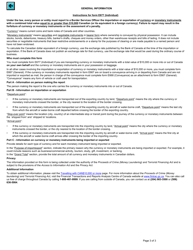

This version of the form is not currently in use and is provided for reference only. Download this version of

Form E677

for the current year.

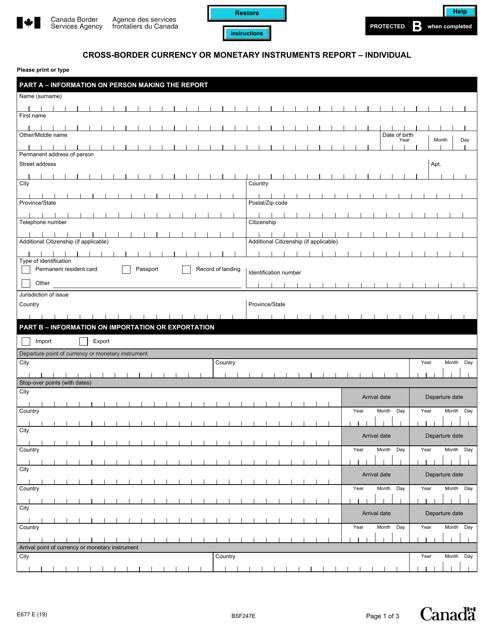

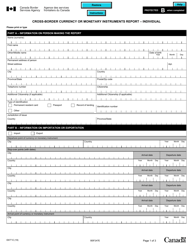

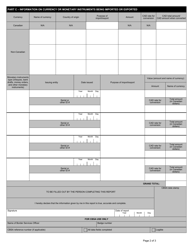

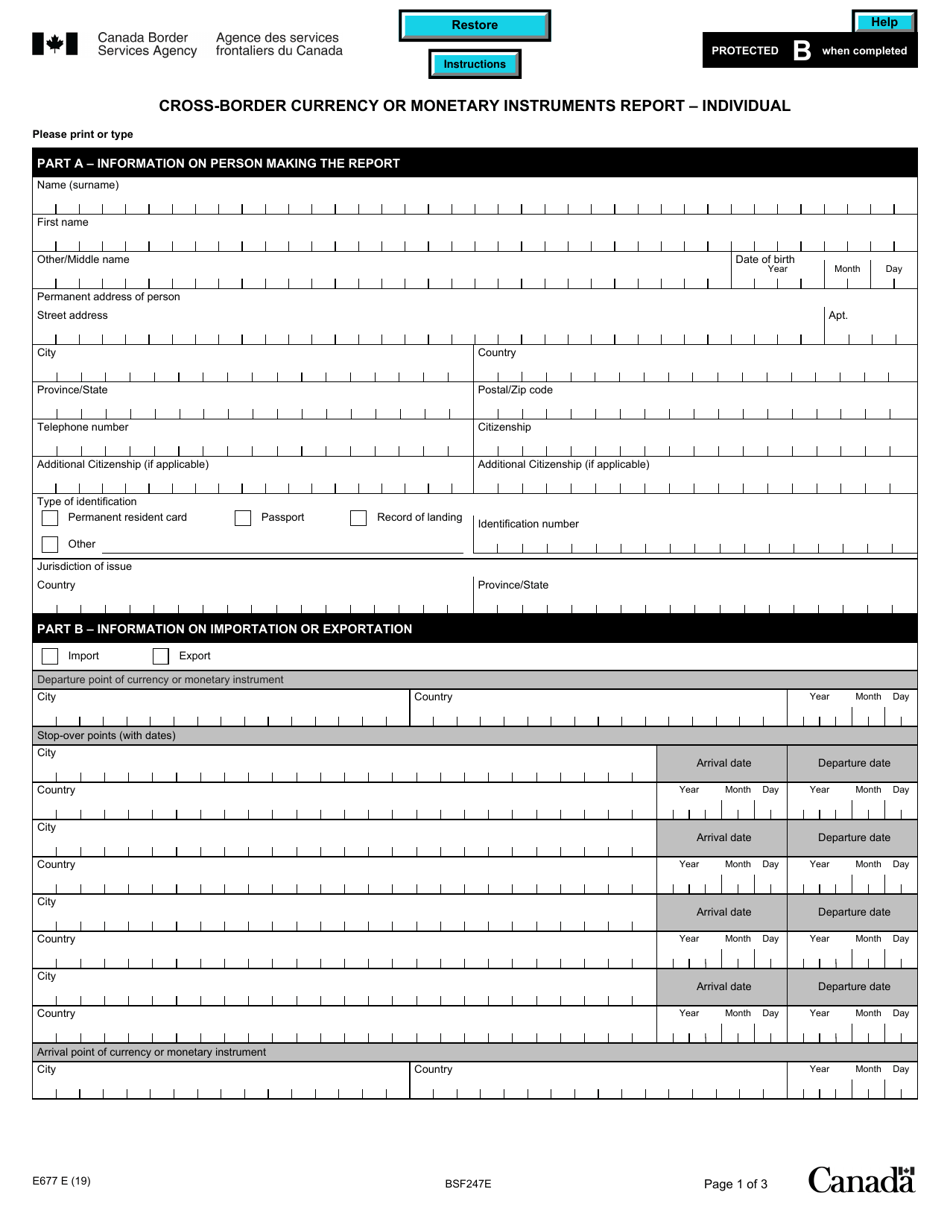

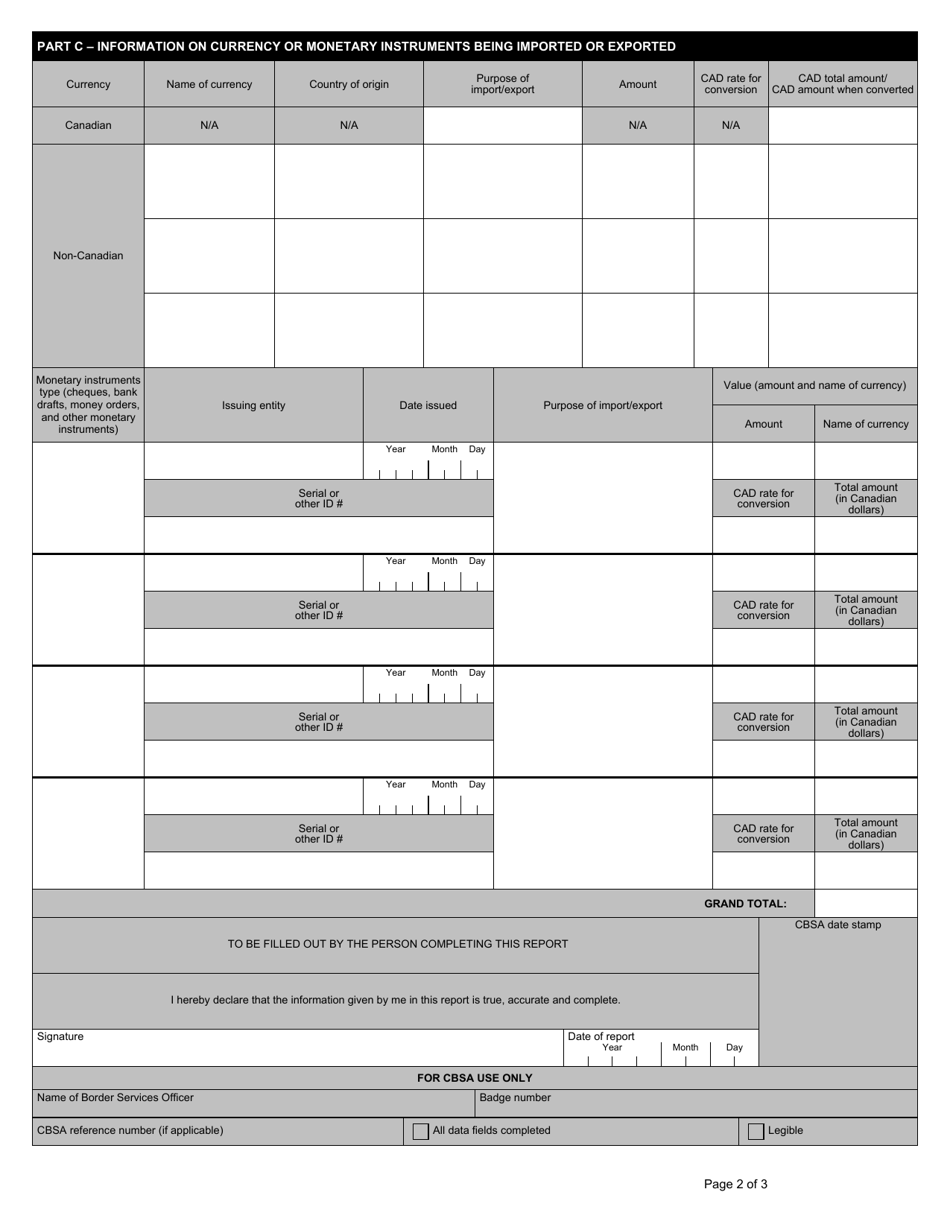

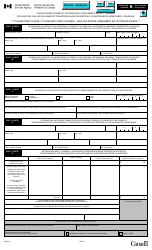

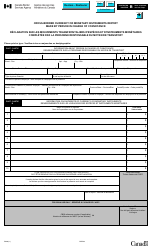

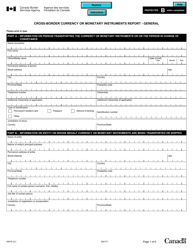

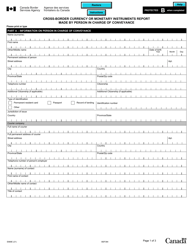

Form E677 Cross-border Currency or Monetary Instruments Report - Individual - Canada

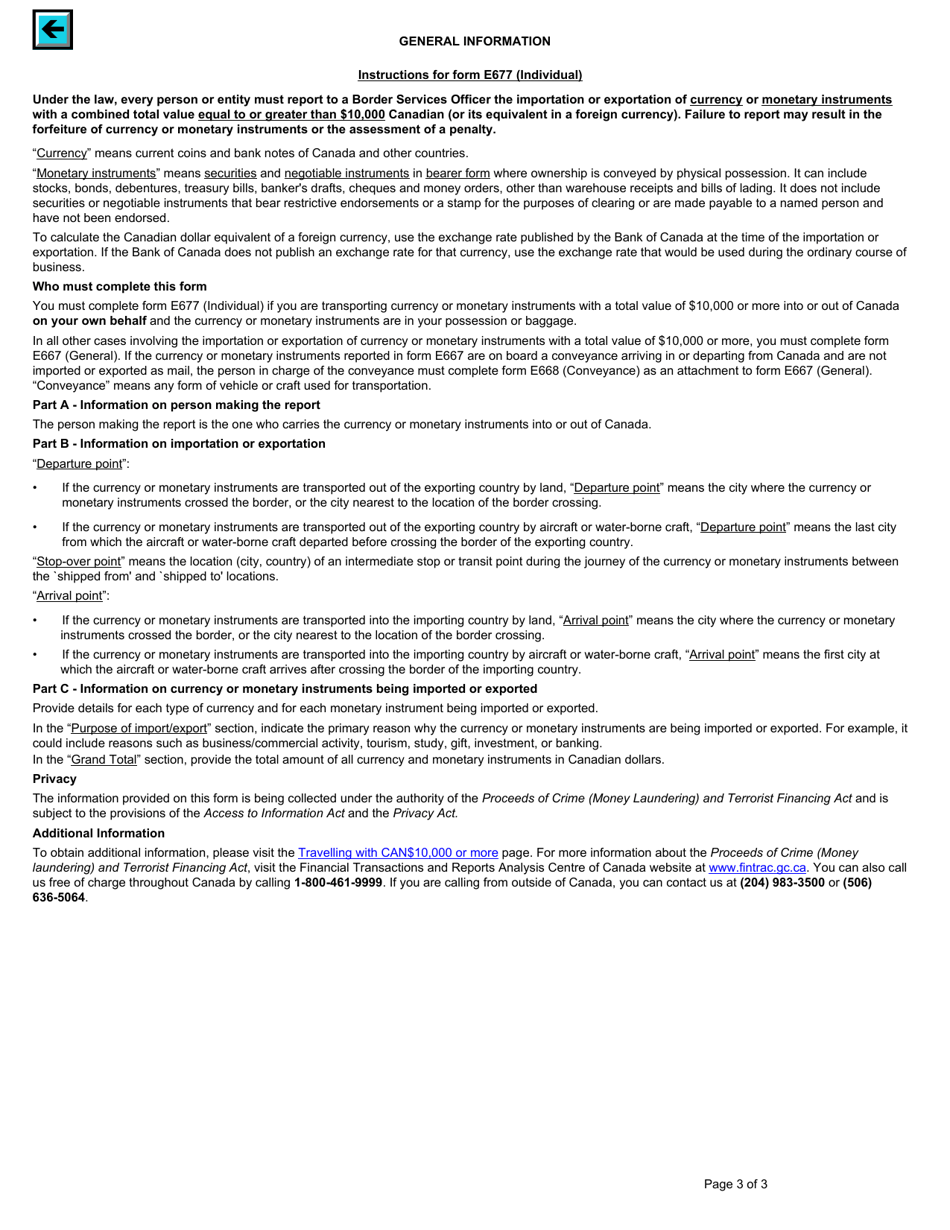

Form E677 Cross-border Currency or Monetary Instruments Report - Individual - Canada is used to report any transportation of currency or monetary instruments exceeding $10,000 CAD entering or leaving Canada. This form helps the Canada Border Services Agency (CBSA) monitor and prevent money laundering, smuggling, and other illegal activities related to cross-border currency movement. It applies to individuals, including Canadian residents and non-residents alike, who are carrying large amounts of cash or monetary instruments across the Canadian border. The form requires individuals to declare the amount and nature of the currency or monetary instruments being transported.

The Form E677 Cross-border Currency or Monetary Instruments Report - Individual in Canada is filed by individuals who are entering or leaving Canada with currency or monetary instruments that exceed the specified limits set by the Canada Border Services Agency (CBSA). This form is used to declare any amounts of currency or monetary instruments exceeding CAD 10,000.

FAQ

Q: What is Form E677 Cross-border Currency or Monetary Instruments Report?

A: Form E677 Cross-border Currency or Monetary Instruments Report is a document used in Canada to report the transportation of large amounts of currency or monetary instruments across the Canadian border.

Q: Who needs to file Form E677 Cross-border Currency or Monetary Instruments Report in Canada?

A: Individuals who are physically carrying or transporting currency or monetary instruments valued at $10,000 or more across the Canadian border need to file Form E677 Cross-border Currency or Monetary Instruments Report.

Q: What information is required on Form E677 Cross-border Currency or Monetary Instruments Report?

A: Form E677 requires the individual to provide personal information such as name, address, and contact details, as well as information about the currency or monetary instruments being transported, including the amount and purpose of the transportation.

Q: When should Form E677 Cross-border Currency or Monetary Instruments Report be filed in Canada?

A: Form E677 Cross-border Currency or Monetary Instruments Report should be filed at the time of entry or exit from Canada, whenever an individual is carrying or transporting currency or monetary instruments valued at $10,000 or more.

Q: Are there any penalties for not filing Form E677 Cross-border Currency or Monetary Instruments Report in Canada?

A: Yes, failure to file Form E677 Cross-border Currency or Monetary Instruments Report when required by law may result in penalties, including fines and seizure of the currency or monetary instruments being transported.