This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST60

for the current year.

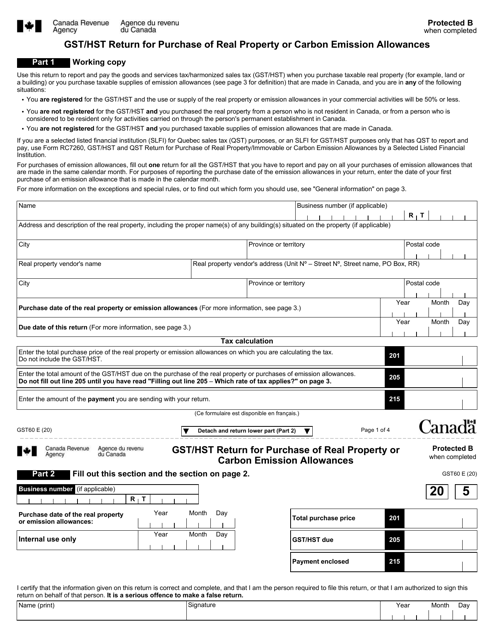

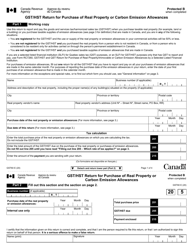

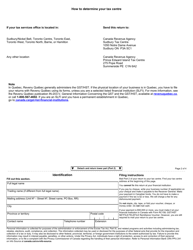

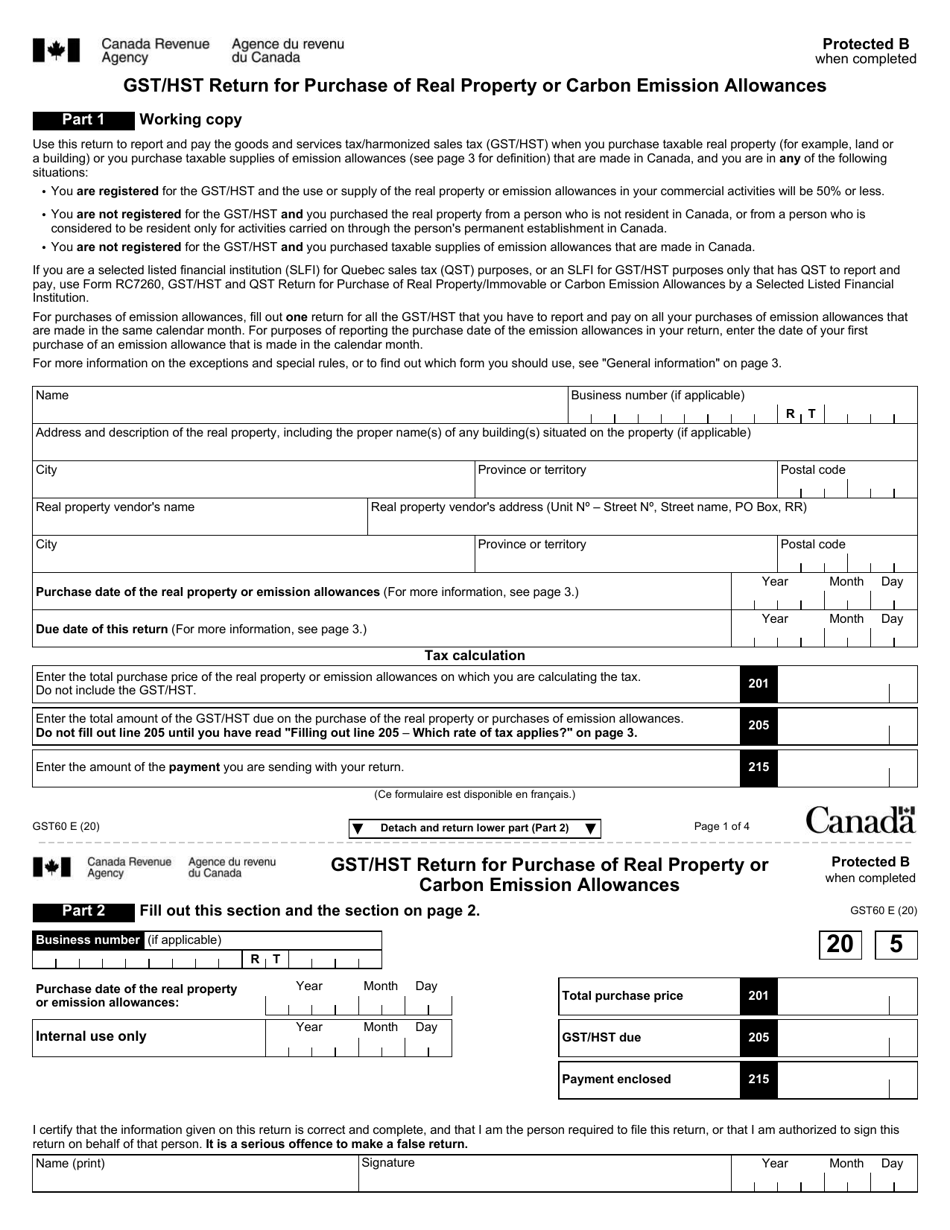

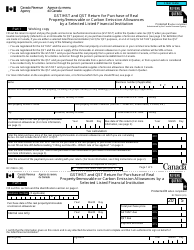

Form GST60 Gst / Hst Return for Purchase of Real Property or Carbon Emission Allowances - Canada

Form GST60 Gst/Hst Return for Purchase of Real Property or Carbon Emission Allowances - Canada is used to report the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) payable on the purchase of real property or carbon emission allowances in Canada.

The purchaser files the Form GST60 Gst/Hst Return for the purchase of real property or carbon emission allowances in Canada.

FAQ

Q: What is GST60?

A: GST60 is a form for the GST/HST return for the purchase of real property or carbon emission allowances in Canada.

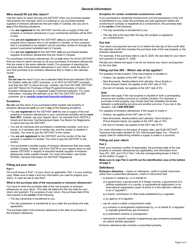

Q: Who needs to file the GST60 form?

A: Anyone who has purchased real property or carbon emission allowances and is registered for the GST/HST in Canada needs to file the GST60 form.

Q: What is the purpose of the GST60 form?

A: The GST60 form is used to report and remit the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) on the purchase of real property or carbon emission allowances in Canada.

Q: How do I fill out the GST60 form?

A: You will need to provide your business information, report the amount of GST/HST payable, and complete the other sections of the form including any adjustments, rebates, and late-filing penalties, if applicable.

Q: When is the deadline to file the GST60 form?

A: The deadline to file the GST60 form is generally one month after the end of the reporting period in which the purchase occurred.

Q: Are there any penalties for late filing of the GST60 form?

A: Yes, there may be penalties for late filing, including late-filing penalties and interest charges on any overdue amounts.