This version of the form is not currently in use and is provided for reference only. Download this version of

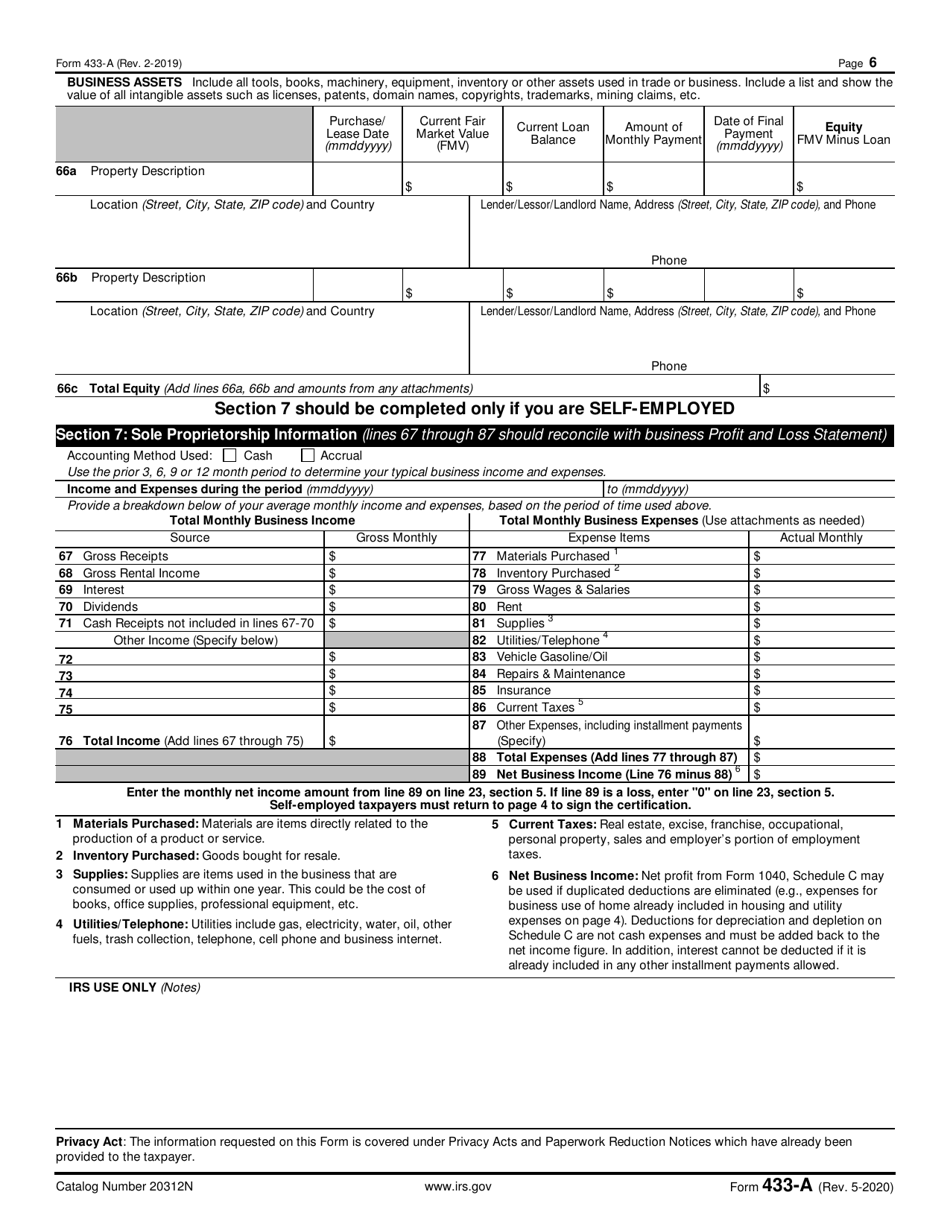

IRS Form 433-A

for the current year.

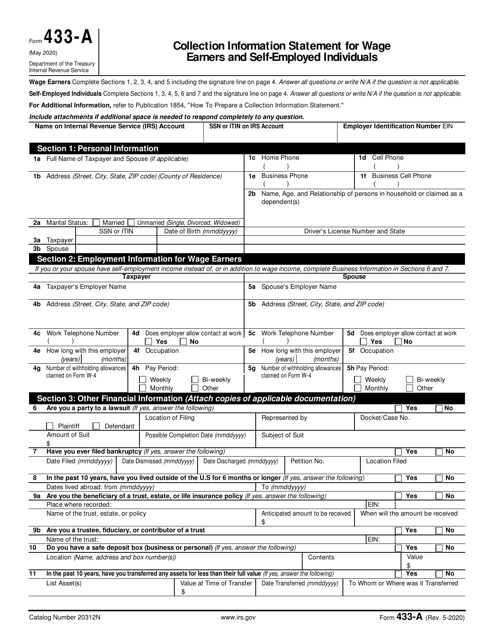

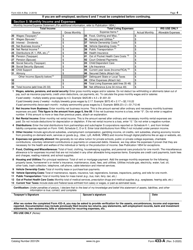

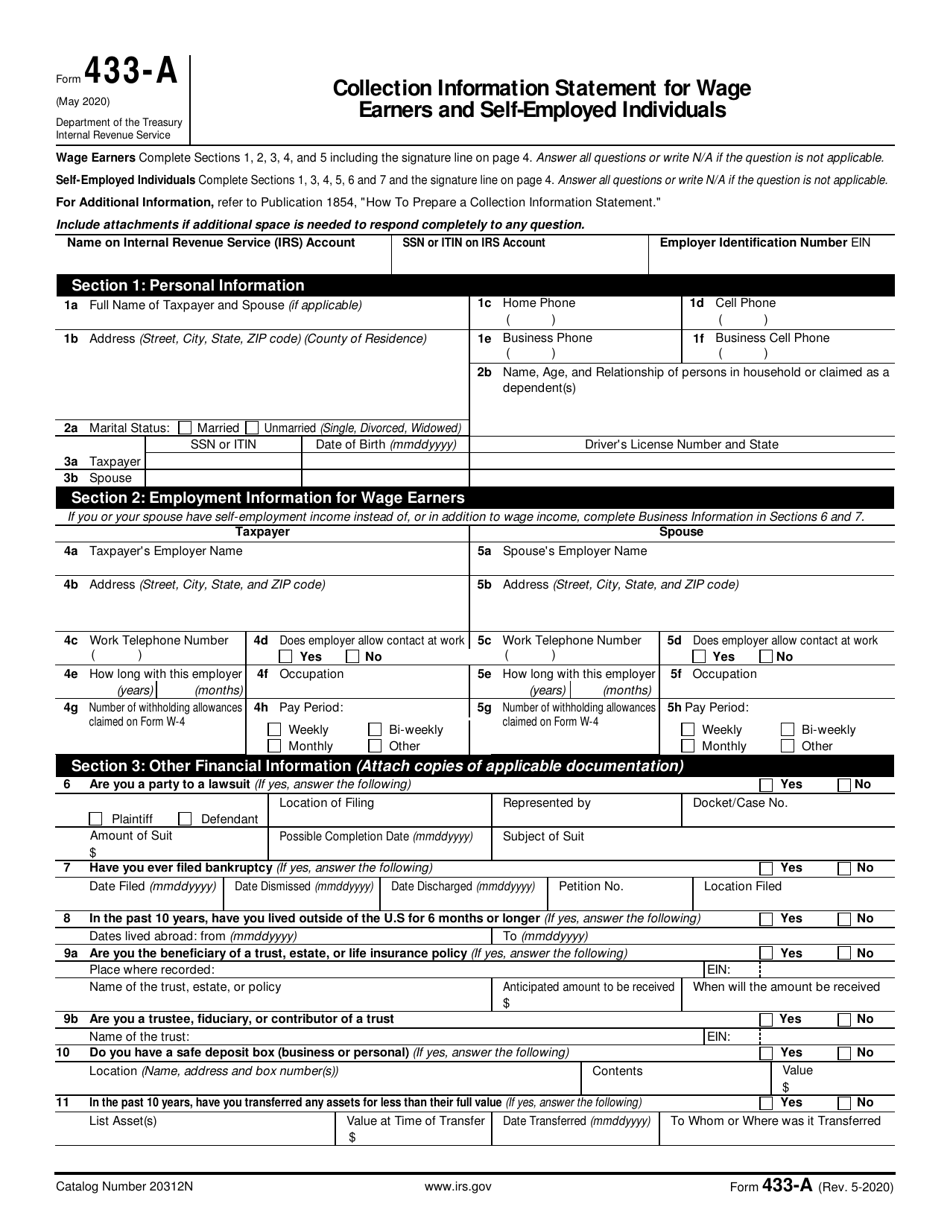

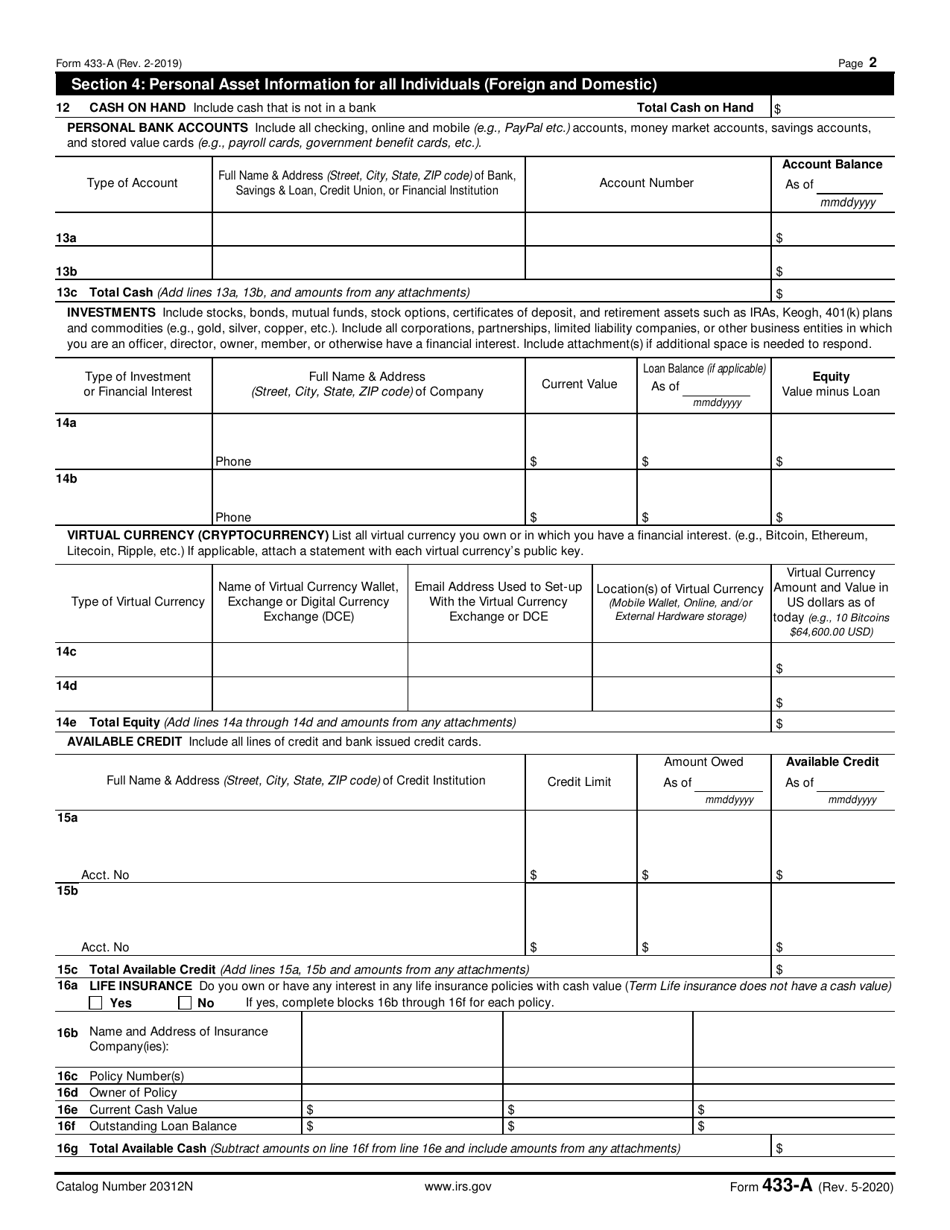

IRS Form 433-A Collection Information Statement for Wage Earners and Self-employed Individuals

What Is IRS Form 433-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 433-A?

A: IRS Form 433-A is a Collection Information Statement specifically designed for wage earners and self-employed individuals.

Q: Who needs to complete IRS Form 433-A?

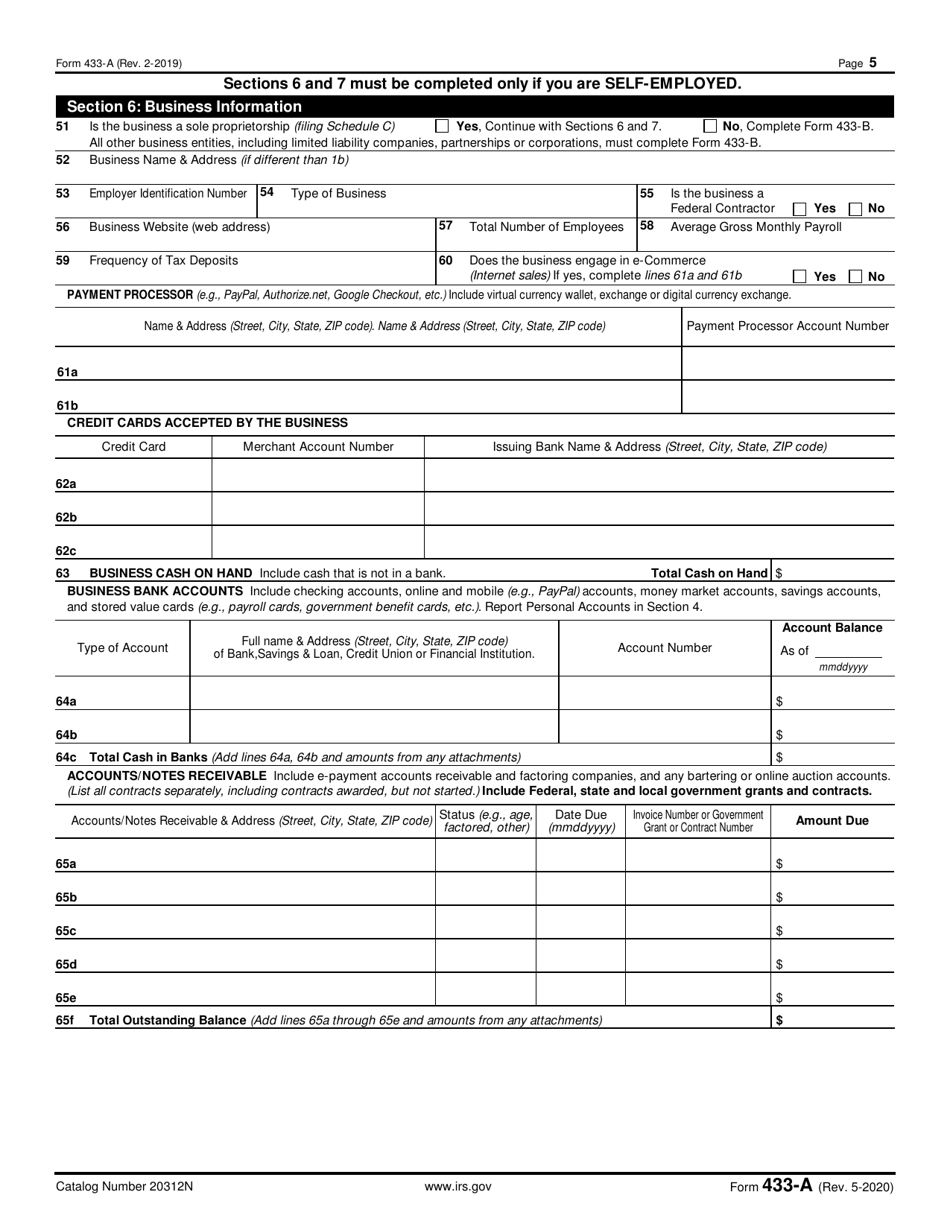

A: Wage earners and self-employed individuals who owe taxes or are in the process of an IRS collection action may need to complete IRS Form 433-A.

Q: What is the purpose of IRS Form 433-A?

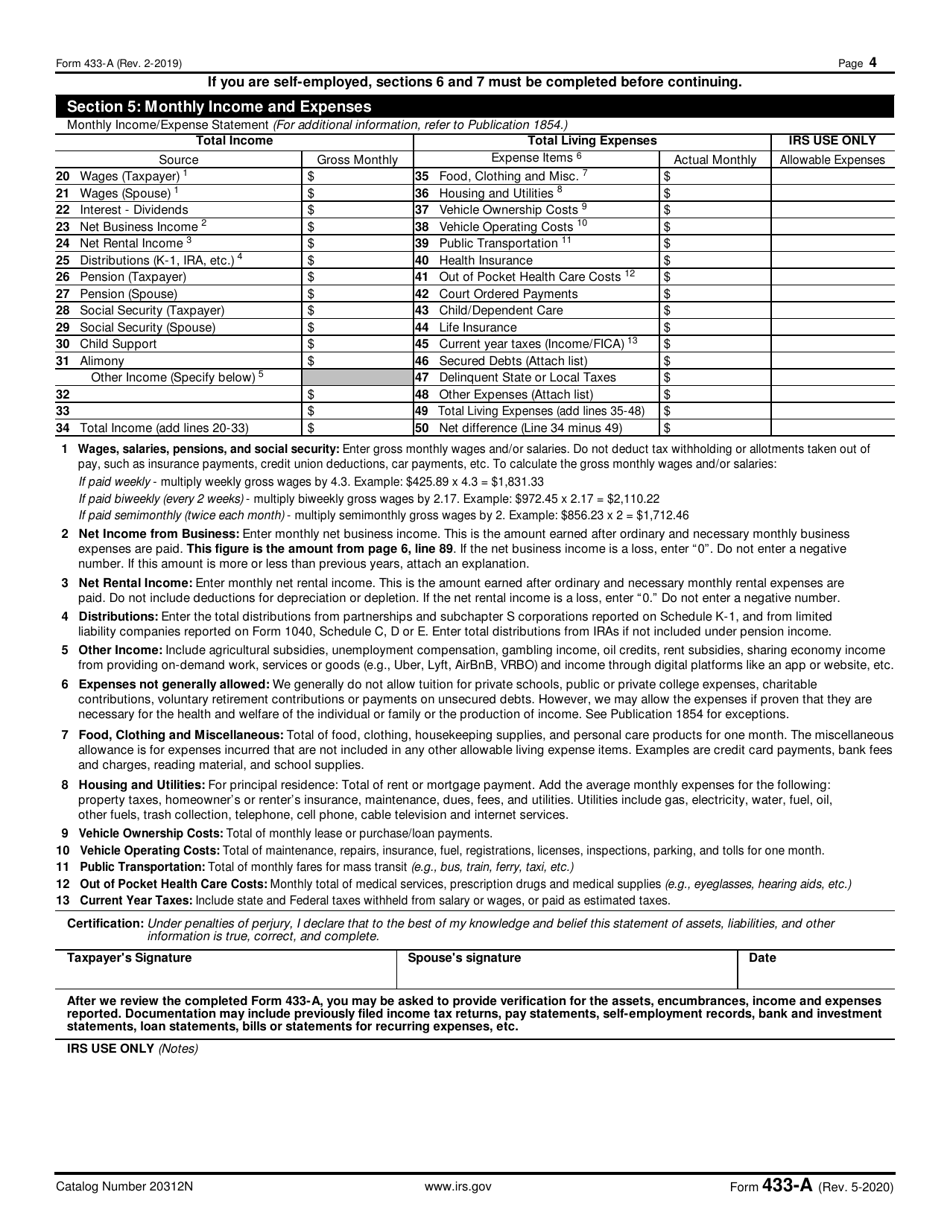

A: The purpose of IRS Form 433-A is to provide detailed financial information about the taxpayer's income, expenses, assets, and liabilities to determine their ability to pay the outstanding tax debt.

Q: What information is required on IRS Form 433-A?

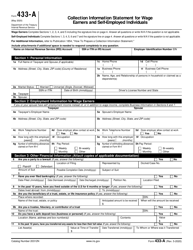

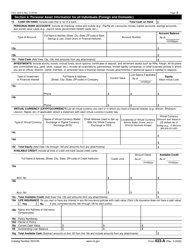

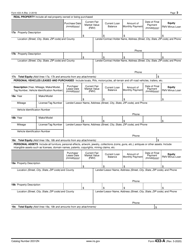

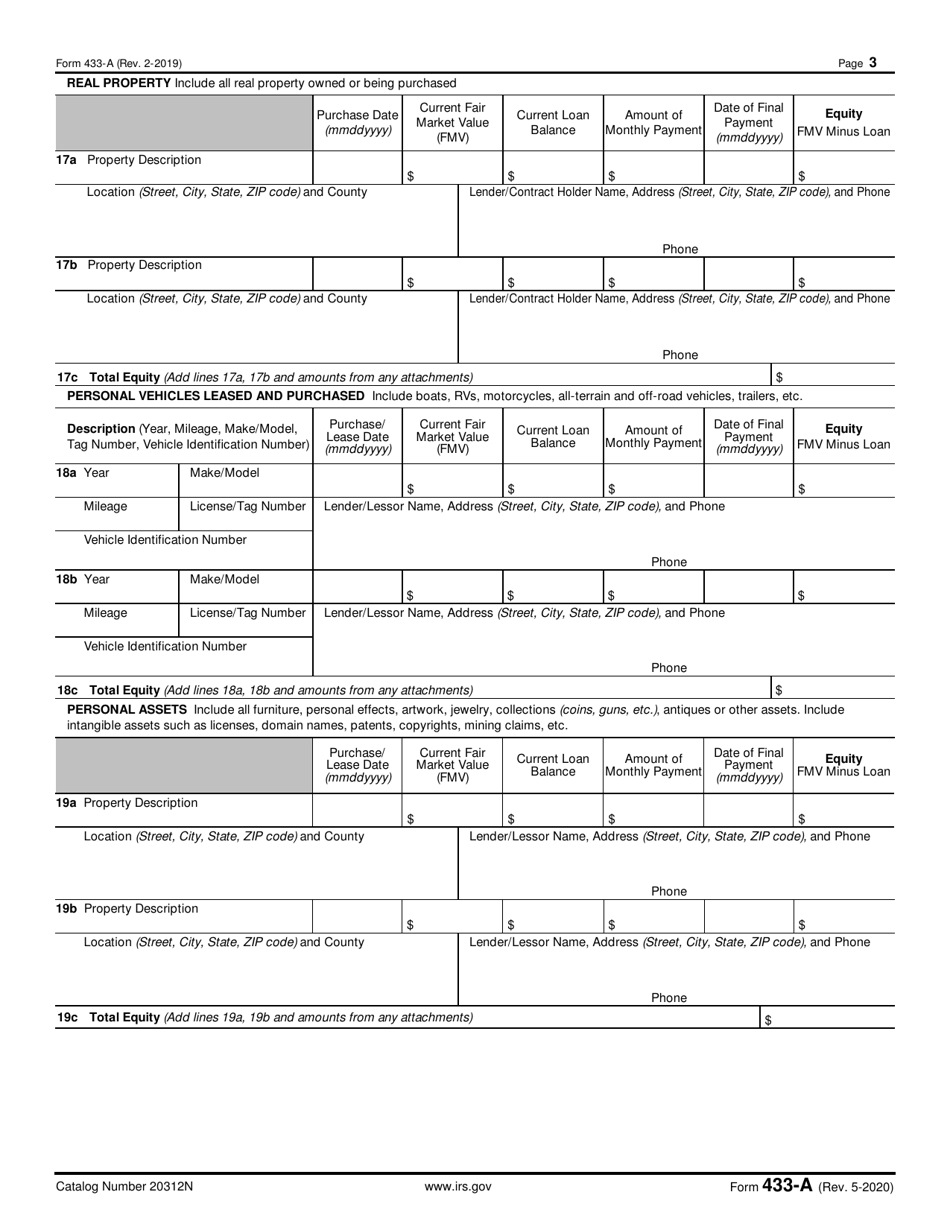

A: IRS Form 433-A requires information related to income, assets, expenses, and liabilities, including details about employment, bank accounts, real estate, vehicles, and other assets.

Q: Can I electronically file IRS Form 433-A?

A: No, IRS Form 433-A cannot be electronically filed. It must be completed manually and submitted by mail or in person to the appropriate IRS office.

Q: Is there a deadline for submitting IRS Form 433-A?

A: The deadline for submitting IRS Form 433-A will depend on the specific circumstances and requirements outlined by the IRS. It is important to follow the instructions provided by the IRS or consult a tax professional for guidance.

Q: What happens after submitting IRS Form 433-A?

A: After submitting IRS Form 433-A, the IRS will review the financial information provided and use it to assess the taxpayer's ability to pay the outstanding tax debt. The IRS may contact the taxpayer for additional information or propose a payment plan based on the information provided.

Q: Can I make changes to IRS Form 433-A after submitting it?

A: Yes, if there are changes to your financial situation or you discover errors on the form, it is important to notify the IRS as soon as possible. You can provide updated information or request corrections by contacting the IRS directly.

Q: What if I need help completing IRS Form 433-A?

A: If you need assistance completing IRS Form 433-A or have questions about the process, it is recommended to consult a tax professional or contact the IRS directly for guidance.

Form Details:

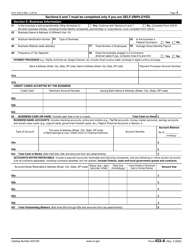

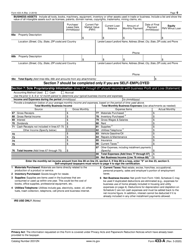

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 433-A through the link below or browse more documents in our library of IRS Forms.