This version of the form is not currently in use and is provided for reference only. Download this version of

Form TL2

for the current year.

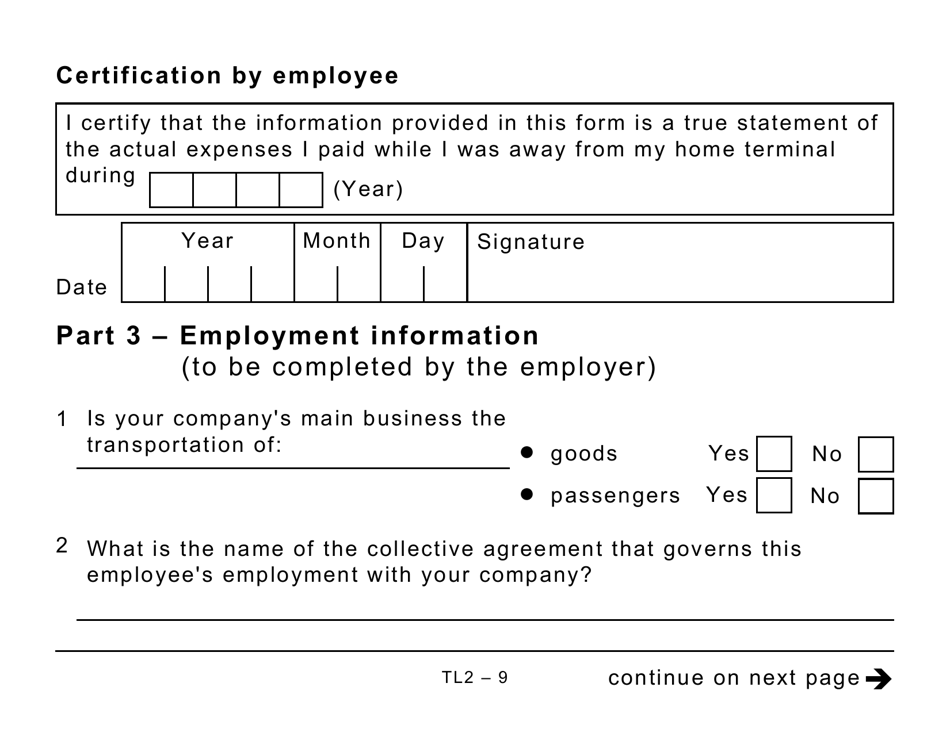

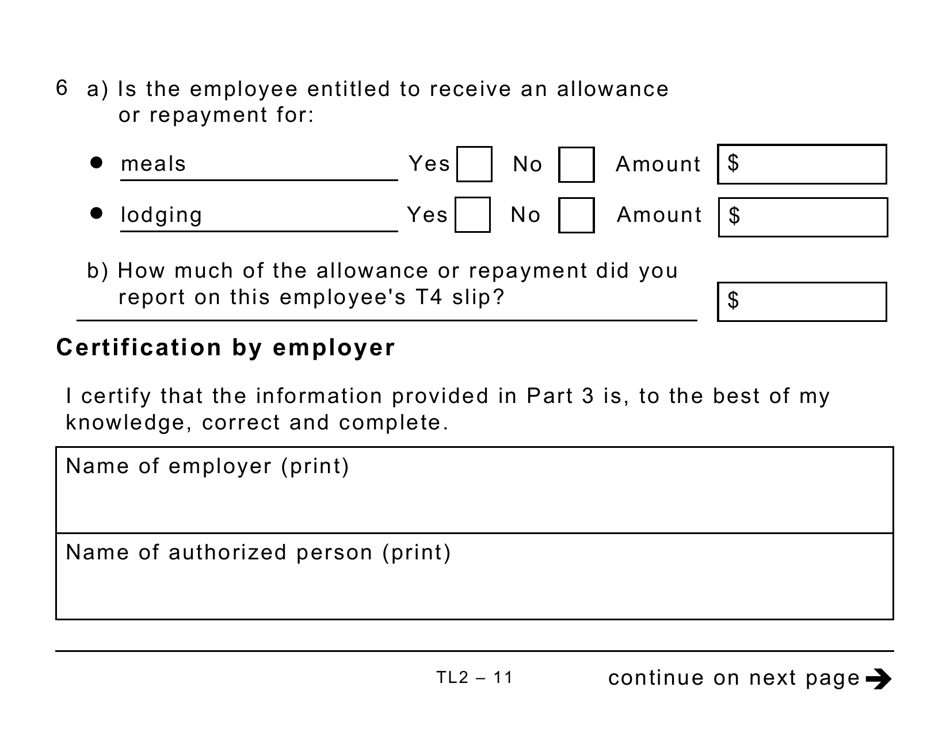

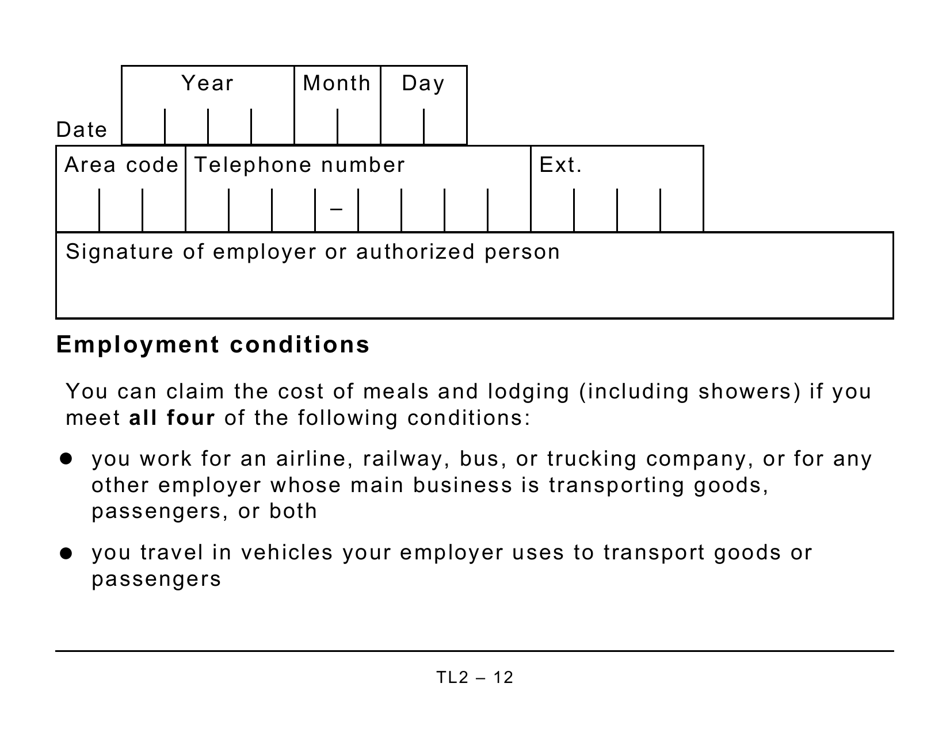

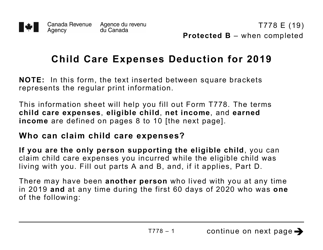

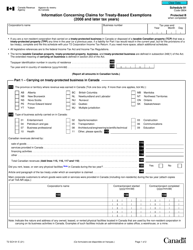

Form TL2 Claim for Meals and Lodging Expenses - Large Print - Canada

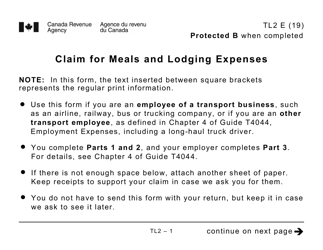

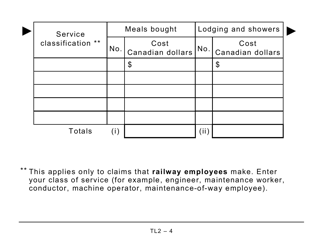

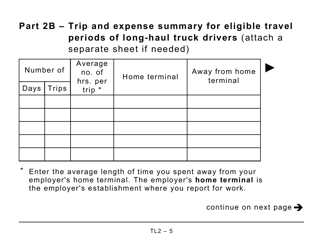

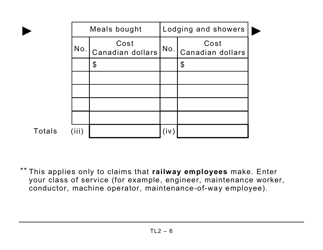

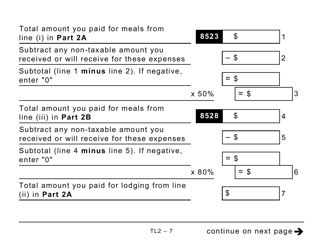

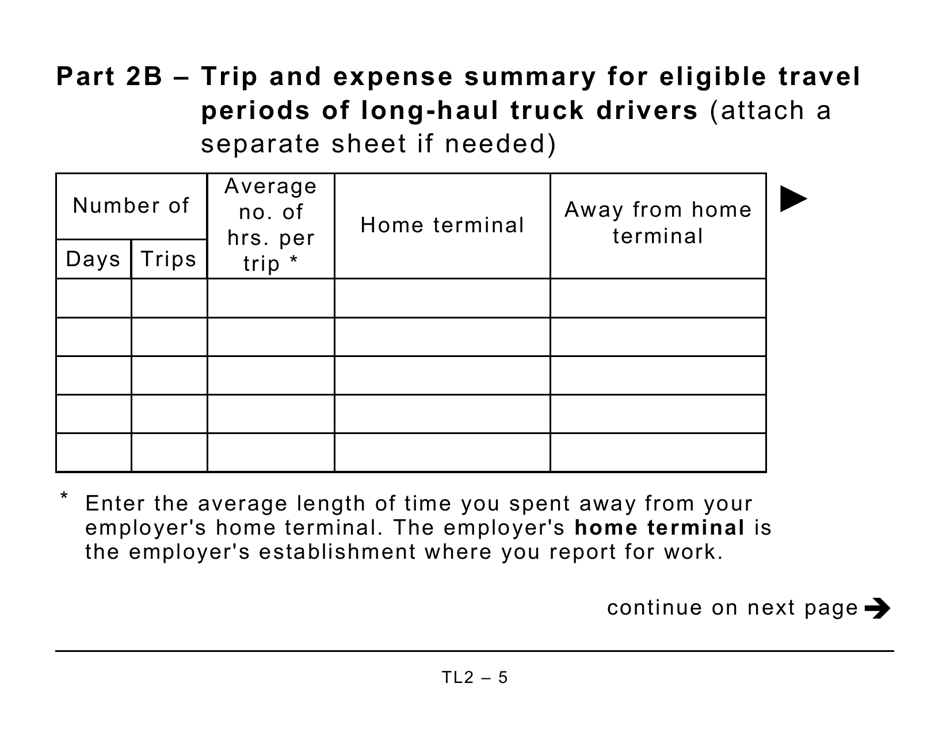

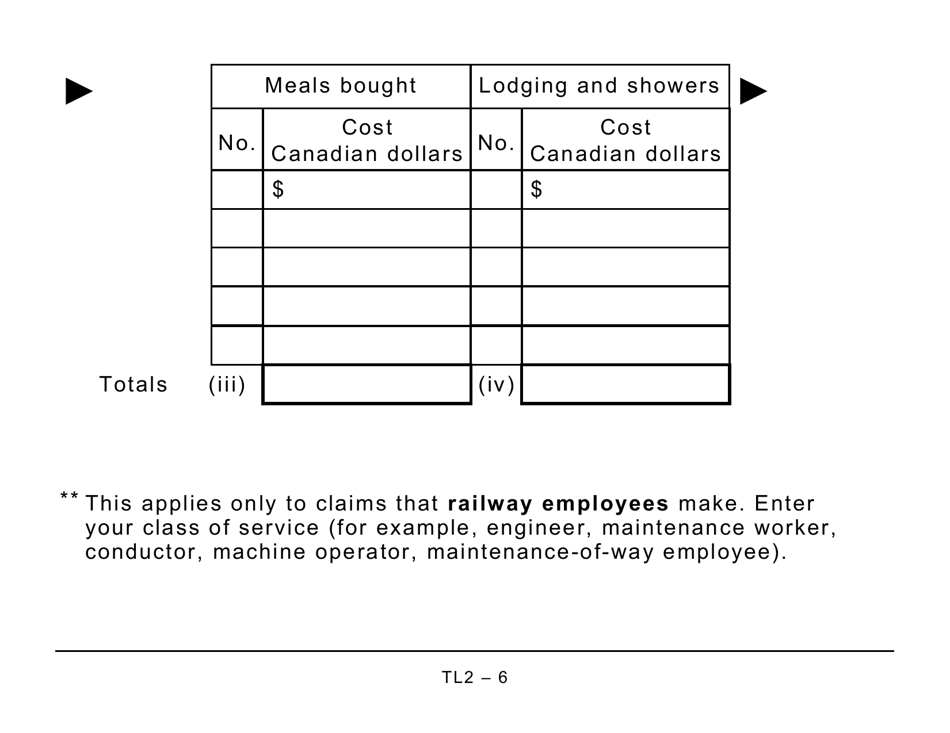

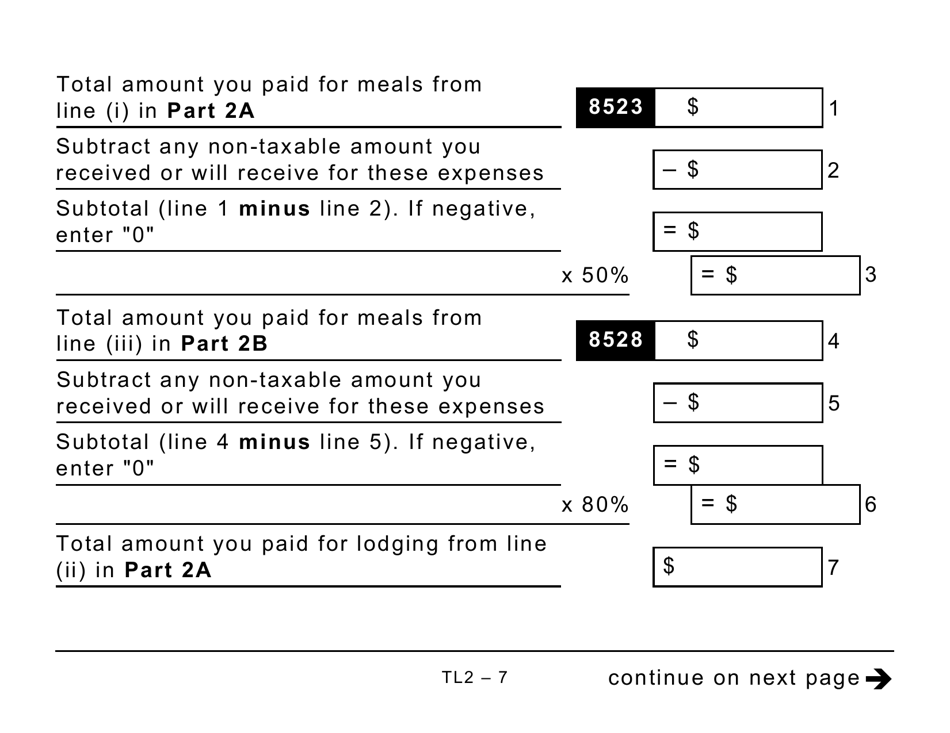

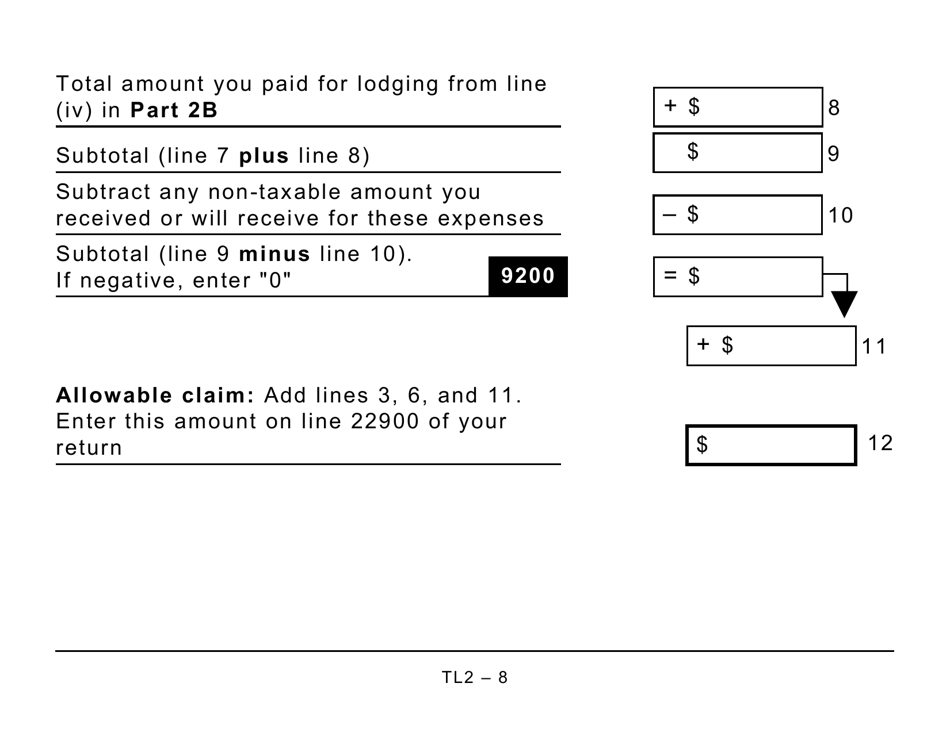

Form TL2 Claim for Meals and Lodging Expenses - Large Print is used in Canada to claim tax deductions for eligible expenses related to meals and lodging when an individual is away from their usual work location for employment purposes.

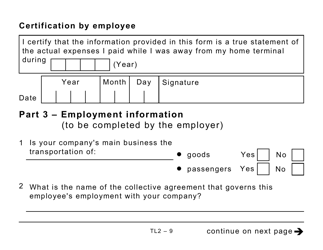

In Canada, the Form TL2 for claiming meals and lodging expenses is typically filed by employees who are eligible for tax deductions related to their employment. It is recommended to consult with the Canada Revenue Agency or a tax professional for more specific information regarding the eligibility and filing process for the Form TL2.

FAQ

Q: What is a TL2 claim?

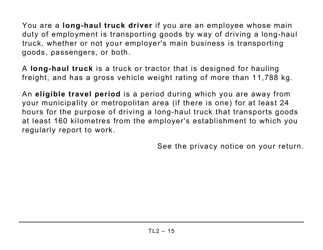

A: A TL2 claim is a form used to claim meals and lodging expenses incurred while traveling for work.

Q: Who can use the TL2 claim form?

A: The TL2 claim form is for Canadian residents who are employees, and who have incurred meals and lodging expenses while traveling for work.

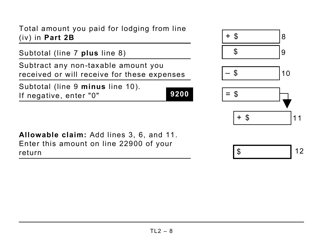

Q: What types of expenses can be claimed using the TL2 form?

A: The TL2 form is used to claim eligible meals and lodging expenses.

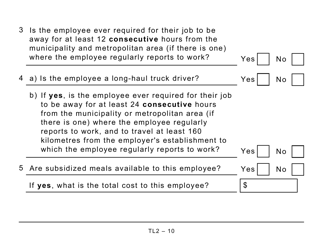

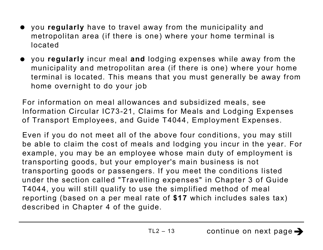

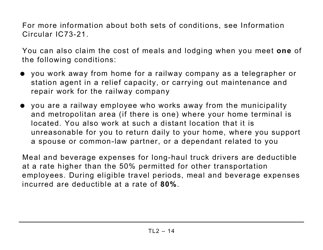

Q: Are there any requirements for claiming meals and lodging expenses?

A: Yes, to claim meals and lodging expenses, you must have stayed overnight at a location that is at least 40 kilometers away from your regular place of work or residence.

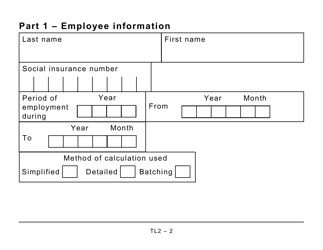

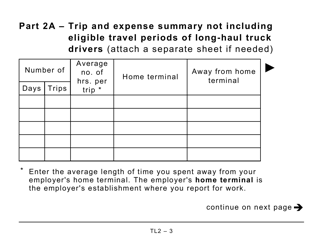

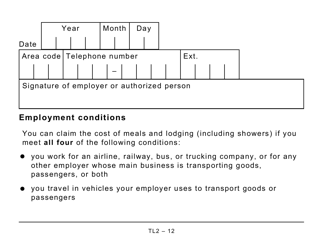

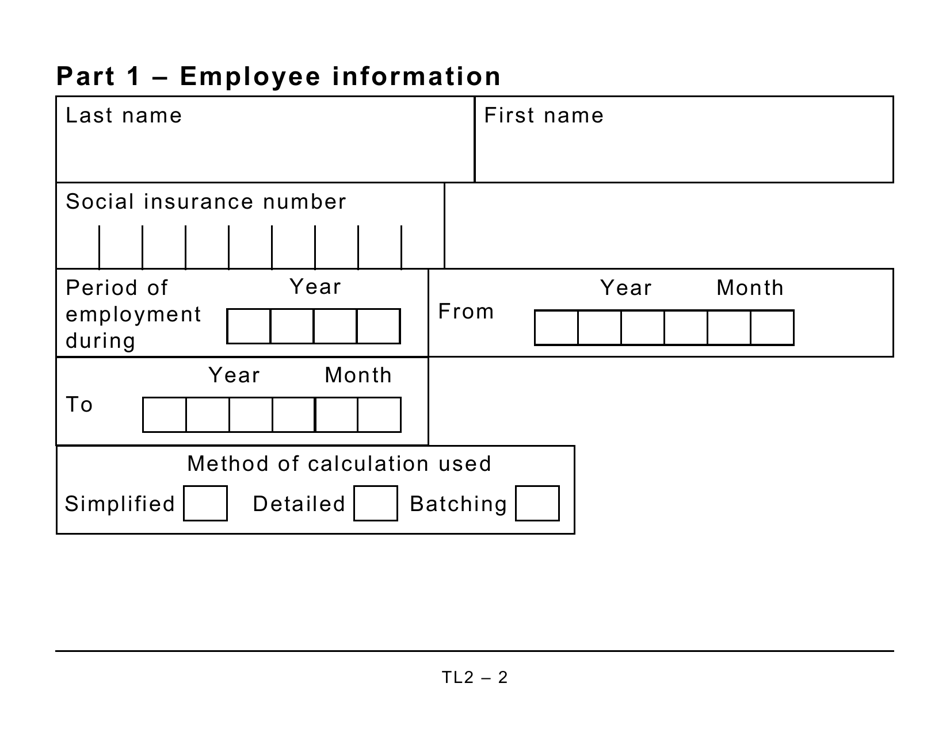

Q: What information do I need to include on the TL2 claim form?

A: You will need to provide details such as the date, location, and purpose of your travel, as well as the amount you spent on meals and lodging.

Q: Is there a deadline for submitting the TL2 claim form?

A: Yes, you must submit your TL2 claim form within six months of the end of the tax year in which the expenses were incurred.

Q: Can I claim expenses for meals and lodging when traveling outside of Canada?

A: No, the TL2 claim form is specifically for expenses incurred within Canada.

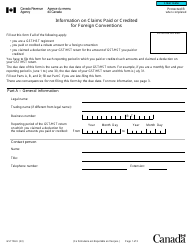

Q: Are there any limits or restrictions on the amount I can claim for meals and lodging expenses?

A: Yes, there are limits on the amounts that can be claimed for each meal and for lodging. These limits are set by the CRA and can vary depending on the location and duration of your travel.

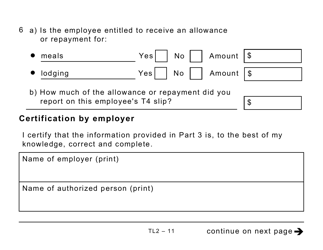

Q: Can I claim expenses for meals and lodging if they were paid for by my employer?

A: No, if your meals and lodging expenses were paid for by your employer or reimbursed to you, you cannot claim them on the TL2 form.