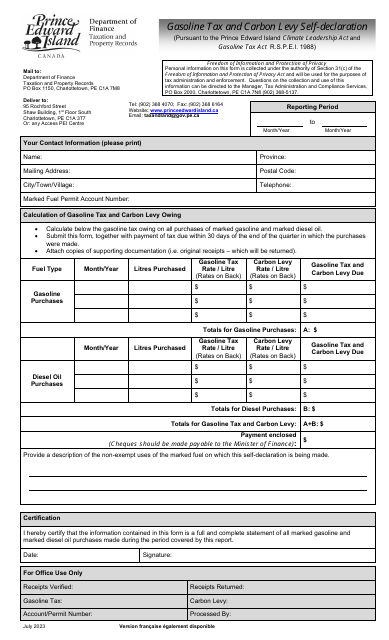

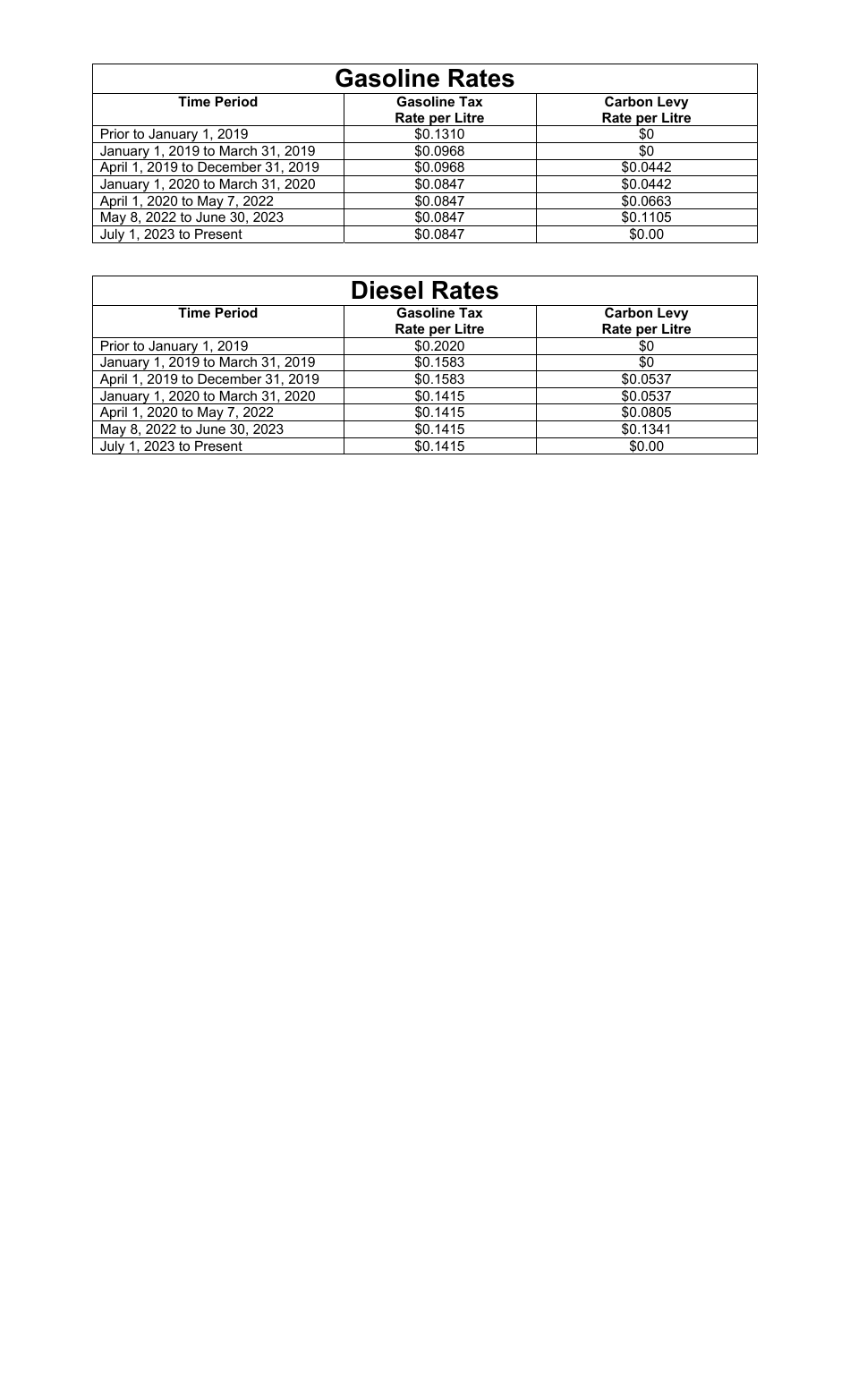

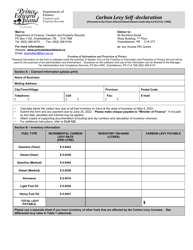

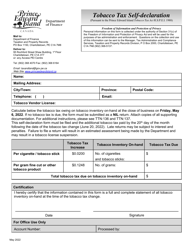

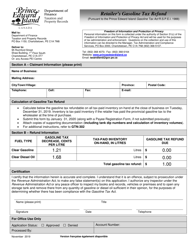

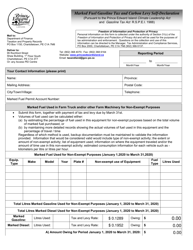

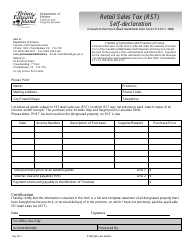

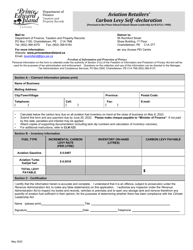

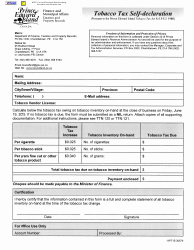

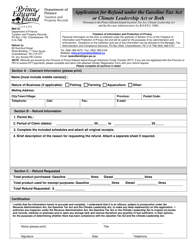

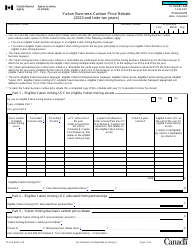

Gasoline Tax and Carbon Levy Self-declaration - Prince Edward Island, Canada

The Gasoline Tax and Carbon Levy Self-declaration in Prince Edward Island, Canada is for individuals to declare and pay the taxes and levies associated with gasoline and carbon emissions. It is a way for the government to collect revenue and encourage individuals to reduce their carbon footprint.

The gasoline tax and carbon levy self-declaration in Prince Edward Island, Canada, is filed by the gasoline distributors.

Gasoline Tax and Carbon Levy Self-declaration - Prince Edward Island, Canada - Frequently Asked Questions (FAQ)

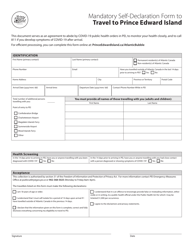

Q: What is the Gasoline Tax and Carbon Levy self-declaration?

A: The Gasoline Tax and Carbon Levy self-declaration is a form that residents of Prince Edward Island, Canada, fill out to report their gasoline consumption and pay the applicable taxes.

Q: Who needs to fill out the Gasoline Tax and Carbon Levy self-declaration?

A: Any resident of Prince Edward Island who purchases gasoline for personal use and does not have the taxes automatically withheld by the retailer needs to fill out the self-declaration.

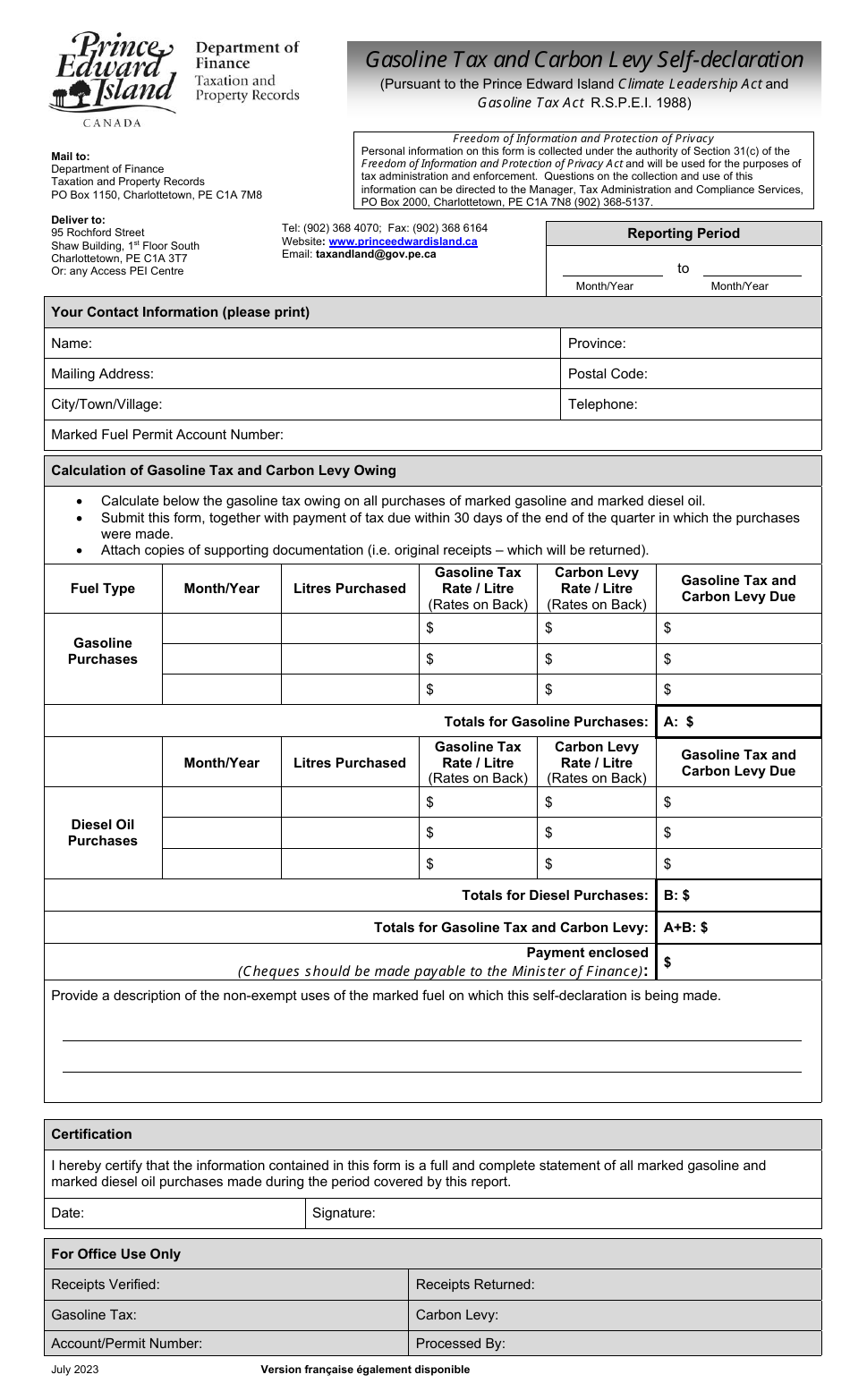

Q: What are the taxes included in the Gasoline Tax and Carbon Levy?

A: The Gasoline Tax and Carbon Levy includes a provincial tax on gasoline consumption and a levy designed to reduce carbon emissions.

Q: When is the deadline to submit the Gasoline Tax and Carbon Levy self-declaration?

A: The deadline to submit the self-declaration is typically before the 20th day of each month for the previous month's gasoline consumption.

Q: What happens if I don't fill out the Gasoline Tax and Carbon Levy self-declaration?

A: If you do not fill out the self-declaration or fail to pay the required taxes, you may face penalties and interest charges imposed by the provincial government.

Q: Can businesses also fill out the Gasoline Tax and Carbon Levy self-declaration?

A: No, the Gasoline Tax and Carbon Levy self-declaration is specifically for individuals who purchase gasoline for personal use. Businesses have a different process to comply with the applicable taxes.