This version of the form is not currently in use and is provided for reference only. Download this version of

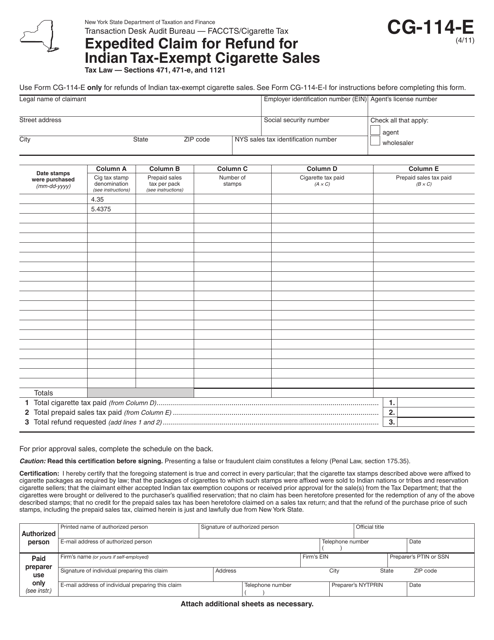

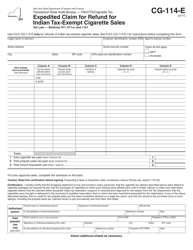

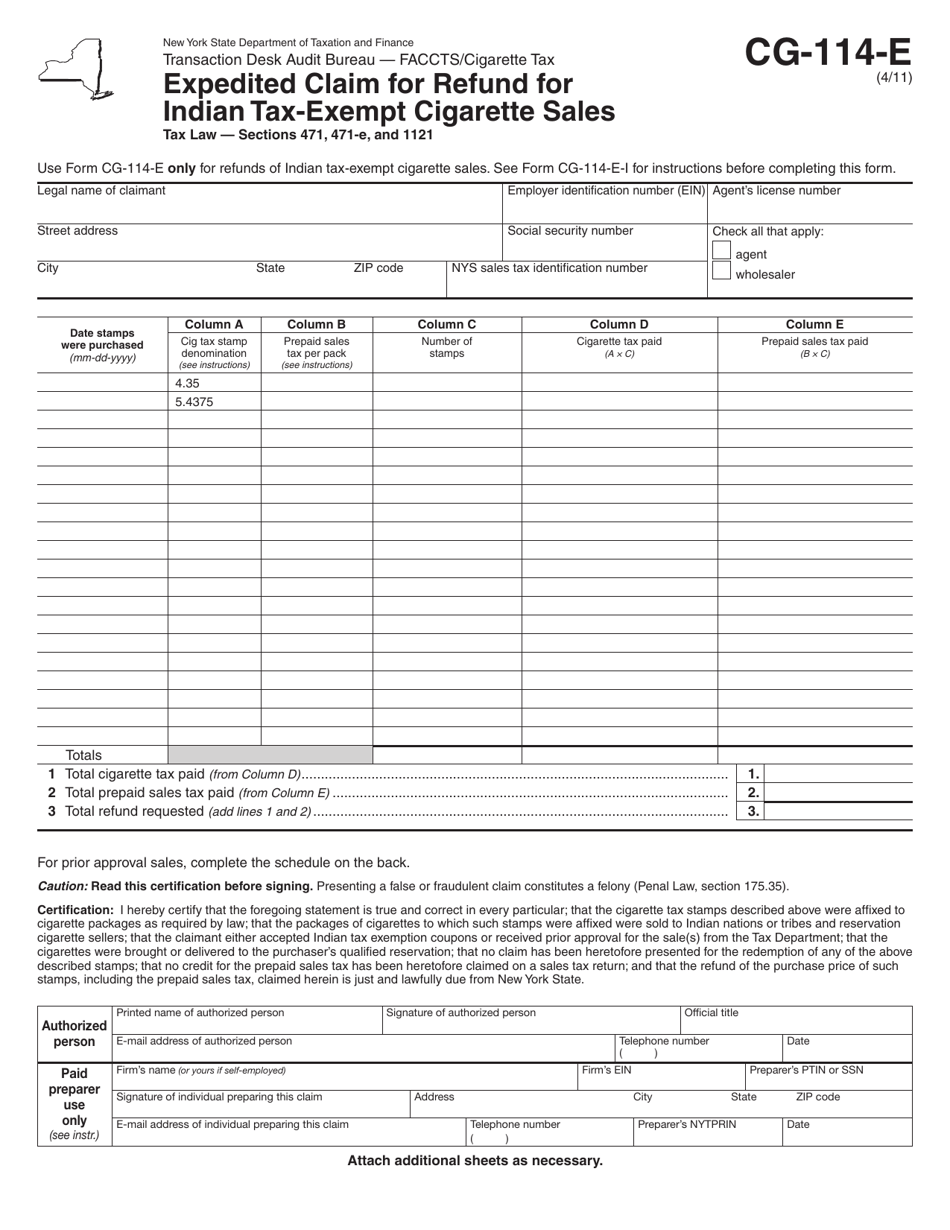

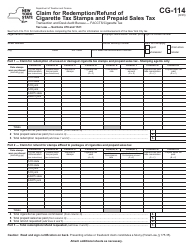

Form CG-114-E

for the current year.

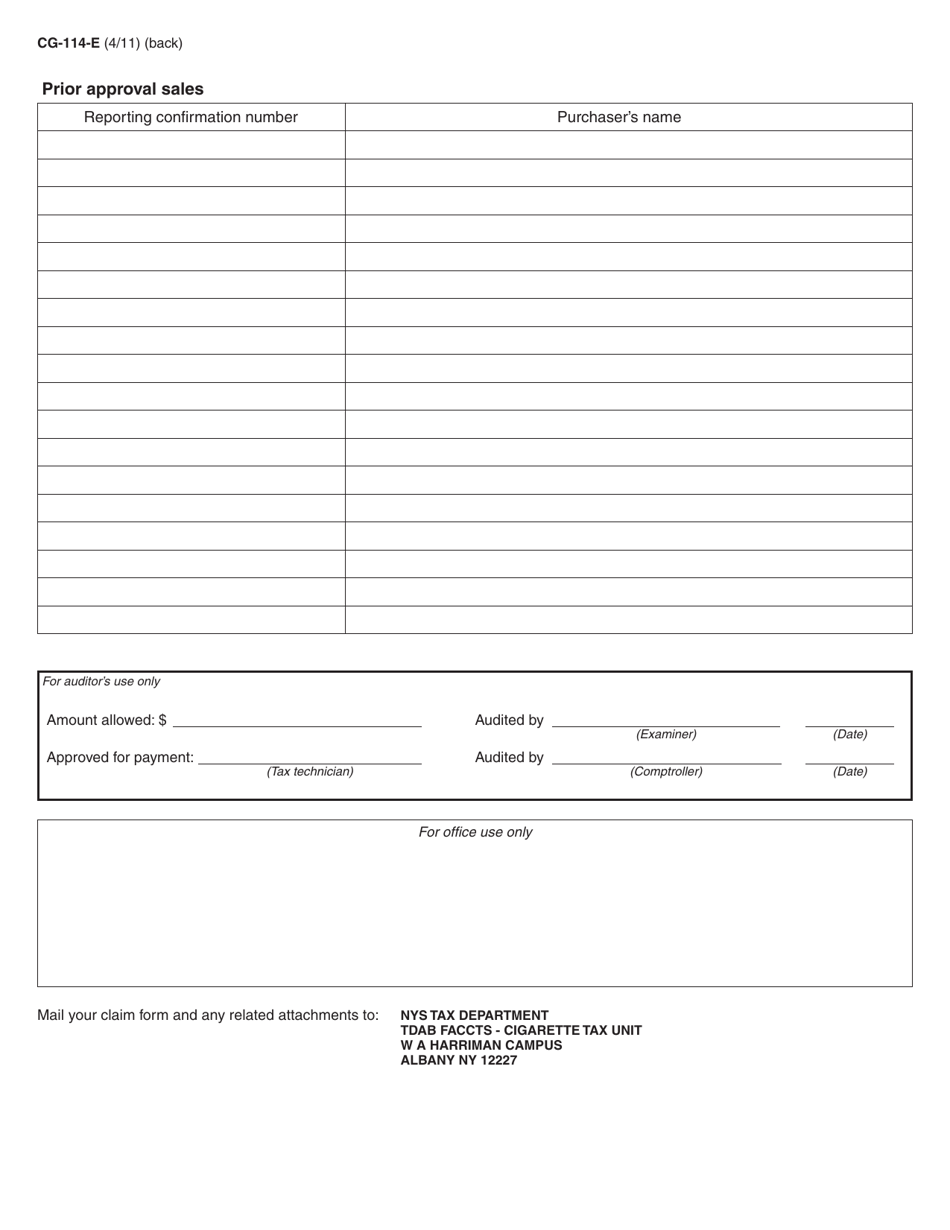

Form CG-114-E Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales - New York

What Is Form CG-114-E?

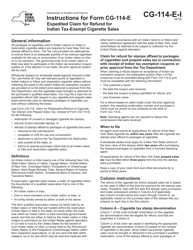

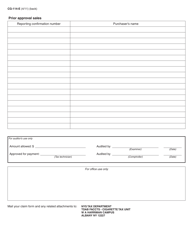

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CG-114-E?

A: Form CG-114-E is the Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales in New York.

Q: Who can use Form CG-114-E?

A: Form CG-114-E can be used by Native American Indian tribes located in New York who sell tax-exempt cigarettes.

Q: What is the purpose of Form CG-114-E?

A: The purpose of Form CG-114-E is to claim a refund for the taxes paid on Indian tax-exempt cigarette sales in New York.

Q: How can I obtain Form CG-114-E?

A: You can obtain Form CG-114-E from the New York State Tax Department.

Q: Is there a deadline for filing Form CG-114-E?

A: Yes, there is a deadline for filing Form CG-114-E. Please refer to the instructions provided with the form.

Q: Are there any supporting documents required with Form CG-114-E?

A: Yes, supporting documents such as proof of purchase and evidence of tax exemption may be required with Form CG-114-E.

Q: Who can I contact for more information about Form CG-114-E?

A: For more information about Form CG-114-E, you can contact the New York State Tax Department.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CG-114-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.