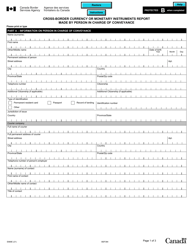

This version of the form is not currently in use and is provided for reference only. Download this version of

Form E667

for the current year.

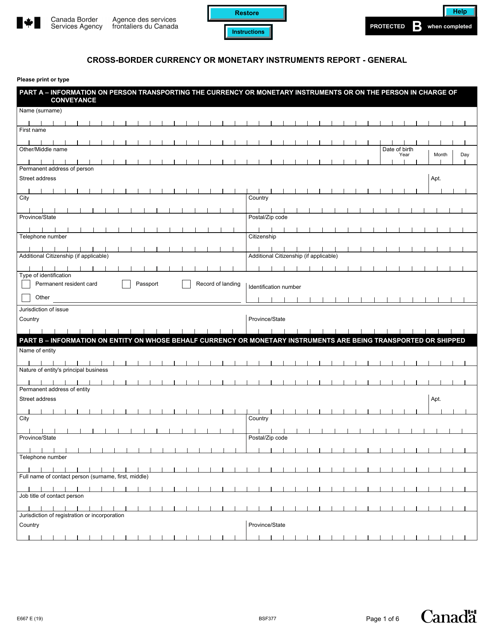

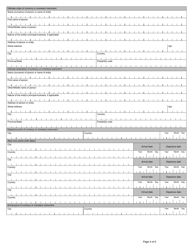

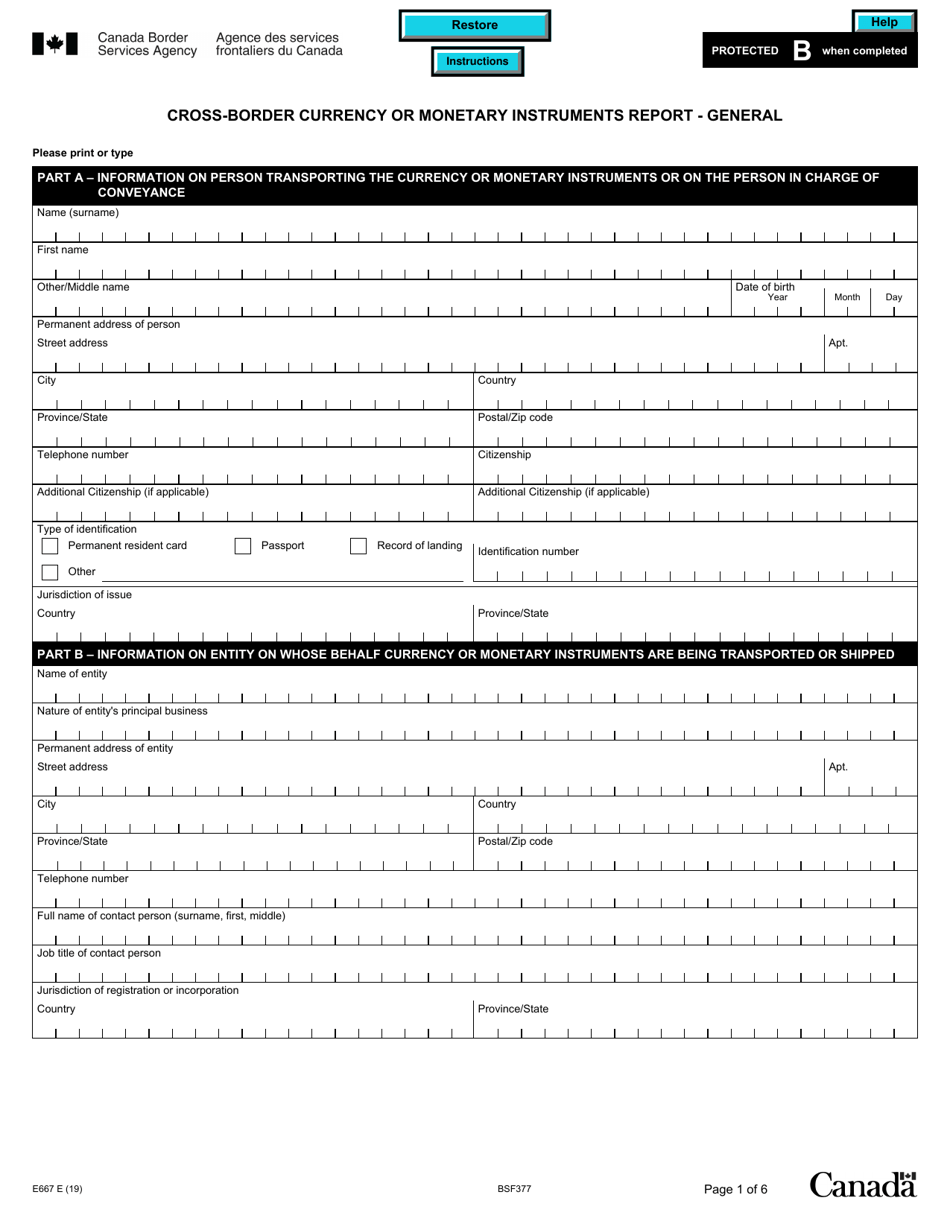

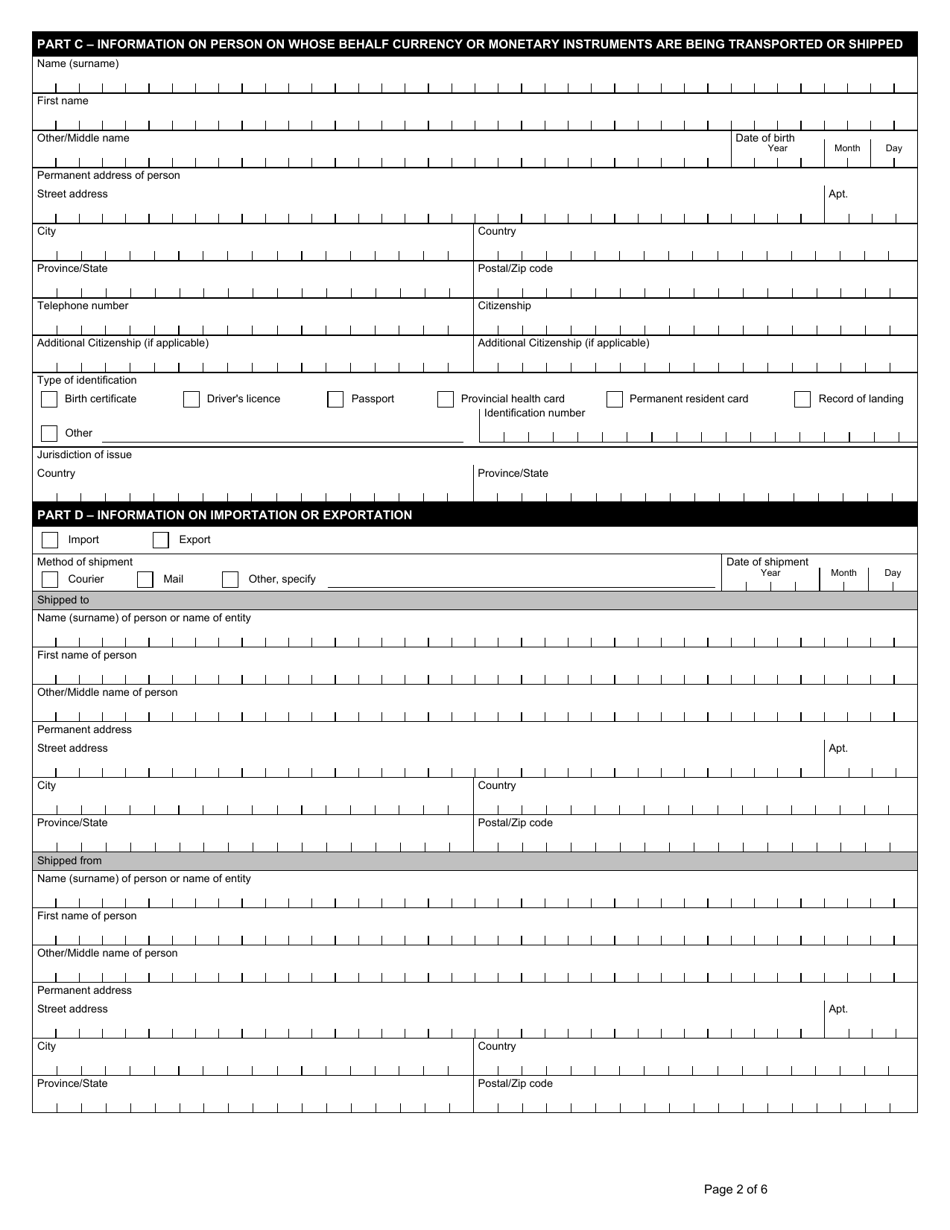

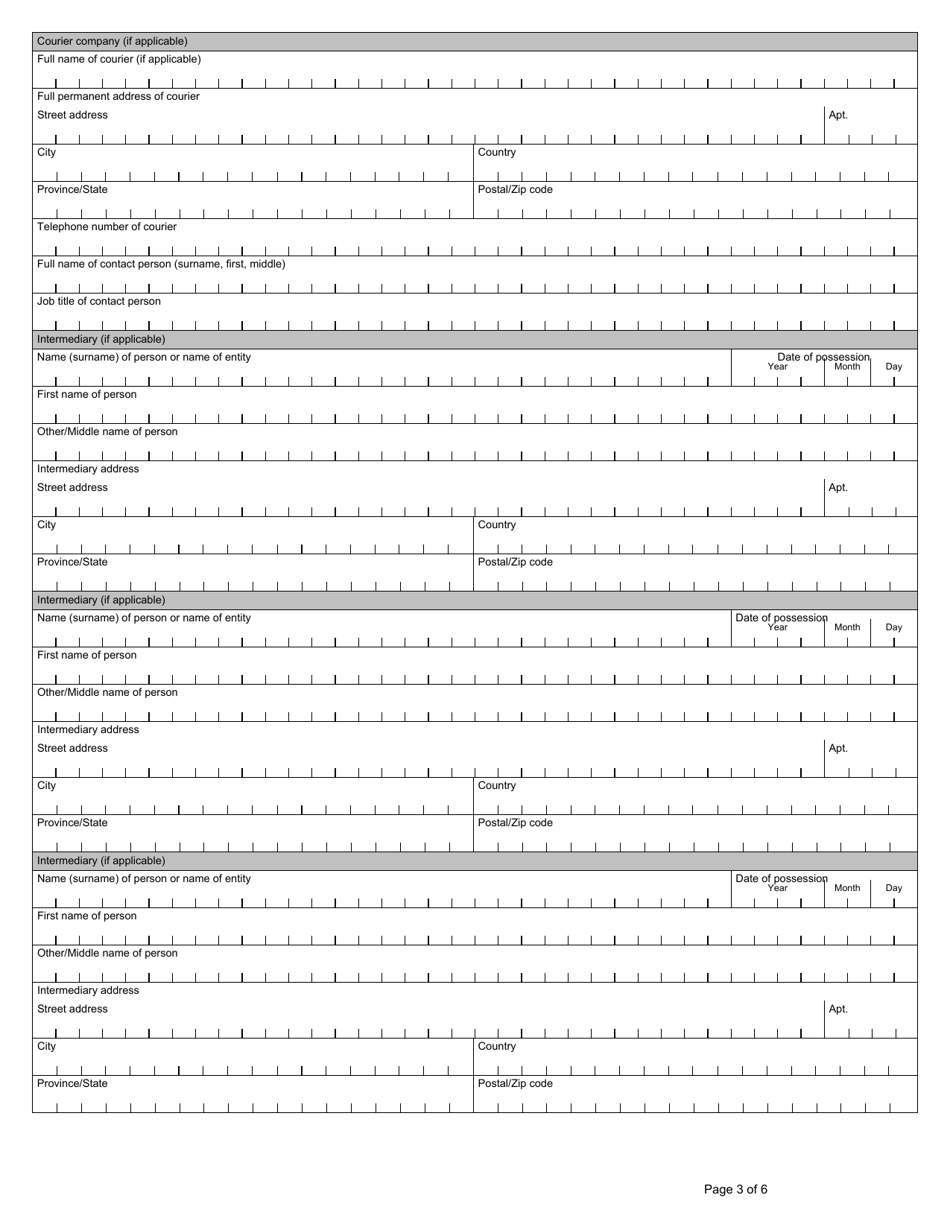

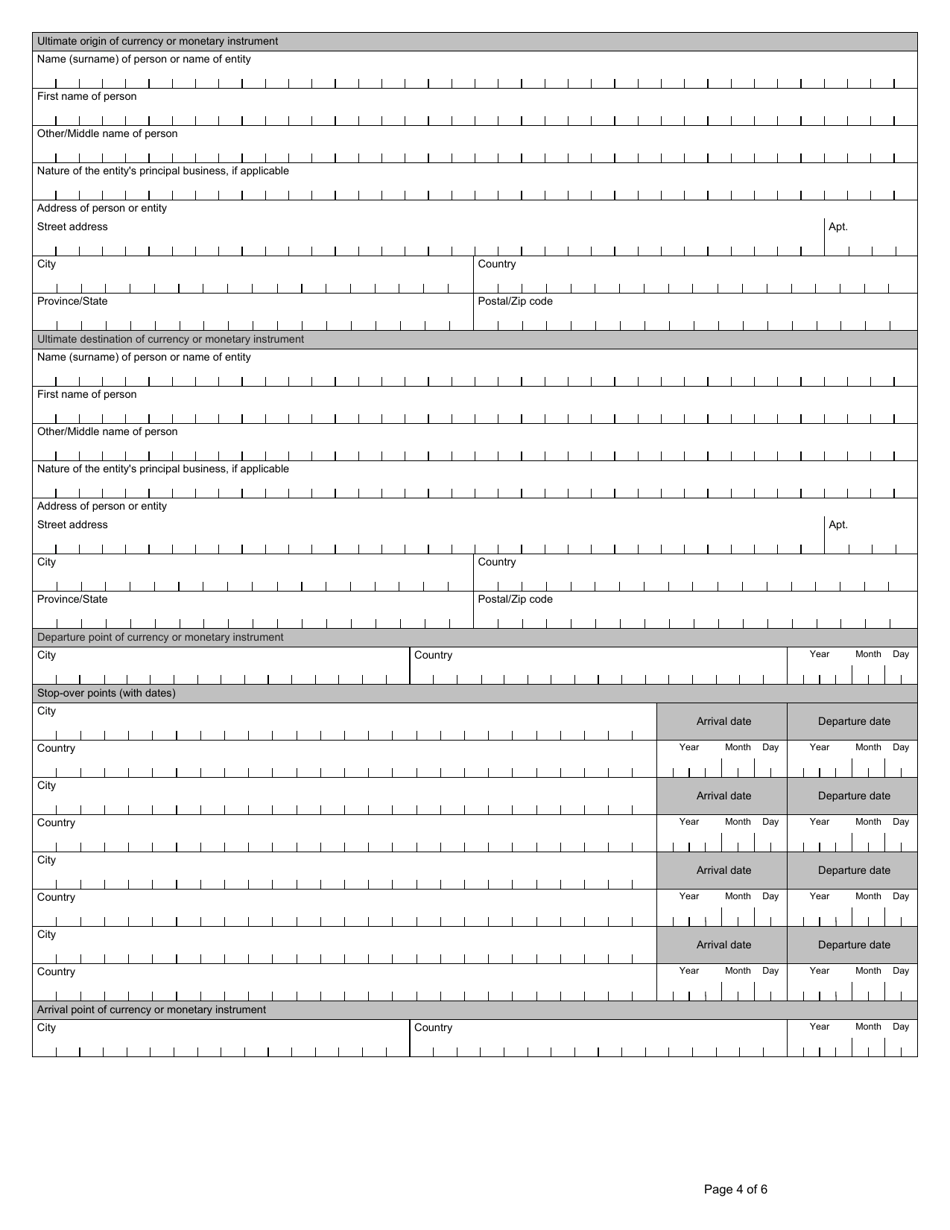

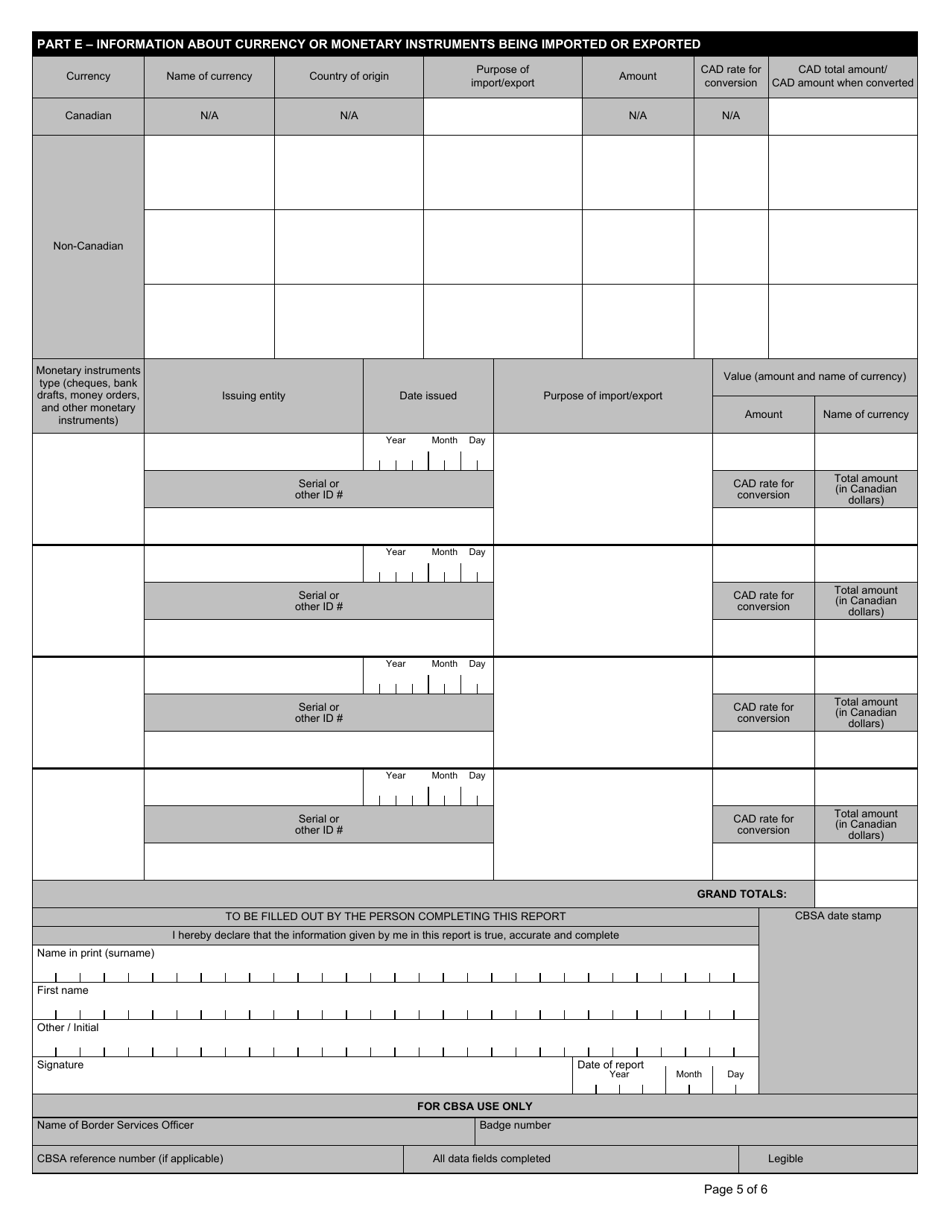

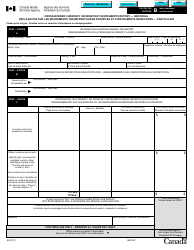

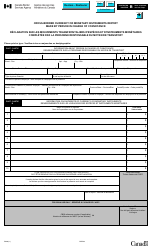

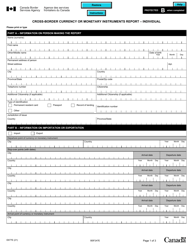

Form E667 Cross-border Currency or Monetary Instruments Report - General - Canada

Form E667 Cross-border Currency or Monetary Instruments Report is used by individuals entering or exiting Canada with currency or monetary instruments exceeding $10,000 CAD. It is used to report the transportation of large amounts of money to the Canada Border Services Agency (CBSA) to ensure compliance with Canadian laws and regulations related to money laundering and terrorist financing.

The Form E667 Cross-border Currency or Monetary Instruments Report in Canada is filed by individuals entering or leaving the country with more than CAD 10,000 in currency or monetary instruments.

FAQ

Q: What is Form E667?

A: Form E667 is a Cross-border Currency or Monetary Instruments Report.

Q: What is the purpose of Form E667?

A: The purpose of Form E667 is to report any movement of currency or monetary instruments across the Canadian border.

Q: Who needs to fill out Form E667?

A: Individuals and businesses who are carrying or receiving currency or monetary instruments in excess of CAD $10,000 are required to fill out Form E667.

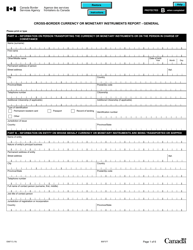

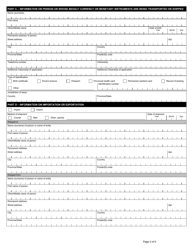

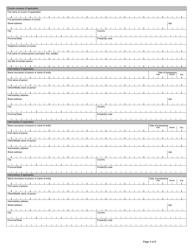

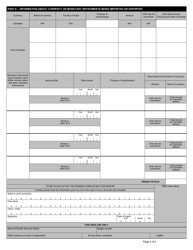

Q: What information is required on Form E667?

A: Form E667 requires information such as the name and address of the person carrying or receiving the currency, the type and value of the currency or monetary instruments, and the purpose of the transaction.

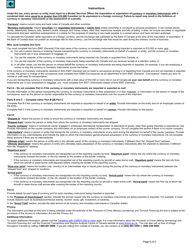

Q: When should Form E667 be filed?

A: Form E667 should be filed at the time of entry or exit from Canada, or within 15 days after the date of entry or exit.

Q: Are there any penalties for not filing Form E667?

A: Yes, there can be penalties for not filing or providing false or misleading information on Form E667.

Q: Is Form E667 only applicable to Canadians?

A: No, Form E667 is applicable to both Canadian and non-Canadian residents who are carrying or receiving currency or monetary instruments across the Canadian border.

Q: Is there a fee to file Form E667?

A: No, there is no fee to file Form E667.

Q: What is the purpose of reporting currency movements?

A: The purpose of reporting currency movements is to monitor and prevent money laundering and terrorist financing activities.