Form 105-16 Motor Fuel Tankwagon Importer Monthly Tax Calculation (For Filing Returns After July 1, 2018) - Oklahoma

What Is Form 105-16?

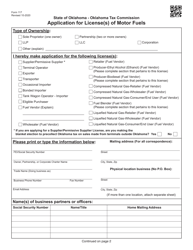

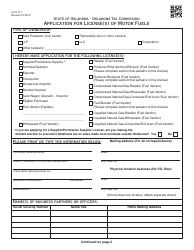

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

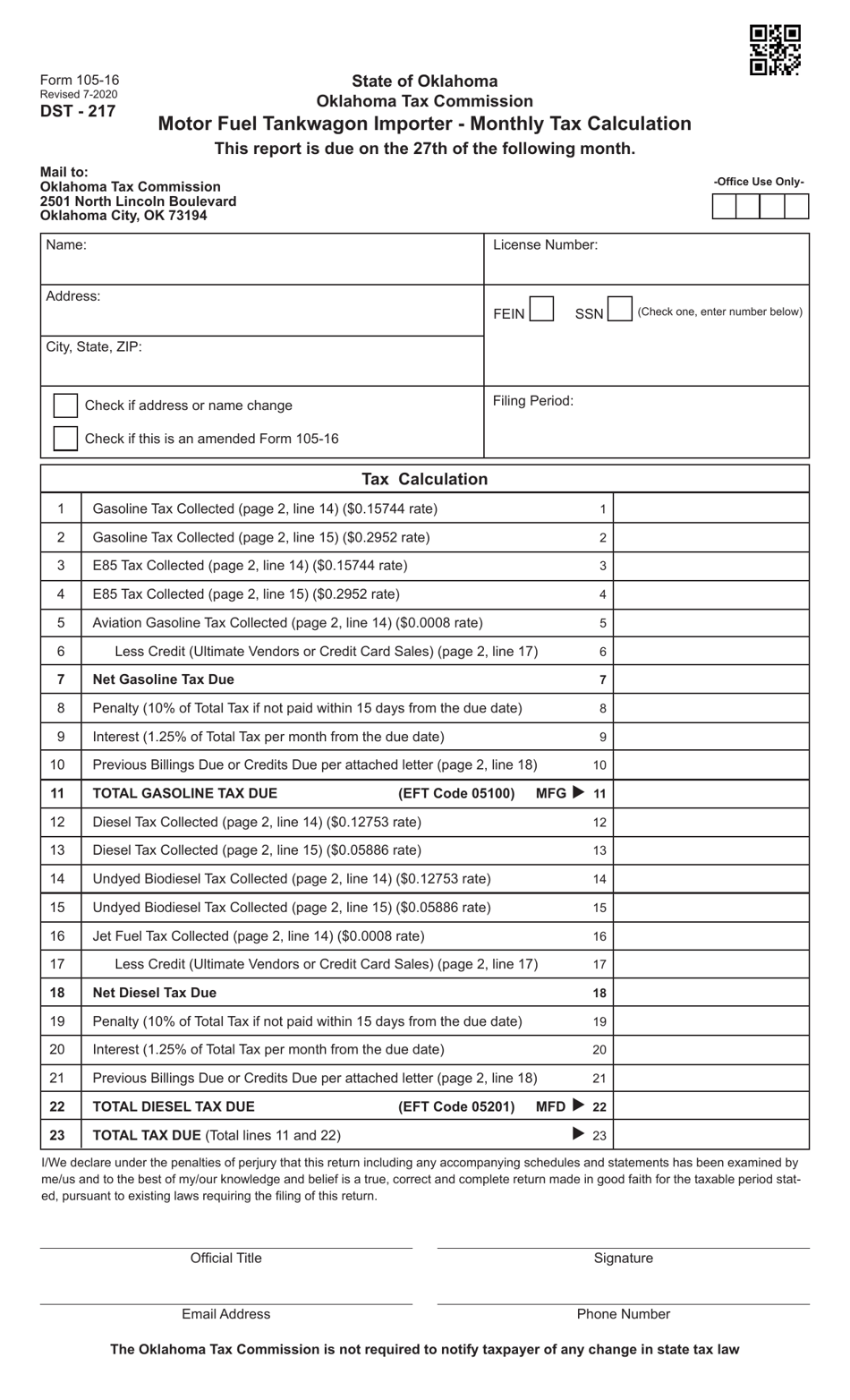

Q: What is Form 105-16?

A: Form 105-16 is the Motor Fuel Tankwagon Importer Monthly Tax Calculation form.

Q: Who is required to file Form 105-16?

A: Importers of motor fuel tankwagon are required to file Form 105-16.

Q: What is the purpose of Form 105-16?

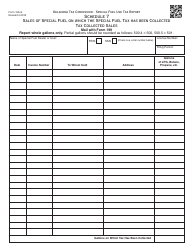

A: The purpose of Form 105-16 is to calculate the monthly tax for motor fuel tankwagon importers.

Q: When should I file Form 105-16?

A: Form 105-16 should be filed for returns after July 1, 2018.

Q: Is Form 105-16 specific to Oklahoma?

A: Yes, Form 105-16 is specific to Oklahoma.

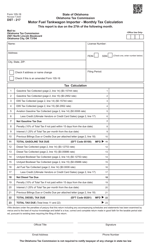

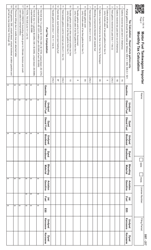

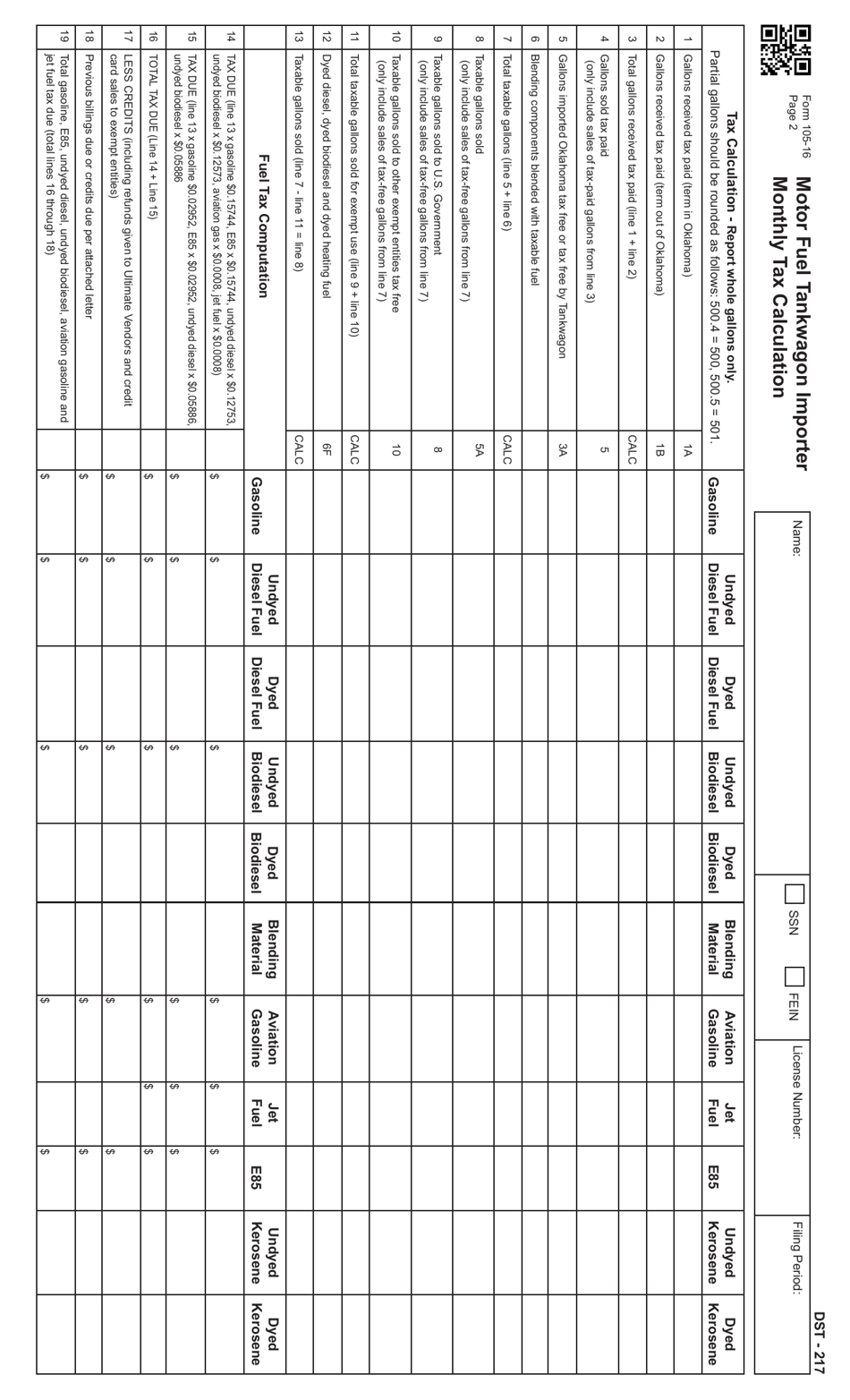

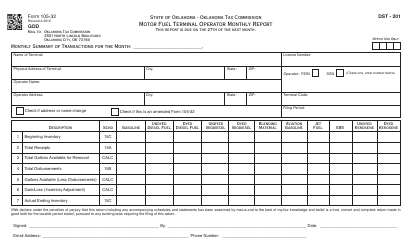

Q: What information is required on Form 105-16?

A: Form 105-16 requires information related to motor fuel tankwagon imports, including the type, quantity, and taxable amount of fuel.

Q: Are there any penalties for late filing of Form 105-16?

A: Yes, there may be penalties for late filing of Form 105-16, so it is important to file on time.

Q: What should I do if I have questions about Form 105-16?

A: If you have questions about Form 105-16, you should contact the Oklahoma Tax Commission for assistance.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 105-16 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.