This version of the form is not currently in use and is provided for reference only. Download this version of

Form PD27

for the current year.

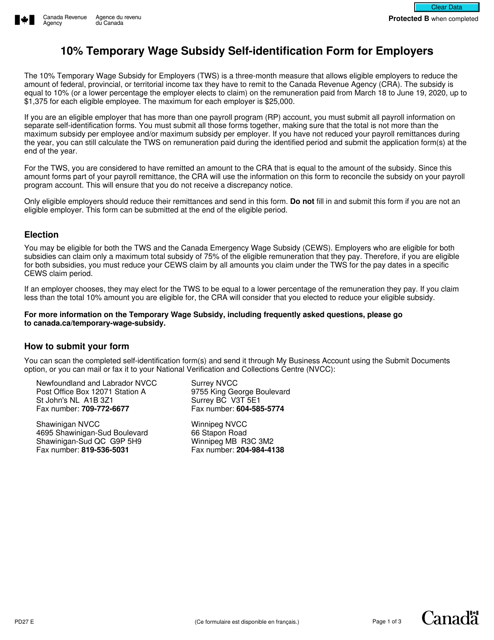

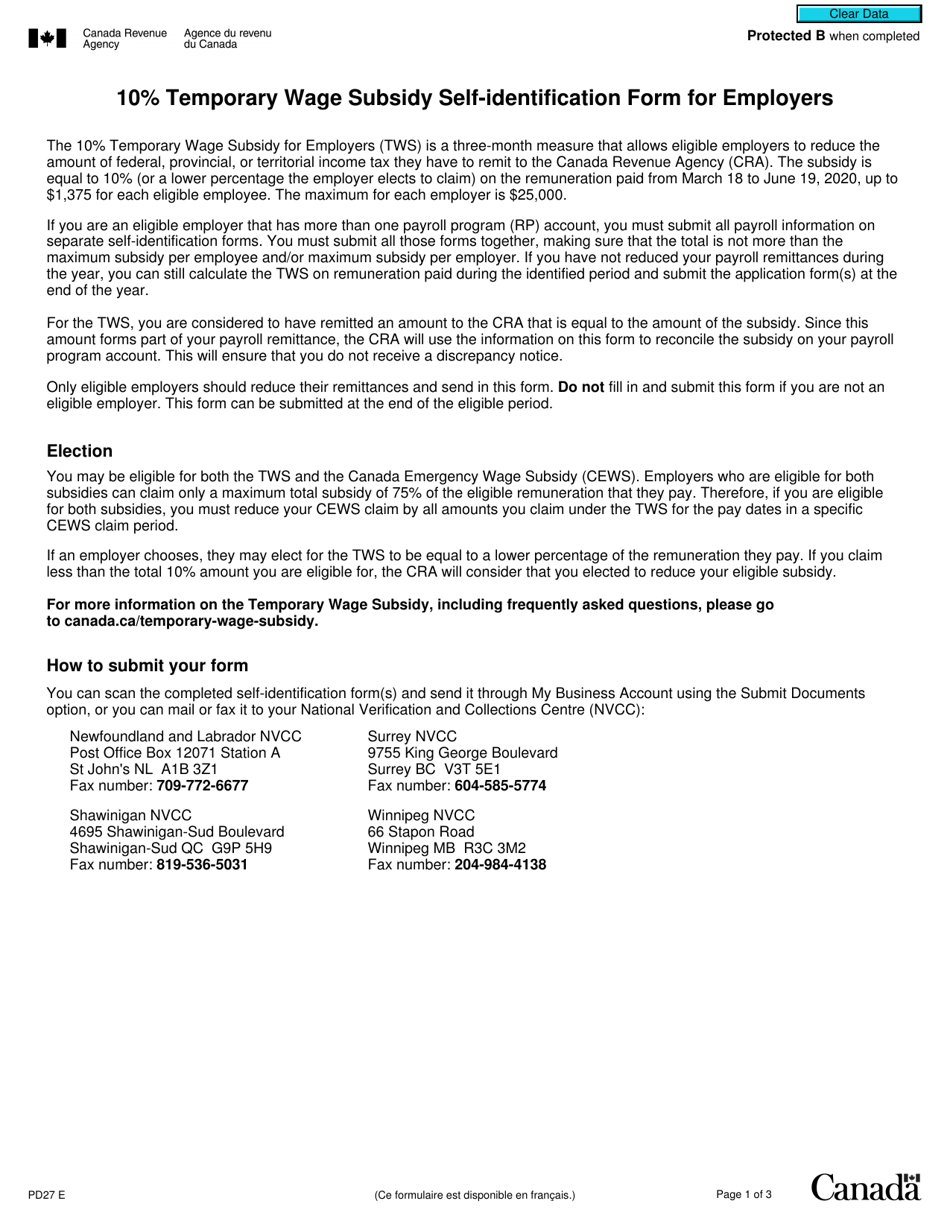

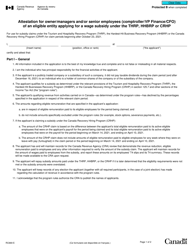

Form PD27 10% Temporary Wage Subsidy Self-identification Form for Employers - Canada

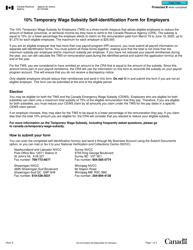

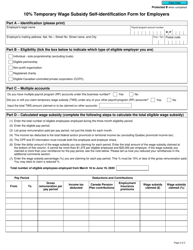

Form PD27, the 10% Temporary Wage Subsidy Self-identification Form for Employers in Canada, is used by eligible employers to identify themselves and confirm their eligibility for the 10% Temporary Wage Subsidy program. This program allows employers to reduce the amount of payroll deductions they send to the Canada Revenue Agency (CRA) by a certain percentage. The form helps employers identify and calculate the amount of subsidy they can receive.

The employer files the Form PD27 10% Temporary Wage Subsidy Self-identification Form for Employers in Canada.

FAQ

Q: What is the PD27 form?

A: The PD27 form is the 10% Temporary Wage Subsidy Self-identification Form for Employers in Canada.

Q: What is the purpose of the PD27 form?

A: The purpose of the PD27 form is for employers in Canada to self-identify and apply for the 10% Temporary Wage Subsidy.

Q: Who needs to fill out the PD27 form?

A: Employers in Canada who want to apply for the 10% Temporary Wage Subsidy need to fill out the PD27 form.

Q: What is the 10% Temporary Wage Subsidy?

A: The 10% Temporary Wage Subsidy is a program in Canada that allows eligible employers to reduce their payroll remittances.

Q: Is the PD27 form mandatory?

A: No, the PD27 form is not mandatory. It is optional for employers who want to apply for the 10% Temporary Wage Subsidy.

Q: Are there any eligibility requirements for the 10% Temporary Wage Subsidy?

A: Yes, there are eligibility requirements for the 10% Temporary Wage Subsidy. Employers must meet certain criteria to qualify.

Q: How long does it take to process the PD27 form?

A: The processing time for the PD27 form may vary. It is recommended to submit the form as early as possible.

Q: What other resources are available for employers applying for the 10% Temporary Wage Subsidy?

A: The Canada Revenue Agency (CRA) provides additional information and resources for employers applying for the 10% Temporary Wage Subsidy.

Q: Can I apply for the 10% Temporary Wage Subsidy if I already applied for the Canada Emergency Wage Subsidy (CEWS)?

A: Yes, you can apply for both the 10% Temporary Wage Subsidy and the Canada Emergency Wage Subsidy (CEWS). However, any benefit received under the 10% Temporary Wage Subsidy will reduce the amount available under the CEWS.