This version of the form is not currently in use and is provided for reference only. Download this version of

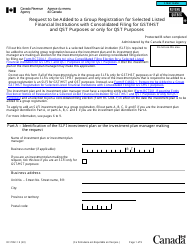

Form RC7257

for the current year.

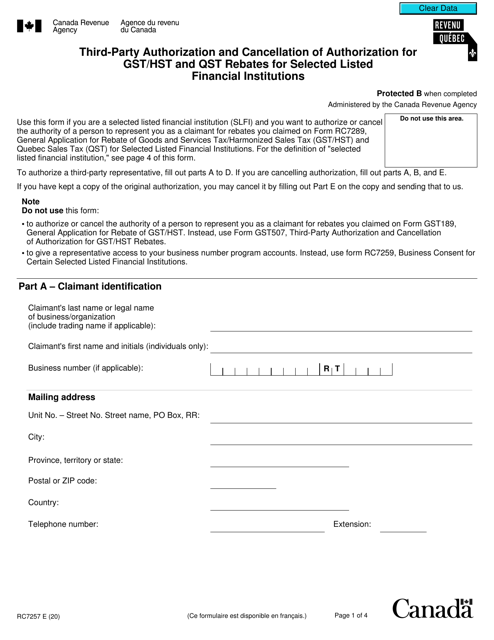

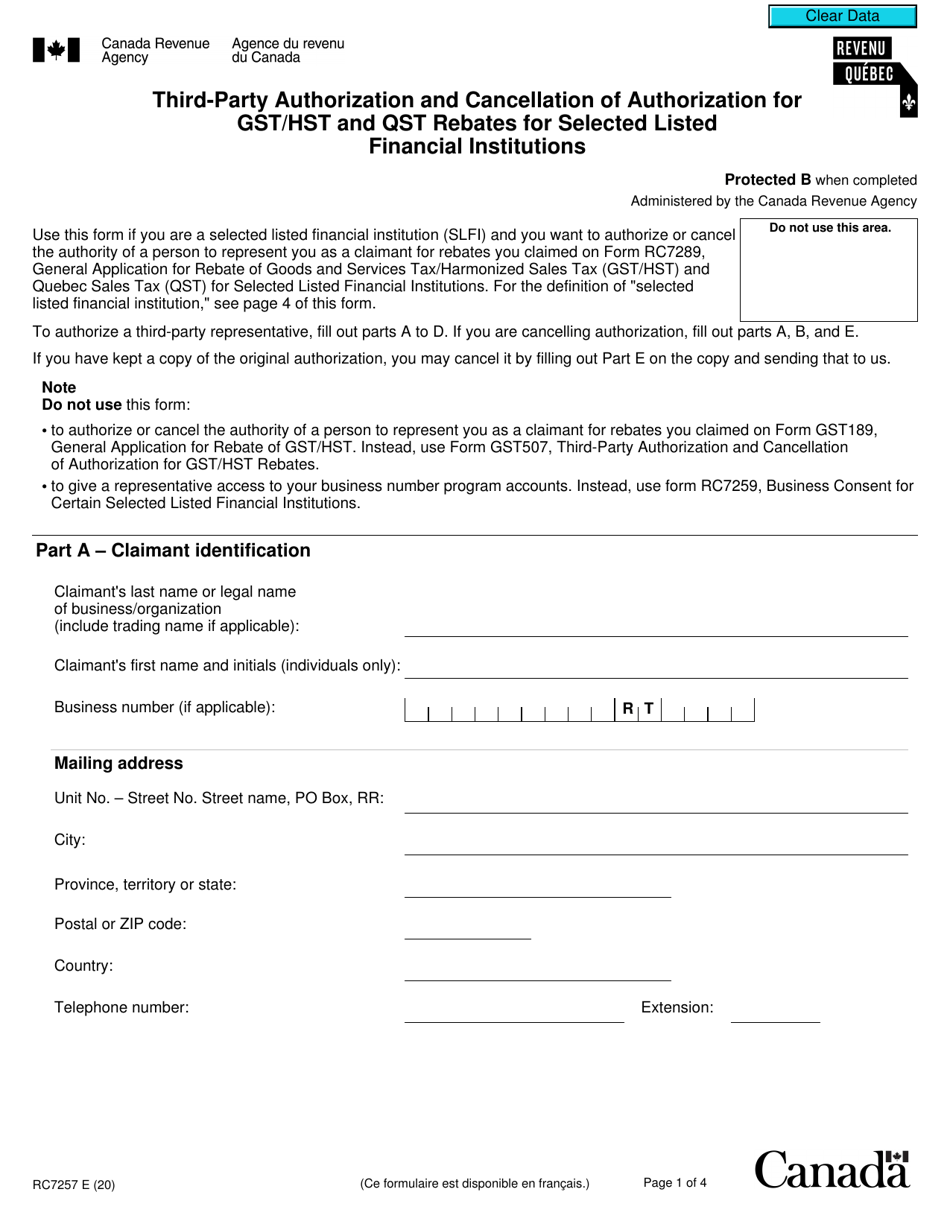

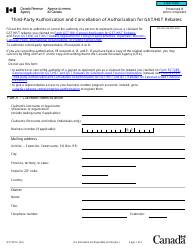

Form RC7257 Third Party Authorization and Cancellation of Authorization for Gst / Hst and Qst Rebates for Selected Listed Financial Institutions - Canada

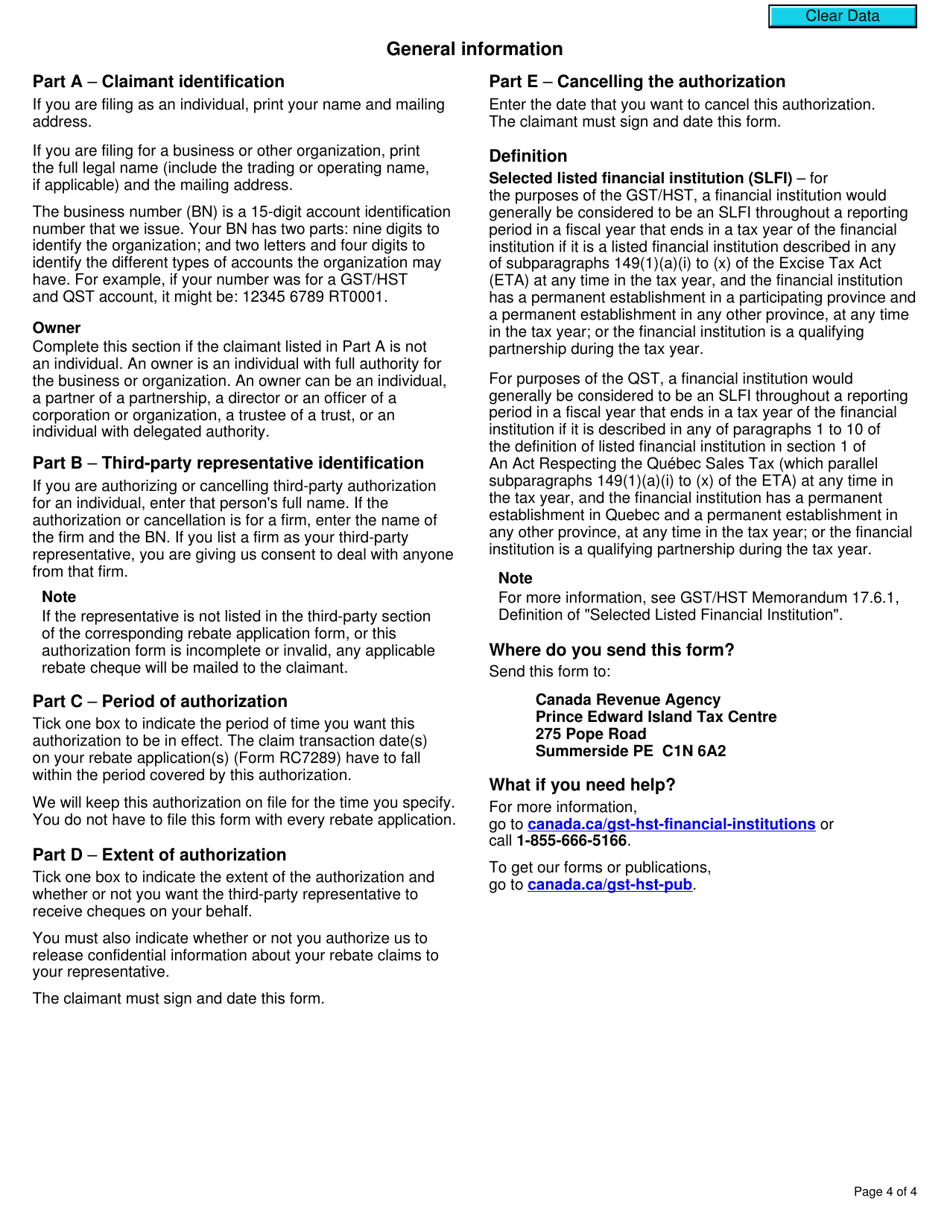

Form RC7257 Third Party Authorization and Cancellation of Authorization for GST/HST and QST Rebates for Selected Listed Financial Institutions - Canada is used to authorize or cancel authorization for a third party to claim GST/HST and QST rebates on behalf of a selected listed financial institution in Canada.

The selected listed financial institutions themselves or their authorized representatives can file the Form RC7257 Third Party Authorization and Cancellation of Authorization for GST/HST and QST rebates in Canada.

FAQ

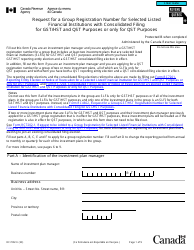

Q: What is Form RC7257?

A: Form RC7257 is used for authorizing or canceling authorization for GST/HST and QST rebates for selected listed financial institutions in Canada.

Q: Who can use Form RC7257?

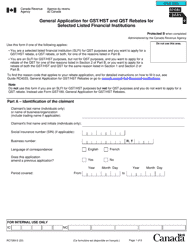

A: Individuals or businesses that have selected listed financial institutions as their authorized representative for GST/HST and QST rebates can use this form.

Q: What is the purpose of Form RC7257?

A: The purpose of this form is to authorize or cancel authorization for selected listed financial institutions to claim GST/HST and QST rebates on behalf of the individual or business.

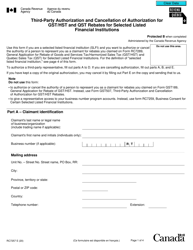

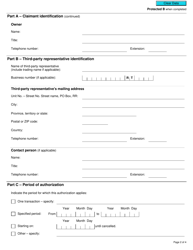

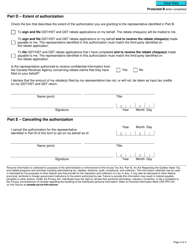

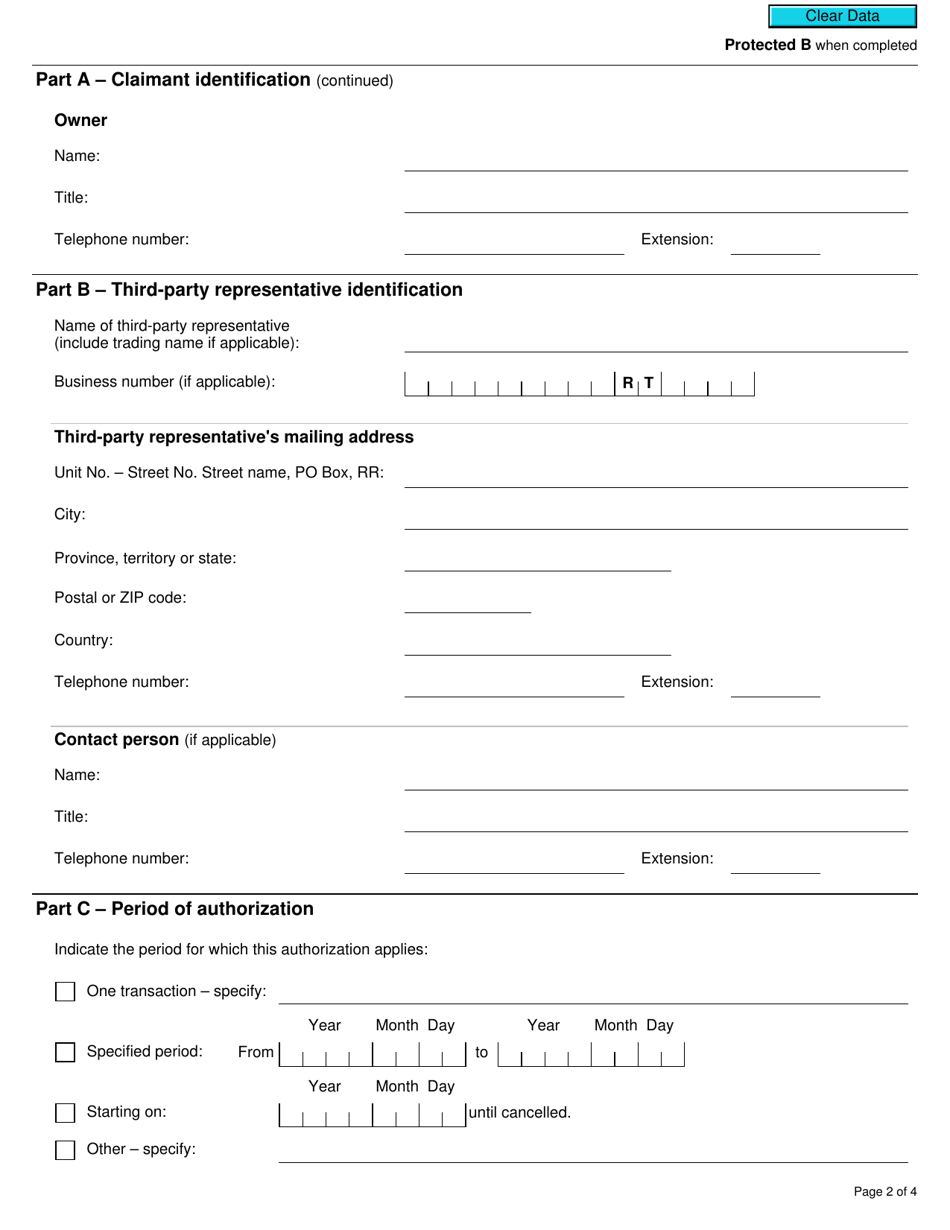

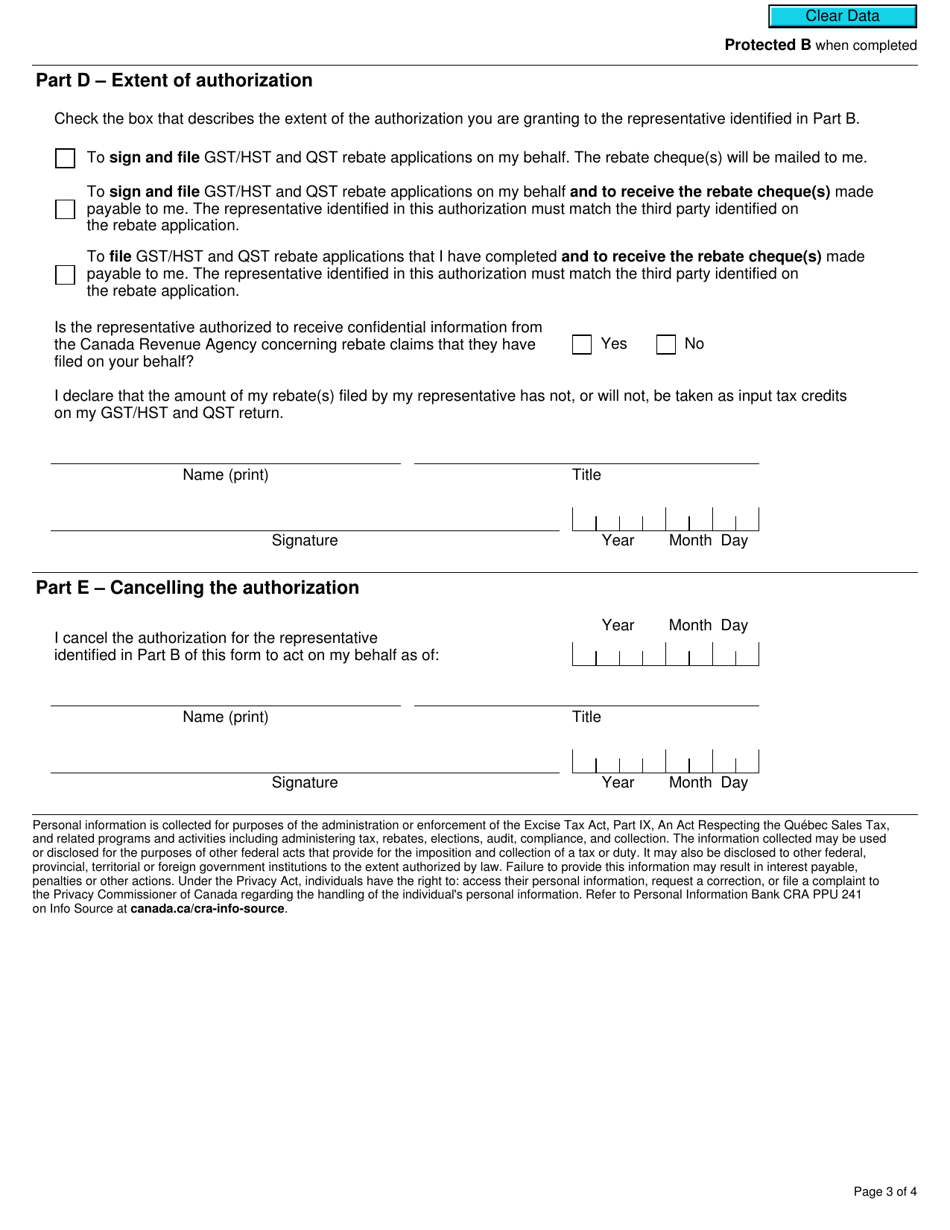

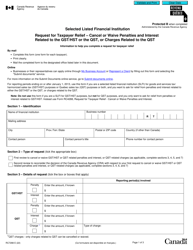

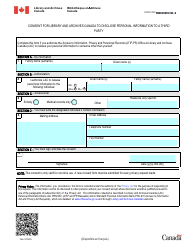

Q: How do I fill out Form RC7257?

A: The form requires you to provide your personal or business information, details of the selected listed financial institution, and specify whether you are authorizing or canceling authorization for GST/HST and QST rebates.