This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST502

for the current year.

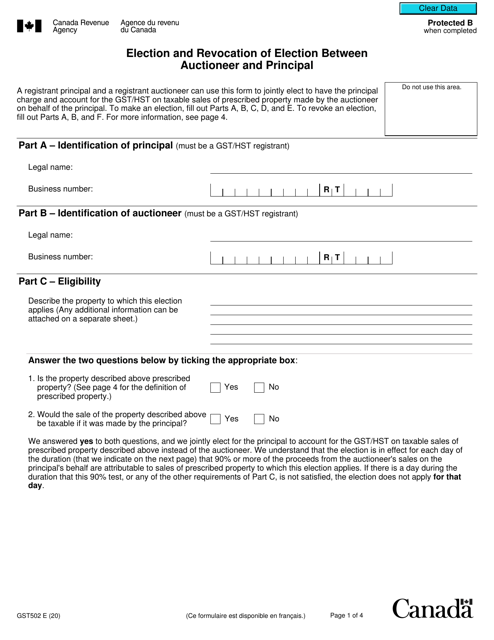

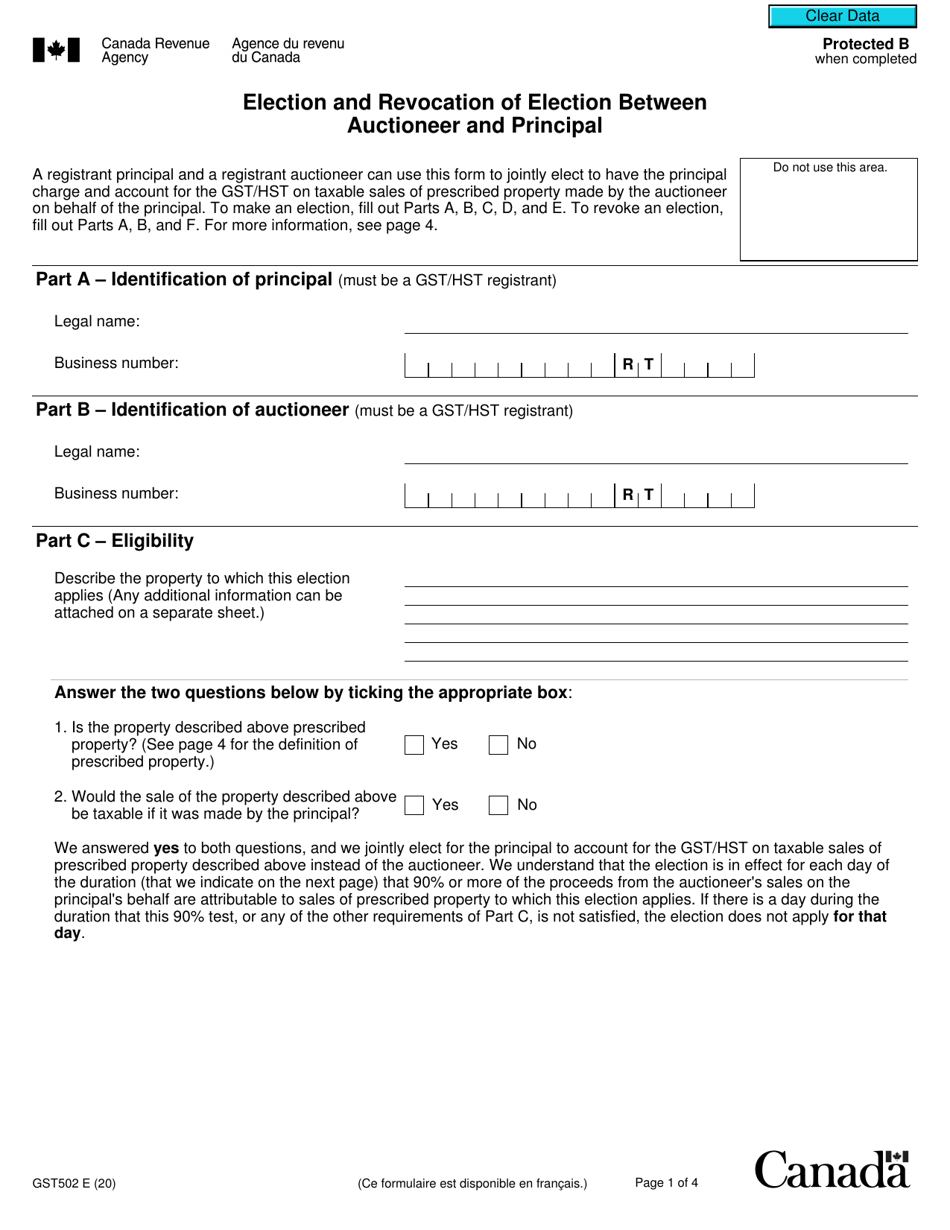

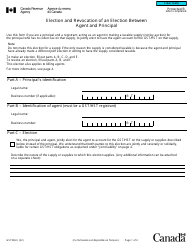

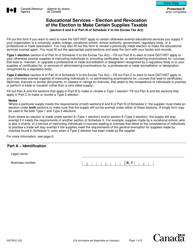

Form GST502 Election and Revocation of Election Between Auctioneer and Principal - Canada

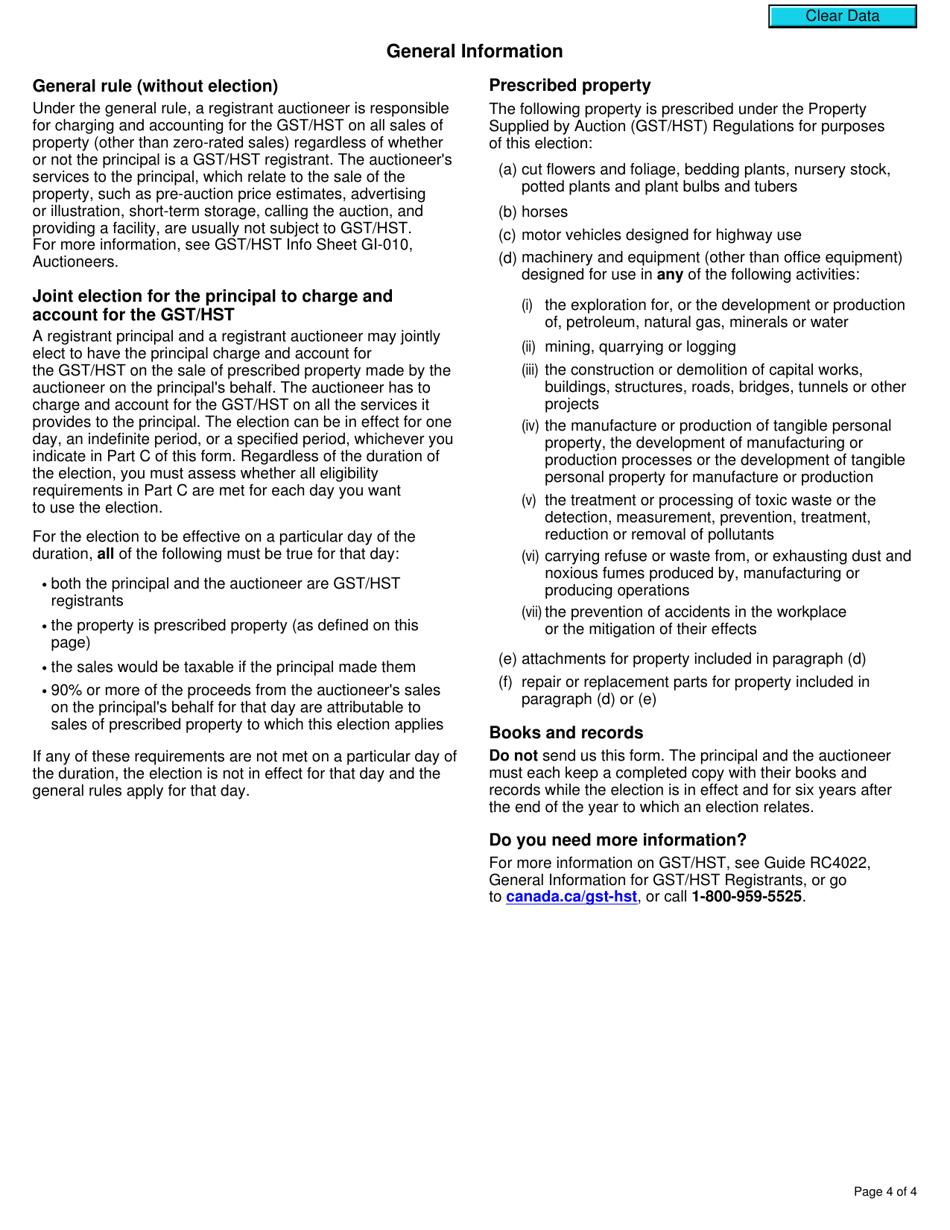

The Form GST502 Election and Revocation of Election Between Auctioneer and Principal in Canada is used to make an election or revoke an election between an auctioneer and their principal for the purposes of the Goods and Services Tax (GST). It allows them to determine who will be responsible for reporting and remitting the GST on auction supplies.

The form GST502 "Election and Revocation of Election Between Auctioneer and Principal" is filed by the auctioneer, not the principal, in Canada.

FAQ

Q: What is Form GST502?

A: Form GST502 is the Election and Revocation of Election Between Auctioneer and Principal form in Canada.

Q: Who can use Form GST502?

A: Both auctioneers and principals in Canada can use Form GST502.

Q: What is the purpose of Form GST502?

A: The purpose of Form GST502 is to elect or revoke the election for the auctioneer to be considered the principal for GST/HST purposes.

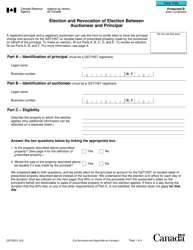

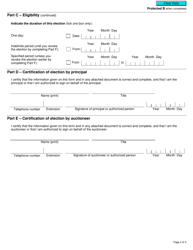

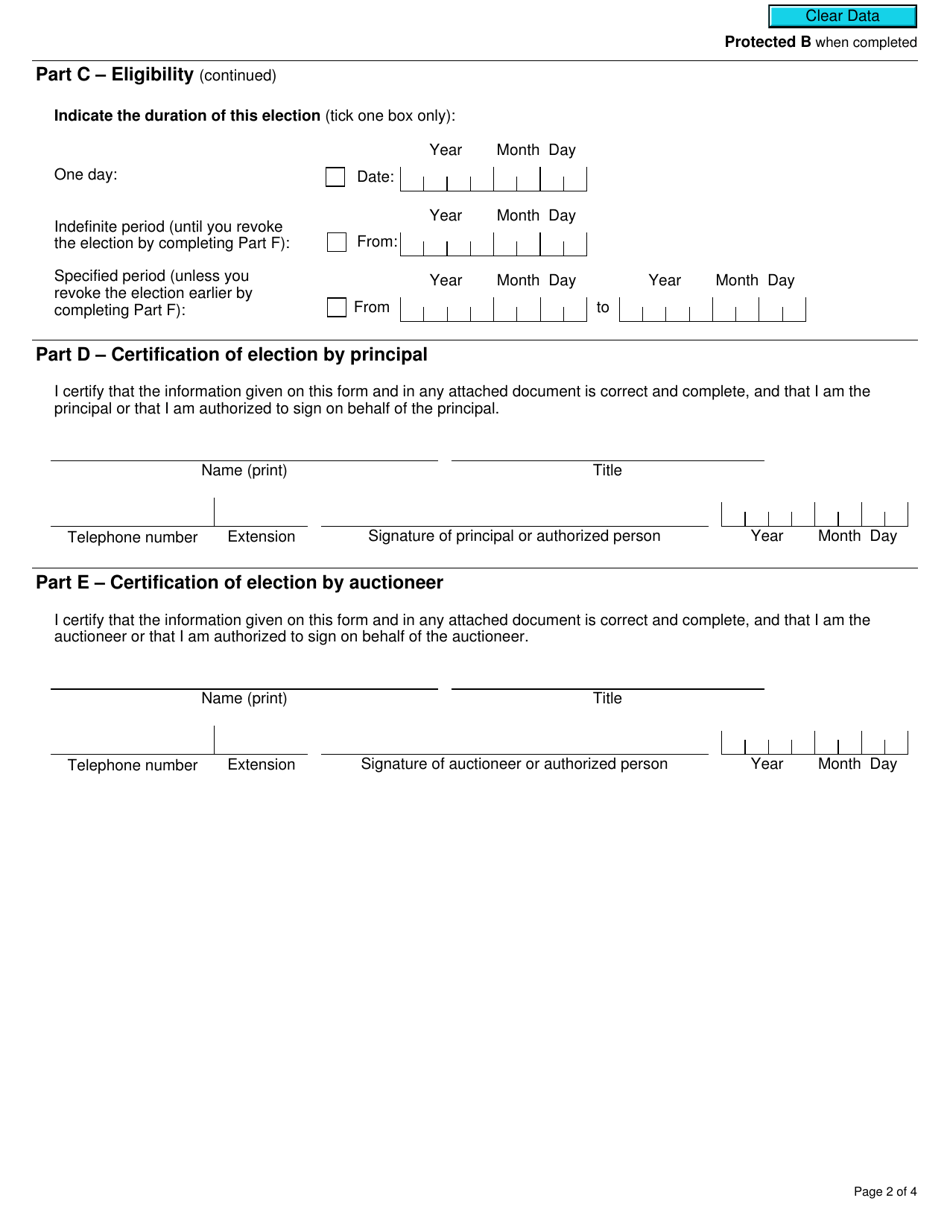

Q: How do I complete Form GST502?

A: To complete Form GST502, you need to provide the required information including the auctioneer's and principal's details, election or revocation details, and signature.

Q: Are there any fees associated with Form GST502?

A: No, there are no fees associated with Form GST502.

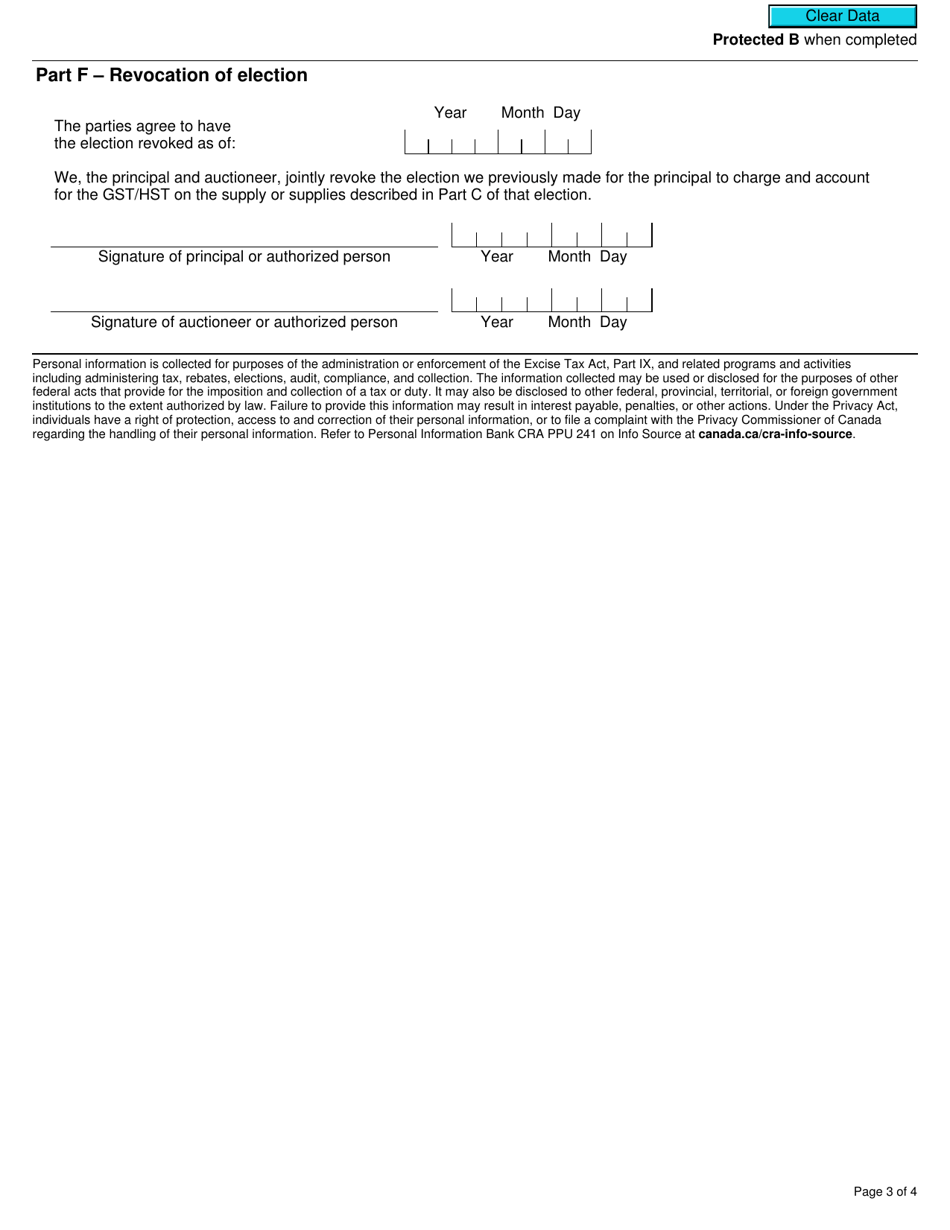

Q: What are the consequences of electing or revoking the election using Form GST502?

A: Electing or revoking the election using Form GST502 can have implications for how GST/HST is calculated and reported for the auctioneer and principal.

Q: Is Form GST502 only applicable in Canada?

A: Yes, Form GST502 is specific to Canada and is used for GST/HST purposes in the country.