This version of the form is not currently in use and is provided for reference only. Download this version of

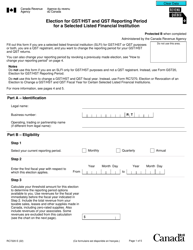

Form GST20-1

for the current year.

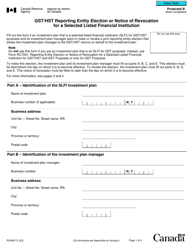

Form GST20-1 Notice of Revocation of an Election for Gst / Hst Reporting Period by a Listed Financial Institution - Canada

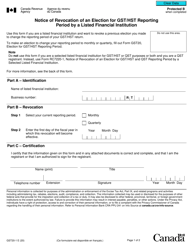

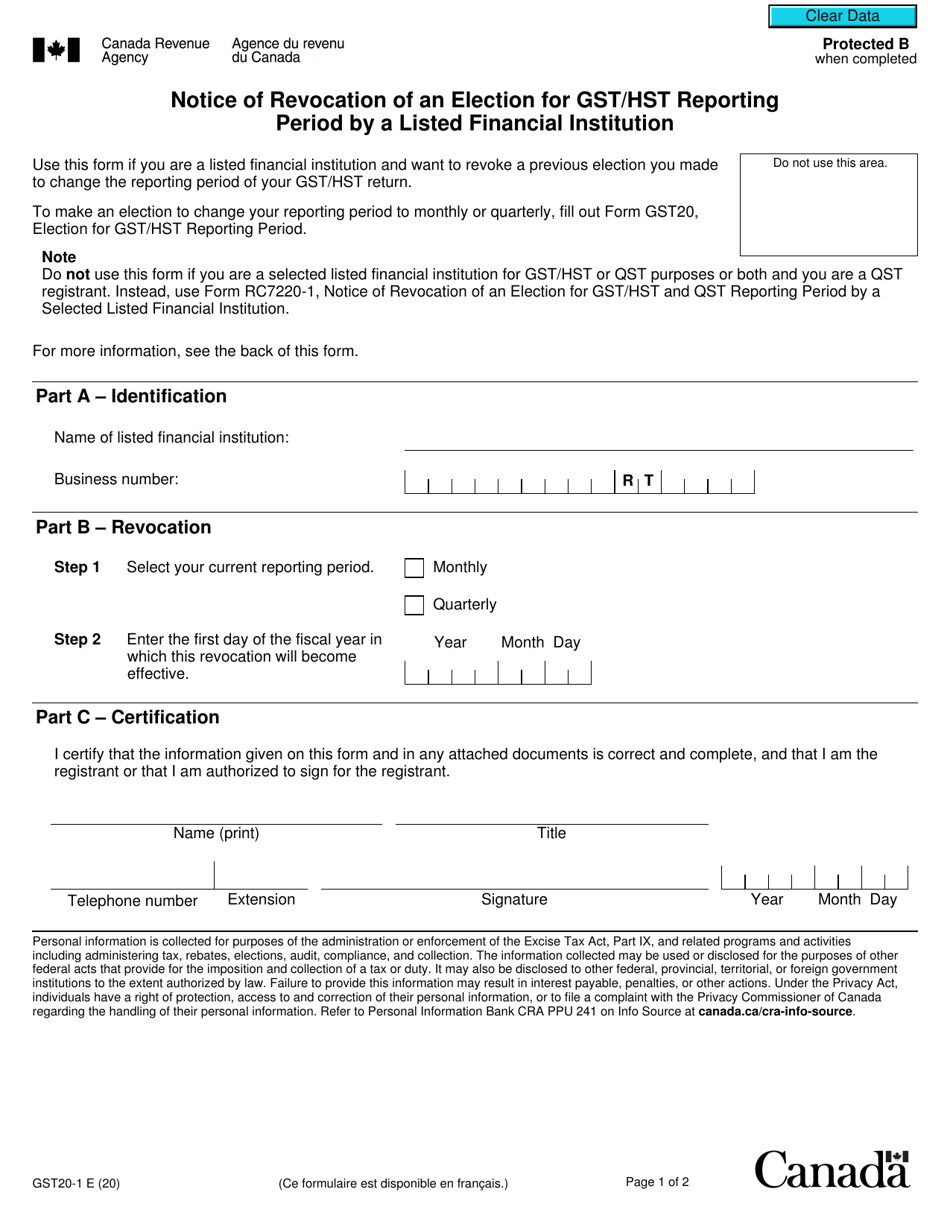

Form GST20-1 Notice of Revocation of an Election for GST/HST Reporting Period by a Listed Financial Institution in Canada is used to notify the Canada Revenue Agency (CRA) about the revocation of an election made by a listed financial institution for filing GST/HST returns. It is used when the financial institution no longer meets the requirements to file under the specified election and needs to revoke it.

The Form GST20-1, Notice of Revocation of an Election for GST/HST Reporting Period by a Listed Financial Institution, is filed by the listed financial institution itself.

FAQ

Q: What is Form GST20-1?

A: Form GST20-1 is a Notice of Revocation of an Election for GST/HST Reporting Period by a Listed Financial Institution in Canada.

Q: What is an election for GST/HST reporting period?

A: An election for GST/HST reporting period is a choice made by a listed financial institution in Canada to report their GST/HST obligations for a specified period of time.

Q: What is a listed financial institution?

A: A listed financial institution in Canada is a financial institution that is required to report their GST/HST obligations on a periodic basis.

Q: When is Form GST20-1 used?

A: Form GST20-1 is used when a listed financial institution wants to revoke their election for GST/HST reporting period.

Q: Why would a listed financial institution want to revoke their election?

A: A listed financial institution may want to revoke their election for various reasons, such as changes in their business structure or reporting requirements.