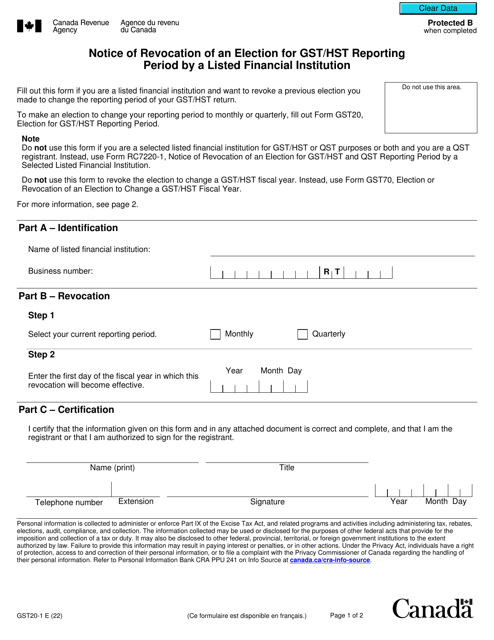

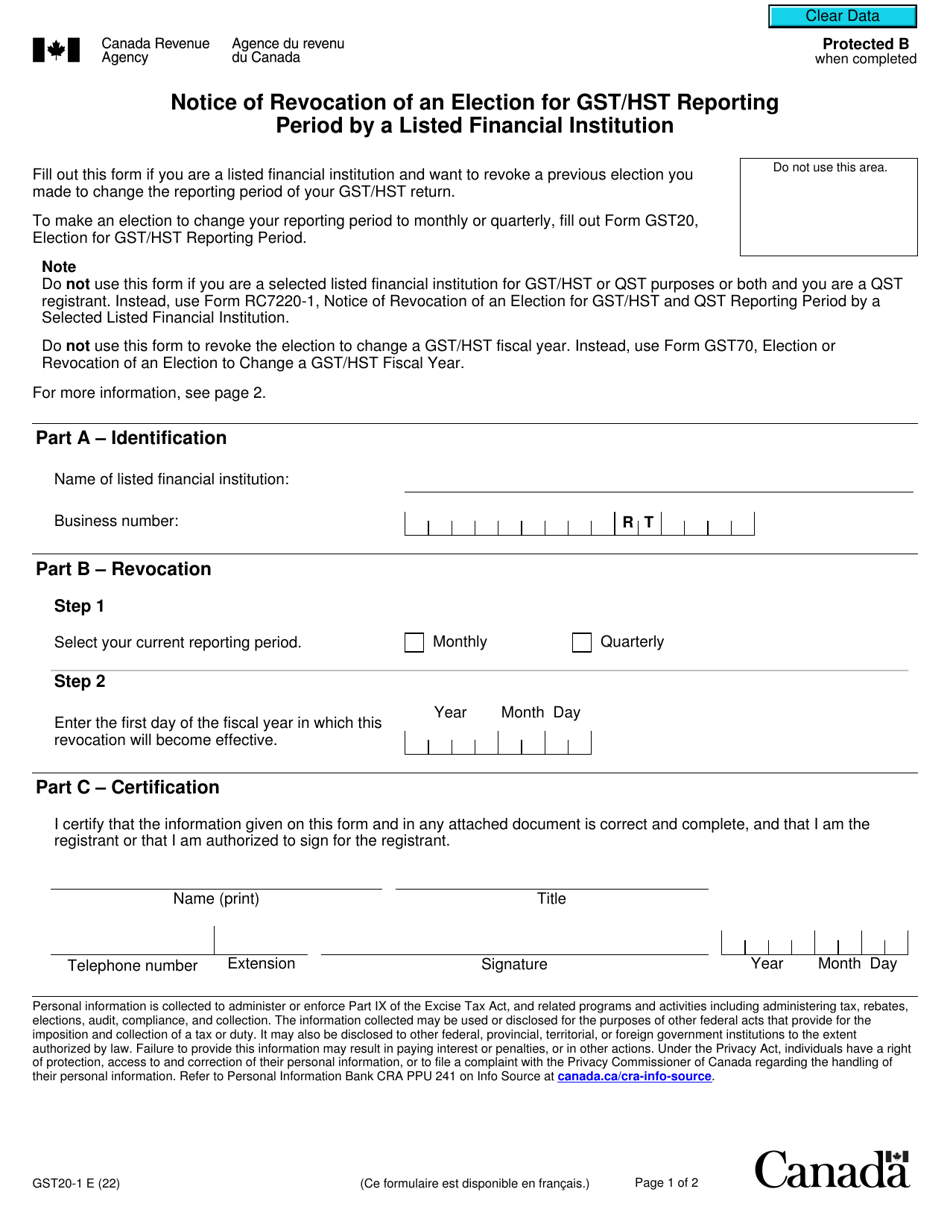

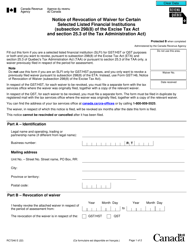

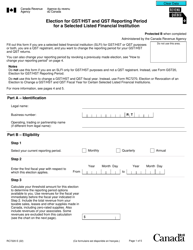

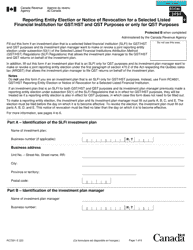

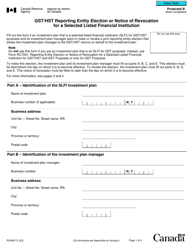

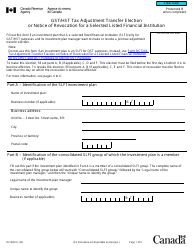

Form GST20-1 Notice of Revocation of an Election for Gst / Hst Reporting Period by a Listed Financial Institution - Canada

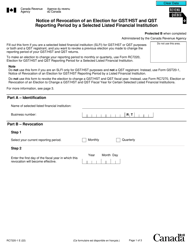

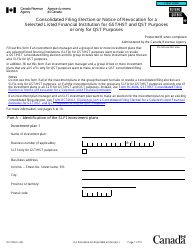

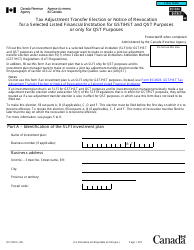

Form GST20-1 Notice of Revocation of an Election for GST/HST Reporting Period by a Listed Financial Institution in Canada is used to notify the Canada Revenue Agency (CRA) when a listed financial institution wants to voluntarily revoke their election to use the special attribution method for reporting GST/HST. This form is used to update the CRA about changes in the reporting method chosen by the financial institution.

The form GST20-1 Notice of Revocation of an Election for GST/HST reporting period by a Listed Financial Institution in Canada is typically filed by the financial institution that wants to revoke its election for GST/HST reporting period.

Form GST20-1 Notice of Revocation of an Election for Gst/Hst Reporting Period by a Listed Financial Institution - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST20-1?

A: Form GST20-1 is a notice of revocation of an election for GST/HST reporting period by a listed financial institution in Canada.

Q: What is the purpose of Form GST20-1?

A: The purpose of Form GST20-1 is to notify the Canada Revenue Agency (CRA) about the revocation of an election for GST/HST reporting period by a listed financial institution.

Q: Who needs to fill out Form GST20-1?

A: Listed financial institutions in Canada that want to revoke their election for GST/HST reporting period need to fill out Form GST20-1.

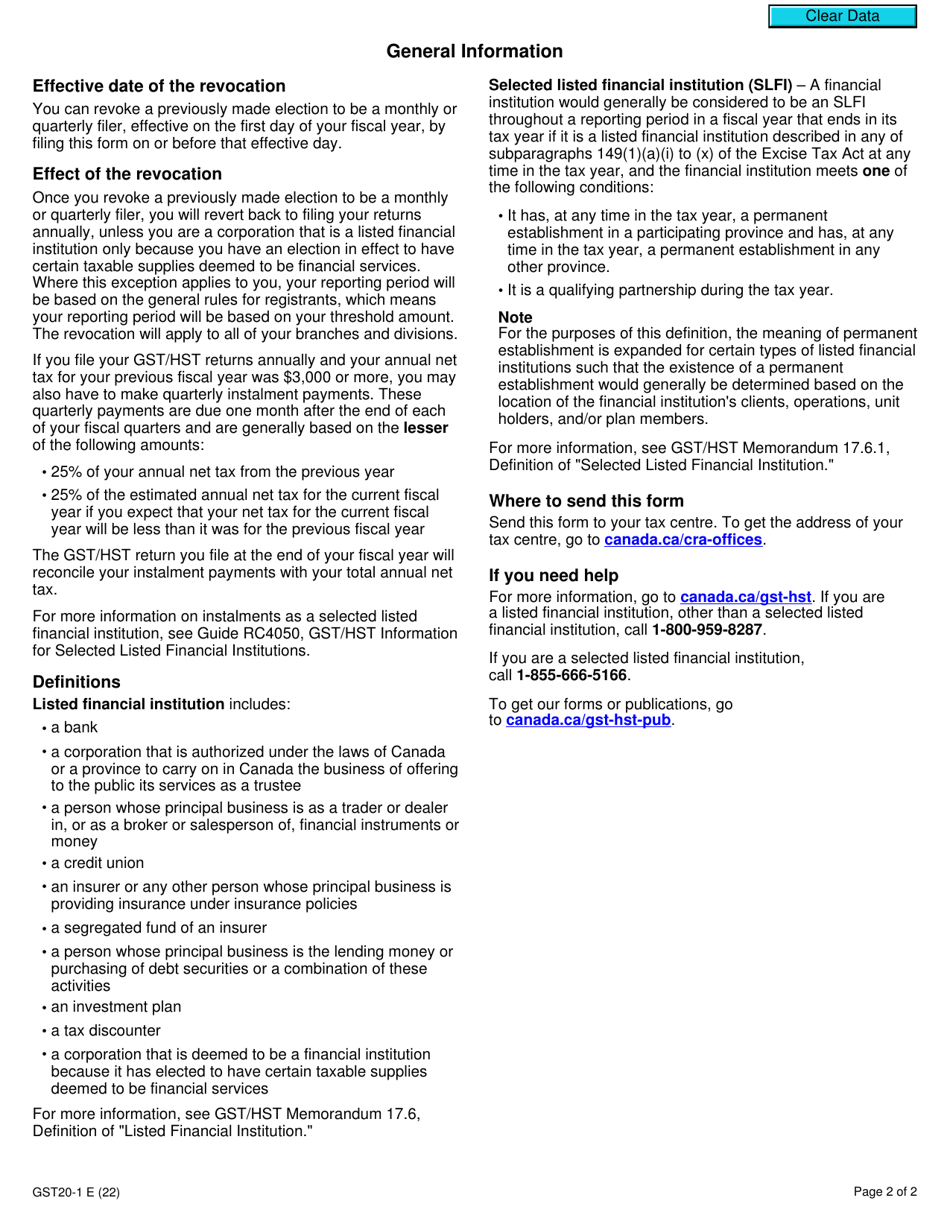

Q: When should Form GST20-1 be filed?

A: Form GST20-1 should be filed as soon as the listed financial institution decides to revoke their election for GST/HST reporting period.

Q: Are there any fees associated with filing Form GST20-1?

A: No, there are no fees associated with filing Form GST20-1.

Q: What happens after filing Form GST20-1?

A: After filing Form GST20-1, the Canada Revenue Agency (CRA) will process the notice of revocation and update the financial institution's GST/HST reporting status accordingly.

Q: Is it possible to re-elect for GST/HST reporting period after revocation?

A: Yes, it is possible to re-elect for GST/HST reporting period after revocation by submitting a new election form to the Canada Revenue Agency (CRA).

Q: What should I do if I have any questions or need assistance with Form GST20-1?

A: If you have any questions or need assistance with Form GST20-1, you can contact the Canada Revenue Agency (CRA) for guidance.