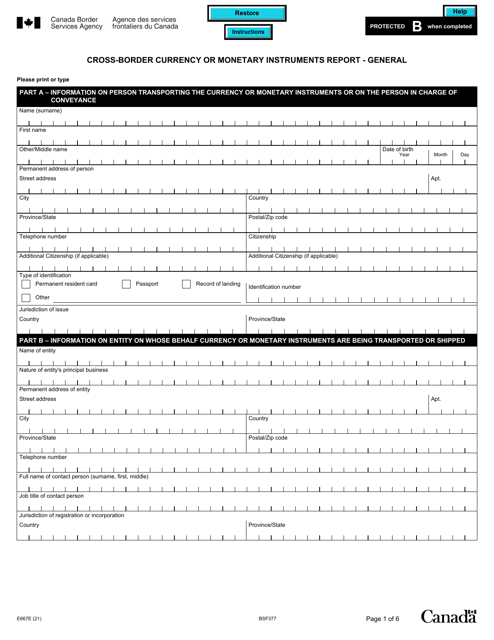

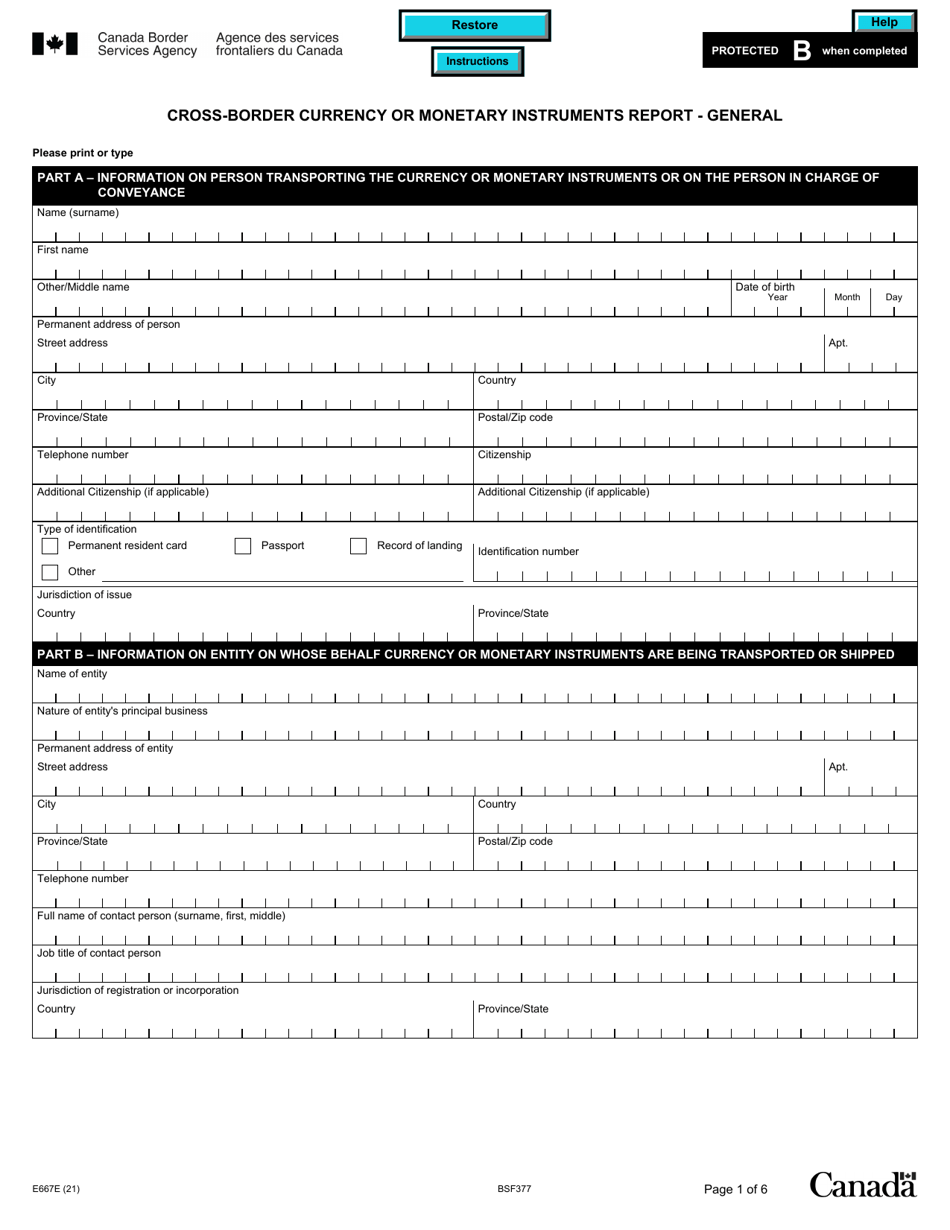

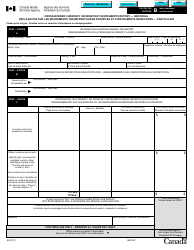

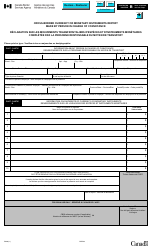

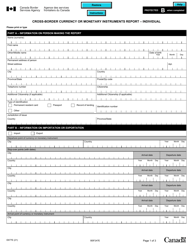

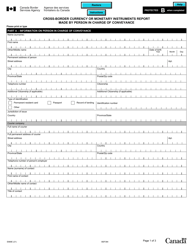

Form E667 Cross-border Currency or Monetary Instruments Report - General - Canada

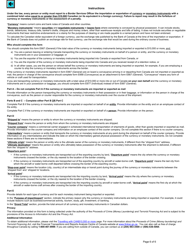

Form E667 Cross-border Currency or Monetary Instruments Report - General is used in Canada for reporting the import or export of currency or monetary instruments such as negotiable instruments, traveler's checks, or money orders in amounts equal to or exceeding Canadian $10,000. This form helps the government track the movement of large amounts of money across the Canadian border to prevent money laundering, terrorism financing, and other illicit activities.

The person responsible for filing the Form E667 Cross-border Currency or Monetary Instruments Report in Canada is the individual or entity who is physically carrying or transmitting currency or monetary instruments across the Canadian border.

Form E667 Cross-border Currency or Monetary Instruments Report - General - Canada - Frequently Asked Questions (FAQ)

Q: What is Form E667?

A: Form E667 is a Cross-border Currency or Monetary Instruments Report.

Q: What is the purpose of Form E667?

A: The purpose of Form E667 is to report the importation or exportation of currency or monetary instruments.

Q: Who needs to file Form E667?

A: Anyone entering or leaving Canada with currency or monetary instruments equal to or greater than CAD 10,000 needs to file Form E667.

Q: What is considered currency or monetary instruments?

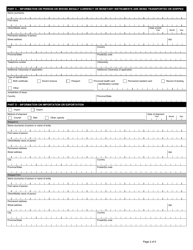

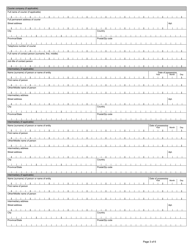

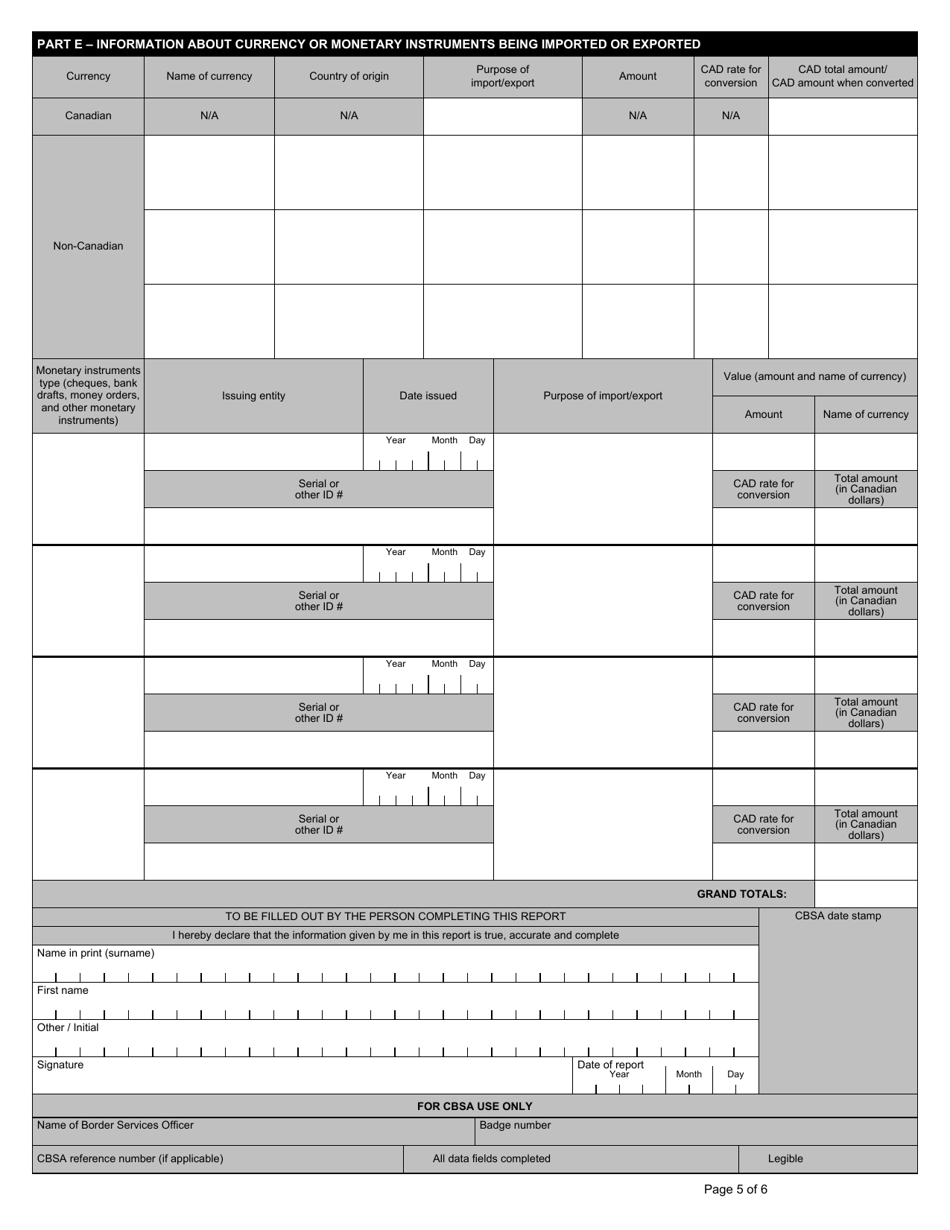

A: Currency or monetary instruments include cash, bank drafts, traveler's checks, and certain negotiable instruments.

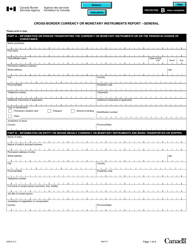

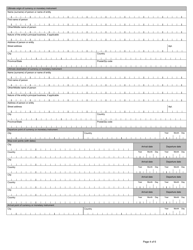

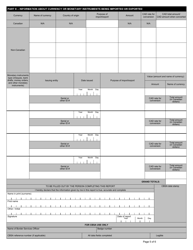

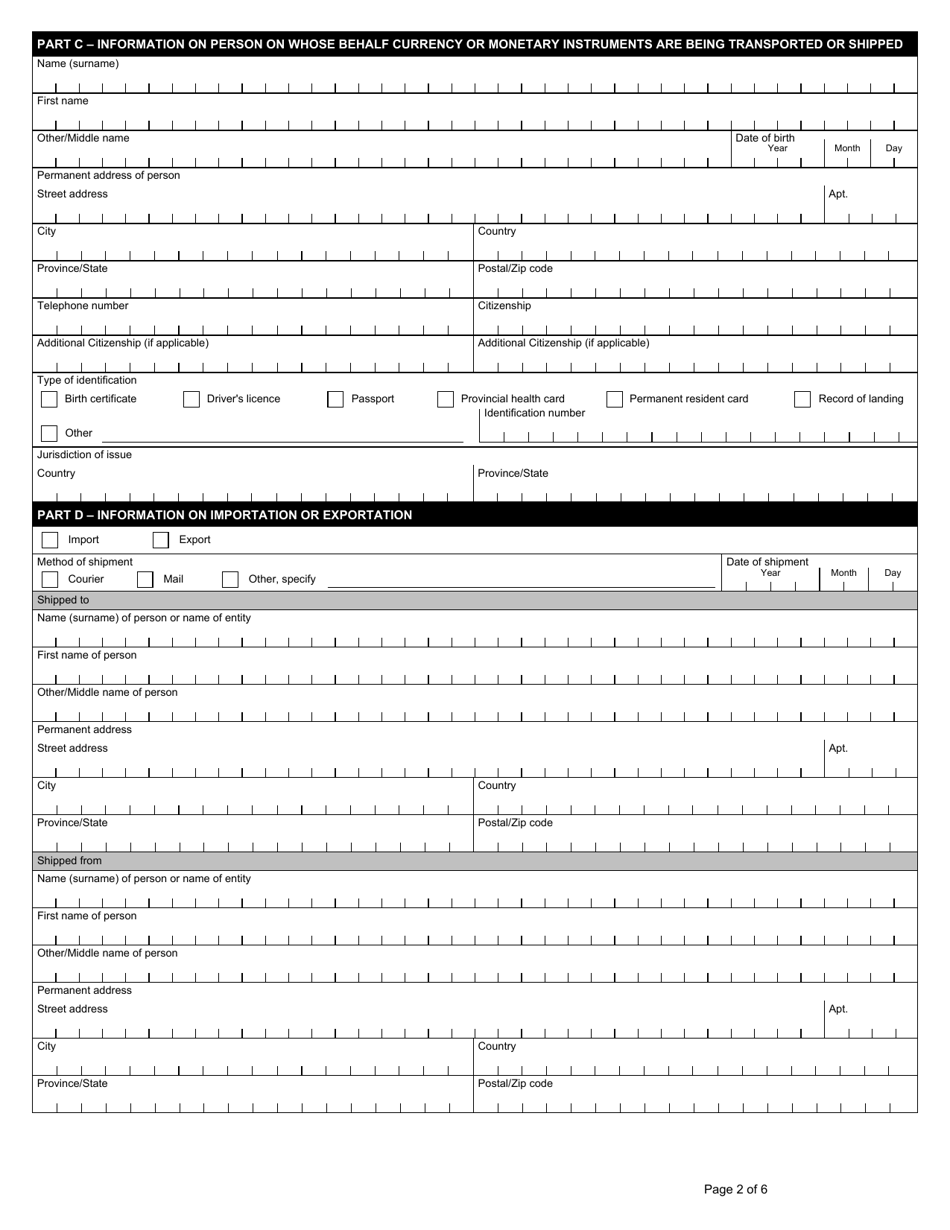

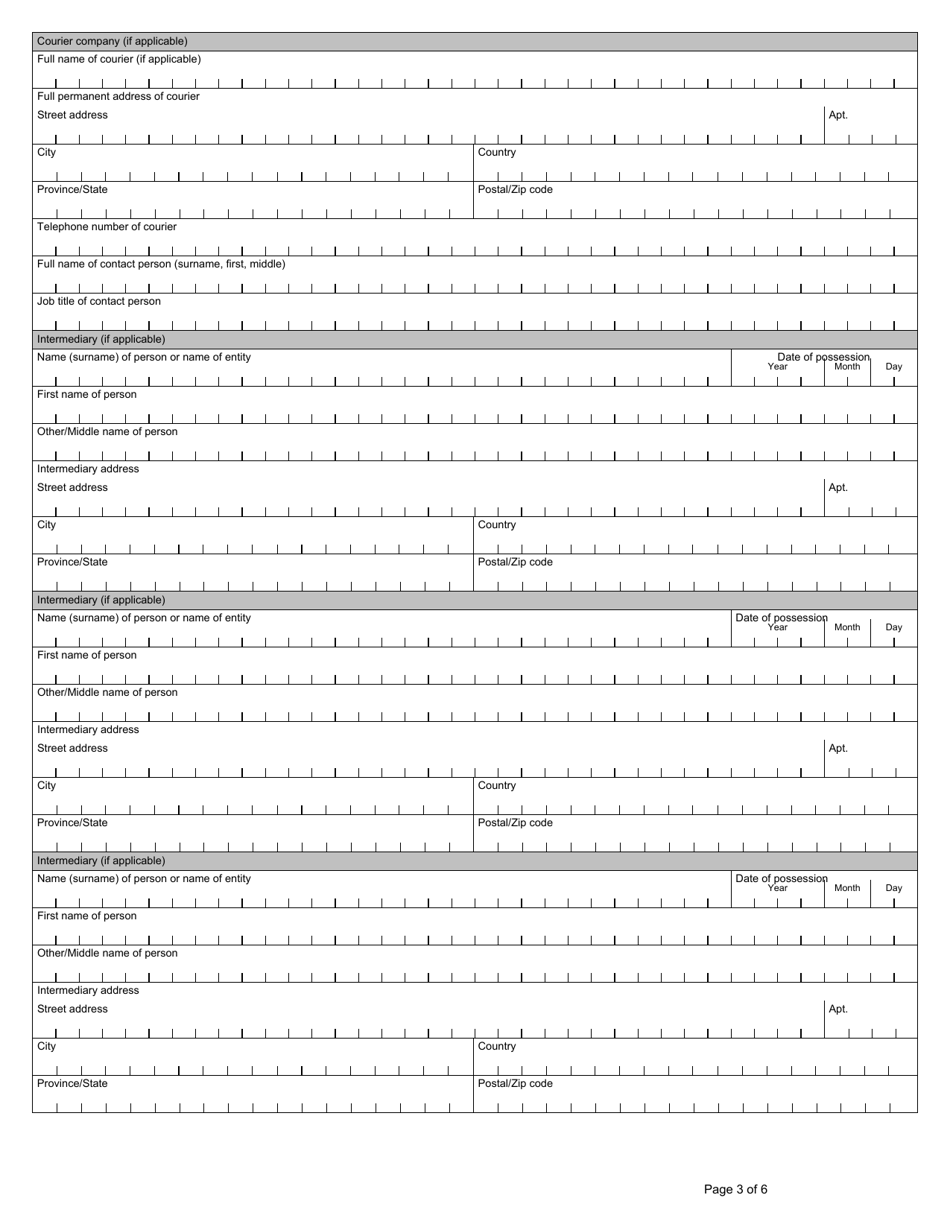

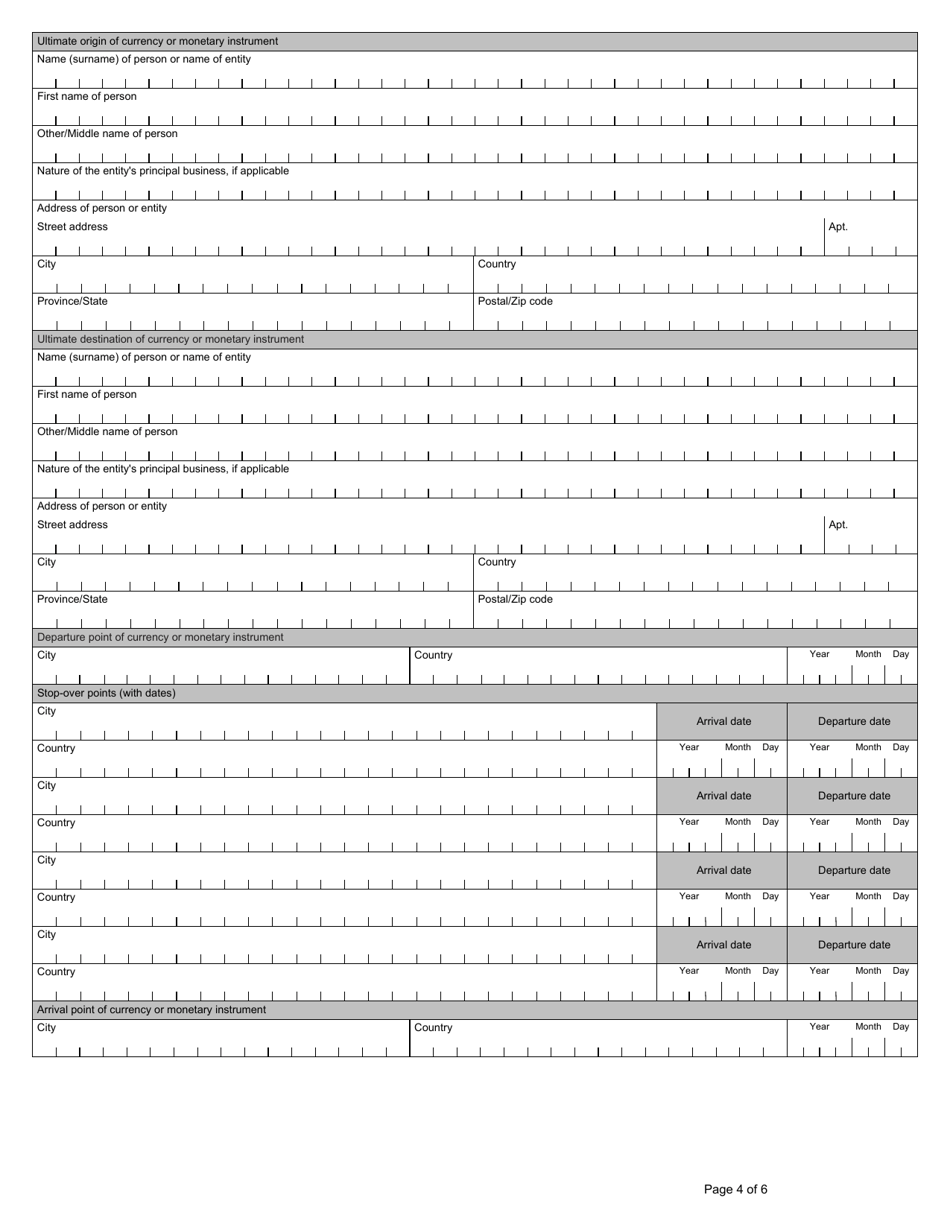

Q: What information is required on Form E667?

A: Form E667 requires information about the amount and type of currency or monetary instruments being imported or exported, as well as personal information and details about the trip.

Q: When should I file Form E667?

A: Form E667 should be filed at the time of entry or exit from Canada.

Q: What are the consequences of not filing Form E667?

A: Failure to file Form E667 can result in penalties, seizure of funds, and potential criminal charges.