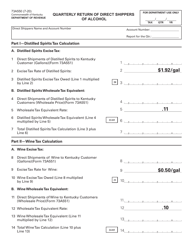

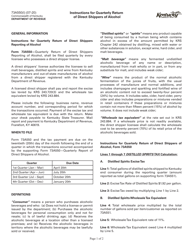

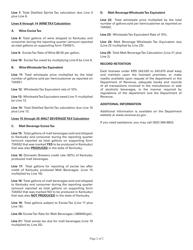

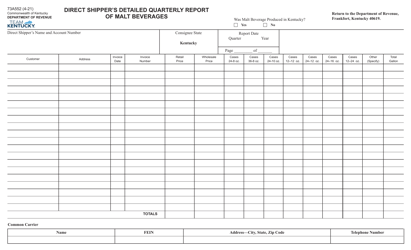

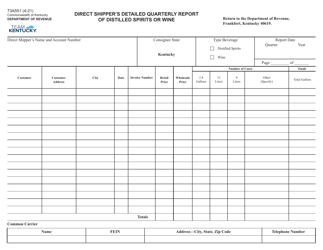

Instructions for Form 73A550 Quarterly Return of Direct Shippers of Alcohol - Kentucky

This document contains official instructions for Form 73A550 , Quarterly Return of Direct Shippers of Alcohol - a form released and collected by the Kentucky Department of Revenue. An up-to-date fillable Form 73A550 is available for download through this link.

FAQ

Q: What is Form 73A550?

A: Form 73A550 is the Quarterly Return of Direct Shippers of Alcohol in Kentucky.

Q: Who needs to file Form 73A550?

A: Direct shippers of alcohol in Kentucky need to file Form 73A550.

Q: How often do I need to file Form 73A550?

A: Form 73A550 must be filed quarterly.

Q: What information is required on Form 73A550?

A: Form 73A550 requires information about the quantity and value of alcohol shipped.

Q: Can Form 73A550 be filed electronically?

A: Yes, Form 73A550 can be filed electronically.

Q: Are there any penalties for not filing Form 73A550?

A: Yes, failure to file Form 73A550 may result in penalties and fines.

Q: Is there a deadline for filing Form 73A550?

A: Yes, Form 73A550 must be filed by the 20th day of the month following the end of the quarter.

Q: Can I amend Form 73A550 if I made a mistake?

A: Yes, you can amend Form 73A550 if you made a mistake.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Kentucky Department of Revenue.