This version of the form is not currently in use and is provided for reference only. Download this version of

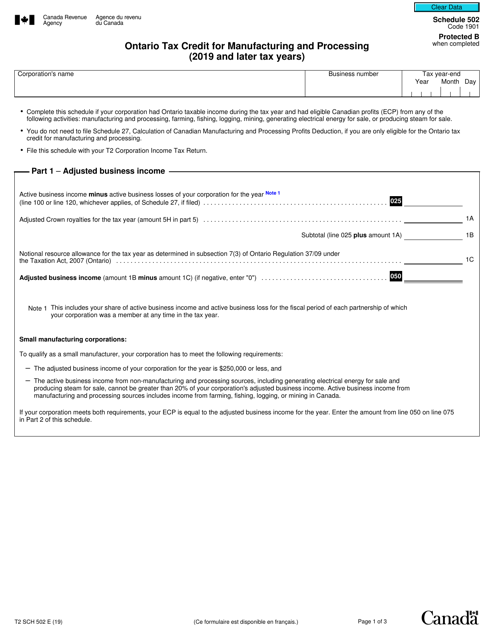

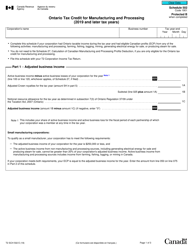

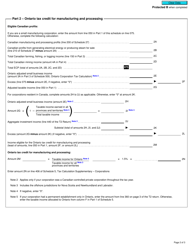

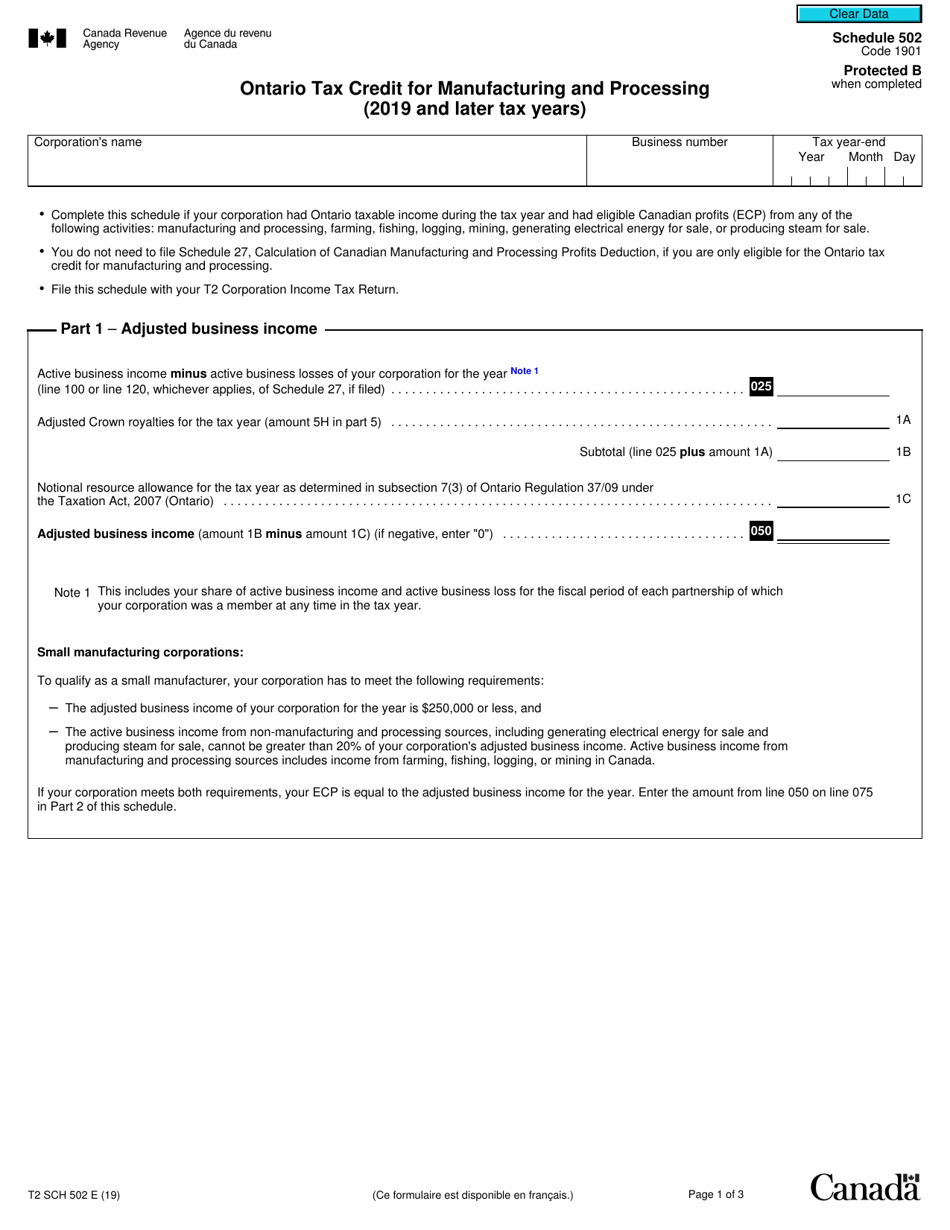

Form T2 Schedule 502

for the current year.

Form T2 Schedule 502 Ontario Tax Credit for Manufacturing and Processing (2019 and Later Tax Years) - Canada

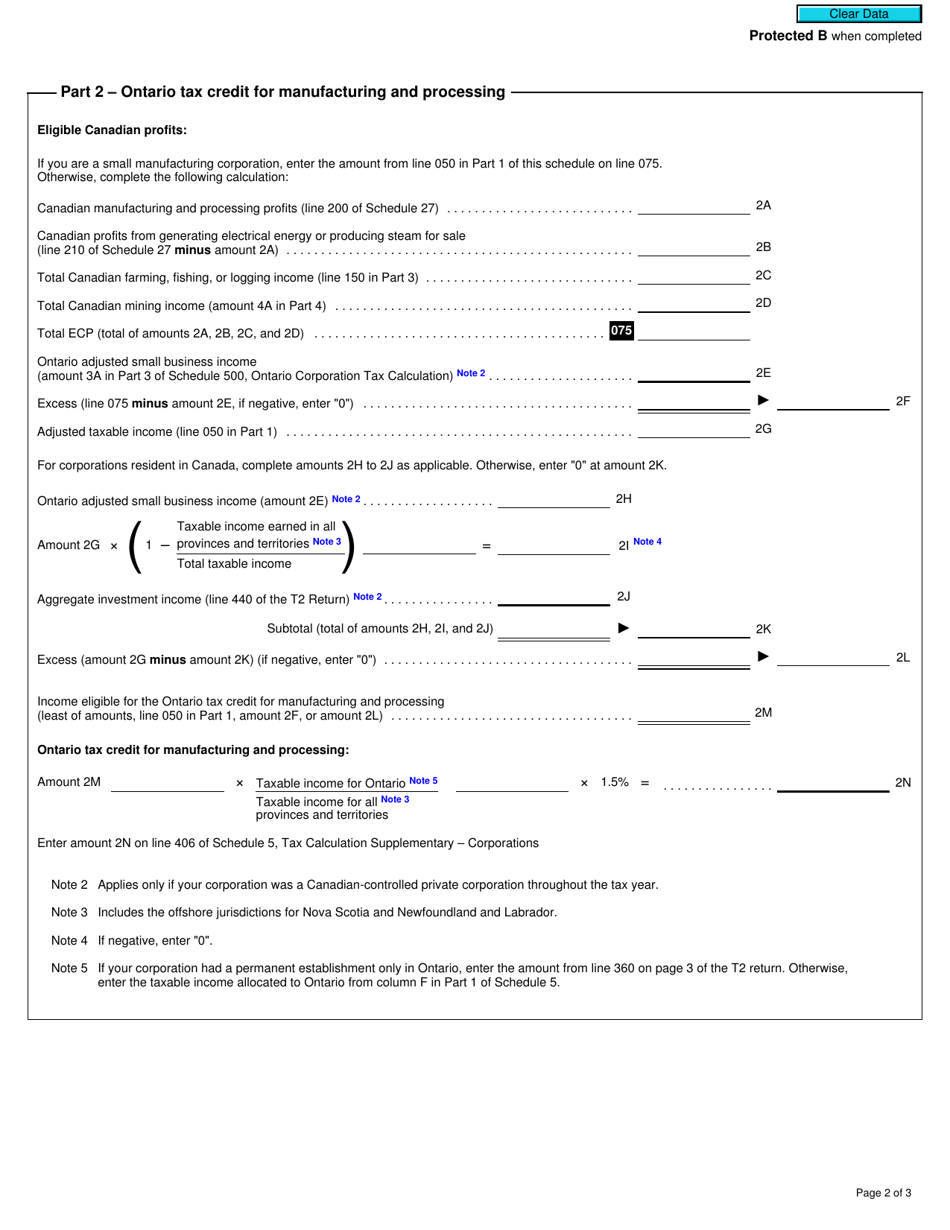

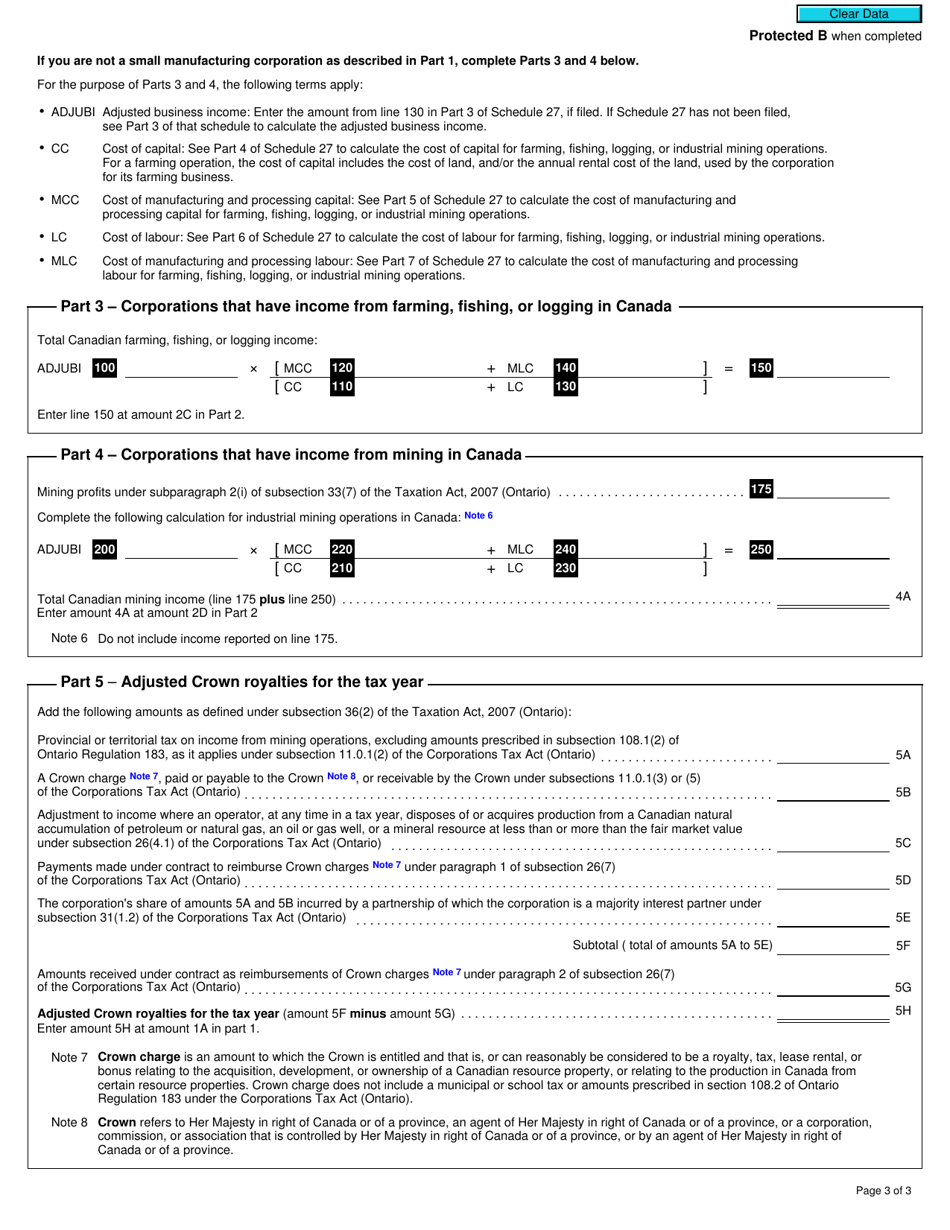

Form T2 Schedule 502 is used in Canada to claim the Ontario Tax Credit for Manufacturing and Processing. This credit provides a tax reduction for eligible businesses engaged in manufacturing or processing activities in Ontario. It is applicable for the 2019 tax year and onwards.

The form T2 Schedule 502 Ontario Tax Credit for Manufacturing and Processing in Canada is typically filed by corporations that are eligible for this tax credit.

FAQ

Q: What is the T2 Schedule 502?

A: T2 Schedule 502 is a tax form in Canada that allows corporations to claim the Ontario Tax Credit for Manufacturing and Processing.

Q: Who is eligible to claim the Ontario Tax Credit for Manufacturing and Processing?

A: Corporations in Ontario that are engaged in eligible manufacturing or processing activities may be eligible to claim this tax credit.

Q: What are eligible manufacturing and processing activities?

A: Eligible activities include manufacturing goods, processing materials, and activities related to research and development in Ontario.

Q: How much is the tax credit?

A: The tax credit is based on a percentage of the qualified Ontario labour expenditures.

Q: Can I claim this tax credit if my corporation is not in Ontario?

A: No, this tax credit is specifically for corporations located in Ontario.

Q: Is there a deadline to claim this tax credit?

A: Yes, you should claim the Ontario Tax Credit for Manufacturing and Processing on your corporation's T2 return for the tax year it applies to.