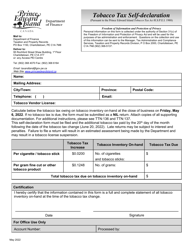

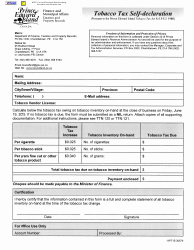

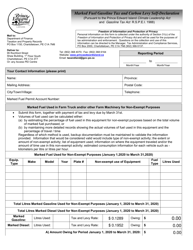

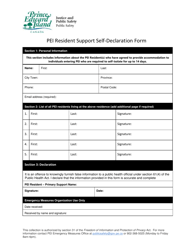

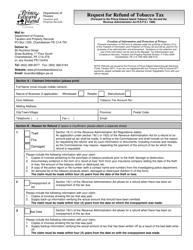

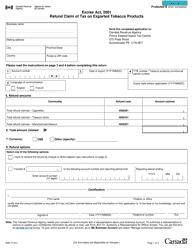

Tobacco Tax Self-declaration - Prince Edward Island, Canada

The Tobacco Tax Self-declaration in Prince Edward Island, Canada is a form that individuals or businesses use to report and pay the taxes on tobacco products they have purchased or imported. The purpose of this declaration is to ensure compliance with tobacco tax laws and to support the funding of various government programs and initiatives.

The tobacco tax self-declaration in Prince Edward Island, Canada is filed by businesses who sell tobacco products.

Tobacco Tax Self-declaration - Prince Edward Island, Canada - Frequently Asked Questions (FAQ)

Q: What is the Tobacco Tax Self-declaration?

A: The Tobacco Tax Self-declaration is a process where individuals or businesses in Prince Edward Island, Canada, are required to report and pay the tobacco tax on their own.

Q: Who needs to complete the Tobacco Tax Self-declaration?

A: Any individual or business that sells or possesses tobacco for sale in Prince Edward Island needs to complete the Tobacco Tax Self-declaration.

Q: How often do I need to complete the Tobacco Tax Self-declaration?

A: The Tobacco Tax Self-declaration needs to be completed on a monthly basis.

Q: What information do I need to provide in the Tobacco Tax Self-declaration?

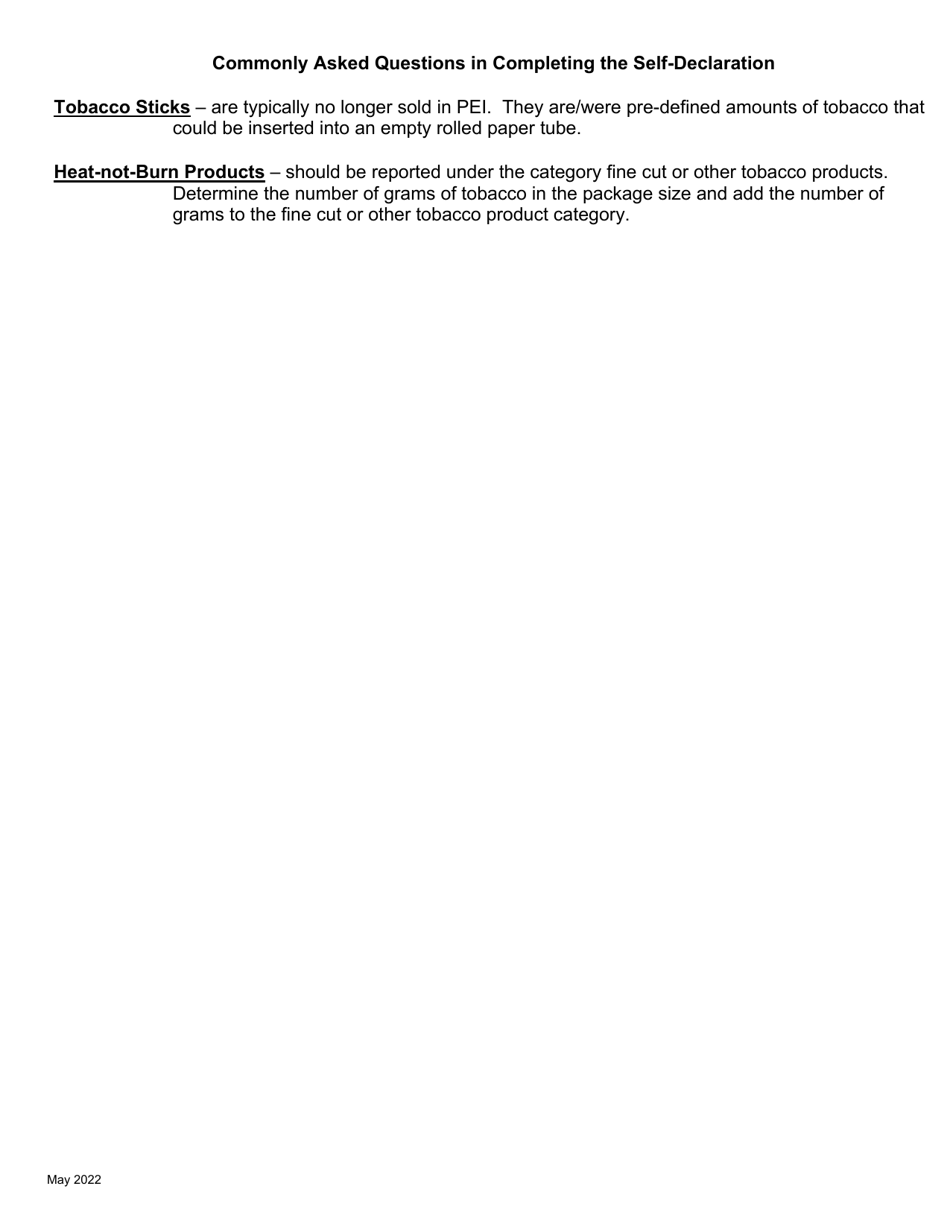

A: You need to provide details of the quantity of tobacco products possessed, sold, or consumed, along with the applicable tax rates and amounts.

Q: What are the consequences of not completing the Tobacco Tax Self-declaration?

A: Failure to complete the Tobacco Tax Self-declaration or underreporting may result in penalties, fines, or legal action by the authorities.