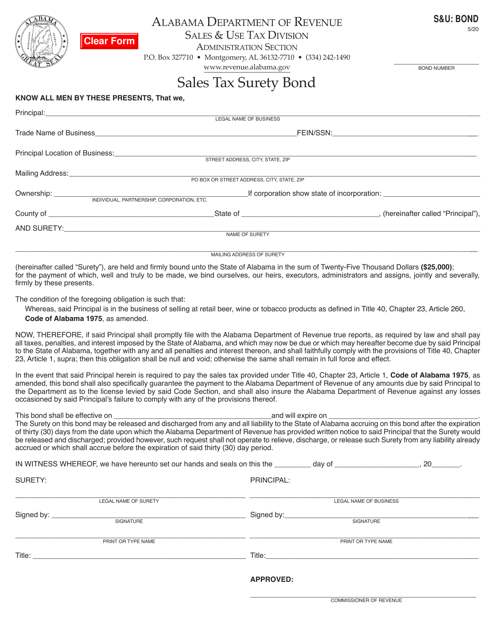

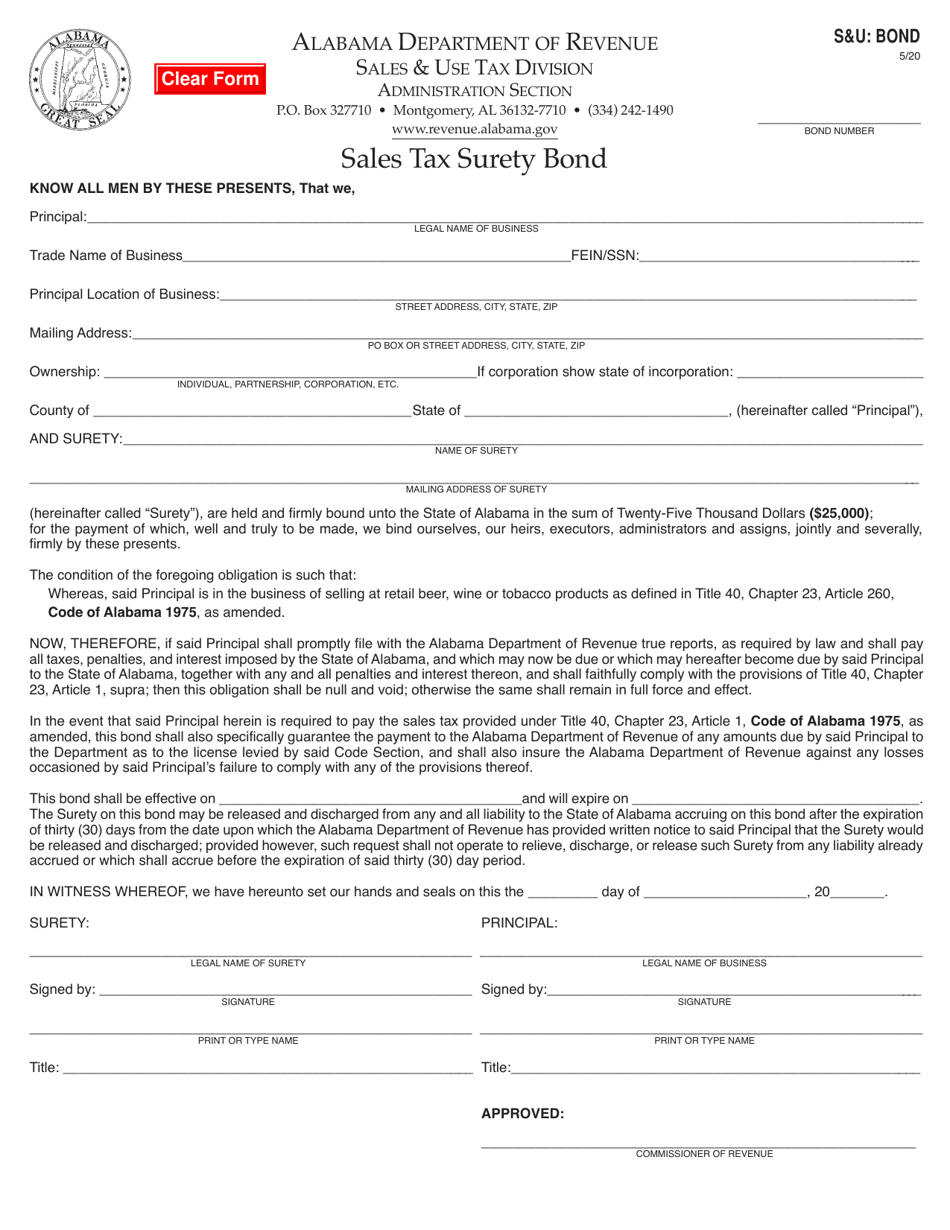

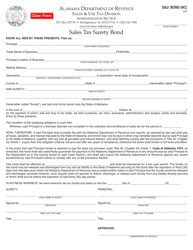

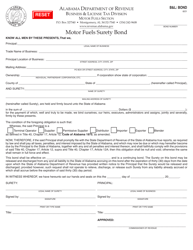

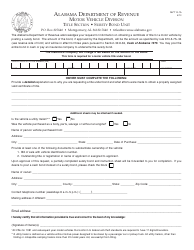

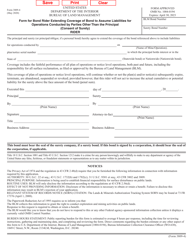

Form S&U: BOND Sales Tax Surety Bond - Alabama

What Is Form S&U: BOND?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the S&U Bond Sales Tax Surety Bond?

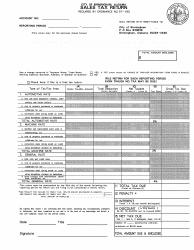

A: The S&U Bond Sales Tax Surety Bond is a type of surety bond required by the state of Alabama for businesses that sell goods and collect sales tax.

Q: Why is the S&U Bond Sales Tax Surety Bond required?

A: The bond is required as a guarantee that businesses will comply with state sales tax laws and remit the appropriate sales tax to the state.

Q: Who needs to get the S&U Bond Sales Tax Surety Bond?

A: Any business in Alabama that sells goods and collects sales tax needs to obtain the bond.

Q: How much does the S&U Bond Sales Tax Surety Bond cost?

A: The cost of the bond varies depending on the business's creditworthiness and the bond amount required by the state.

Q: How do I apply for the S&U Bond Sales Tax Surety Bond?

A: To apply for the bond, you will need to provide your business information and undergo a credit check.

Q: What happens if I don't get the S&U Bond Sales Tax Surety Bond?

A: Failing to obtain the bond can result in penalties, fines, and the suspension or revocation of your business license.

Q: How long does the S&U Bond Sales Tax Surety Bond last?

A: The bond is typically valid for one year and needs to be renewed annually.

Q: Can I cancel the S&U Bond Sales Tax Surety Bond?

A: The bond is usually non-cancelable, meaning it cannot be canceled during the term.

Q: What is the purpose of the S&U Bond Sales Tax Surety Bond?

A: The bond provides financial protection to the state and ensures that businesses fulfill their sales tax obligations.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S&U: BOND by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.