This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

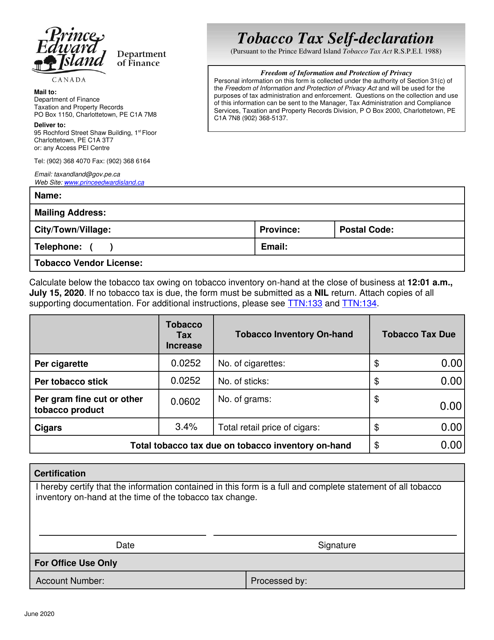

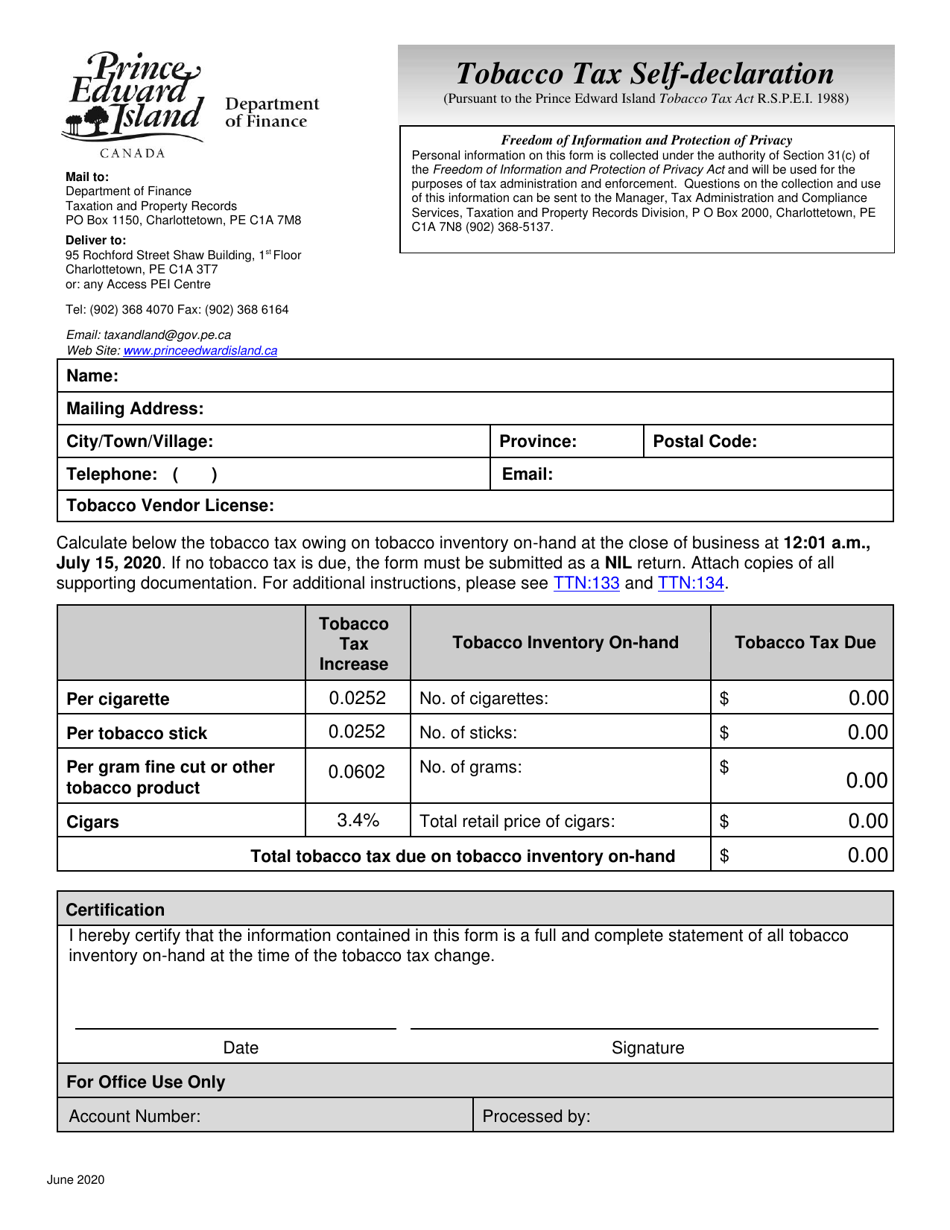

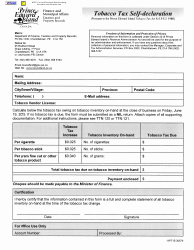

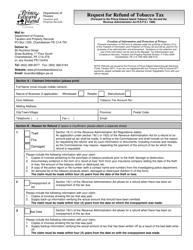

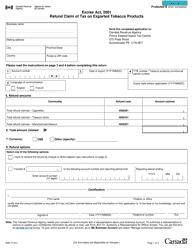

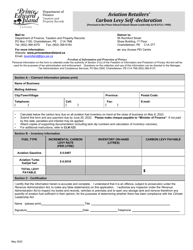

Tobacco Tax Self-declaration - Prince Edward Island, Canada

Tobacco Tax Self-declaration in Prince Edward Island, Canada is for individuals to report and pay taxes on the tobacco products they possess for personal use, including cigarettes, cigars, and other tobacco-related items.

The tobacco tax self-declaration in Prince Edward Island, Canada is filed by tobacco retailers and wholesalers.

FAQ

Q: What is the Tobacco Tax Self-declaration in Prince Edward Island?

A: The Tobacco Tax Self-declaration is a process by which individuals declare and pay the required taxes on tobacco products in Prince Edward Island, Canada.

Q: Do I have to declare and pay taxes on tobacco products in Prince Edward Island?

A: Yes, individuals are required to declare and pay taxes on tobacco products in Prince Edward Island.

Q: Who needs to file a Tobacco Tax Self-declaration in Prince Edward Island?

A: Any individual who possesses or consumes tobacco products in Prince Edward Island needs to file a Tobacco Tax Self-declaration.

Q: When is the deadline to file a Tobacco Tax Self-declaration in Prince Edward Island?

A: The deadline to file a Tobacco Tax Self-declaration in Prince Edward Island is typically April 30th of each year.

Q: What are the consequences of not filing a Tobacco Tax Self-declaration in Prince Edward Island?

A: Failure to file a Tobacco Tax Self-declaration or pay the required taxes can result in penalties, fines, or legal consequences.