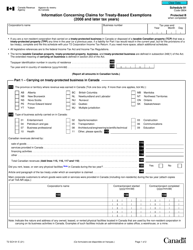

Form TL2 Claim for Meals and Lodging Expenses - Large Print - Canada

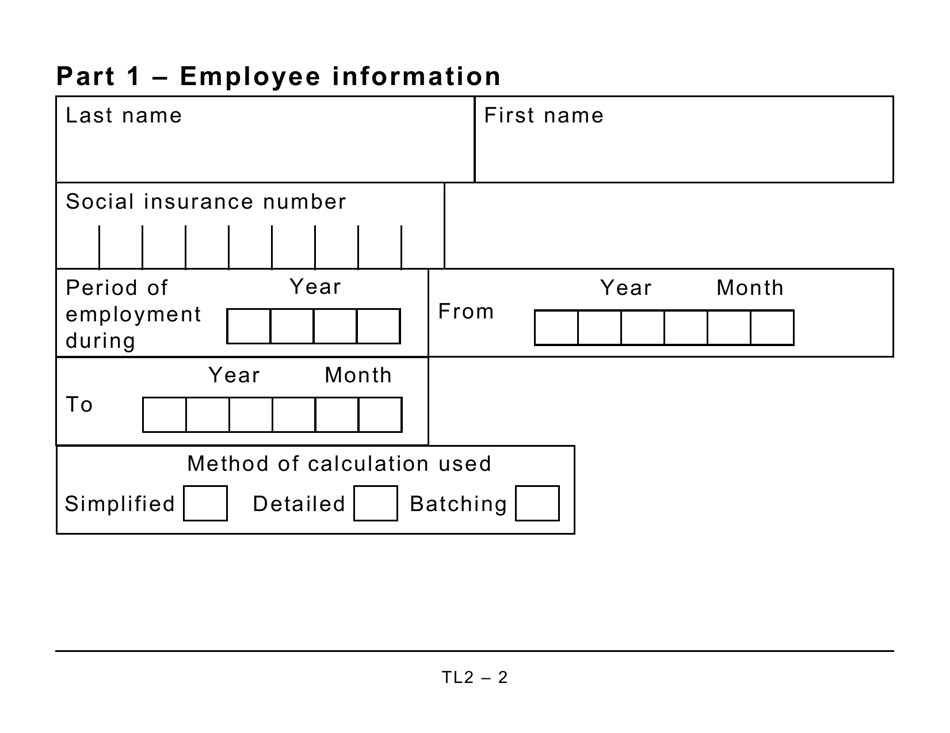

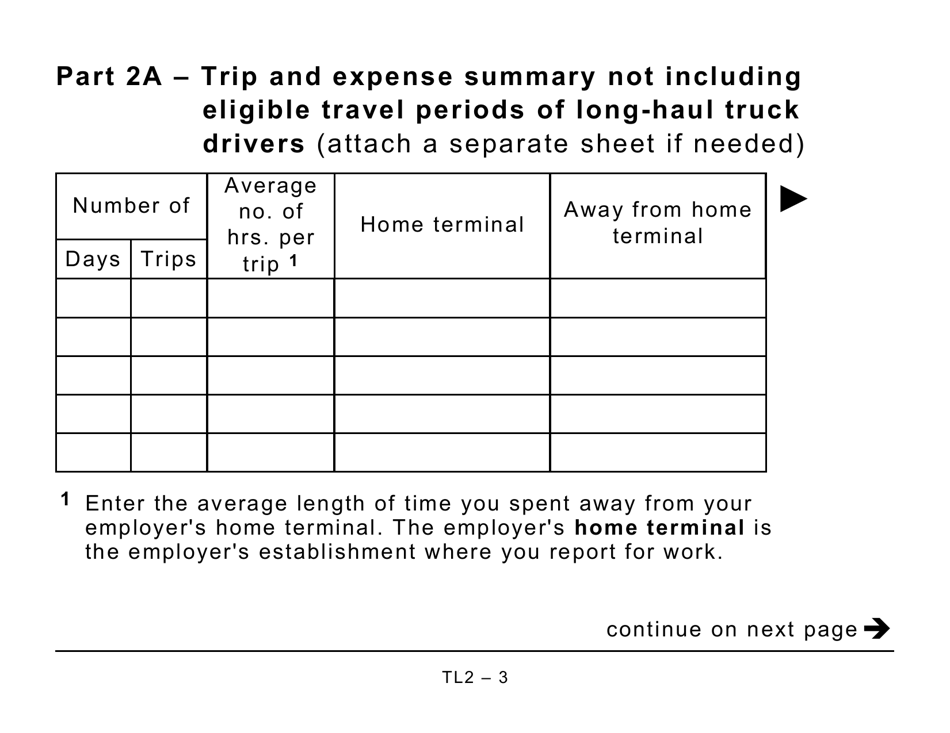

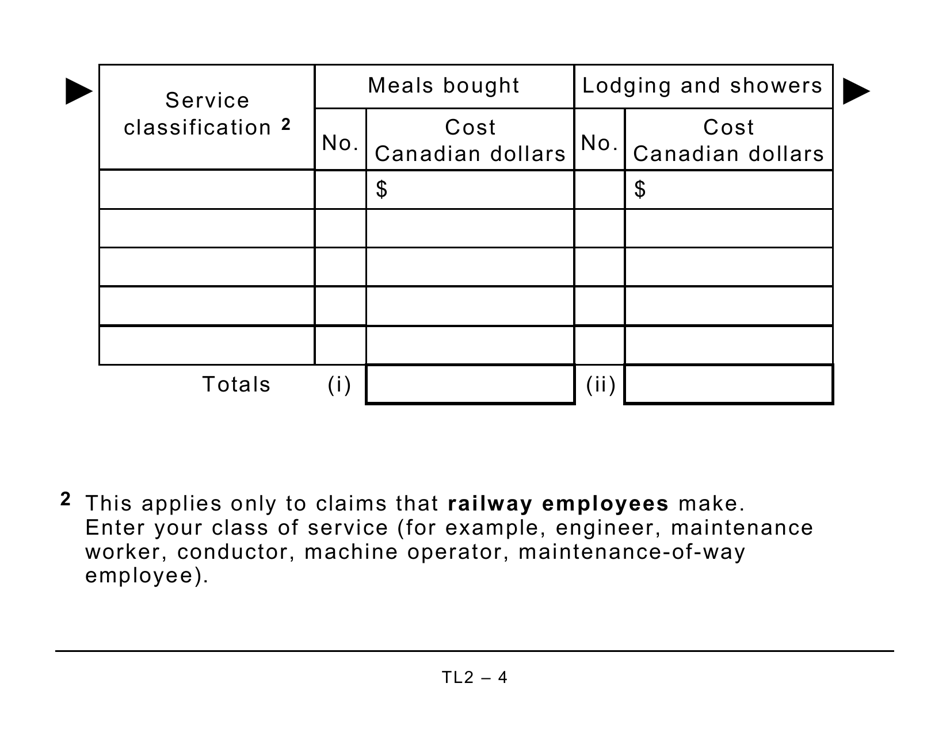

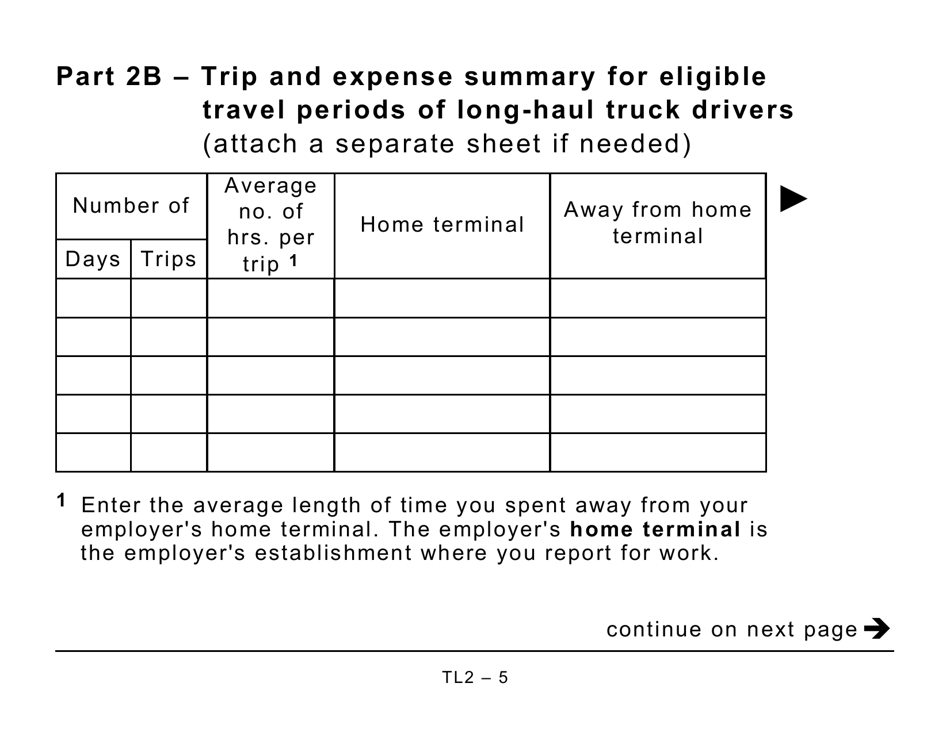

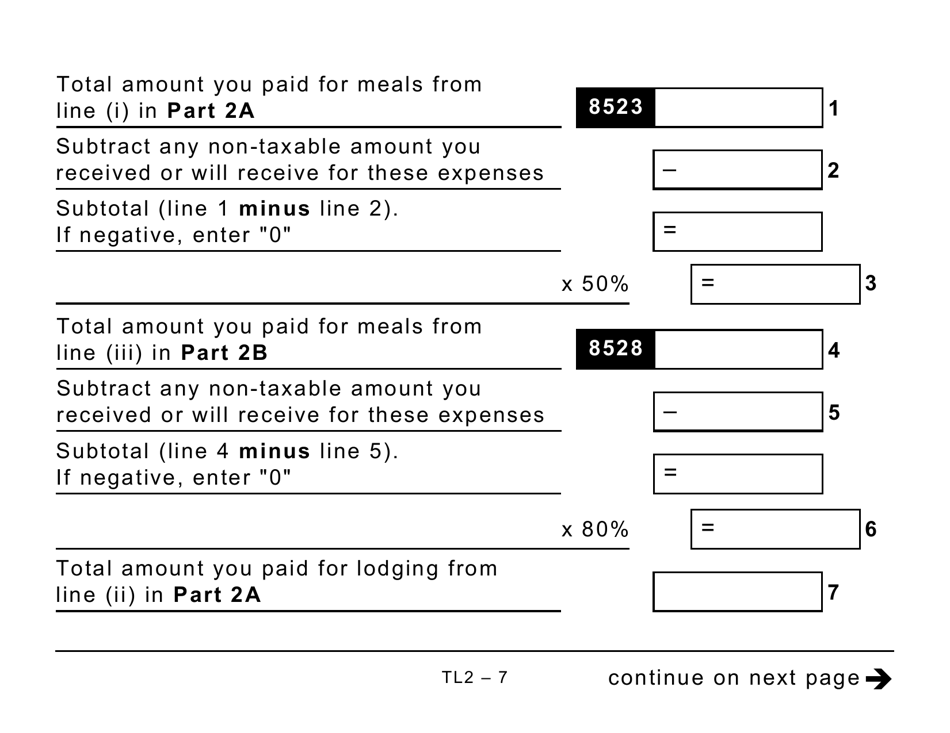

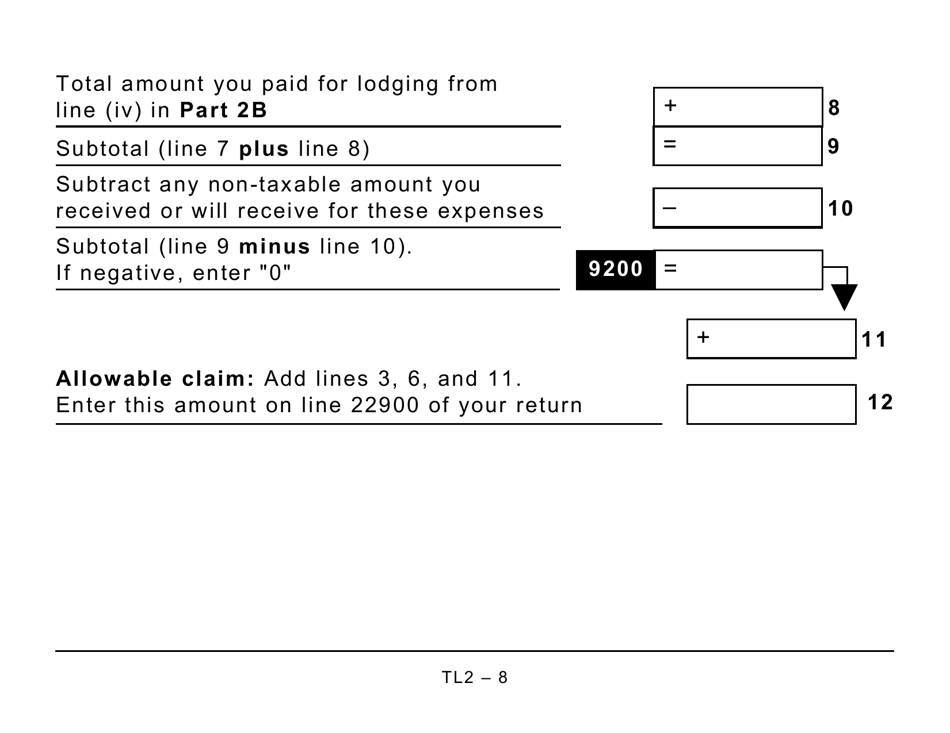

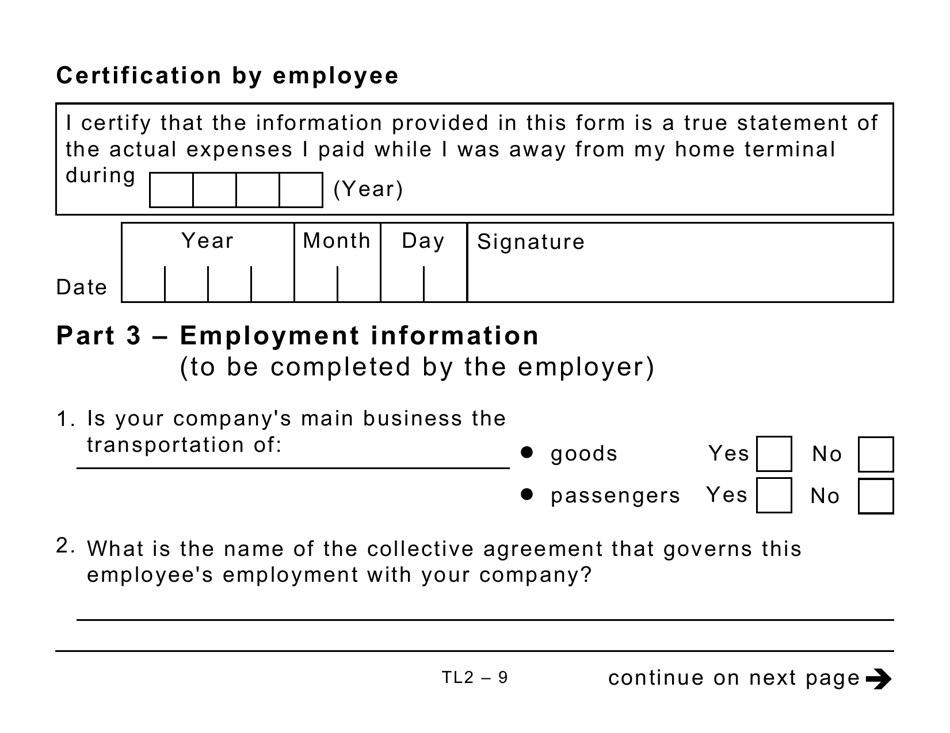

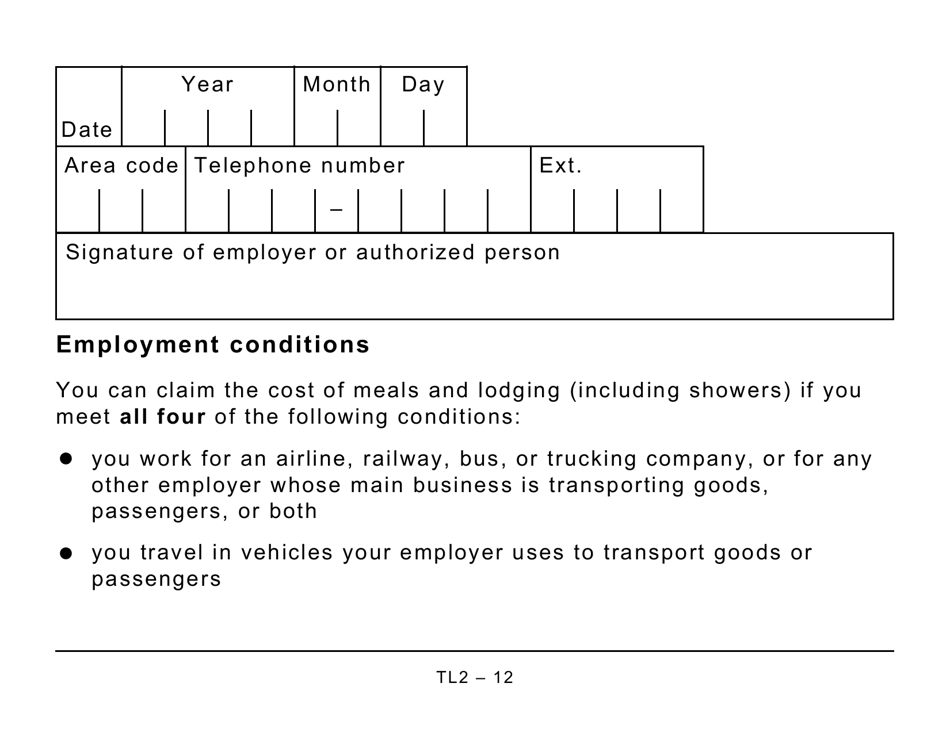

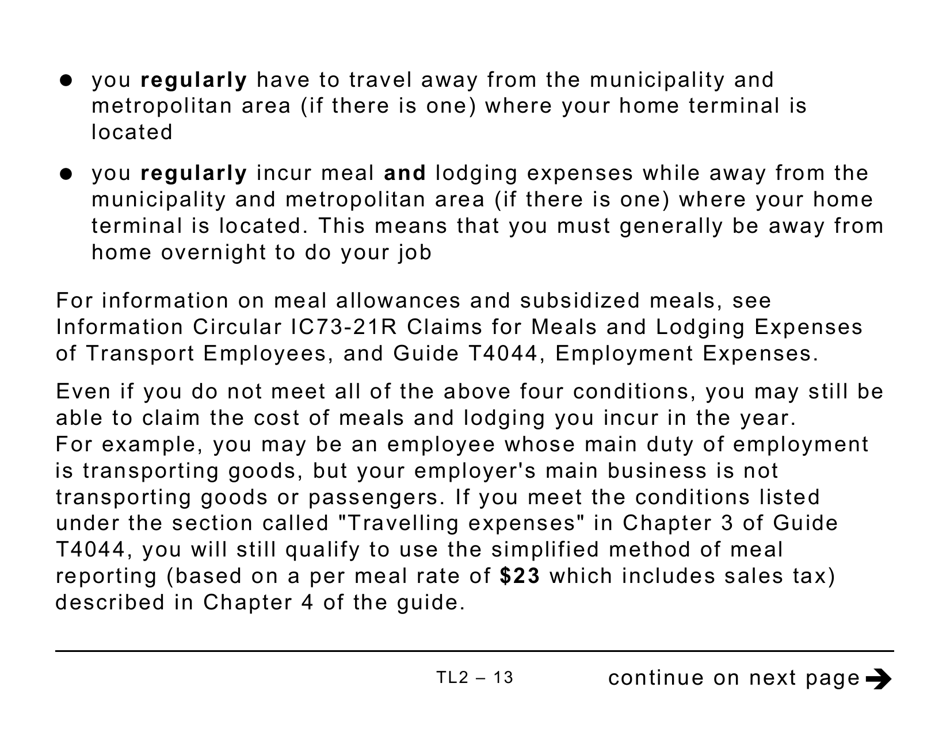

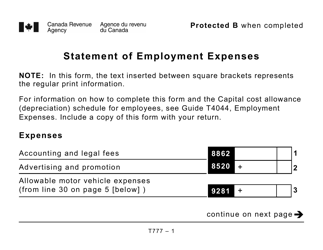

Form TL2 Claim for Meals and Lodging Expenses - Large Print is used in Canada to claim reimbursement for expenses related to meals and lodging incurred while traveling for work or business purposes.

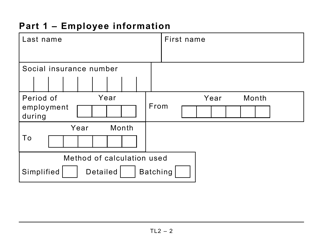

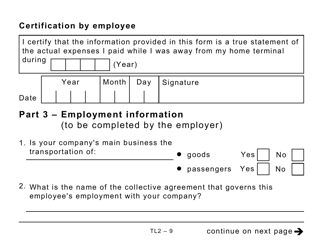

The individual who incurred the meals and lodging expenses would typically file the Form TL2 claim in Canada.

FAQ

Q: What is the TL2 claim form?A: The TL2 claim form is used to claim meals and lodging expenses in Canada.

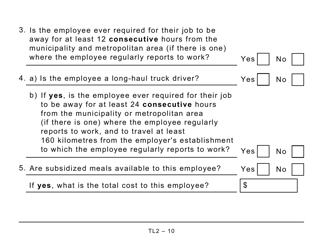

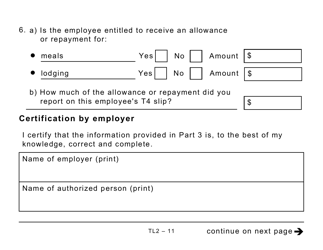

Q: Who can use the TL2 claim form?A: Any taxpayer who has incurred meals and lodging expenses in Canada can use the TL2 claim form.

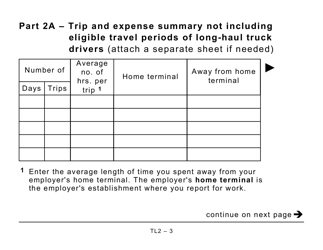

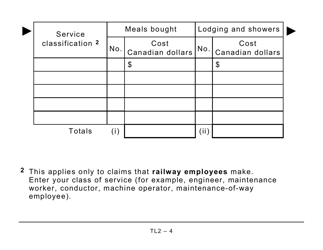

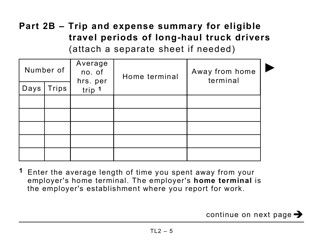

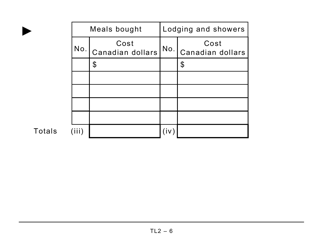

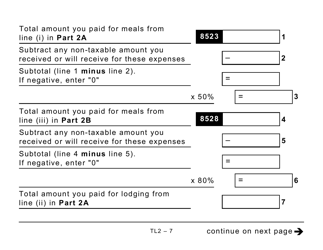

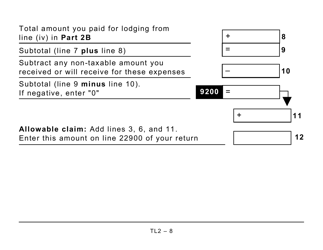

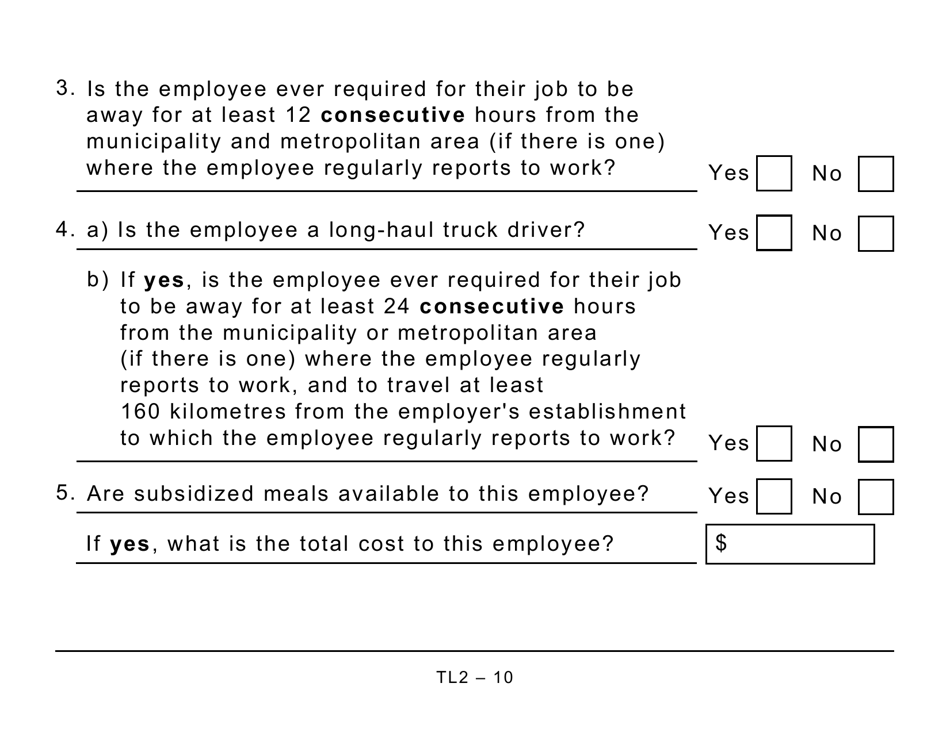

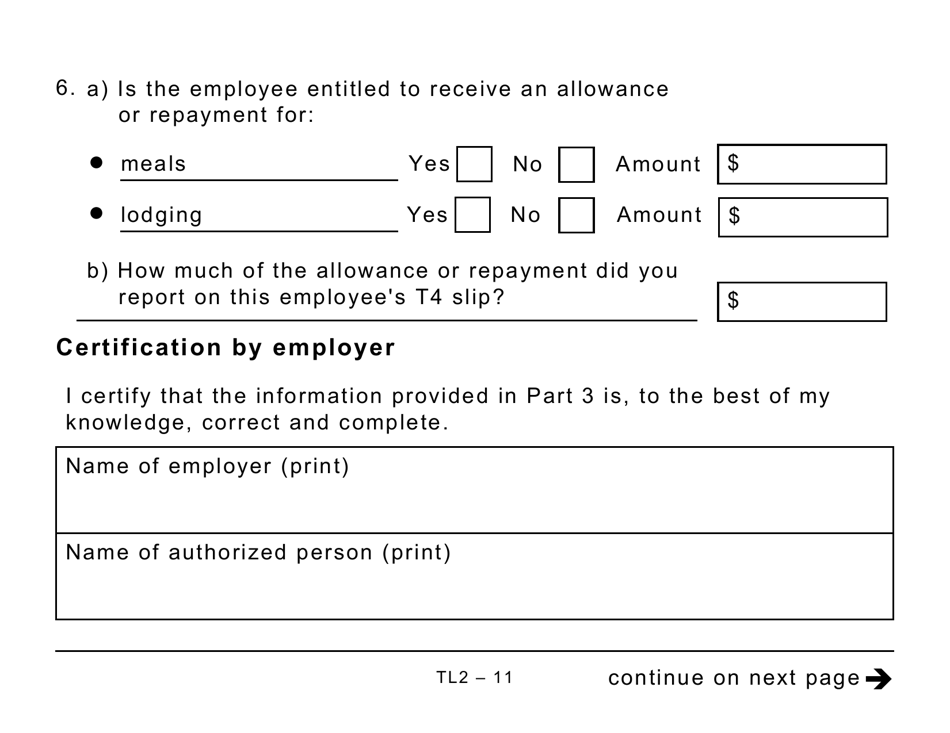

Q: What expenses can be claimed using the TL2 form?A: The TL2 form is specifically for claiming meals and lodging expenses.

Q: Is the TL2 claim form available in large print?A: Yes, the TL2 claim form is available in large print to accommodate individuals with visual impairments.

Q: Do I need to provide receipts with the TL2 claim form?A: Yes, you need to provide receipts for all expenses claimed using the TL2 form.

Q: When should I submit the TL2 claim form?A: You should submit the TL2 claim form along with your income tax return for the corresponding tax year.

Q: Can I claim expenses for meals and lodging outside of Canada using the TL2 form?A: No, the TL2 form is specifically designed for claiming expenses incurred within Canada.

Q: Are there any limitations or restrictions on the expenses that can be claimed using the TL2 form?A: Yes, there are certain limitations and restrictions on the expenses that can be claimed using the TL2 form. You should refer to the instructions provided with the form for details.

Q: What happens after I submit the TL2 claim form?A: After you submit the TL2 claim form, the Canada Revenue Agency will review your claim and either approve or deny it based on the eligibility criteria and supporting documentation provided.