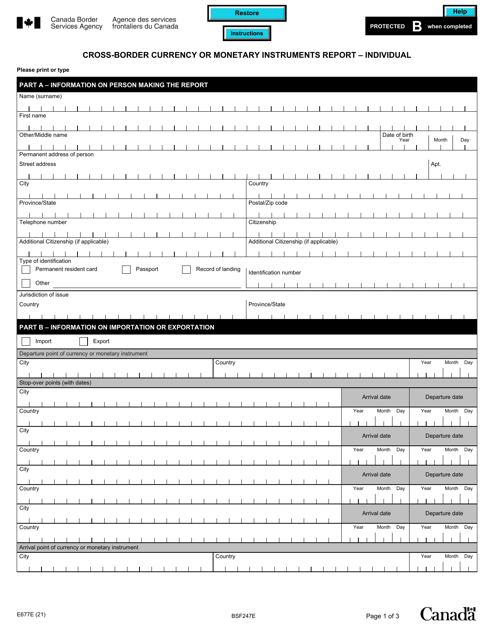

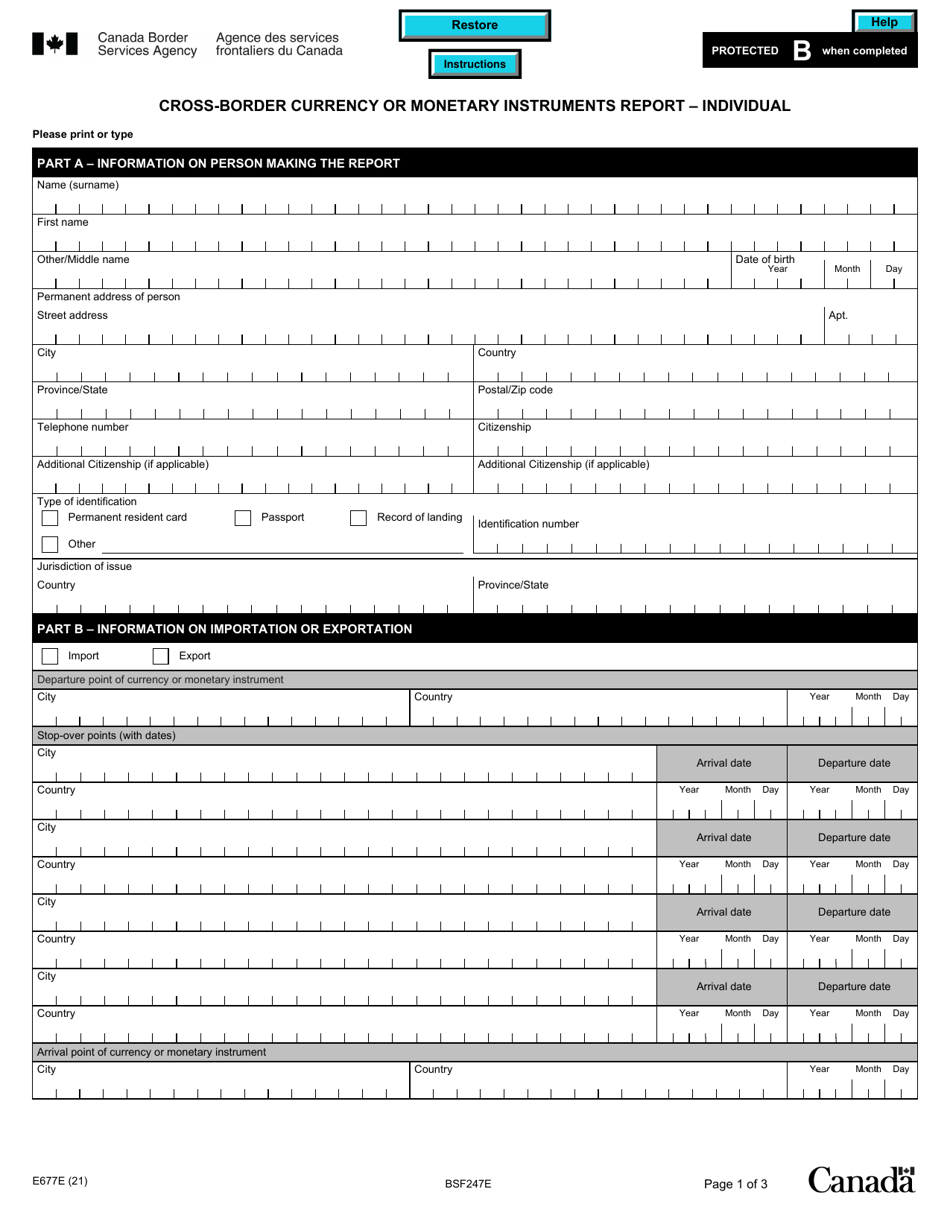

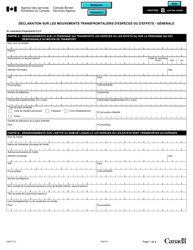

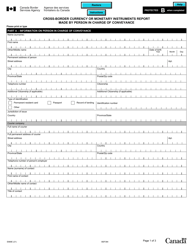

Form E677 Cross-border Currency or Monetary Instruments Report - Individual - Canada

The Form E677 Cross-border Currency or Monetary Instruments Report - Individual in Canada is used to report the movement of currency or monetary instruments when individuals enter or leave Canada with a value exceeding CAD 10,000. It helps monitor and prevent money laundering, terrorist financing, and other criminal activities.

The individual who is carrying more than $10,000 CAD in currency or monetary instruments when entering or leaving Canada is required to file the Form E677 Cross-border Currency or Monetary Instruments Report.

Form E677 Cross-border Currency or Monetary Instruments Report - Individual - Canada - Frequently Asked Questions (FAQ)

Q: What is Form E677?

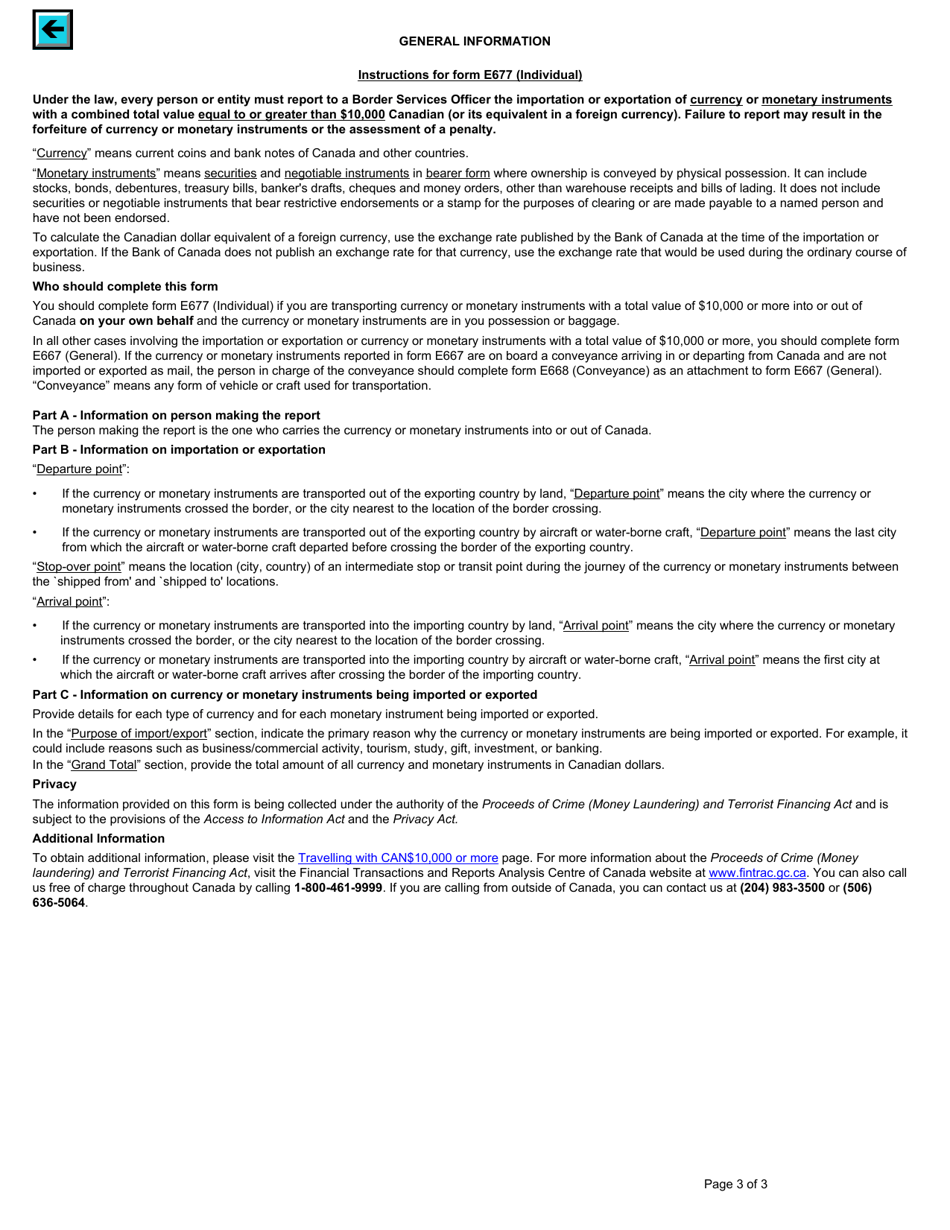

A: Form E677 is a Cross-border Currency or Monetary Instruments Report that must be filled out by individuals in Canada when crossing the Canadian border with currency or monetary instruments exceeding certain thresholds.

Q: Who needs to fill out Form E677?

A: Individuals entering or leaving Canada with currency or monetary instruments exceeding certain thresholds need to fill out Form E677.

Q: What are the thresholds for reporting on Form E677?

A: The threshold for reporting on Form E677 is CAD $10,000 or more in currency or monetary instruments.

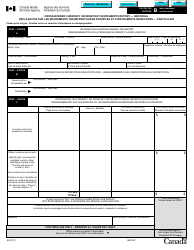

Q: What is considered 'currency or monetary instruments'?

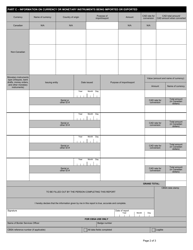

A: Currency or monetary instruments include cash, traveler's cheques, money orders, promissory notes, stocks, bonds, and negotiable instruments.

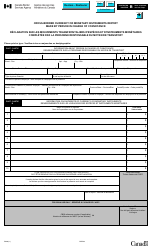

Q: When should Form E677 be filled out?

A: Form E677 should be filled out at the time of crossing the Canadian border if carrying currency or monetary instruments exceeding CAD $10,000.

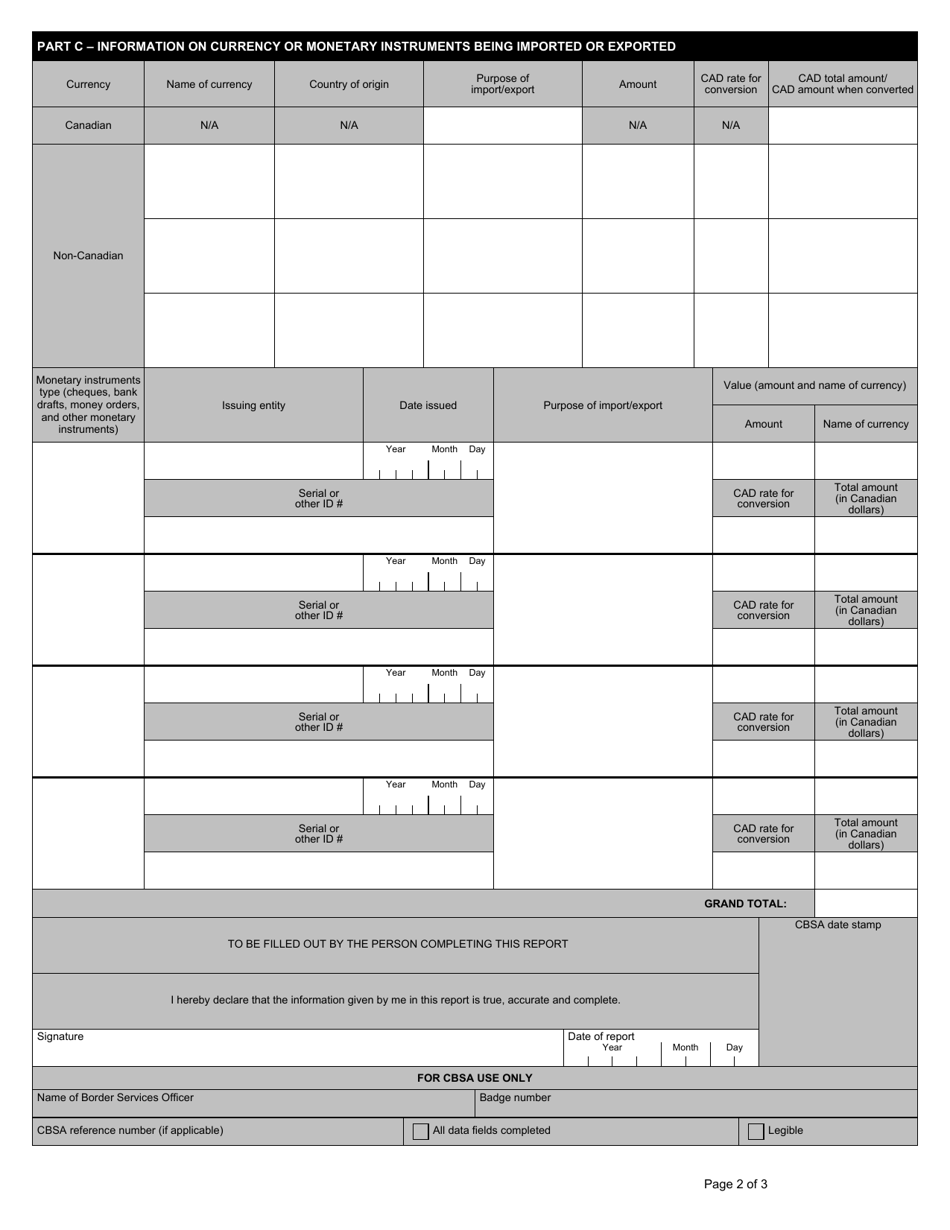

Q: What information is required on Form E677?

A: Form E677 requires information such as the individual's name, contact information, passport details, and declaration of the amount of currency or monetary instruments being transported.

Q: What happens after I submit Form E677?

A: Once you submit Form E677, the Canada Border Services Agency will review the form and may ask you further questions or conduct a search of your belongings.

Q: What are the consequences of not filing Form E677?

A: Failing to file Form E677 or providing false or misleading information can result in penalties, including monetary fines and seizure of the undeclared currency or monetary instruments.