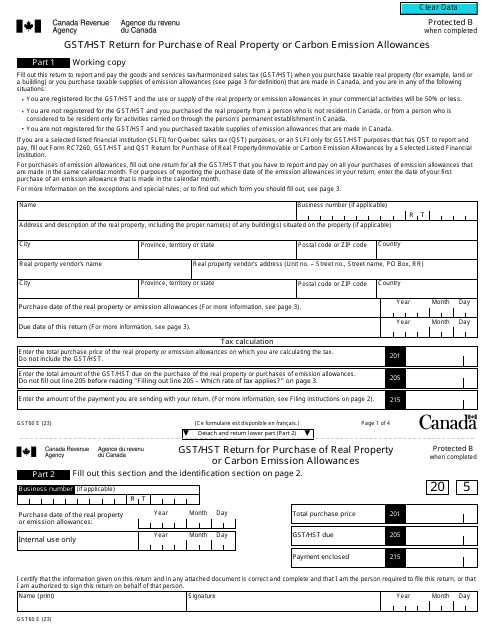

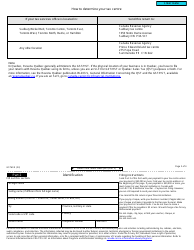

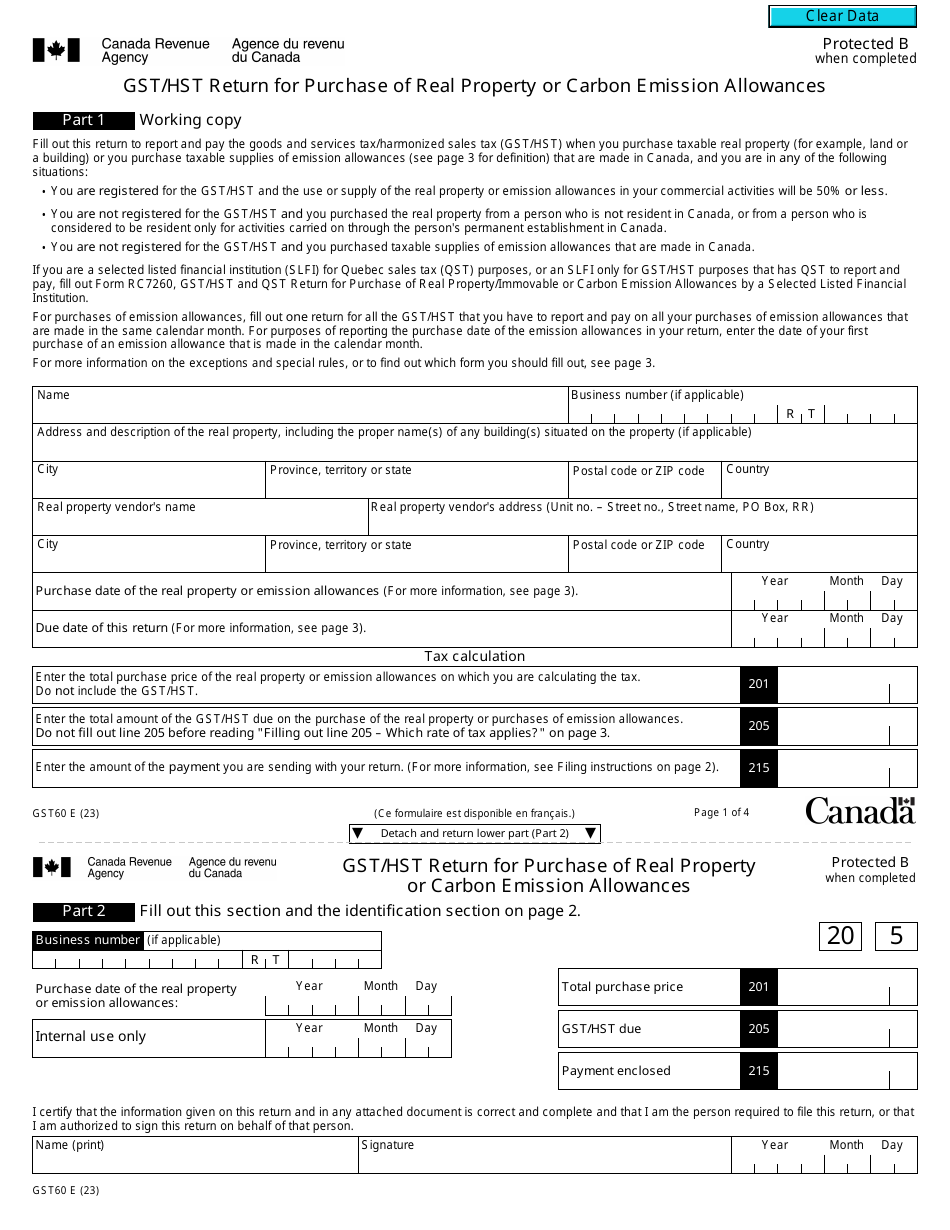

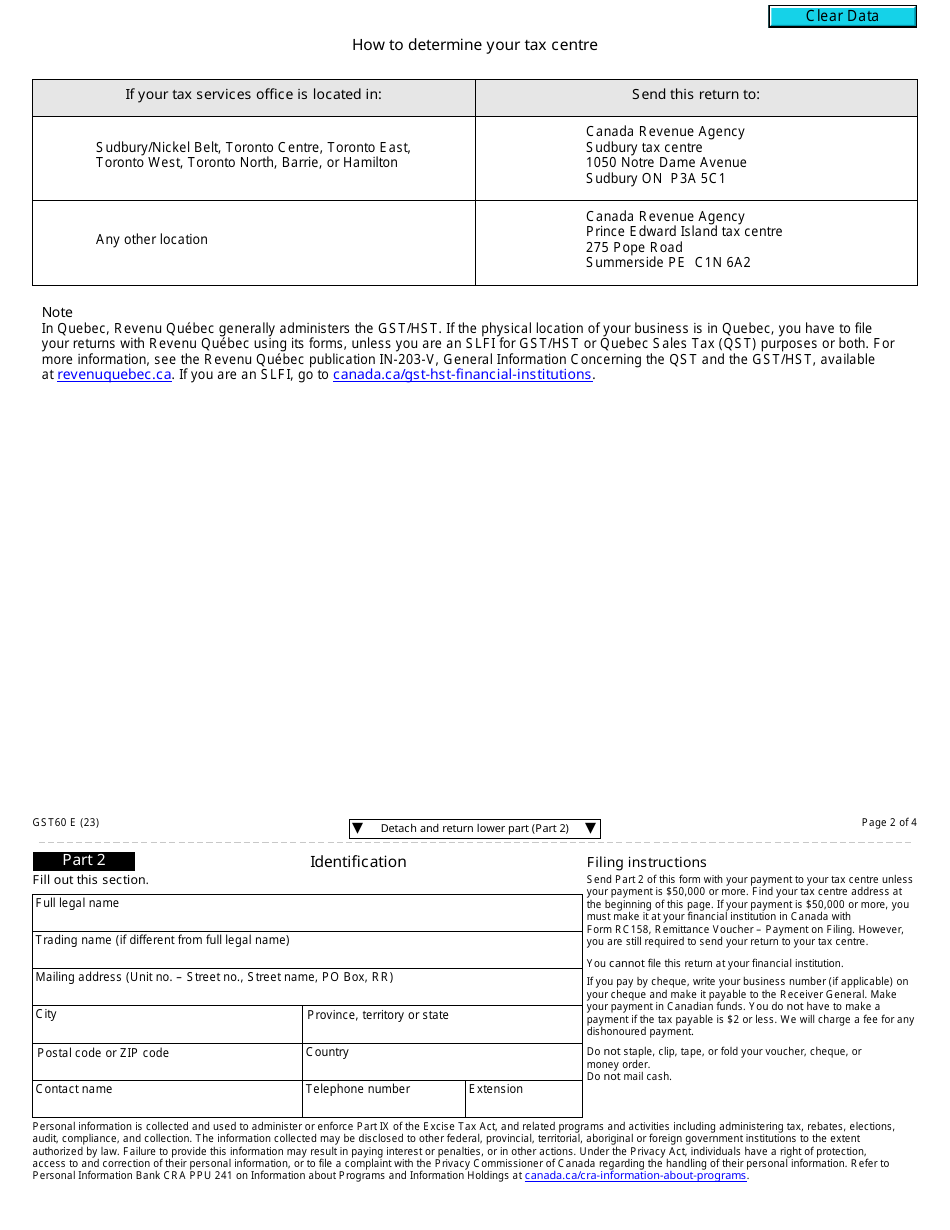

Form GST60 Gst / Hst Return for Purchase of Real Property or Carbon Emission Allowances - Canada

Form GST60, GST/HST Return for Purchase of Real Property or Carbon Emission Allowances, is used in Canada to report and remit the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) on the purchase of real property or carbon emission allowances. It is a tax return form for individuals or businesses who are required to collect and remit GST/HST on these specific transactions.

The buyer of real property or carbon emission allowances in Canada files the Form GST60 GST/HST return for these purchases.

Form GST60 Gst/Hst Return for Purchase of Real Property or Carbon Emission Allowances - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST60?

A: Form GST60 is the GST/HST Return for Purchase of Real Property or Carbon Emission Allowances in Canada.

Q: When is Form GST60 used?

A: Form GST60 is used when reporting the purchase of real property or carbon emission allowances for goods and services tax (GST) or harmonized sales tax (HST) purposes in Canada.

Q: What information is required on Form GST60?

A: Form GST60 requires information about the buyer, the seller, the property or allowances purchased, and the applicable GST/HST.

Q: How often should Form GST60 be filed?

A: Form GST60 should be filed within 4 weeks after the end of the reporting period or as otherwise directed by the CRA.

Q: Are there any penalties for late or incorrect filing of Form GST60?

A: Yes, there may be penalties for late or incorrect filing of Form GST60. It is important to ensure accurate and timely submission to avoid penalties or interest charges.

Q: Can I claim input tax credits on Form GST60?

A: Yes, if you are a GST/HST registrant, you may be eligible to claim input tax credits on eligible property or allowances purchased. Consult the CRA or a tax professional for more information.

Q: What should I do if I have questions or need assistance with Form GST60?

A: If you have questions or need assistance with Form GST60, you can contact the CRA directly or consult a tax professional for guidance.