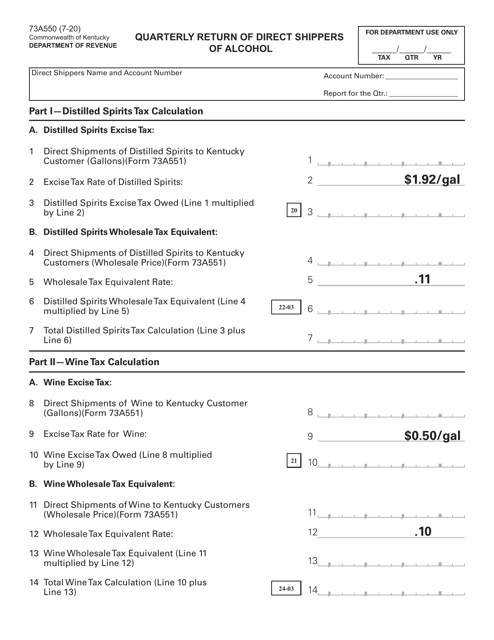

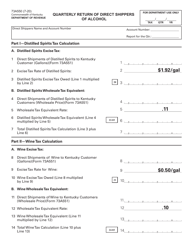

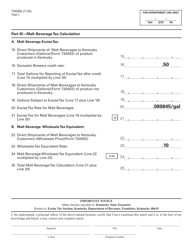

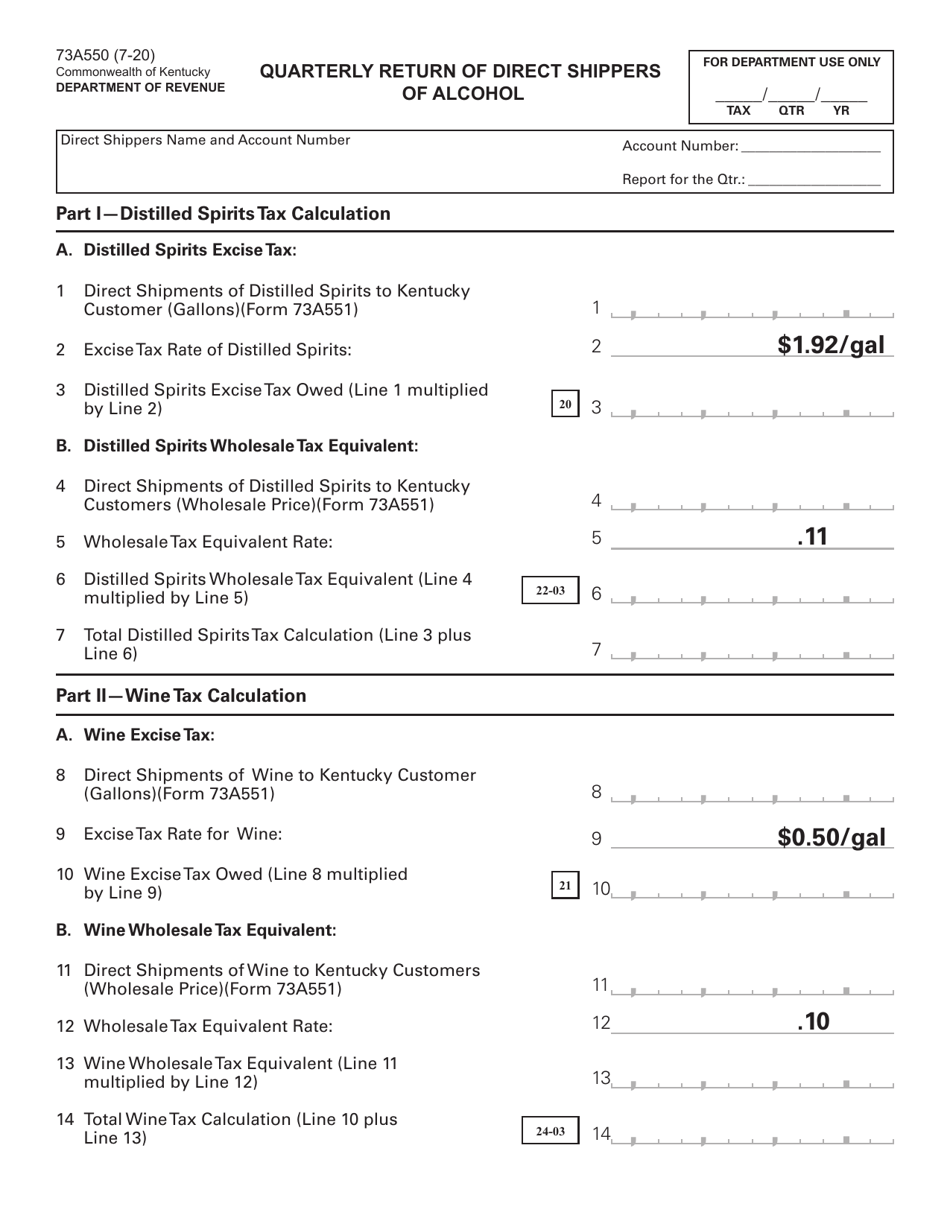

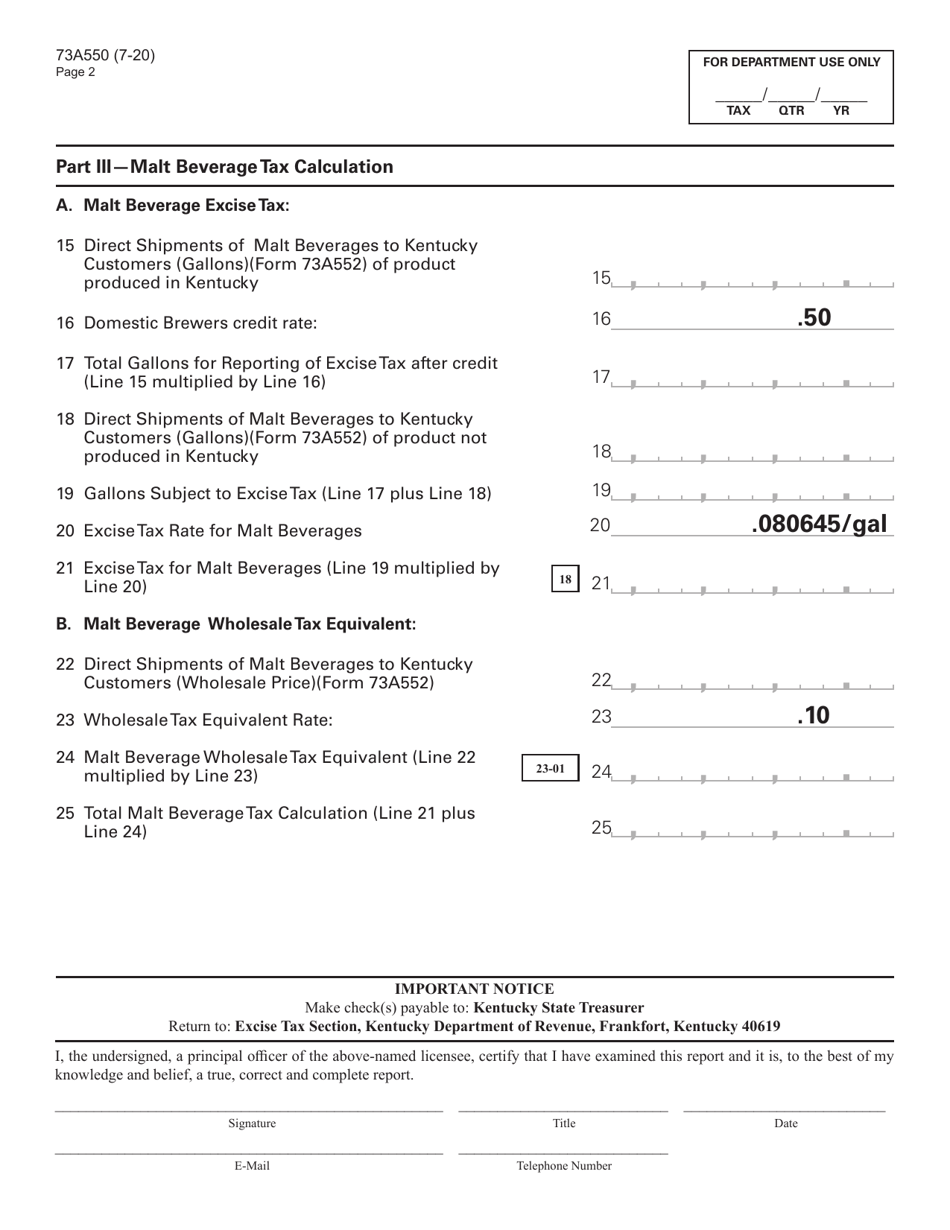

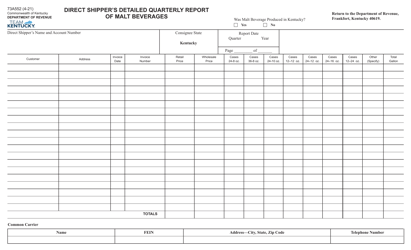

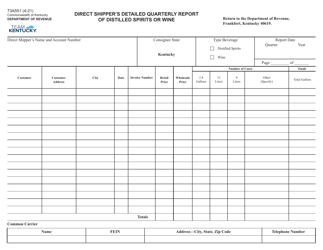

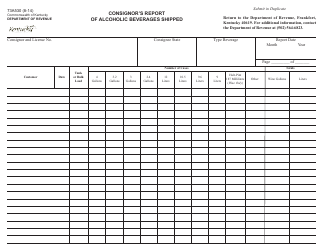

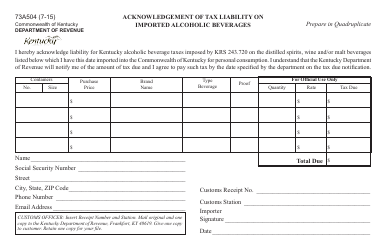

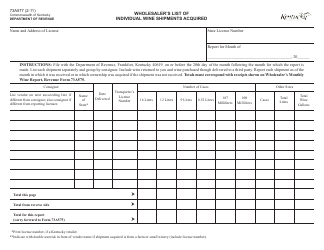

Form 73A550 Quarterly Return of Direct Shippers of Alcohol - Kentucky

What Is Form 73A550?

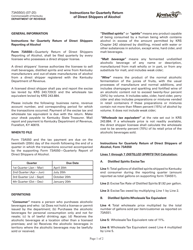

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 73A550?

A: Form 73A550 is the Quarterly Return of Direct Shippers of Alcohol in Kentucky.

Q: Who needs to file Form 73A550?

A: Direct shippers of alcohol in Kentucky need to file Form 73A550.

Q: What is the purpose of Form 73A550?

A: The purpose of Form 73A550 is to report and remit the sales and excise taxes collected from direct shipments of alcohol in Kentucky.

Q: How often should Form 73A550 be filed?

A: Form 73A550 should be filed on a quarterly basis.

Q: What information is required on Form 73A550?

A: Form 73A550 requires information such as the total sales, gallons sold, taxes collected, and other related details of direct shipments of alcohol.

Q: Is Form 73A550 used for both sales and excise taxes?

A: Yes, Form 73A550 is used to report both sales and excise taxes collected from direct shipments of alcohol.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A550 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.