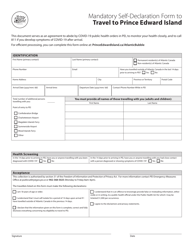

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

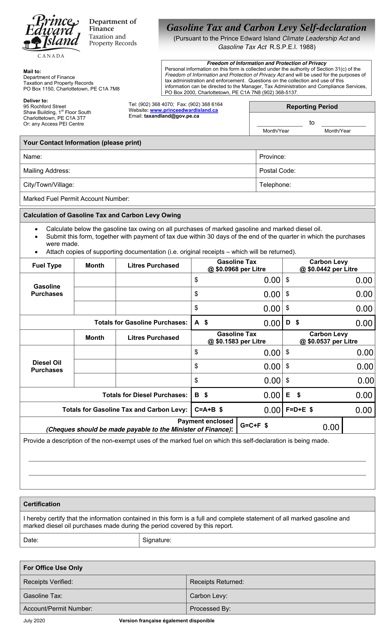

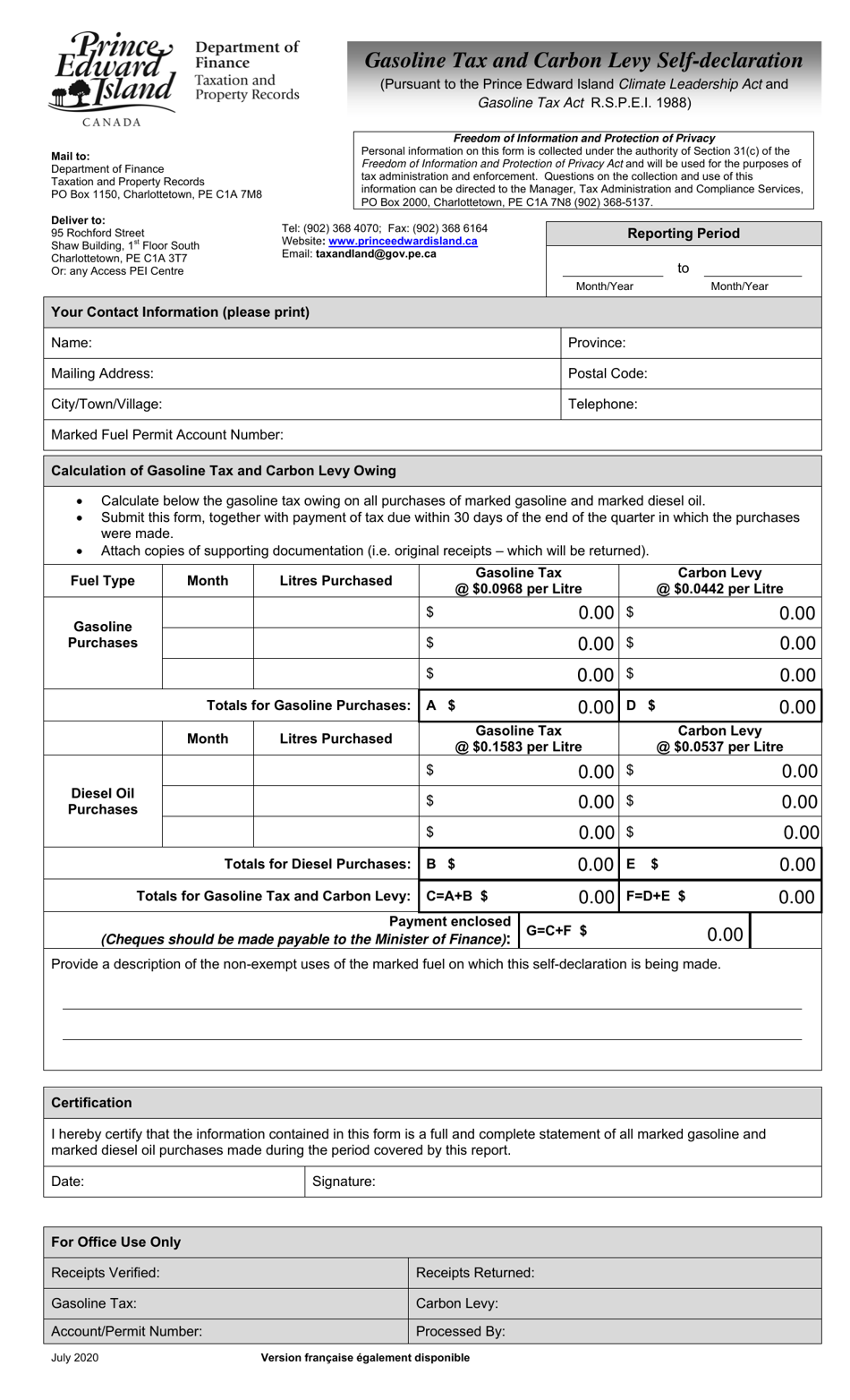

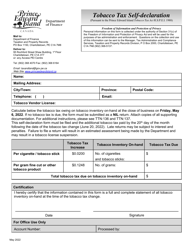

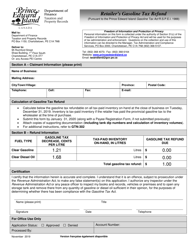

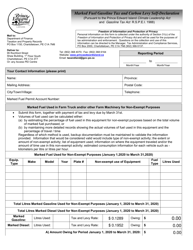

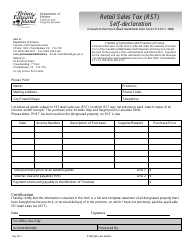

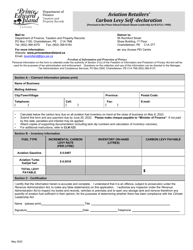

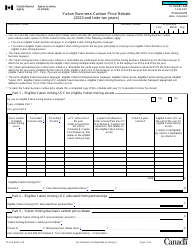

Gasoline Tax and Carbon Levy Self-declaration - Prince Edward Island, Canada

The Gasoline Tax and Carbon Levy Self-declaration in Prince Edward Island, Canada is a system for individuals to declare and pay taxes on gasoline and carbon emissions. It helps fund government programs and initiatives related to transportation and environmental conservation.

The gasoline tax and carbon levy self-declaration in Prince Edward Island, Canada, is filed by businesses that sell gasoline and other petroleum products.

FAQ

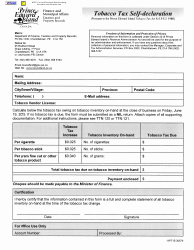

Q: What is the gasoline tax in Prince Edward Island?

A: The gasoline tax in Prince Edward Island is 15.5 cents per litre.

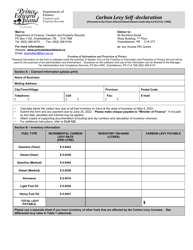

Q: What is a carbon levy?

A: A carbon levy is an additional charge on fossil fuels based on their carbon content.

Q: Is there a carbon levy in Prince Edward Island?

A: Yes, Prince Edward Island has a carbon levy.

Q: How much is the carbon levy in Prince Edward Island?

A: The carbon levy in Prince Edward Island is 6.63 cents per litre.

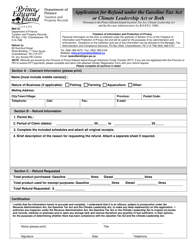

Q: Do I need to self-declare my gasoline tax and carbon levy?

A: Yes, you are required to self-declare your gasoline tax and carbon levy.

Q: How do I self-declare my gasoline tax and carbon levy?

A: You can self-declare your gasoline tax and carbon levy using the appropriate forms provided by the government.

Q: Are there penalties for not self-declaring the gasoline tax and carbon levy?

A: Yes, there are penalties for not self-declaring the gasoline tax and carbon levy.