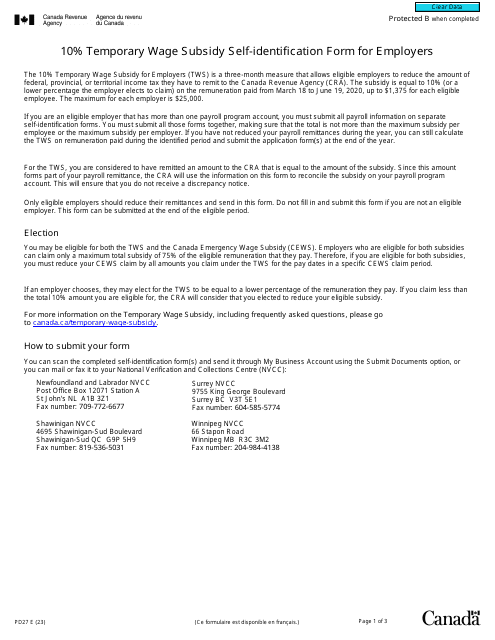

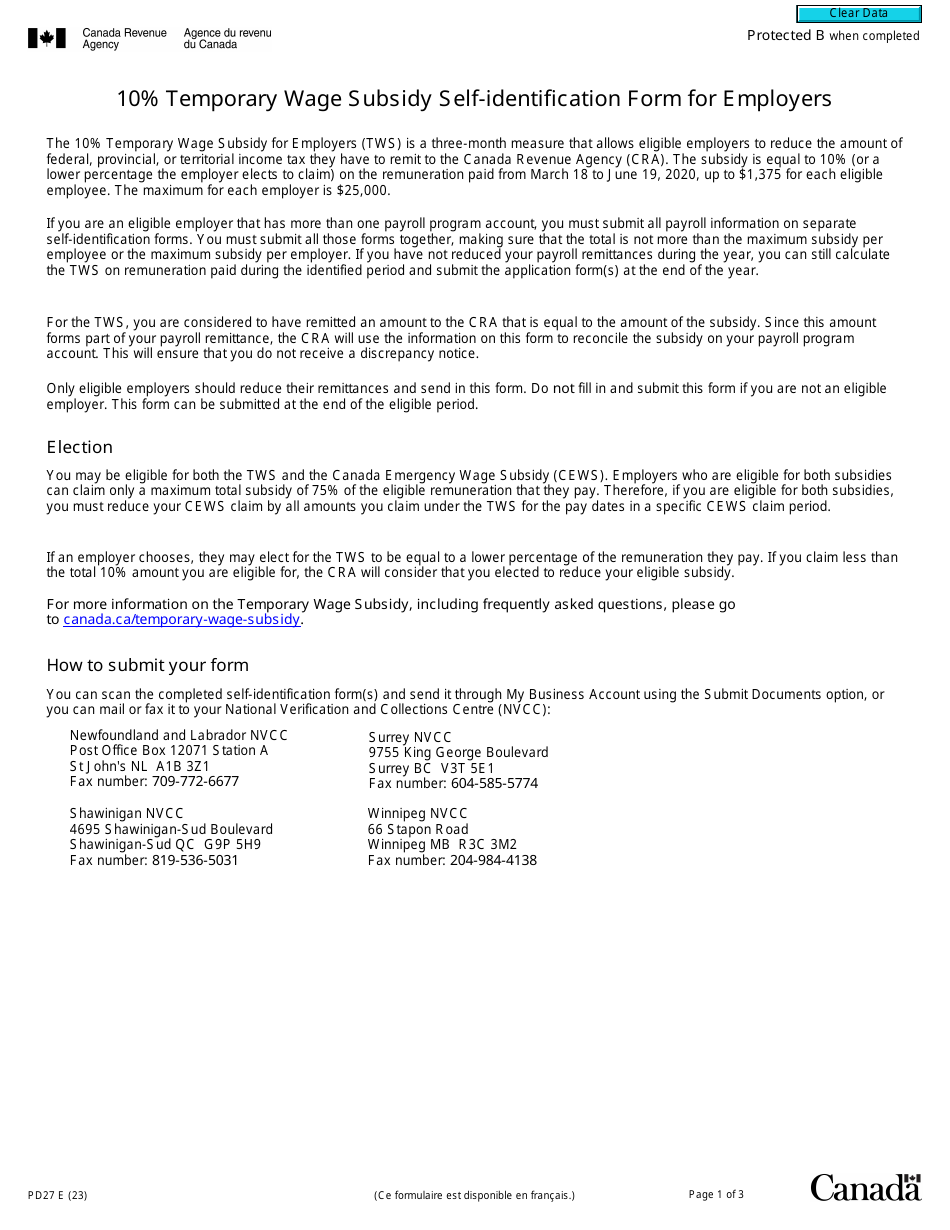

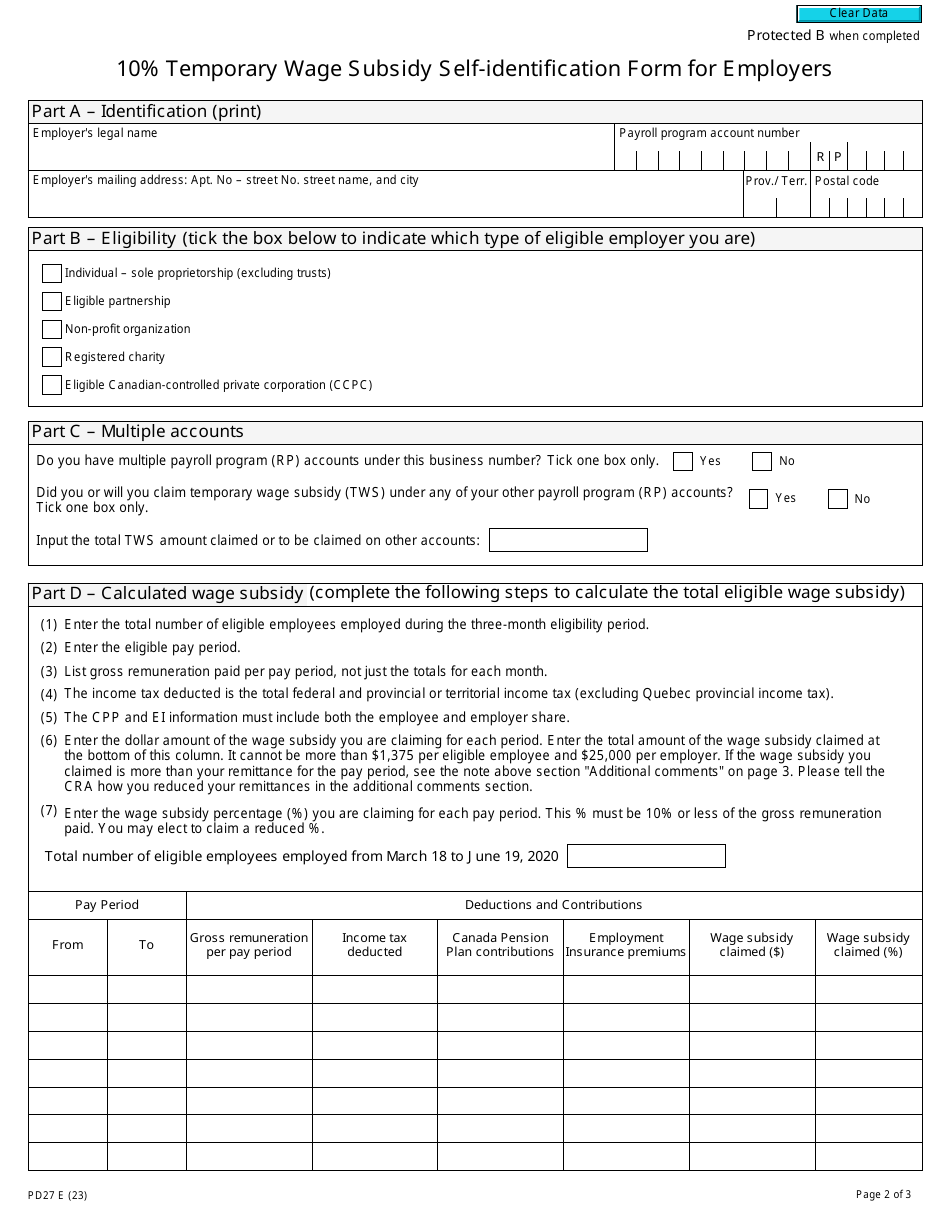

Form PD27 10% Temporary Wage Subsidy Self-identification Form for Employers - Canada

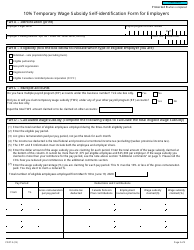

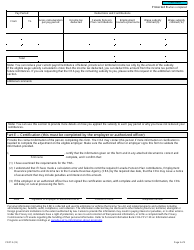

The Form PD27 is used by employers in Canada to self-identify for the 10% Temporary Wage Subsidy program. This form allows employers to declare their eligibility and intention to participate in the subsidy program.

The employer files the Form PD27 10% Temporary Wage Subsidy Self-identification Form for Employers in Canada.

Form PD27 10% Temporary Wage Subsidy Self-identification Form for Employers - Canada - Frequently Asked Questions (FAQ)

Q: What is Form PD27? A: Form PD27 is the 10% Temporary Wage Subsidy Self-identification form for employers in Canada.

Q: What is the purpose of Form PD27? A: The purpose of Form PD27 is to help employers in Canada identify if they are eligible for the 10% Temporary Wage Subsidy.

Q: What is the 10% Temporary Wage Subsidy? A: The 10% Temporary Wage Subsidy is a measure introduced by the Canadian government to provide financial support to eligible employers during the COVID-19 pandemic.

Q: Who needs to fill out Form PD27? A: Employers in Canada who believe they are eligible for the 10% Temporary Wage Subsidy need to fill out Form PD27.

Q: When should Form PD27 be filled out? A: Form PD27 should be filled out as soon as possible after an employer becomes eligible for the 10% Temporary Wage Subsidy.