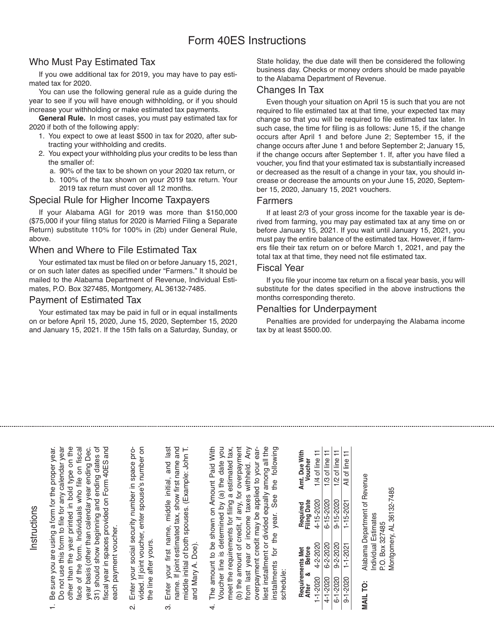

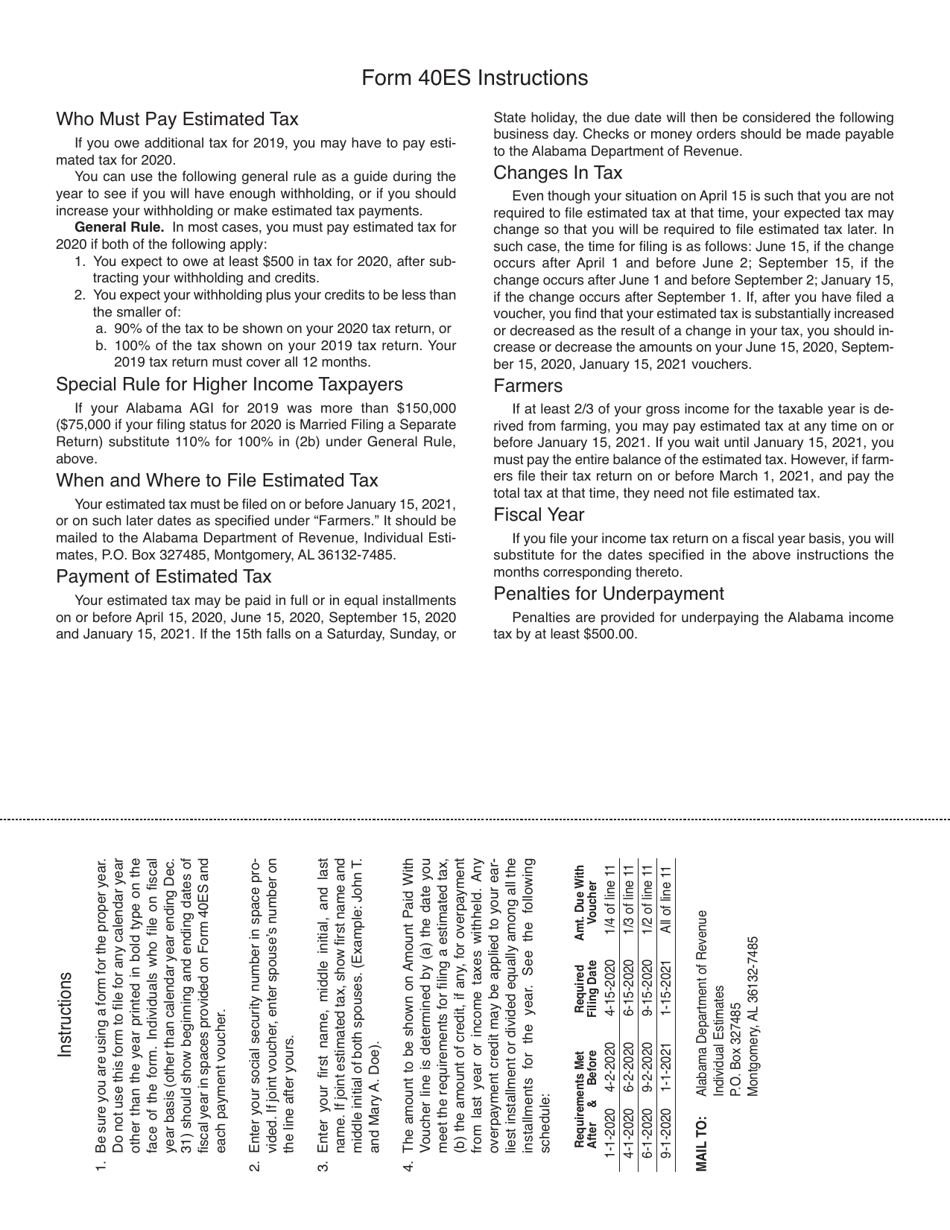

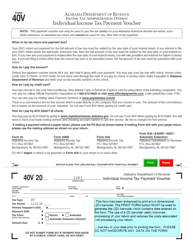

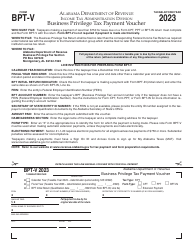

Instructions for Form 40ES Estimated Income Tax Payment Voucher - Alabama

This document contains official instructions for Form 40ES , Estimated Income Tax Payment Voucher - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form 40ES is available for download through this link.

FAQ

Q: What is Form 40ES?

A: Form 40ES is the Estimated Income Tax Payment Voucher for Alabama.

Q: What is the purpose of Form 40ES?

A: Form 40ES is used to make estimated income tax payments in Alabama.

Q: Who needs to use Form 40ES?

A: Individuals who expect to owe income tax in Alabama and will not have enough taxes withheld from their income.

Q: When should I file Form 40ES?

A: Form 40ES should be filed on a quarterly basis by the due dates specified on the form.

Q: How do I complete Form 40ES?

A: You will need to provide your personal information, estimate your income, calculate your estimated tax liability, and indicate any previous payments made.

Q: What happens if I don't file Form 40ES?

A: If you don't file Form 40ES or pay enough estimated tax, you may be subject to penalties and interest.

Q: Can I make changes to my estimated tax payments?

A: Yes, if your estimated income or circumstances change, you can adjust your estimated tax payments for the next quarter.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.