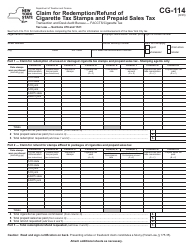

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CG-114-E

for the current year.

Instructions for Form CG-114-E Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales - New York

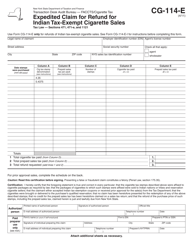

This document contains official instructions for Form CG-114-E , Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CG-114-E is available for download through this link.

FAQ

Q: What is Form CG-114-E?

A: Form CG-114-E is the Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales in New York.

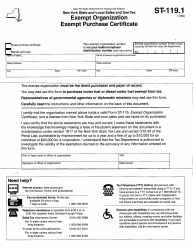

Q: Who can use Form CG-114-E?

A: The form is meant to be used by vendors who made tax-exempt cigarette sales to eligible Native Americans in New York.

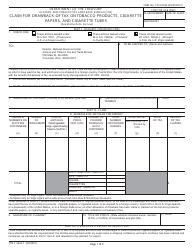

Q: What is the purpose of Form CG-114-E?

A: The purpose of the form is to claim a refund for the sales tax paid by vendors on Indian tax-exempt cigarette sales.

Q: What is considered an Indian tax-exempt cigarette sale?

A: An Indian tax-exempt cigarette sale refers to cigarette sales made to eligible Native Americans on their reservation lands.

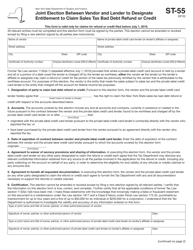

Q: Is Form CG-114-E for individuals or businesses?

A: The form is primarily for businesses or vendors who made tax-exempt cigarette sales to Native Americans in New York.

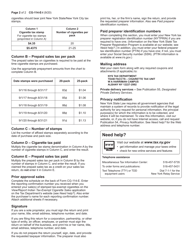

Q: What information is required on Form CG-114-E?

A: The form requires the vendor's information, details of the tax-exempt sales, and supporting documentation.

Q: When should I submit Form CG-114-E?

A: The form should be submitted quarterly, within 20 days following the end of each calendar quarter.

Q: How long does it take to process a CG-114-E claim?

A: The processing time can vary, but the New York Department of Taxation and Finance aims to process claims within 90 days.

Q: Are there any penalties for late filing of Form CG-114-E?

A: Late filing of the form may result in penalties and interest charges, so it is important to submit it on time.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.