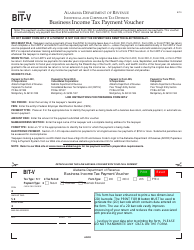

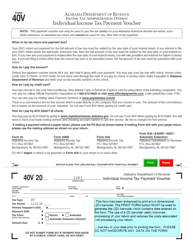

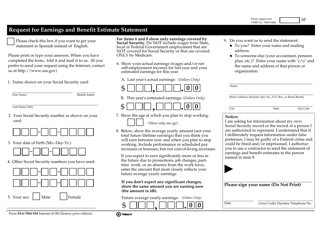

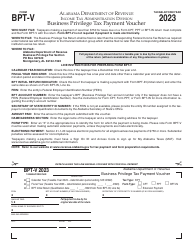

Form 40ES Estimated Income Tax Payment Voucher - Alabama

What Is Form 40ES?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 40ES?

A: Form 40ES is the Estimated Income Tax Payment Voucher for Alabama.

Q: What is the purpose of Form 40ES?

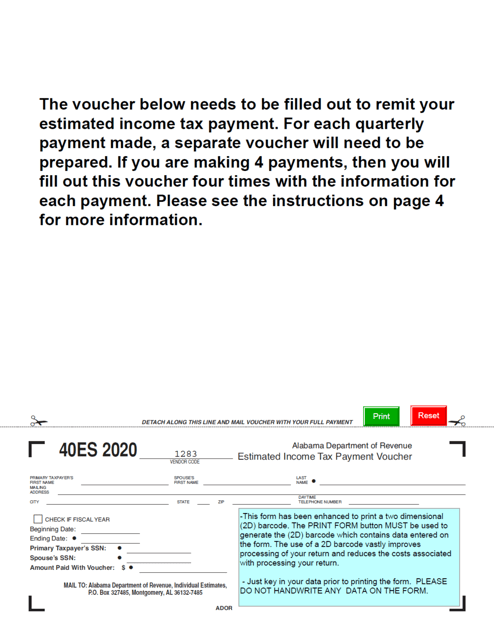

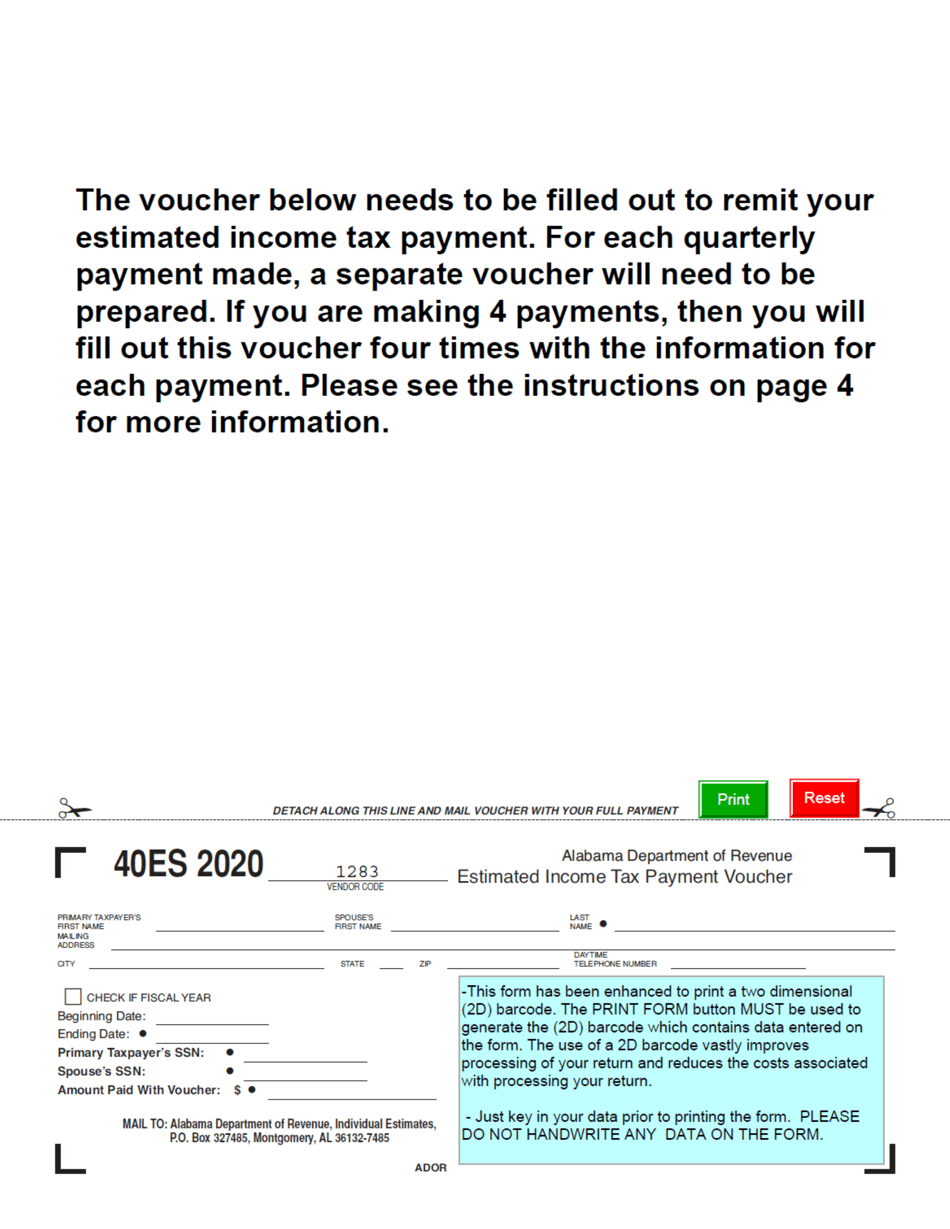

A: Form 40ES is used to make quarterly estimated income tax payments in Alabama.

Q: Who needs to file Form 40ES?

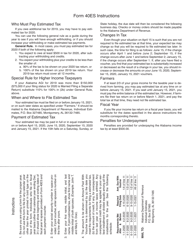

A: Individual taxpayers in Alabama who expect to owe $500 or more in state income tax for the year are generally required to file Form 40ES.

Q: How often do I need to file Form 40ES?

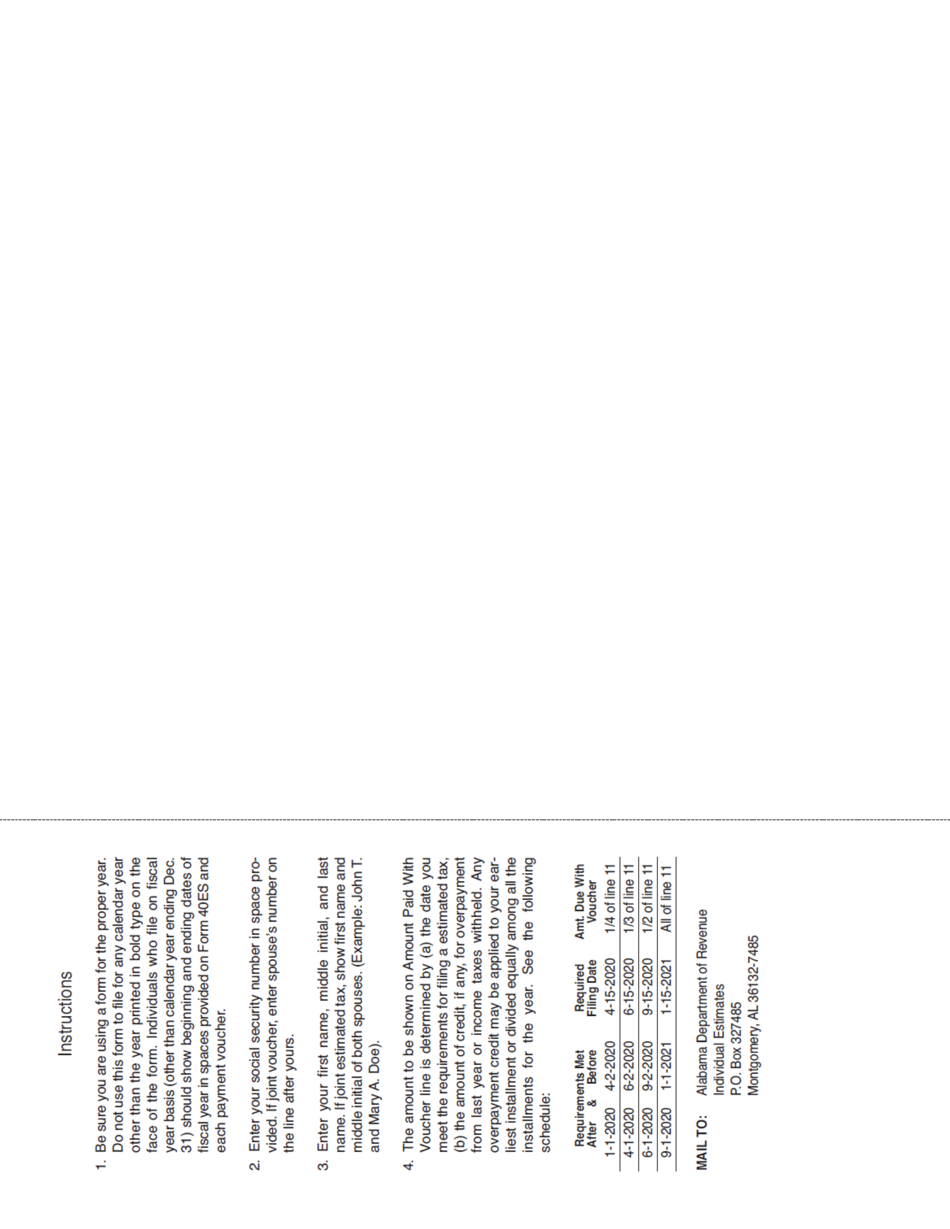

A: Form 40ES should be filed quarterly, with payments due in April, June, September, and January of the following year.

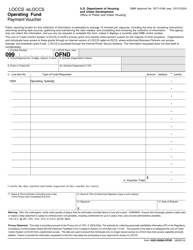

Q: What information is required on Form 40ES?

A: Form 40ES requires information such as taxpayer's name, address, Social Security number, estimated income, and estimated tax liability.

Q: What happens if I don't file Form 40ES?

A: Failure to file Form 40ES or underpayment of estimated tax may result in penalties and interest.

Q: Are there any exceptions to filing Form 40ES?

A: Some taxpayers may be exempt from filing Form 40ES, such as those who had no tax liability in the previous year or have income solely from wages subject to withholding.

Q: Is Form 40ES specific to Alabama?

A: Yes, Form 40ES is specific to Alabama and should not be used for federal estimated tax payments or tax payments to other states.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40ES by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.