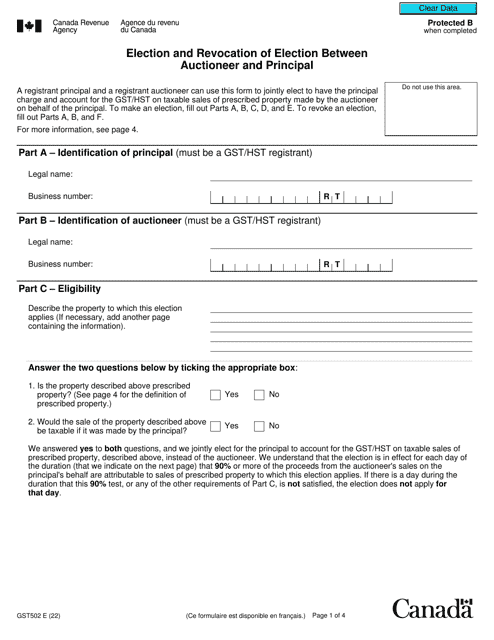

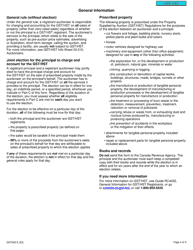

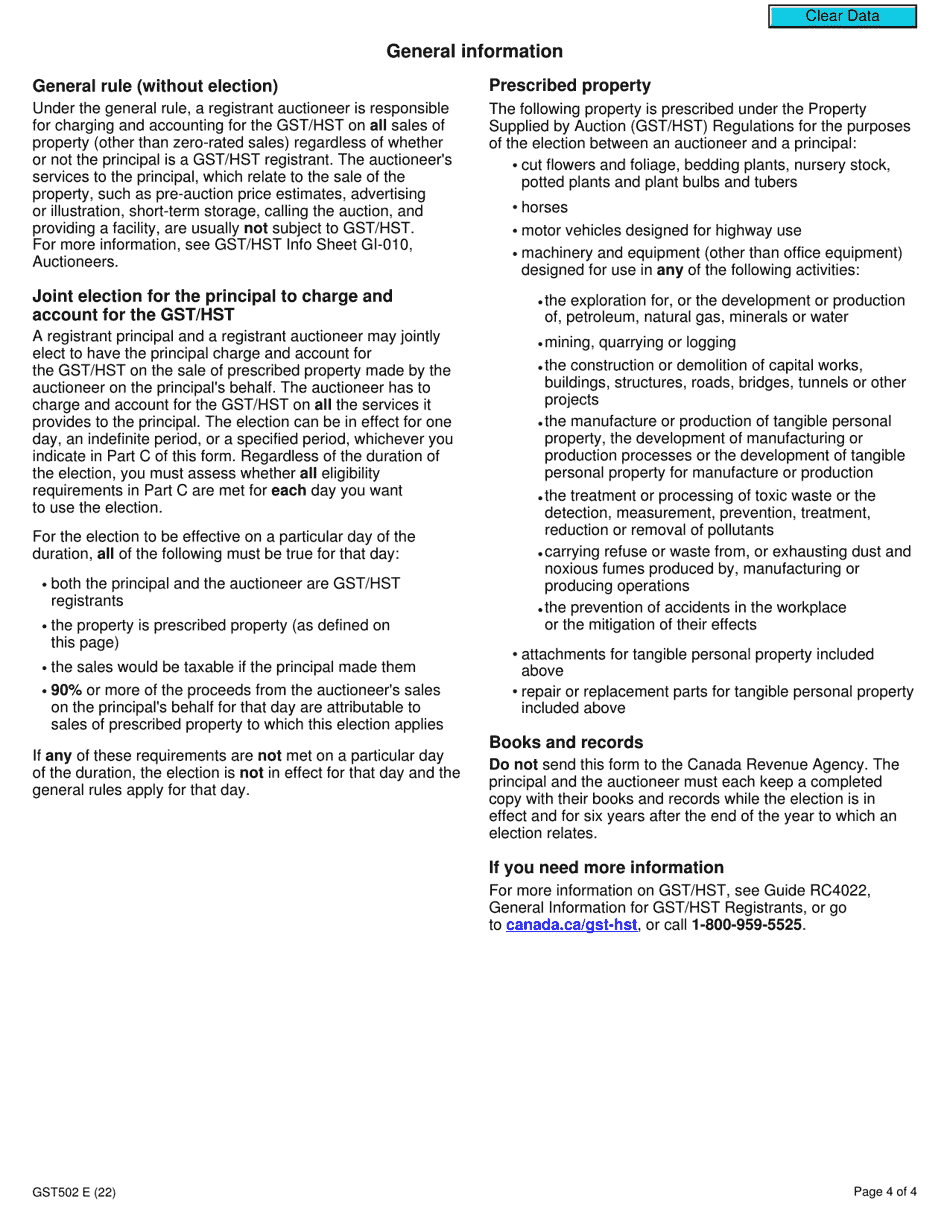

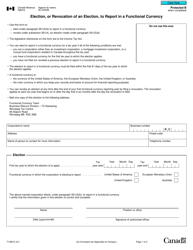

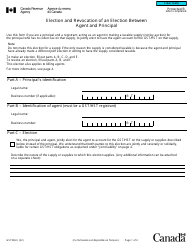

Form GST502 Election and Revocation of Election Between Auctioneer and Principal - Canada

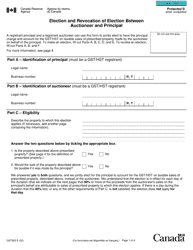

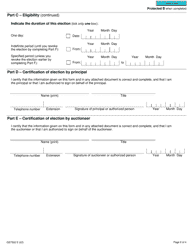

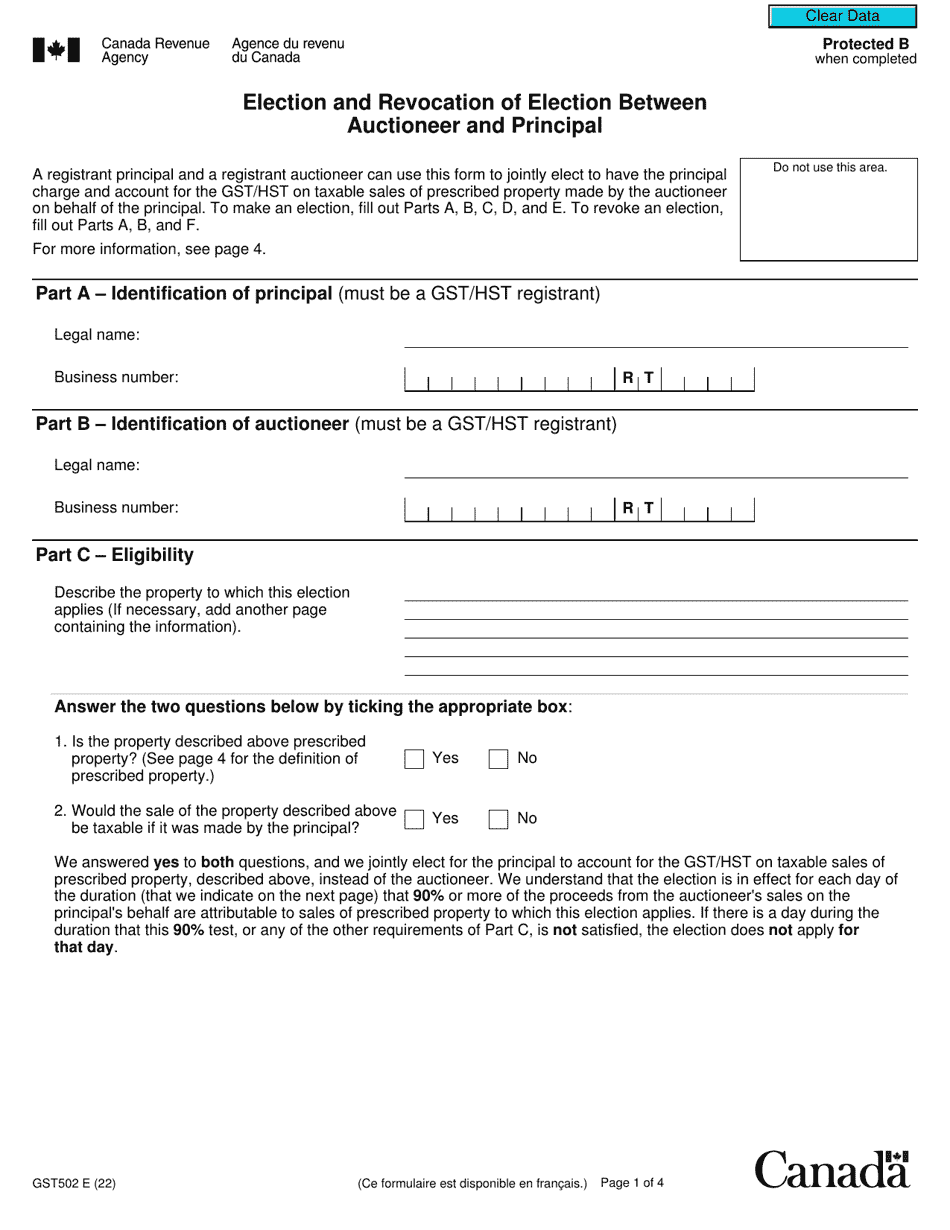

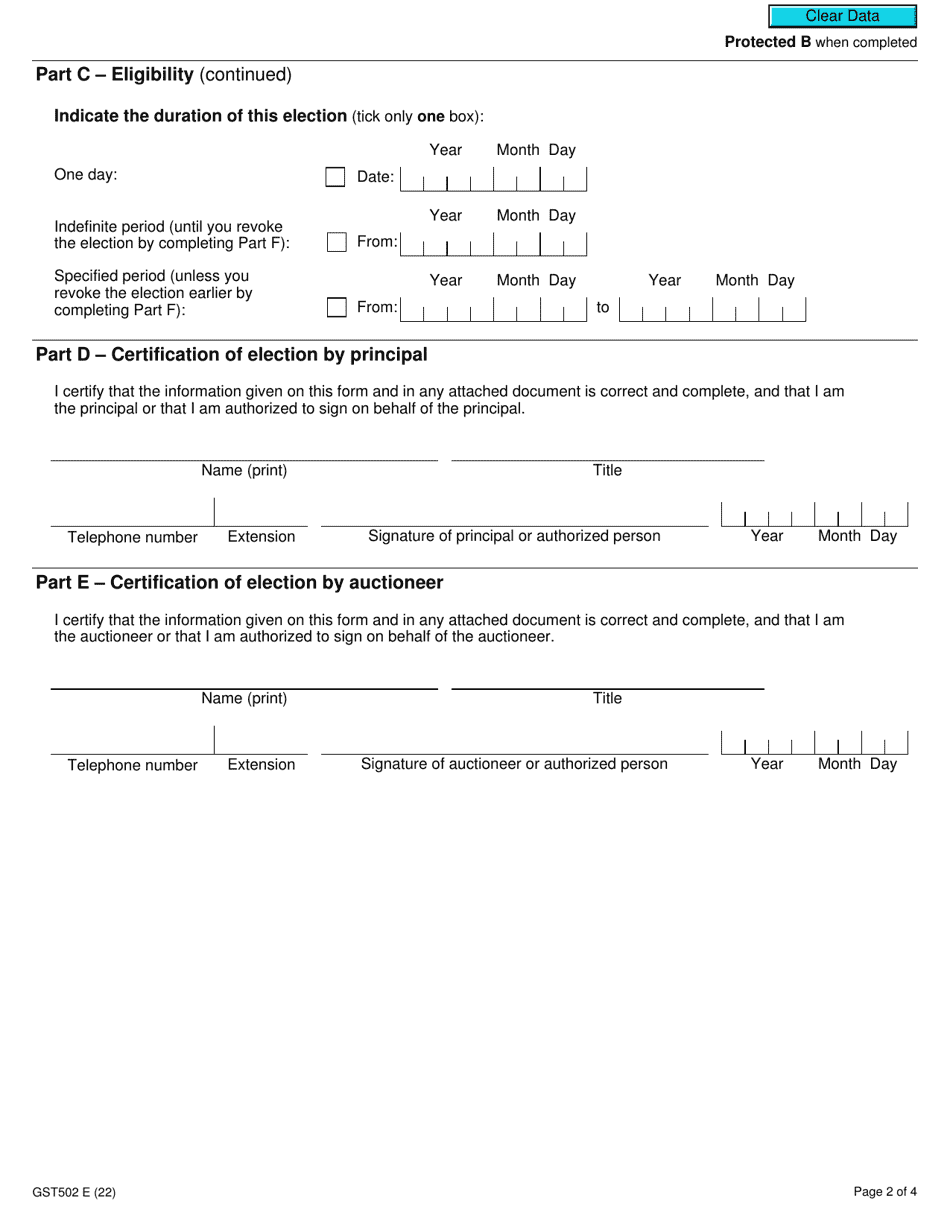

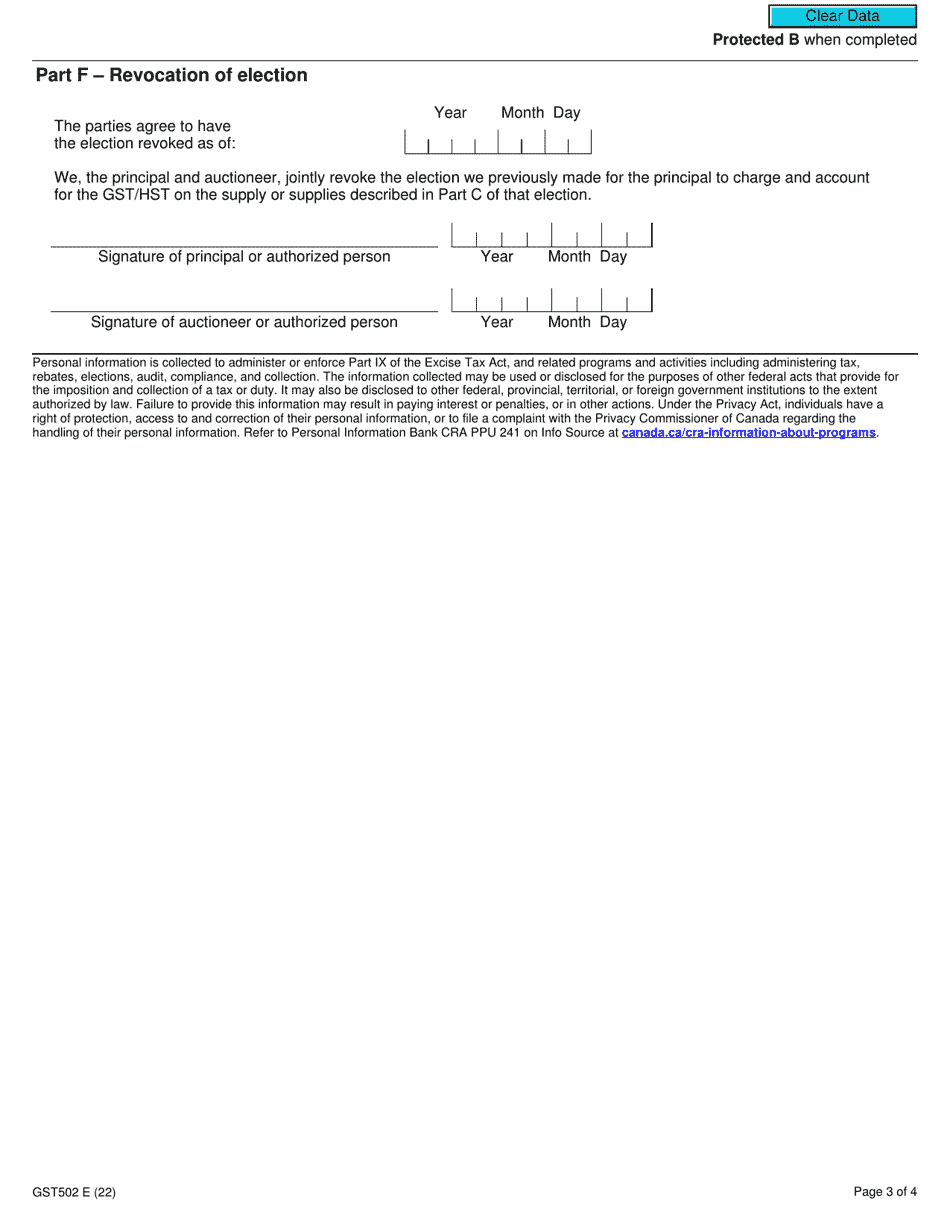

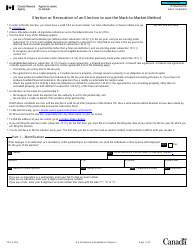

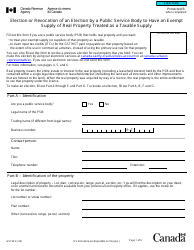

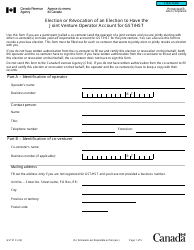

Form GST502 Election and Revocation of Election Between Auctioneer and Principal in Canada is used to elect or revoke the election of a principal to treat supplies made by an auctioneer as made by the principal. This form is for the purpose of Goods and Services Tax/Harmonized Sales Tax (GST/HST) reporting and compliance. It allows the auctioneer and principal to determine the GST/HST liability on supplies made during auctions.

The principal files the Form GST502 Election and Revocation of Election Between Auctioneer and Principal in Canada.

Form GST502 Election and Revocation of Election Between Auctioneer and Principal - Canada - Frequently Asked Questions (FAQ)

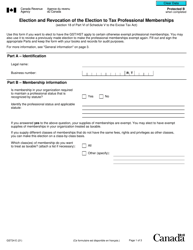

Q: What is Form GST502?

A: Form GST502 is used for the election and revocation of election between an auctioneer and principal in Canada.

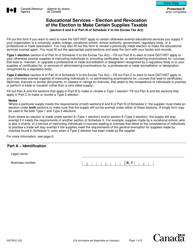

Q: What does this form allow for?

A: This form allows an auctioneer to elect to have the GST/HST apply to their supplies of auction services to the principal or to revoke their election.

Q: Who can use this form?

A: Both auctioneers and principals in Canada can use this form.

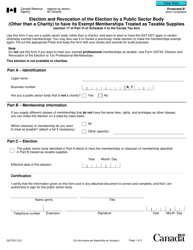

Q: How can an auctioneer elect or revoke their election using this form?

A: An auctioneer can elect or revoke their election by completing and filing Form GST502 with the Canada Revenue Agency (CRA).

Q: Are there any requirements or conditions for using this form?

A: Yes, there are specific requirements and conditions outlined in the form instructions that must be met in order to use this form.