This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 433-A

for the current year.

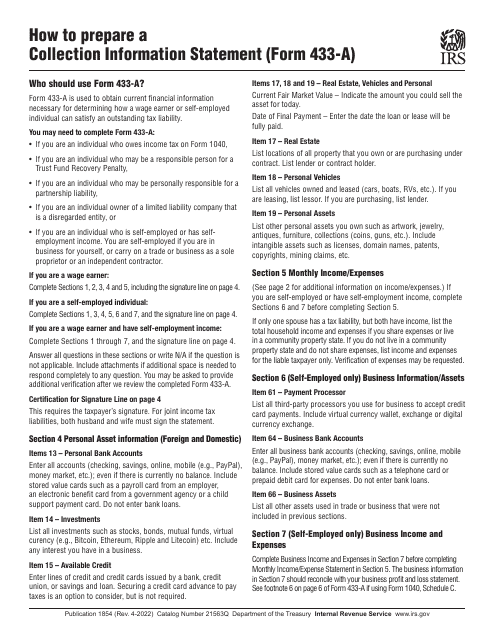

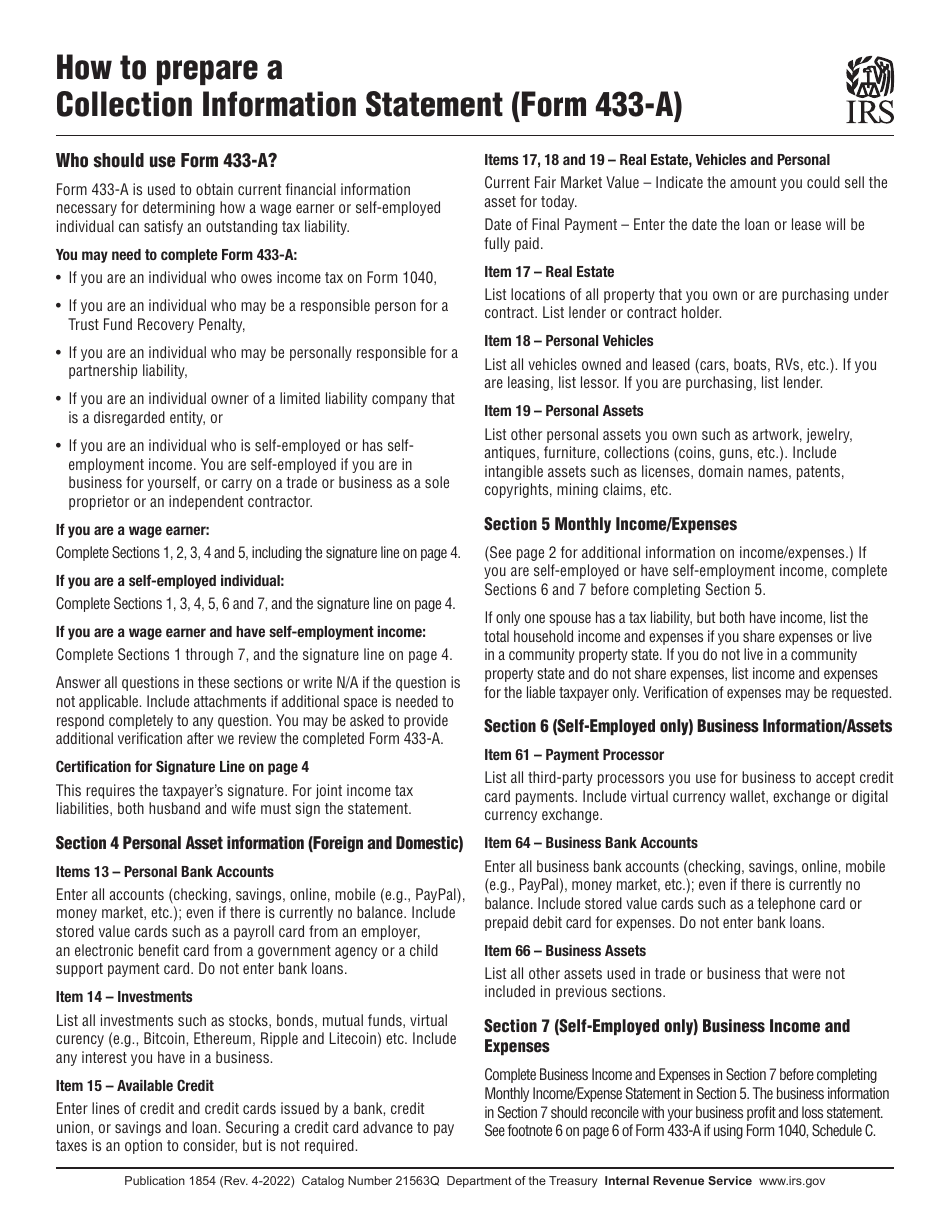

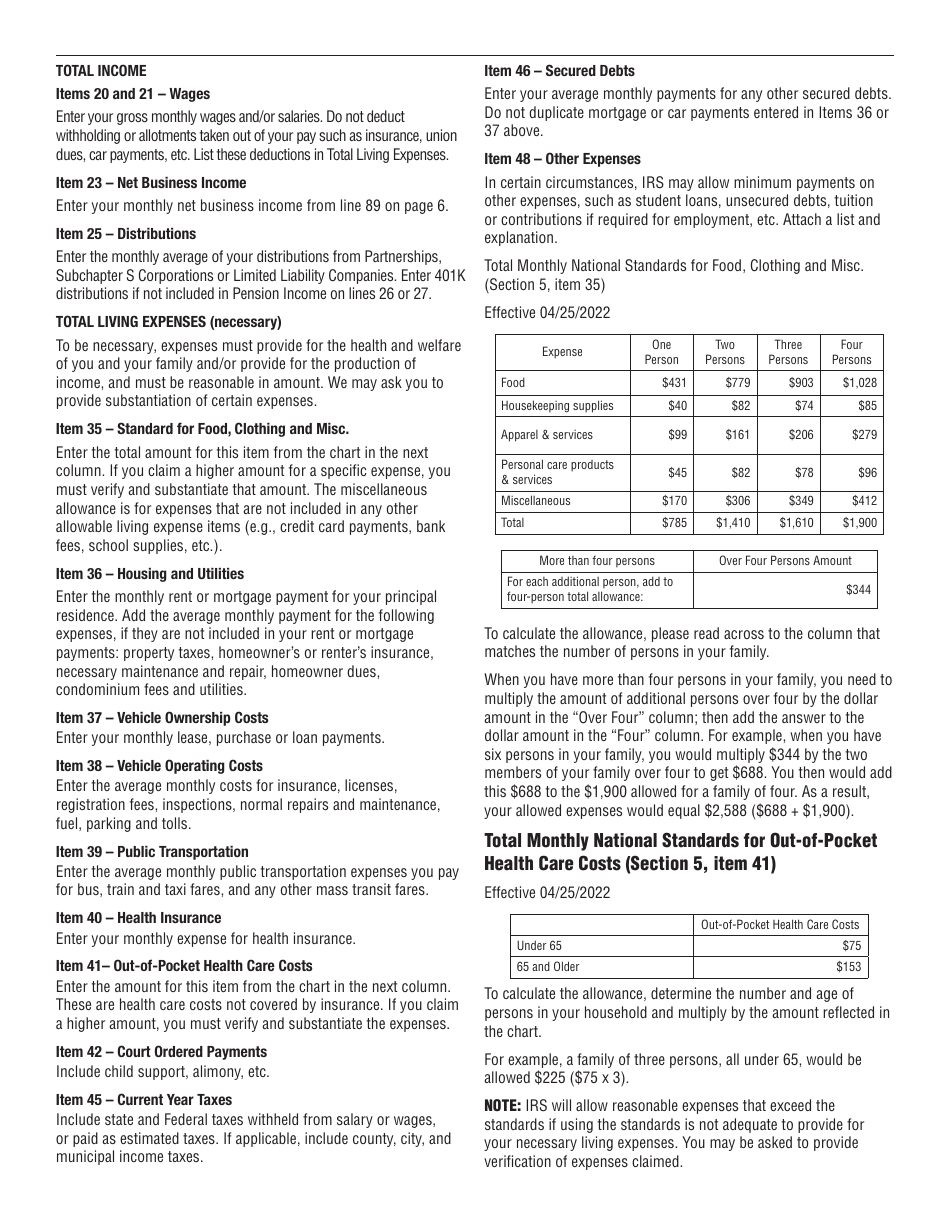

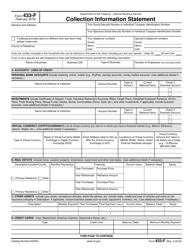

Instructions for IRS Form 433-A Collection Information Statement for Wage Earners and Self-employed Individuals

This document contains official instructions for IRS Form 433-A , Collection Information Statement for Wage Earners and Self-employed Individuals - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 433-A is available for download through this link.

FAQ

Q: What is IRS Form 433-A?

A: IRS Form 433-A is the Collection Information Statement for Wage Earners and Self-employed Individuals.

Q: Who needs to file IRS Form 433-A?

A: Wage earners and self-employed individuals who owe taxes and are unable to pay in full may need to file IRS Form 433-A.

Q: What is the purpose of IRS Form 433-A?

A: The purpose of IRS Form 433-A is to provide the IRS with a snapshot of your financial situation, including your income, expenses, assets, and liabilities.

Q: What information is required on IRS Form 433-A?

A: IRS Form 433-A requires you to provide information about your personal and business assets, income, expenses, and other financial details.

Q: How do I complete IRS Form 433-A?

A: To complete IRS Form 433-A, you will need to provide accurate and detailed information about your financial situation. You may also need to provide supporting documents.

Q: Can I electronically file IRS Form 433-A?

A: No, you cannot electronically file IRS Form 433-A. It must be submitted by mail or in person.

Q: What happens after I file IRS Form 433-A?

A: After you file IRS Form 433-A, the IRS will review your financial information to determine the appropriate course of action for collecting the taxes owed.

Q: Are there any penalties for filing IRS Form 433-A?

A: There are no penalties for filing IRS Form 433-A. However, failing to provide accurate and complete information may result in penalties.

Q: Can I negotiate a payment plan with the IRS using IRS Form 433-A?

A: Yes, you can negotiate a payment plan with the IRS using IRS Form 433-A. The form provides information that can help the IRS determine your ability to make monthly payments.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.