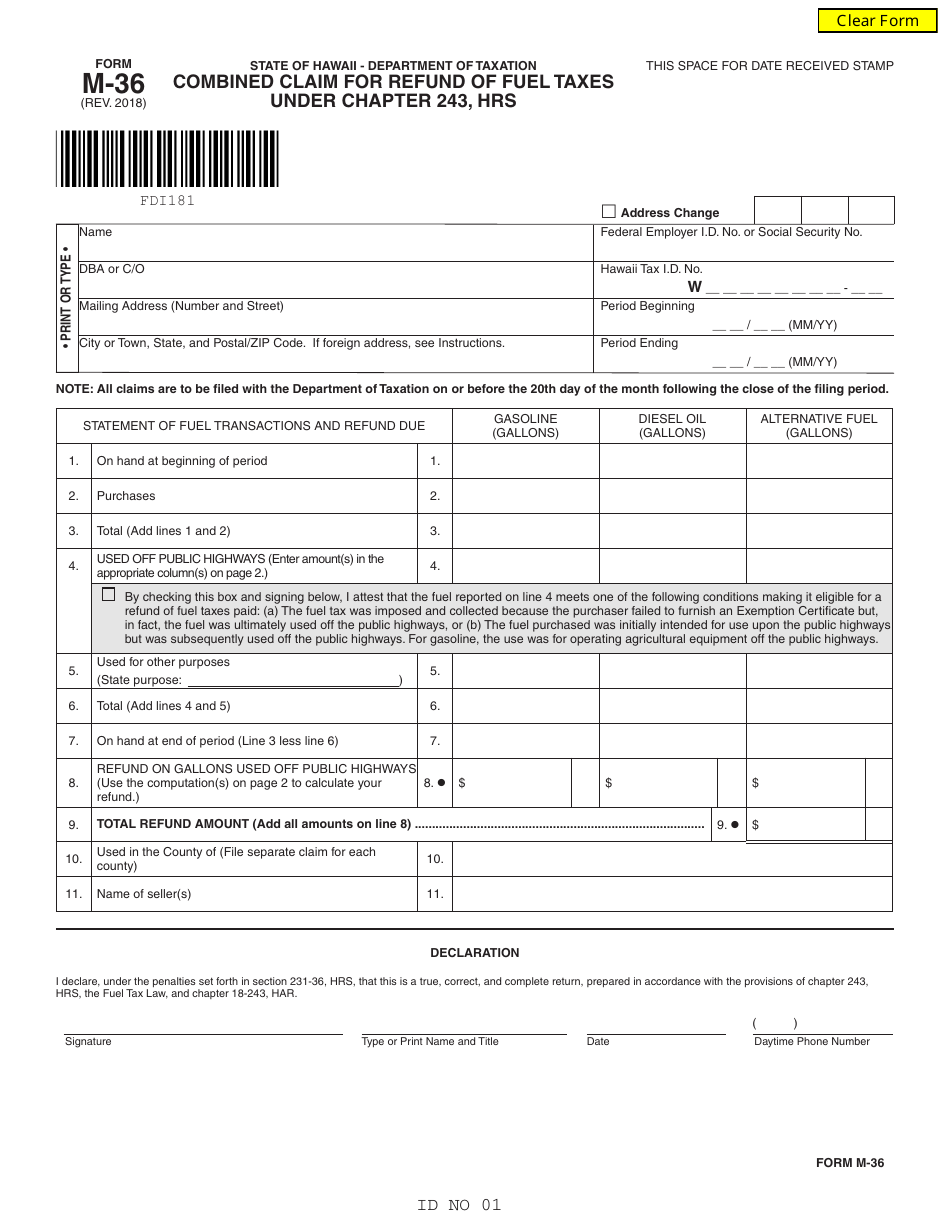

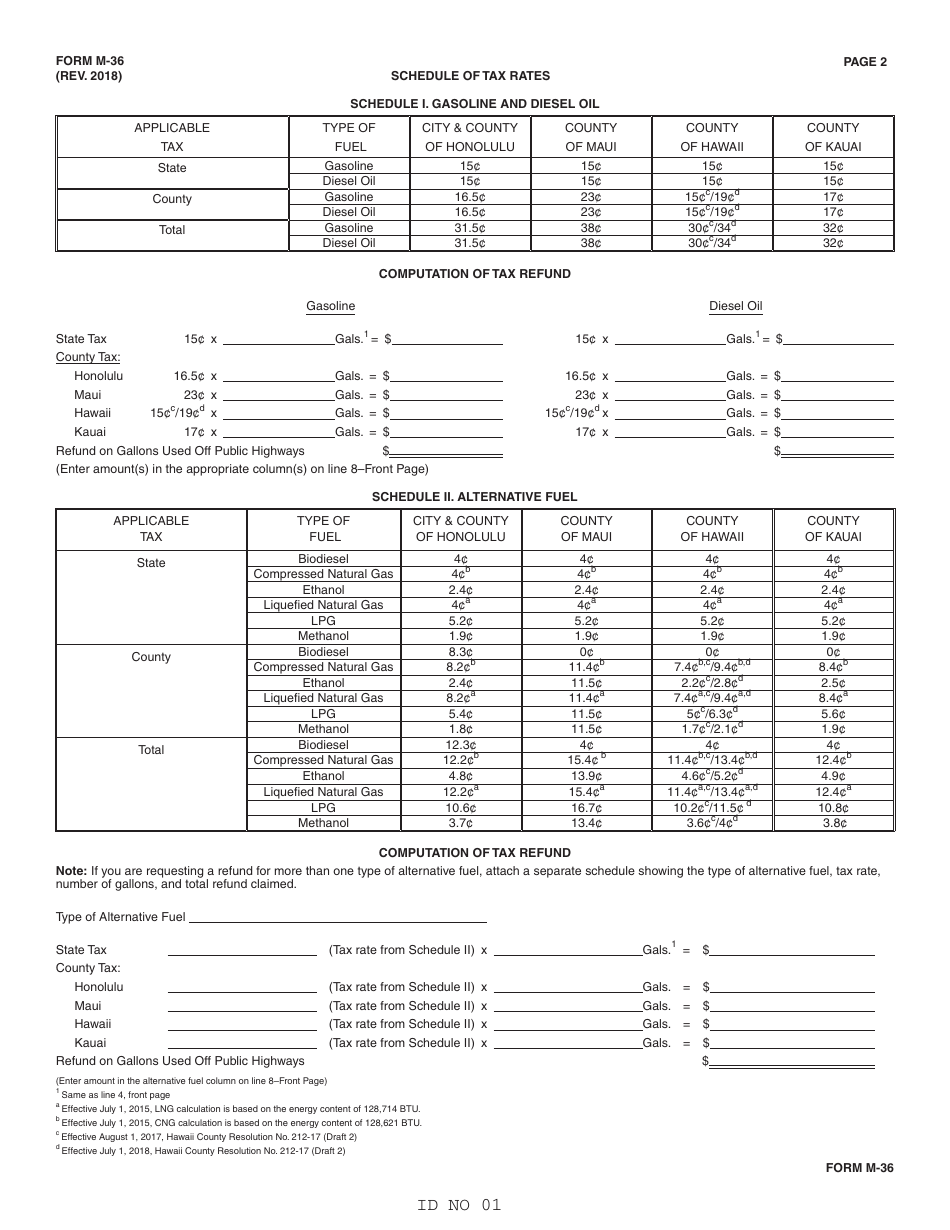

Form M-36

for the current year.

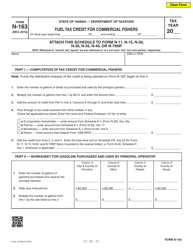

Form M-36 Combined Claim for Refund of Fuel Taxes Under Chapter 243, Hrs - Hawaii

What Is Form M-36?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-36?

A: Form M-36 is a form used to claim a refund of fuel taxes in Hawaii.

Q: What does Chapter 243, HRS refer to?

A: Chapter 243, HRS refers to the Hawaii Revised Statutes that govern fuel taxes.

Q: What can I use Form M-36 for?

A: You can use Form M-36 to claim a refund of fuel taxes paid in Hawaii.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-36 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.