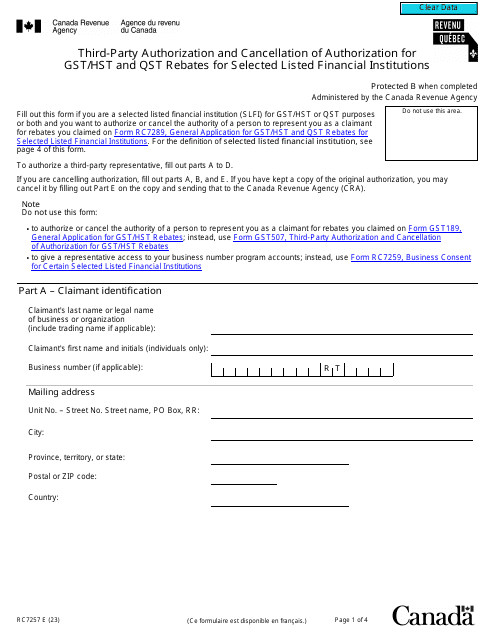

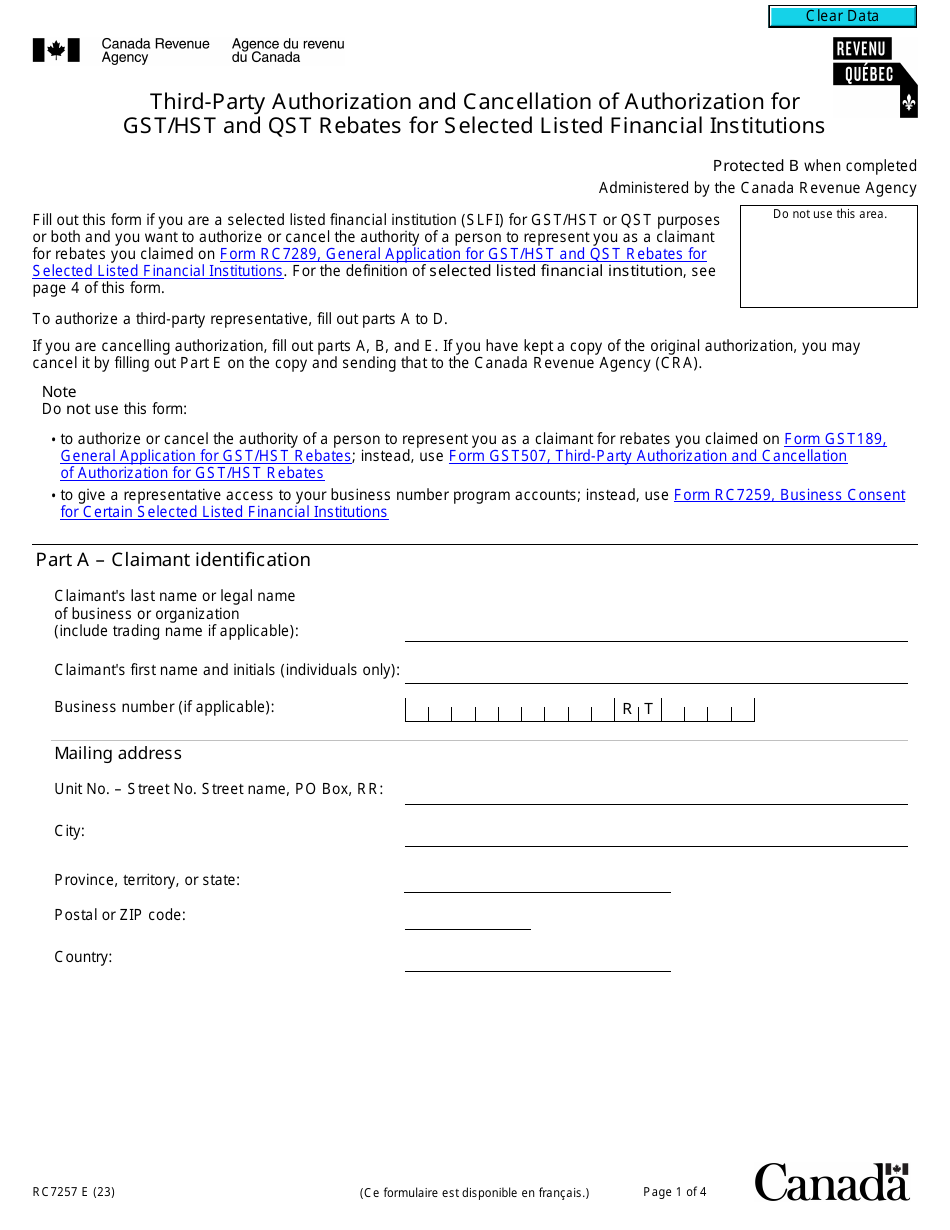

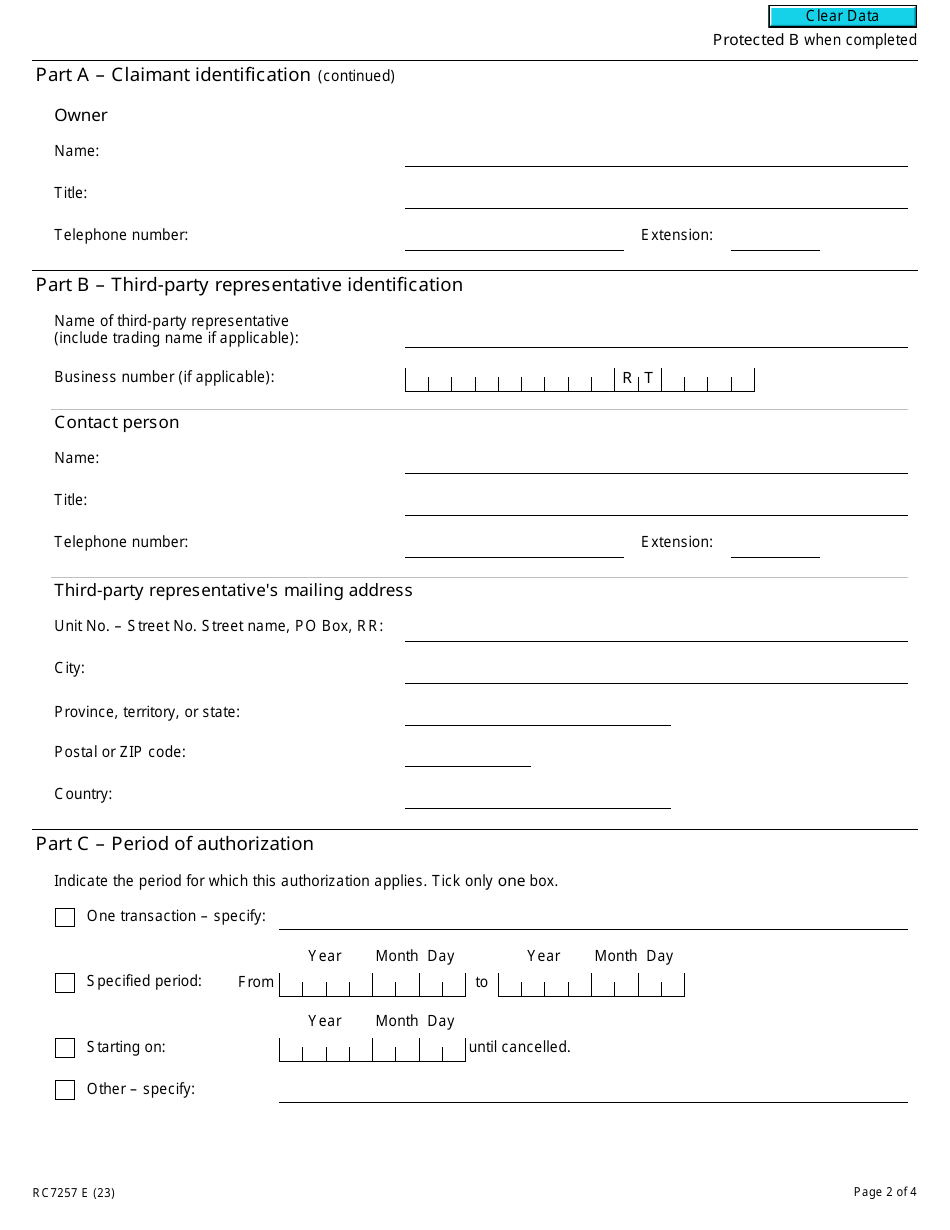

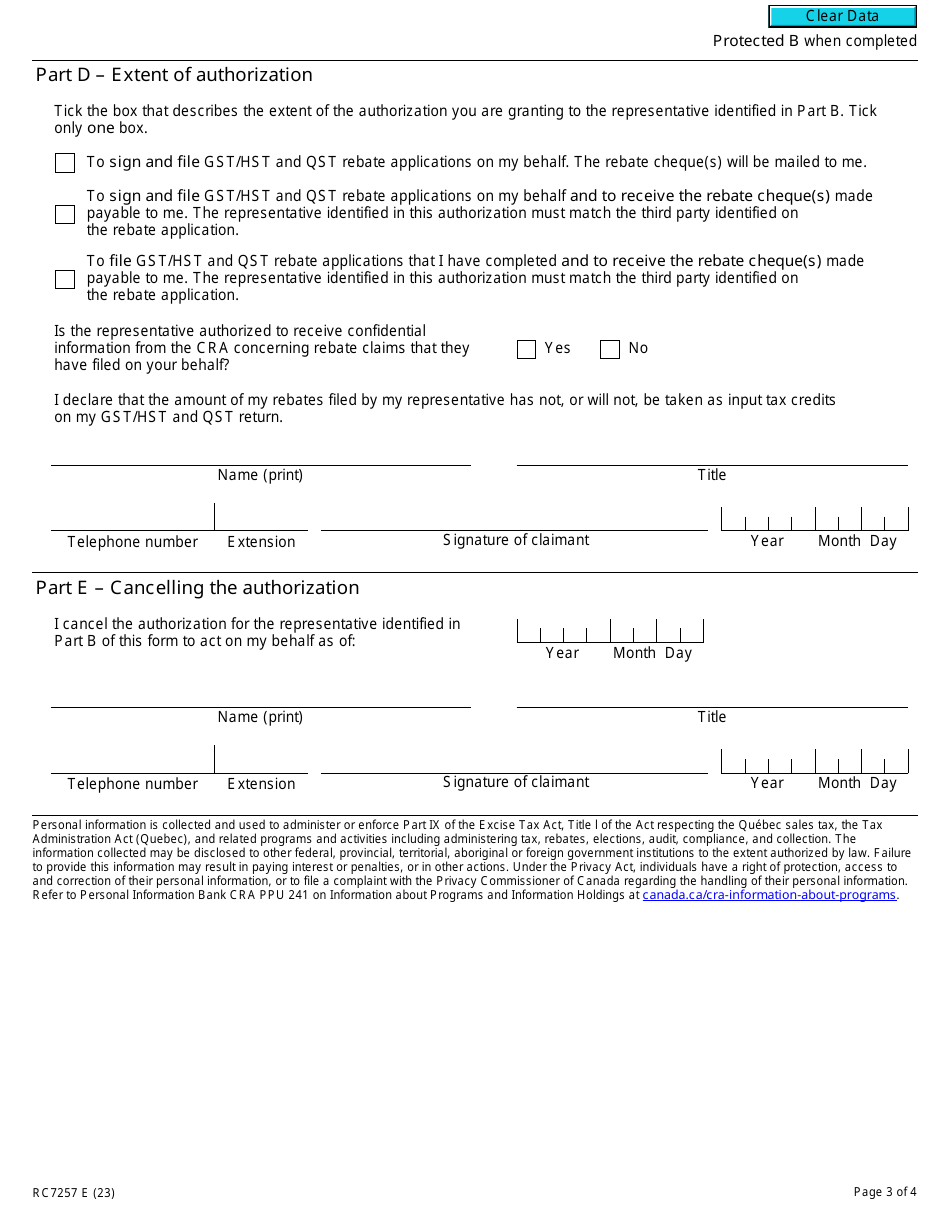

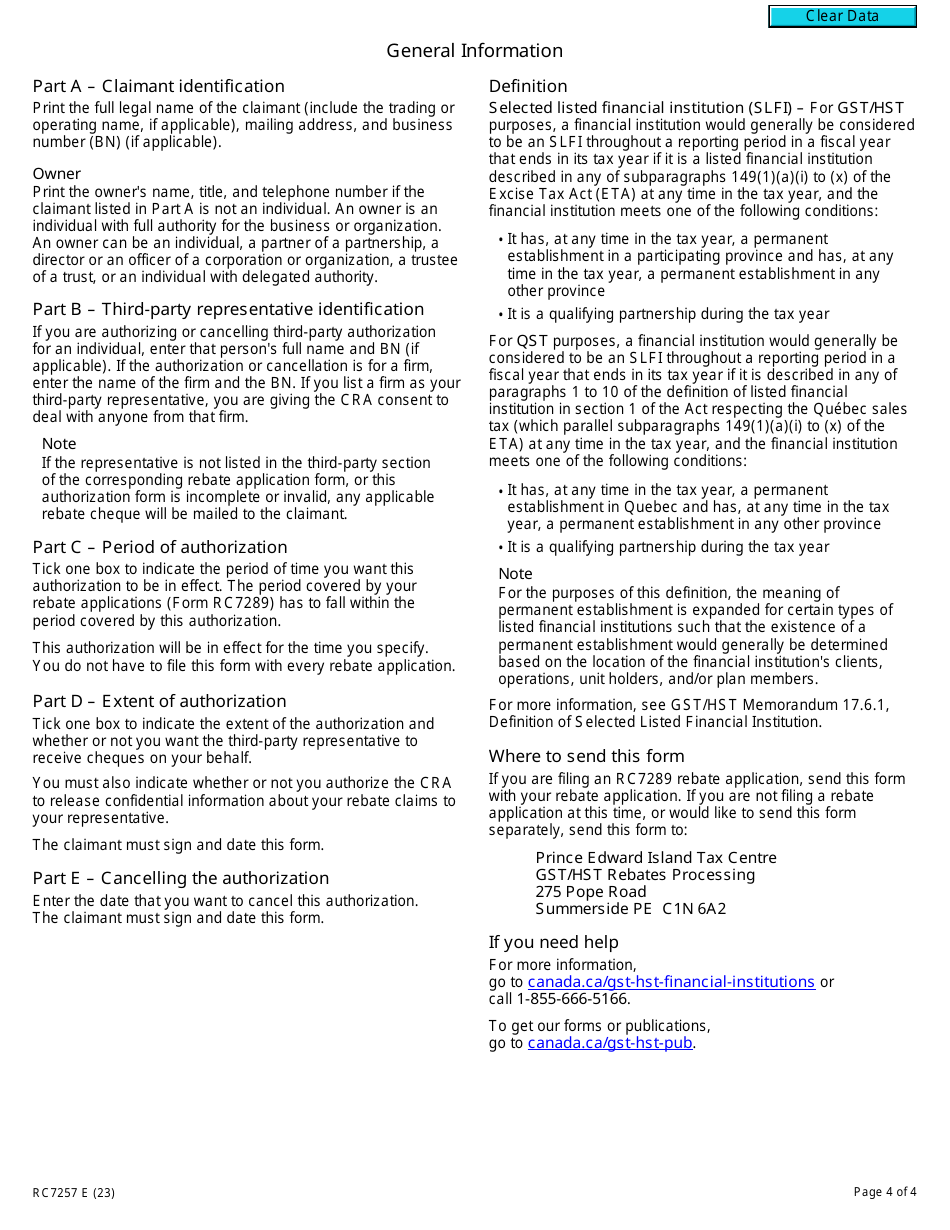

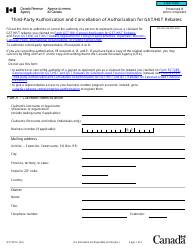

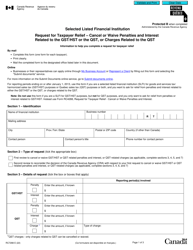

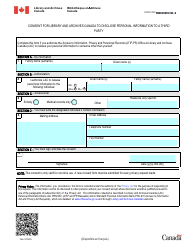

Form RC7257 Third-Party Authorization and Cancellation of Authorization for Gst / Hst and Qst Rebates for Selected Listed Financial Institutions - Canada

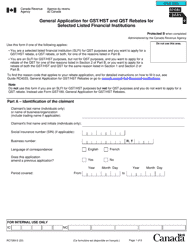

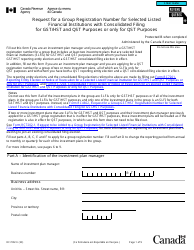

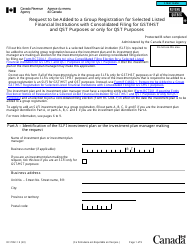

Form RC7257 Third Party Authorization and Cancellation of Authorization for GST/HST and QST Rebates for Selected Listed Financial Institutions - Canada is used to authorize or cancel authorization for a third party to claim GST/HST and QST rebates on behalf of a selected listed financial institution in Canada.

The selected listed financial institutions themselves or their authorized representatives can file the Form RC7257 Third Party Authorization and Cancellation of Authorization for GST/HST and QST rebates in Canada.

Form RC7257 Third Party Authorization and Cancellation of Authorization for Gst/Hst and Qst Rebates for Selected Listed Financial Institutions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC7257?

A: Form RC7257 is used for authorizing or canceling authorization for GST/HST and QST rebates for selected listed financial institutions in Canada.

Q: Who can use Form RC7257?

A: Individuals or businesses that have selected listed financial institutions as their authorized representative for GST/HST and QST rebates can use this form.

Q: What is the purpose of Form RC7257?

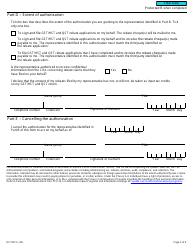

A: The purpose of this form is to authorize or cancel authorization for selected listed financial institutions to claim GST/HST and QST rebates on behalf of the individual or business.

Q: How do I fill out Form RC7257?

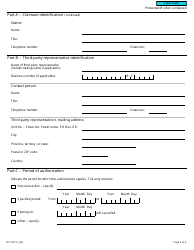

A: The form requires you to provide your personal or business information, details of the selected listed financial institution, and specify whether you are authorizing or canceling authorization for GST/HST and QST rebates.